The government just raised the debt ceiling by another few trillion (always be spendin’), bitcoin crashed for some easy stackin’ (always be stackin’), the crypto congressional hearing was extremely bullish…LFG!! Be like Turk, get excited!

Remember - money printing is only going to accelerate from here. They’ll bluff they’re decreasing it and maaaaybe turn it down for a stretch, but not for long. My prediction is they taper bond purchases and threaten rate hikes or approve 1-2 small ones before everything goes crash and they turn back on the printer into overdrive. Let’s see how that plays out over the next year.

Regardless, inflation is at 40-year highs. If you didn’t get a 7% raise this year, your salary isn’t keeping up with currency debasement, sad huh? If you’re retired and have lots of cash in a savings account (obviously some is necessary)- time to think really hard about that. Protect yourself and your family. Protect your time. For Noah and I, the answer to that is Bitcoin.

Moving on…

In prior newsletters, we talked about the dysfunction of the current monetary system and the consequences of inflationary policies. Now it’s time to start digging into the nitty gritty of Bitcoin over the next few weeks so you truly understand it and why it’s going to change the world. Time to geek out!

But before we even talk about WHAT a Bitcoin actually is, IMO, you cannot understand Bitcoin until you have some understanding of the properties that define money, and how the dollar bill or credit card you use every day came into existence. I repeat -

You cannot understand Bitcoin until you have some understanding of what money really is.

One more time? Nah. You get it by now. I will put a link for a book at the end to help you on your journey to understanding money, and ultimately Bitcoin. I trust you are here to learn, so get after it! It really helped set the stage for me. However, we will talk about a few basic concepts that are critical to understanding Bitcoin, its importance, and the problem it is solving.

Once you understand what money is, you will want the best money, and that quite simply, is Bitcoin.

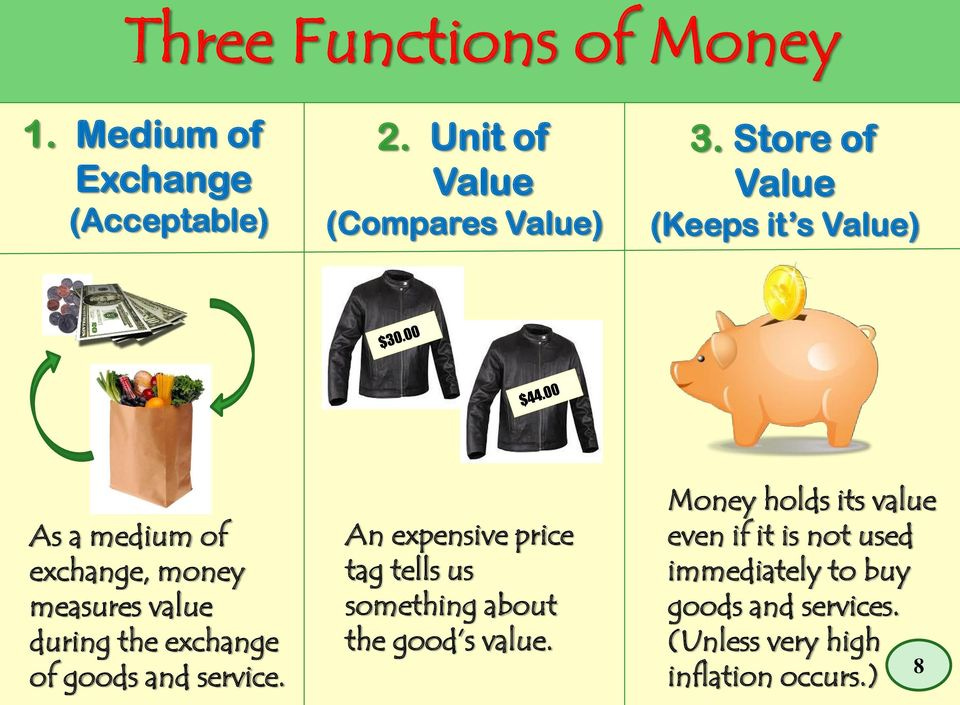

Money is ultimately just a tool and a ledger to allow for fair trade (who owes who what). It has desirable traits listed below, with some forms of money better than others.

** “Fiat” currency is a government-issued currency that is not backed by a commodity such as gold. Fiat = the dollar or any other currency (Euro, etc). **

Although only three examples are shown in this table, remember money has evolved over thousands and thousands of years. I know we’re all used to dollar bills and swiping plastic, but back in the day people used to trade salt, flour, arrow heads, cigarettes, chickens, silver or gold before moving to the fiat (paper money) system we know today.

Money is essential because it allows for trade. It underpins everything in society and allows it to function. What that “money” exactly is has evolved over the years as technology has improved. Again, in the early days money was in the form of commodities like salt, because it was abundant and could be measured. Ever heard the phrase, “worth your weight in salt?” That’s where it comes from. However, salt isn’t very portable, durable or scarce, so eventually other commodities that had these better monetary properties were adopted, namely gold, because it was scarce.

Gold is an incredible form of money. Look at the chart above. It has many many properties of outstanding money and is certainly better than fiat currency which we use today. So why don’t we use gold as money anymore then? It’s a great question and there are two main reasons. First, I take you back to the end of the “gold standard” in 1971 when Nixon and the USA ended it. With the gold standard, countries agreed to hold a reserve amount of gold equal to the amount of fiat paper money they issued. When Nixon ended it, the reason was that the US didn’t have enough gold to pay all the fiat debt they had issued, and people/other countries were starting to call their bluff and ask for gold in exchange for dollar bills, which we didn’t have. With the end of the "gold standard”, no one (including other countries) had to keep gold in reserves anymore as a way to pay their debt if called upon. Now, they were free to print as much fiat money as they wanted to buy stuff because they didn’t need to have gold stashed away in reserve when someone came asking for their debt to be repaid. Voila! Problems solved!

Second, as good as gold is as money, look at the problems it has. Do you store a gold bar in your house? Can you buy a coffee with a gold bar at Starbucks? Are you gonna shave a few flecks off to get the PSL? Mmmmmm PSL….

Heck no! You can’t easily store it in your wallet, verify it’s real gold at Starbucks, or transport it across town to buy shoes amongst other things. It’s incredibly valuable though because it’s SCARCE. You love your gold watch because gold is a scarce commodity, and society has deemed it valuable because of how scarce it is (and yea, it’s pretty, but so is fake gold). It has some industrial use cases as well, but not like silver. Most of gold’s value is due to its scarcity and its monetary premium.

Ultimately, humans value scarce objects immensely.

But when the price of gold goes up, gold miners dig more up to sell because they make more profit. It’s not easy to dig up, but they’ll find a way to get more out of the earth as the price rises, no doubt about it. This ultimately brings more gold supply to the market and prices go down (supply and demand). Which brings me to this.

Gold is valuable and a great form of money, BUT IT IS NOT THE BEST MONEY ANYMORE. Ultimately, the best money wins.

Enter Bitcoin.

Remember, money is ultimately just a tool (that can be improved with technology) that allows for trade. Not until Bitcoin was invented in 2008 and available for trade in 2009 did we have a better option regarding “the best money”. We had to use fiat because the government decreed it, and using gold, to be honest, wasn’t really an option for all the reasons discussed above (Starbucks example). We HAD to use paper money given how easy it was to transport and pay for things compared to gold. However, we didn’t have to go off the gold standard, we chose to, and that has led to many unintended consequences we are now paying for dearly.

With the invention of Bitcoin (as a technology), the best form of money that has ever existed in the history of the world is now available to us all. Its biggest downfall is that it’s not 5000 years old like gold, but I think we’ll get there. Look at all those desirable qualities of money it has! We’ve never seen anything like it! Most importantly, it has absolute scarcity, even more scarce than gold! There will only ever be 21 million Bitcoin. No one can print more of it or dig more out of the earth when prices are higher. We’ll talk about this more in subsequent newsletters, but don’t try to fool yourself.

There will only ever be 21 million Bitcoin.

Importantly, money is whatever people agree upon it is (salt, cigarettes, gold, etc.). The US government can make this harder and influence it, but ultimately cannot control what the world ultimately decides. Bitcoin is in the very early stage of that process of becoming money, and already has millions of people like Noah and myself as adopters. How insane is that? We’re living through a time where new money is evolving before our eyes! This will go down in history and you get to witness it and partake in it if you choose!

Like all monies before it, it is going through an evolution…

First used as a store of value (Bitcoin current state)

Then used as a medium of exchange

Finally, a unit of account/value

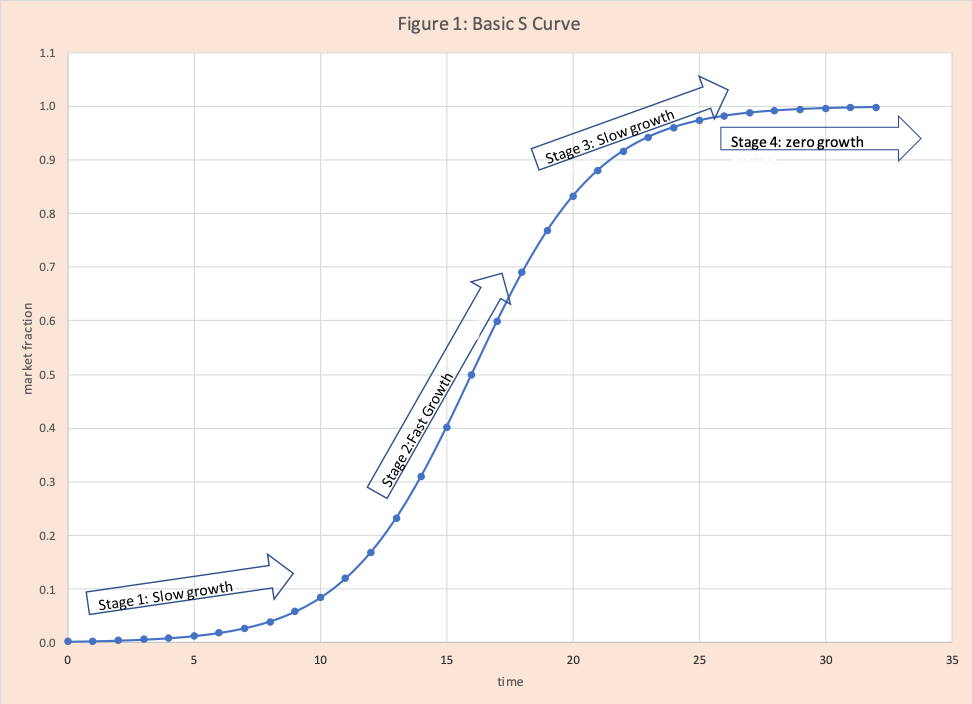

Also like every technology that’s adopted, it’s on an S curve.

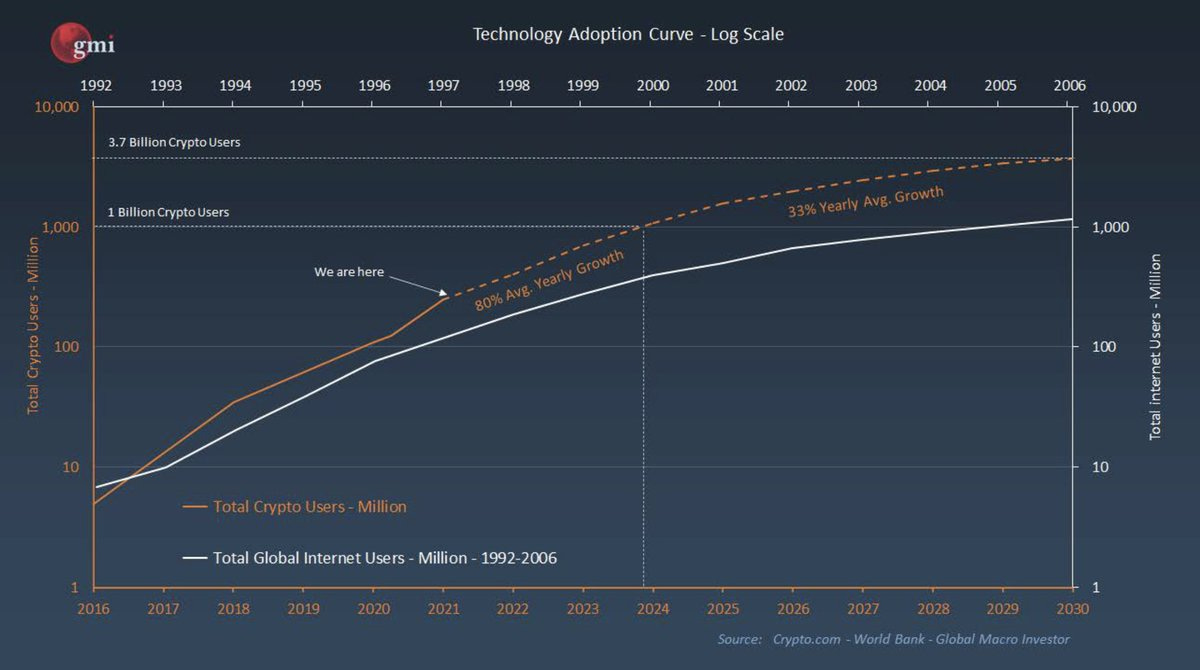

We’re getting closer to the lower inflection point every day. In fact, compare Bitcoin/crypto adoption to the adoption of the internet and it’s WAY AHEAD.

That should make you do this:

Wish you could go back in time and invest in the internet if it were possible? Now’s your chance with Bitcoin.

Once everyone in the world adopts Bitcoin and agrees that it is money, fiat money simply dies/becomes useless. Take Venezuela for example. Think this currency has any value with all the money they printed? A wheelbarrow for a cup of coffee…

That’s the path we’re on with central banks revving up the printer throughout the world, and it’s not stopping. People like Noah and I are opting out of the old system because we now have a choice, and are choosing Bitcoin. I expect over time all of you will as well, just at different points along the adoption curve. Everyone eventually buys Bitcoin at the price they deserve. The earlier you take the leap, the cheaper it is. I wouldn’t want to be a laggard (we’re currently at early adopter stage).

Eventually, when Bitcoin is recognized as the best form of money by everyone, those who refuse to accept it simply get pushed aside. The best money creates network effects that everyone converges on, and ultimately if you choose to keep using salt/chickens/gold/fiat as your version of money, no one will accept it because we’ve all moved on and now you have to as well.

It’s like refusing to move to an Electronic Health Records (EHR) system because you like to write orders by hand.

Either adapt or retire because the system is moving on with or without you. We digitized medical records and we’re digitizing money next. Is it really that hard to fathom? And no, Venmo is not digital money like Bitcoin because I know you’re asking yourself that. Venmo is just like a credit card built as a layer on top of the corrupt and broken fiat monetary system. Yes it’s “digital”, but it’s based off of fiat money, so ultimately it’s going to be worthless.

The fiat monetary system is broken as we discussed prior (Mo’ money Mo’ problems I and II). Gold is yesterday’s news. It will always have value due to its scarcity, but just like Netflix kicked Blockbuster to the curb, Bitcoin will do the same to gold. EVERYTHING IS BEING DIGITIZED, INCLUDING GOLD. You can think of Bitcoin like digital gold, but it’s so so so so so much more than that and at least 10-100x better.

Its intrinsic value is off the charts, and I can’t wait to talk about it soon.

Bitcoin is digital money for the digital age…it couldn’t be more perfect. It’s really just a natural evolution of money, incorporating technology that was never available before. We better our lives in every way with technology (email, Google maps, streaming, cars/planes over horses), why can’t it be the same with money? You just have to get over that massive hurdle in your brain that money can be natively digital and be based on math and code, not printed and controlled by humans who are not infallible. The more you permit human intervention, the more corruption, greed, and desire for power will result. It’s just natural and no one’s fault really, it’s how we’re wired as a species… self-preservation at all costs. Money should be left alone IMO. It should remain out of the hands of human intervention so that it’s fair, consistent, and no one party can take advantage. If you fix the money and make it fair, you can then start to fix and heal the world with a stable, trustworthy, transparent foundation.

Ultimately, Bitcoin is like taking the red pill or the blue pill in The Matrix.

Instead of red, you take the orange pill of Bitcoin and you never look back.

Until next week…

Thanks for reading

Be humble, stay hungry, stay foolish.

THIS is Crypto Pulse

@cryptofordocs

@noahkaufmanmd