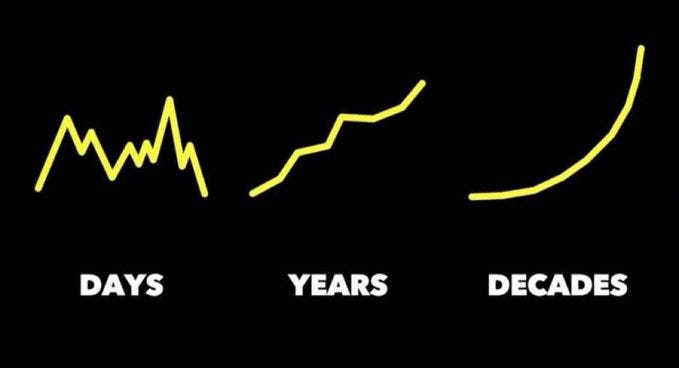

***Saw the news Bitcoin crashed? Ahhhhh! Deep breath. Noah and I are actually smiling/buying more! Price volatility is a feature, not a bug, but you have to be able to stomach it. Look at it as an opportunity to buy cheaper! Long term thinking pays off (years/decades). Zoom out when in doubt!***

So let’s pick this up where we left off last week. As you recall, inflation is a YUUGE problem.

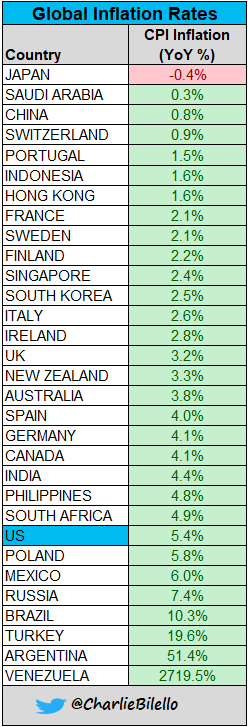

It’s also crazy complicated/multifactorial. We’re actually living in tremendously DEFLATIONARY times (many items getting cheaper, people spending less) due to technology, globalization, and demographics (boomers retiring). This is incompatible with our INFLATIONARY/DEBT-BASED monetary system and is only accelerating short term inflation to keep the party going. It’s not just a US problem, either. It’s a global issue, which makes it even harder to see.

Everyone’s currency is being debased at a torrent pace. Some faster than others. It’s like 2 cars moving at 100mph together towards a cliff but they don’t notice it. A person on the side of the road does though and is screaming, “STOP!” The USD will be the last currency standing - make no mistake about that - but we can talk about why that is NOT a good end game scenario some other time (check out “dollar milkshake theory” if you’re interested). That will just lead to money printing x infinity.

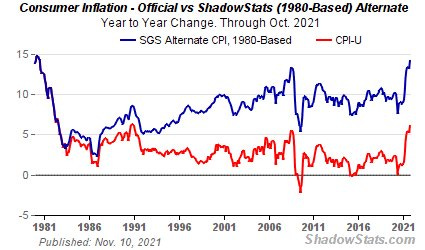

Importantly, you may look at this chart and say, “Hey, between 2-10% ain’t bad. No big deal.” Well, I think many of you would agree that it “feels” higher than that in real life, and that’s because it probably is.

Consumer Price Index (CPI in red) is a metric that has been manipulated over the years to make it look better (lower) than it truly is. Many other metrics put inflation closer to around 15-20% today, which seems more in line with daily living. Just to put that in perspective - if your stocks and house price AREN’T going up by that, you’re actually losing money. Tough bar to hurdle for sure. Imagine if you just left cash in a savings account though…eek!

Something else to keep in mind with inflation is this. Michael Saylor (CEO of Microstrategy) said, “Inflation is a vector. Define a market basket of products, services, and assets that you desire, weight them subjectively, and you can have your own index. If you want a low number, place a bunch of abundant, low variable cost items in that basket.”

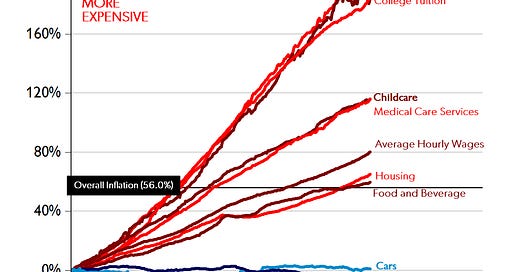

I think this graph gives a nice perspective on that concept.

Before Covid supply chain issues complicate the picture, if you personally define inflation by how much Netflix, flat-screen TVs, smartphones, clothing, and anything you buy on Amazon costs- life is great! Inflation is low because of technology being incredibly DEFLATIONARY (lower costs over time because of better technology - great book The Price of Tomorrow ). If you define it by things you truly need and want - a house, energy, food, stocks, land, college education, travel, healthcare, childcare - life is getting harder and waaay more expensive. Lots of money chasing scarce desirable assets = prices go up = harder to keep up = wealth inequality extremes.

My Why #2 (con’t from last week)

My time away from family and friends at work is being devalued through inflation. Inflation = a silent tax = theft.

Putting my life on the line during Covid was the breaking point

Being on the front lines in EM and CCM during COVID has been a rewarding yet frightening and sometimes awful experience. From the beginning, when we knew so little about the virus and were afraid for our own lives and the safety of our families, we geared up with what little PPE we had and did our best. It was our duty and part of the oath we took. I’d do it again gladly. The problem I have is that much of my time at work has been devalued due to endless government money printing/inflation.

That was time at work where I put my life, my wife’s, and my daughter’s on the line to help others. Sure we should all have altruistic motives and I’d love to say that I go to work for free just to help others, and to an extent that’s true! For example…

Let’s say I made $1000 working a shift in the ED. Take 30ish% out for taxes and now you have $~700. If I put that in my savings account earning essentially zero % and the government prints money constantly with an average inflation of 5%, then in 10 years that shift gives me ~$350 of purchasing power (5% x 10 years x $700), and in another 30 years, it buys me almost nothing. 40 years later (in retirement), my time away at work from my family today, buys me almost nothing. Sigh…

I’m a good person. I don’t work for free. I won’t apologize and you shouldn’t either. Yes, you could make the argument that you earned that money and then bought stocks and a house to save for retirement, BUT THAT SHOULDN’T BE THE CASE!

We shouldn’t HAVE to do this, and many people can’t access the markets/buy property and don’t have a financial advisor. Unfortunately though, putting money into a savings account for a safe bet is just like “watching an ice cube melt.” Inflation is a silent tax that you aren’t aware of but is robbing you of your wealth. Income tax (fed and state), property tax, Medicare, Medicaid, Social Security, capital gains, sales tax, and even taxes when you die aren’t enough. There’s also a silent tax (inflation) that is unspoken that reduces your purchasing power at the whim of a few people who are targeting an inflation rate.

We all took risks to care for patients during the pandemic. Heck, we take risks every day at our jobs (some more than others) regardless of the pandemic.

All I’m asking for in return is that my time working is valued in 20 years like it is the day I leave my house, kiss my family goodbye, and miss out on time with them.

It sounds crazy, but it’s not to me. I want my dollars today to remain constant and not be forced into companies that I don’t really know enough about just so that I can “keep up” with inflation. Then, I don’t have to worry when the CEO goes on a cocaine bender and insiders sell all their shares first and leave the rest of us holding the bag. The stock market is risky and always has been, but now low-cost ETFs have become the de facto savings account for everyone, and ask anyone older than me and it’s pure insanity – it's not how it’s supposed to be. Everyone is forced to keep running on the dollar hamster wheel - working harder for longer to one day retire, and simultaneously making your money “make money” so that you don’t have to return to work because you ran out of money. Pure madness.

My Why #3

My daughter deserves a better world. Society is becoming increasingly fragile due to a broken monetary system.

“It is well enough that people of the nation do not understand our banking and monetary system, for if they did, I believe there would be a revolution before tomorrow morning.” - Henry Ford

Fix the money, fix the world

The current monetary system is broken all over the world (NOT just the US). Everyone is on a fiat (paper money not backed by a physical commodity like gold) standard ever since Nixon depegged the US from the gold standard in 1971. Lots of info about this out there. It’s not a conspiracy theory, this is public knowledge, you just have to learn about it. Highly recommend you read up on this as it sets the stage for many of today’s problems.

What this has led to is a skyscraper (today’s monetary system) built on quicksand, and when the roof leaks, we just keep fixing the roof, ignoring the fact that the foundation is unstable. It’s a house of cards. The US owes ~29 TRILLION DOLLARS OF DEBT. I REPEAT, 29 TRILLION. You know how much a trillion is? Here’s 3.5…

That DOESN’T even count Medicare and Social Security debt. That brings it to ~150 trillion. Think about that number. You can’t comprehend it. You pay Social Security and Medicare tax so that when you hit that golden age you get monthly income and healthcare. Hate to break it to you, but it’s not guaranteed anymore you’ll even get those benefits when you retire.

Medicare runs out of money soon

They can cut it or trim it or change the rules whenever they want if we can’t pay for it. How much would that suck? In 20 years your day at work today earned you nothing AND the taxes you’re paying now don’t get you what they promised you. Yikes!

How are we gonna pay for it all??? Print the money of course. There is no other way.

How did the government even rack up 29 trillion in debt? Great question. How much debt do you have on your credit cards right now? Probably not 29 trillion. What happens when you see something you want but can’t afford? You sigh and say, “I wish...”. Sometimes you push it and put it on the credit card, but it eats at you because if you can’t pay it back you know you’re in trouble down the road. The government luckily can just print money and pay for stuff they can’t afford. Paying down debt, like you and I are forced to do, would force the government to raise taxes (not what voters want) and cut spending (not what voters want). So, they continue to kick the can down the road so that they can get elected promising things they can’t afford. That way, paying the piper doesn’t have to happen on their watch!

But trust me, we all have to pay the piper at some point, and the way things look it’s gonna be our generation (Millennials and younger) or my daughter’s, and that’s not fair to me, you, or her! Being the new parent that I am, the analogy for me is like having your kids make the financial decisions in the house. Sometimes as a parent you have to be the bad guy and even if you know it won’t make your kids happy right now, you do it in their best interest because they can’t make logical, tough choices with the future in mind. The current system is setting society up to fail. Our elected leaders are trying to carry out OUR wishes (fewer taxes, spend more), but we the public don’t really understand complex economics, or have the future in mind because we’ll be dead! It’s a recipe for disaster. The real question in this game of musical chairs is when the music finally stops (it will), will you (or your kids) have a seat?

And what’s all this talk about debt ceilings? In real life, if I go broke and can’t pay for the things I bought, creditors take it all back. That’s not the case in a fiat monetary system. The government can just say, “print the money… we're good! Also, raise the debt ceiling so we can keep upping our credit limit and buy more stuff we can’t afford right now, but we’ll be able to in the future…we hope.”

So that means they’re taking out another credit card to pay for their current credit card? Riiiiiight. You and I can’t do that forever. How is that fair?

If the government can print endless money, why do we pay taxes? Why is anyone poor? Why do kids go hungry? Just print the money and hand it out, right? We’ll all be millionaires! End poverty!

By now you should be seeing the cracks in the system. Wealth inequality is worsening and causing societal unrest. People are getting mad and they don’t know why. They see a select few living the American dream but they’re stuck on a hamster wheel they can’t get off. They work, they save, their money doesn’t go as far because of inflation, they work harder, it doesn’t help. They can’t keep up, they see the rich getting richer, they get mad, and eventually revolt. Even newly elected officials that promise change can’t really do anything because the monetary system is so broken and entrenched, but no one knows why so they try to fix other stuff and it doesn’t work. Add a pandemic on top that is stressful and causes people to lose their jobs/livelihoods and it’s a powder keg.

To keep the peace, the government has moved to its last desperate measure before the system unravels completely...'stimmies’. AKA helicopter money. Money directly into the people’s hands. Skip the banks, send it right to the people. Suddenly, people are flush with cash they didn’t work for. The velocity of money, which truly determines inflation, picks up. Demand for goods and services picks up as a result. Supply chains get strapped, and Covid makes it worse. Inflation soars with demand outpacing supply. Now, despite the stimulus money, it’s hard to afford bacon anymore, and people are pissed. More dollars floating around with less supply of goods is bad news bears.

To combat this, the government tries to tamper inflation by raising interest rates/tapering bond purchases so there is less lending/borrowing and money floating around the system. But they can’t raise rates too much as they did in the 70s and 80s because just like if you owed a ton of money on your credit card and the rates went up, you’d never pay it off and you’d go bankrupt. Also, when they raise rates, the stock market sells off because it’s been conditioned to need the government printing money/injecting liquidity and keeping interest rates low so stocks seem favorable. Furthermore, pensions and everyone’s life savings are in the market (and not a savings account earning nothing), and if the market crashes, a massive recession would ensue – no one wants that. On top of that, Medicare and SS aren’t properly funded as discussed prior, and now that everyone is flush with cash and not working there isn’t enough tax revenue collected for gov’t programs. Uh oh...the fiat ponzi debt bubble is about to burst.

But wait, the government has the solution....

Print more money baby!!

You will get used to this meme as it gets to the heart of everything I’m speaking of. Money printer goes brrrr, always and forever. It can’t be turned off. It can be temporarily stopped or turned down, but that’s becoming more infrequent. The US will never default on its debt. Ever. Why? Say it with me folks, “they can just print more money!” As discussed above there are really no other good options.

They must print because if inflation runs high, bonds sell off and bond interest rates rise (inverse relationship) because no one wants to hold a bond earning 1-2% interest when inflation is at 5% or more. This leads to the government not being able to pay the interest on their debt...like a high credit card interest rate.

If they hike rates to tamper inflation – they doom themselves because as stated before they can’t pay the debt interest if they raise rates too high.

Hiking rates also crushes the stock market – no bueno for anyone. Especially the rich with assets and everyone’s 401K/pension fund.

So what’s the option? Raise taxes? No chance - too unpopular. Raise interest rates and send the economy into a depression and default on our trillions of debt? Not gonna happen. The answer - Brrrrrrrrrr. AKA Quantitative Easing. Printing money to buy their own US treasury bonds keeps bond interest rates low so the debt is affordable while they also hand out money so people spend it. It’s like a chef at a restaurant eating their own food with no customers but telling everyone, “business is great!”

What’s different than the 2008 financial crisis? Well, they did print billions of dollars back then, but if you recall interest rates were around 5% or more. Cutting interest rates dramatically stimulates the economy, but that trick is played out now. You can’t cut them any lower. Or can you???

In Europe, bonds were/are earning NEGATIVE YIELDS.

I REPEAT, NEGATIVE YIELDS. YOU ARE PAYING THEM TO HOLD YOUR MONEY… SO THEY CAN LEND IT OUT AND EARN MONEY.

They are so desperate for you to spend money so they can collect taxes they are charging you to save it!

It’s not here yet in the US but it could be soon. Even if rates don’t go negative (which could cause a bank run with people pulling their money out) the real yields ARE negative. If inflation is 6% and you’re earning 1%, your real yield on that bond is –5%. Ouch. Real “safe” investment. At least it’s better than the cash in your savings account which is earning nothing, so effectively your yield is –6% on that. Awesome!

Basically, the government is out of options other than to print money at an unprecedented rate to keep the party going. The problem in the meantime is everyone thinks they’re getting rich because helicopter money is flowing and stocks are racing higher and your home is worth more.

You’re not getting rich, you’re currency is just being devalued. Bummer!

It’s going to end, it’s just a matter of when (see Weimar Republic -Germany for reference). When the music stops, what’s your plan?

Trust me, I’m not an anarchistic and I don’t wish for the collapse of governments/the US dollar despite their shortfalls and policy errors - that would be a disaster. What I want is a fair system. I want transparency. I want an opportunity to opt-OUT of the inflationary bubble I’ve been forced into my whole life, if I so choose. I want to store my wealth and protect my time without fear of currency debasement that I don’t control, or be forced into risky assets that I’m not really interested in. I now have a choice, and so do you.

Luckily for everyone on the planet, in 2009 an open monetary network/protocol was launched - Bitcoin. A technological evolution of money the world has never seen before - so profound hardly anyone can comprehend its magnitude. Digital, programable, sound money. The best of gold’s attributes (as money) and more, digitized for the 21st century. Literally digital gold. Available to all, with the click of a button.

In brief, Bitcoin is an open-source digital monetary protocol for everyone (and controlled by no one) built on math and code that is transparent and fair, immutable, secure, removes counterparty risk, and eliminates debasement with an absolute fixed supply of 21 million bitcoins. ~19 million have been released into circulation. The final 2 million will be distributed about every 10 minutes over the next 118 years. Supply and demand…starting to get interested?

If yes, good! You’re early. If not, I suspect you will in time, and that’s okay too. It’s complicated for sure. You’ll have to learn “what is money” from scratch and embrace change, not fear it. It’s not for the faint of heart, but the reward could be massive. Open-mindedness will prevail. Crypto Pulse is here to help!

So we’ve finally gotten through the all important WHY. Now we move into exactly WHAT Bitcoin is and how it changes the game. Until next time…

Thanks for reading.

Be humble, stay hungry, stay foolish

THIS is Crypto Pulse

https://m.youtube.com/watch?v=AO4n0eqSx84&feature=youtu.be

This is a good video to watch,

We are bankrupt monetarily and fundamentally

My concern is the value of BTC is based on the dollar as is all other commodities. When and how will the value of BTC stand alone?