The time has come! All this talk about money and inflation and central banks and…

Get to the point! WTF is Bitcoin???? We know…it’s a painful but necessary setup. Sorry bout’ that. As discussed though, without the background of WHY Bitcoin is necessary you wouldn’t understand WHY you’re even buying it. Then when the price plummets 80% (yes this will happen) you’ll freak out and sell it because you have no conviction in what you bought and why you bought it. This is a long-term game, and just like you shouldn’t buy stocks or a house or anything of value before you really understand what it is that you’re buying, the same goes for Bitcoin. So let’s do some Bitcoin 101, shall we?

Yes, we’ll get to “altcoins” (Ethereum, etc.) after Bitcoin…chill. In our opinion, you can’t understand those without understanding the OG (Bitcoin)first.

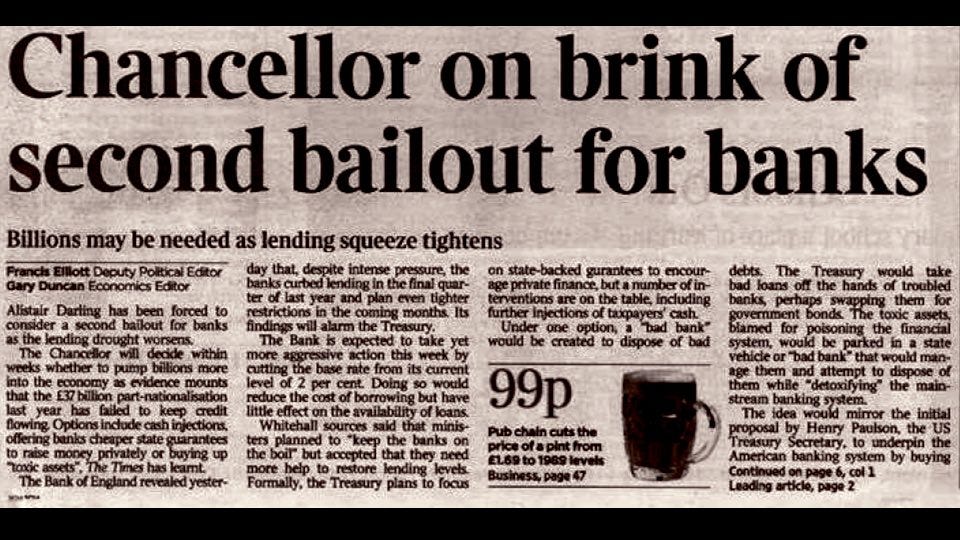

Some basics:

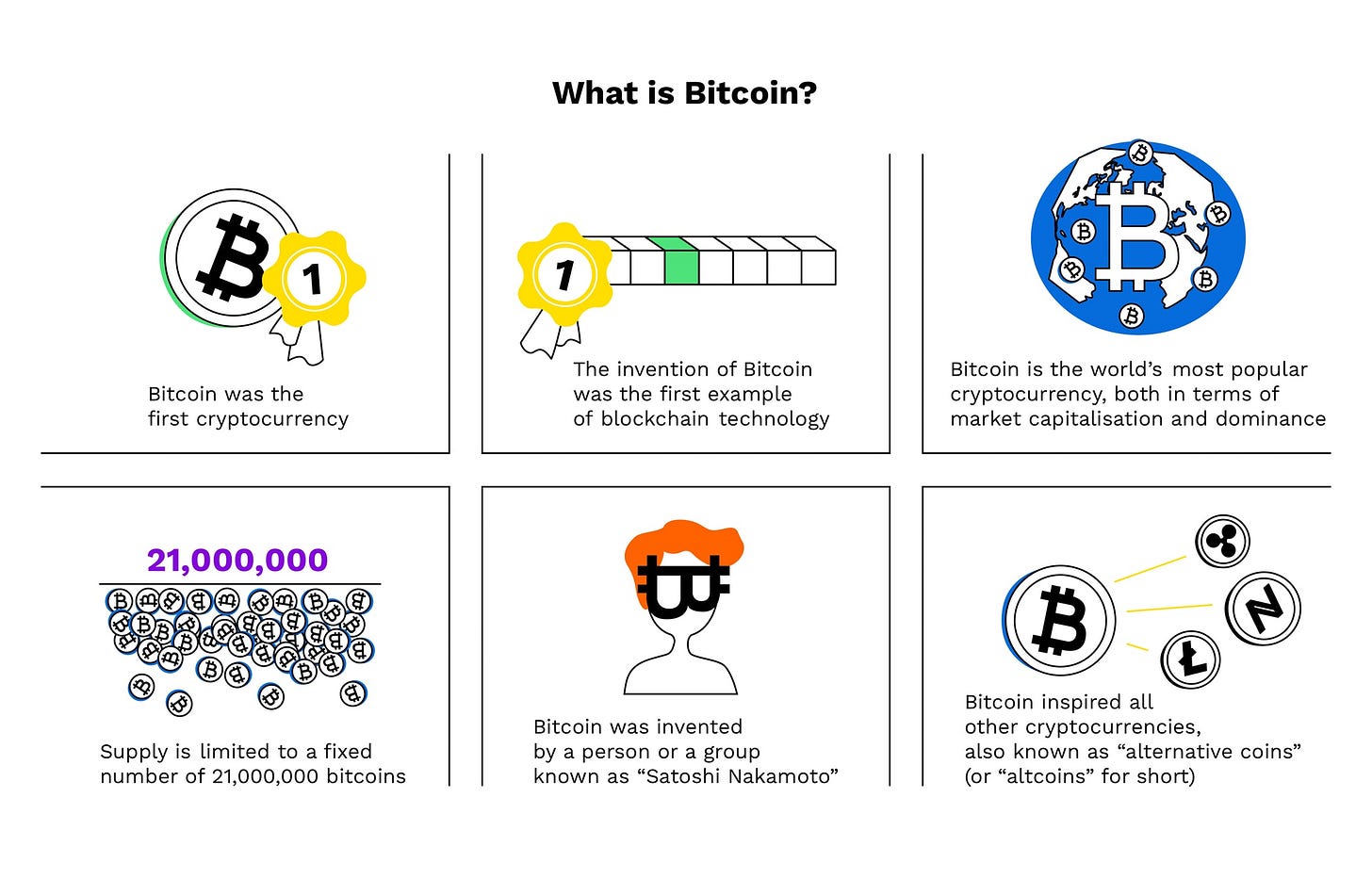

Bitcoin was invented by a pseudonymous person or group named “Satoshi Nakamoto”. The whitepaper was released 10/31/2008 and Bitcoin was available to be “mined” (more on this later) starting January 2009. To this day, no one knows who Satoshi is exactly as he/she/they have disappeared from public forums. Notably, Satoshi imprinted this message on the genesis block of the Bitcoin blockchain:

Satoshi did not invent Bitcoin to get rich and famous. Quite the contrary. The invention of natively digital money with deflationary properties was to combat the endless printing of money/debasement of currencies (inflation) that eat away at everyone’s wealth in an unfair way and promote wealth inequality. It’s a new form of sound money that is natively digital in a now digital world based on math and code. It’s a perfect match. There were attempts to create non-government issued digital money in the past, but they all failed due to needing a central authority. Satoshi solved that problem with the invention of Bitcoin and the creation of a truly decentralized monetary network (no one person or group owns it/controls it).

To understand Bitcoin you first need to understand blockchain technology and cryptography, which is what Bitcoin (and other cryptocurrencies) are built on. So what the heck is blockchain? To be fair it’s quite complicated, and I’m not the world’s expert on it and you don’t have to be to use it, just like I don’t know how my iPhone works. What you do need to understand is that it’s going to change the world.

Blockchain uses computers, math, and code to create trust - eliminating human manipulation/inefficiencies.

Blockchains use cryptography (where the word “crypto” comes from) to secure and verify the transactions on-chain. Cryptography is the mathematical and computational practice of encoding and decoding data, and it’s critical to the security of the network.

Looks like the decoder ring Ralphie uses in The Christmas Story, right?

“Okay, cool. Blockchain seems awesome, but what’s Bitcoin got to do with it?”

How does Bitcoin work?

You can think of the Bitcoin blockchain as the world’s most secure and incorruptible Excel spreadsheet (ledger) - which is ultimately what money is…a tool and a ledger to allow for fair trade (record who owes who what). It tracks everything and records it and it cannot be undone/edited unless it is “attacked” at insanely high costs (more on that later). No one authority owns or is in control of it. It is “decentralized”. Given this new technology, all transactions are on an open, transparent, easily verifiable network (the Bitcoin blockchain) that prevents people from lying/cheating/manipulating, etc. Importantly, it is open source and not closed source technology, meaning a company like Goggle doesn’t control it. It is public like the internet and everyone is free to use it and build on it. Hence, the “internet of money”.

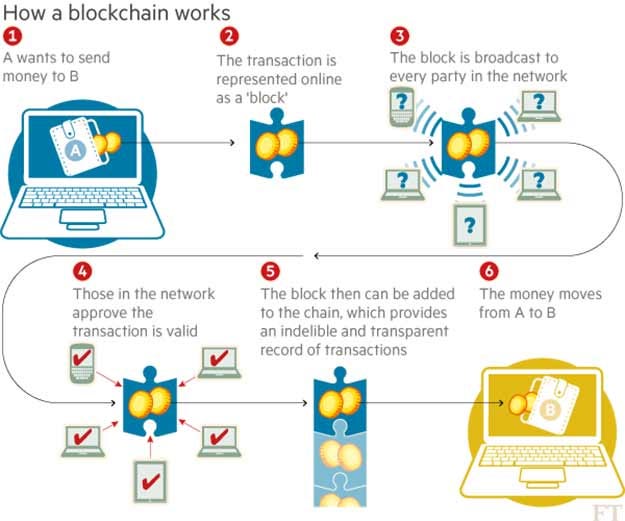

The outline/simplified version goes something like this (more detail to follow):

If I buy/receive bitcoin and want to send it someplace/spend it, the transaction request is placed in a “pool” for the “miners” to complete and add to the blockchain. It’s like waiting in line at a bus stop.

“Miners” are powerful computers used to solve complex math/guessing problems (requiring trillions of guesses per second). They use electricity to perform this task. FYI this is not your typical PC at home - it’s a special mining device.

Miners race each other in competition to solve the complex math problem and whoever solves it first is granted permission to take transaction requests from the pool, incorporate them into the Bitcoin blockchain ledger (and make sure the last batch of transactions was not modified), broadcast their work out to the “nodes” who make sure they are acting honestly, and if approved by the nodes, the miner is rewarded bitcoin based on a pre-programmed monetary policy. As of today, 6.25 bitcoin are awarded ~every 10 minutes to the winning miner. This will decrease until the year 2140 when no more will be awarded and all 21 million bitcoin will be in circulation.

Of note - nodes are not miners. Nodes are run by people like Noah, me, and tens of thousands of others across the world to verify the blockchain is being updated accurately. You can run Bitcoin software code on a simple setup at home. This ensures decentralization.

Those who own the mining hardware sell Bitcoin onto the market when they receive it to pay for expenses and earn profit. Plebs like you and me buy it.

You don’t have to buy/sell whole bitcoins. You can buy/sell Satoshis, or SATs, which are a fraction of a Bitcoin. Simply put, a Satoshi is more or less to a Bitcoin what a penny is to a dollar. They’re both units of the same monetary system. The difference is that 1 dollar = 100 pennies, whereas 1 Bitcoin = 100,000,000 Satoshis.

Cycle repeats.

“But what’s the point of bitcoin? Why do you NEED it?”

The bitcoin reward is the proverbial “carrot” in front of the donkey.

In order for the Bitcoin network to be “secure” and trusted as discussed above and prevent someone from attacking it and messing with the pristine Excel spreadsheet (ledger), Bitcoin must have value to those that are responsible for keeping the ledger updated and accurate. This is where “miners” come in (step 3 above).

Bitcoin miners are rewarded bitcoin for guessing a crazy rare number using computer hardware that expends electricity to do so. Whoever guesses it first is rewarded bitcoins IF they accurately update the ledger and all the “nodes” in the Bitcoin network approve of their work. If the miner lies or commits an error the “nodes” will reject their work and they will lose out on the bitcoin reward - a very costly mistake.

Thus, there is a massive incentive to update the ledger correctly because bitcoin is ridiculously valuable ($~50,000 per coin x 6.25), and the expenses to buy the hardware and pay for the electricity, etc. to mine bitcoin are not small. It’s a business for these miners and a very profitable one if they are good at it.

The key is that if bitcoin itself was worthless, no miners would want to mine it and update the ledger because they’d lose money running all their equipment. That would open up the blockchain to attack and for someone to easily rewrite it and lie/cheat/steal.

You will hear people say “blockchain, not Bitcoin”. Don’t fall for it.

The price, scarcity, network effects, longevity (13 years), and open-source nature of bitcoin drives the flywheel effect and ensures its security so trust is maintained. If you remove the “carrot” (bitcoin), it all falls apart.

It has taken ~13 years for Bitcoin to get to this point. It didn’t have value on the first day in 2009 (and could have been easily attacked). But over time, people started to see the potential value it could have in the future as a store of value that could not be inflated away like today’s currencies, and a massive flywheel effect took over that’s only getting stronger.

The beauty of bitcoin could never be re-created now that it is mainstream and any “new” Bitcoin copycat would just get front run. Bitcoin is the solution famed economist Friedrich Hayek was hoping for back in 1984, the technology just didn’t exist yet…

“I don't believe we shall ever have a good money again before we take the thing out of the hands of government, that is, we can't take it violently out of the hands of government, all we can do is by some sly roundabout way introduce something they can't stop.”

So let’s talk even more about this whole mining thing and bitcoin rewards (aka tokenomics).

Bitcoin mining is done by "Proof of Work” (POW). You will hear this a lot in the crypto world. POW vs. POS (proof of stake). We will talk about POS later with other altcoins, but for now, the focus is on Bitcoin and POW. POW is exactly what it sounds like as detailed above. Bitcoin miners use electricity to power their computer mining rigs to solve a hard guessing game to earn bitcoin rewards. The miners must do “work” to earn the reward and spend real-world resources in order to do so (money on electricity, computers, etc.). The reward for solving the problem first and updating the ledger accurately according to the software code that nodes are holding them accountable to, is bitcoin. Bitcoin is a deflationary asset/currency. The rewards get SMALLER over time.

The graph above is incorrect as of today, just FYI. In 2021 the rewards per bitcoin block are 6.25 coins, not 12.5. Every 4 years bitcoin rewards per block go down so that in the year 2140 all of bitcoins supply (21 million) will be mined and no more will be made. At this time, ~19 million of the 21 million total have been mined and are in circulation. Only a few million to go over the next 118 years.

I repeat, at this time, ~19 million of the 21 million total have been mined and are in circulation. Only a few million to go over the next 118 years.

Supply and demand is a very simple but elegant concept, and trust me, demand for bitcoin is skyrocketing.

The supply reduction every 4 years is called the “halving” (next one in 2024) and helps to create flywheel effects due to a supply shock and increased scarcity - which again is the most important property of money.

There will only ever be 21 million bitcoin.

How do I know this? Well, as Noah and I operate bitcoin nodes and I can promise you if anyone ever proposes to change the code and increase the number of bitcoins produced while we’re alive, we’ll reject it, and so will many others. You have our word! This is a non-issue. The fixed monetary supply is its most important property.

“Okay cool, bitcoin is valuable so I’m going to get all this computer equipment and mine it all asap before 2140. Easy peasy. I’ll be rich AF.”

Sorry…Bitcoin is smarter than you. This is where it can get weird but we think of Bitcoin as a living organism almost.

It’s called "the difficulty adjustment” built into the software code of Bitcoin. The harder you try to mine it, the harder it is to solve the guessing problem to earn the bitcoin reward. Bitcoin always aims to produce a “block” of transactions that are verified by the nodes ~10 minutes. If that time goes down, it’s becoming too easy for the miners and so the difficulty to solve the guessing problem goes UP so the blocks stay near-constant around 10 minutes. Same thing if the blocks are taking longer than 10 minutes. The difficulty adjustment goes DOWN and it gets easier for the miners. The difficulty adjusts ~every 2 weeks. The reward is adjusted every 4 years. Important to know the difference.

Thus, unlike when the price of real physical gold goes up and more miners dig it out of the ground because it’s expensive and they will get rich selling it, you can’t do that with bitcoin.

It knows you want it all, but prevents you from getting it any faster, thus making it fair to all. This also creates a backstop if the price of bitcoin goes down and fewer miners want it (because the price is less) because it gets easier for other miners to now earn it, and that starts the flywheel effect up again. I mean…

We’ve talked a lot about POW and mining and that’s because it’s essential to the network and underpins everything. It’s responsible for the security of the network so that no one can mess with the ledger and undo prior transactions or double spend and cause you to not trust it. Trust is everything. THAT is bitcoin’s ultimate intrinsic value. You can TRUST it (unlike the government money printer).

If trust is gone - Bitcoin is dead. Thus, security is everything.

Regarding the security of the network (this is not a simple concept FYI), “hashrate” is the computational energy the computers(miners) are spending to solve the guessing problem and earn the bitcoin reward. The higher the hashrate the more miners there are trying to earn bitcoin and the “healthier and more secure” the network is. This prevents the so-called “51% attack” on bitcoin whereby if a miner had more than 51% of the hashrate they could “control” the network and mess with the ledger and destroy trust. This has never happened with Bitcoin and it’s only getting harder to do as it would take billions and billions of dollars to run all those miners and pay for the electricity to outcompete all the other miners in existence. We consider this more or less a non-issue at this point given the status of Bitcoin. It could have happened in the early years, but now we’re 13 years in and Bitcoin has gone mainstream.

Concerns over what is going to take down Bitcoin (ex. 51% attack) are called FUD. Fear, uncertainty, and doubt. You’ll hear the term a lot and we’ll devote a whole newsletter to it coming up soon. To believe in and hold Bitcoin you must have thick skin and deal with FUD. There is no other way. Your reward for doing so could be immense, but there are no guarantees.

The technological breakthrough of Bitcoin is unrivaled. It set the stage for other cryptocurrenices, but when it comes to money that is natively digital, for everyone and controlled by no one, cannot be shut down (unless you can shut down the internet), open, transparent, secure, easily verifiable, and the list goes on and on - there is only one, and that is the OG -Bitcoin.

In the next few newsletters we’ll discuss topics such as:

Bitcoin’s “intrinsic value”

FUD - why can’t you just make another Bitcoin? Energy concerns, etc.

Scaling / real world use / future scenarios

How to buy it/store it/spend it & tax implications

If you want a simple video to help you start to understand what is money and Bitcoin, here is a link that is a good starter. Sometimes you need a video and not just a newsletter. Other links (podcasts, articles, etc.) are also below. Never stop learning and challenging your assumptions. Enjoy your trip down the rabbit hole!

Till next time…(January 8th - taking some time off for the holidays)

Be humble, stay hungry, stay foolish.

THIS is Crypto Pulse