Just in time for the show! Energized, ready to rock. How was your summer? I got caught in a hurricane. That was fun.

If you’re hoping the hurricane has passed and I’m writing to hype you up about the insanity that’s hopefully on the horizon, well, you got it!!! I got bullishness pumping through my veins right now. You have NO idea. Whatever you’re feeling, x1000.

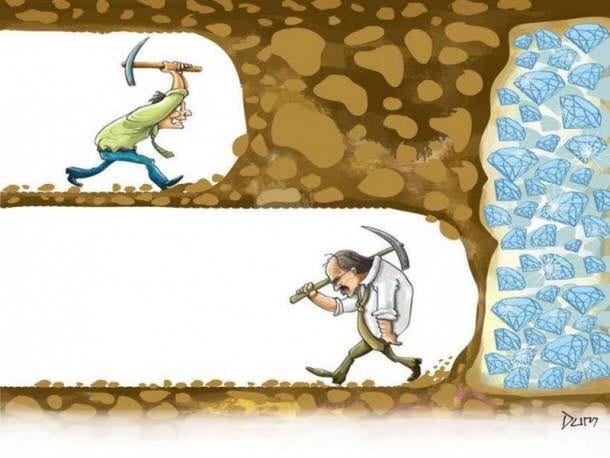

I recently graduated from my first bitcoin cycle (8/2020 – 8/2024) and I truly believe that’s the hardest part.

Making it through and HODLing the whole way. NO selling. Endless learning. Persevering through adversity when you’re down 80+% but having full conviction to buy more. Everyone laughing at you, but deep down you feel like you understand something they don’t. If you can make it through that first cycle and graduate, things look…

So good that it’s impossible to break your conviction. You’ve got the results now to prove it, and the best is yet to come.

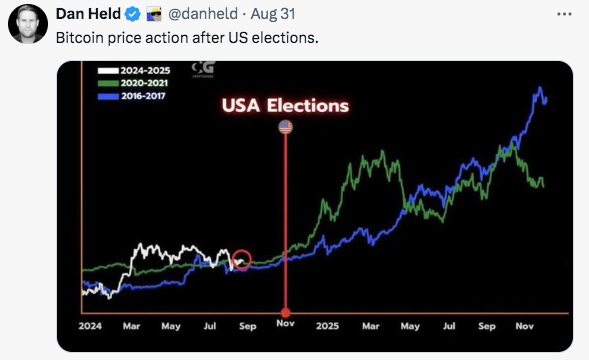

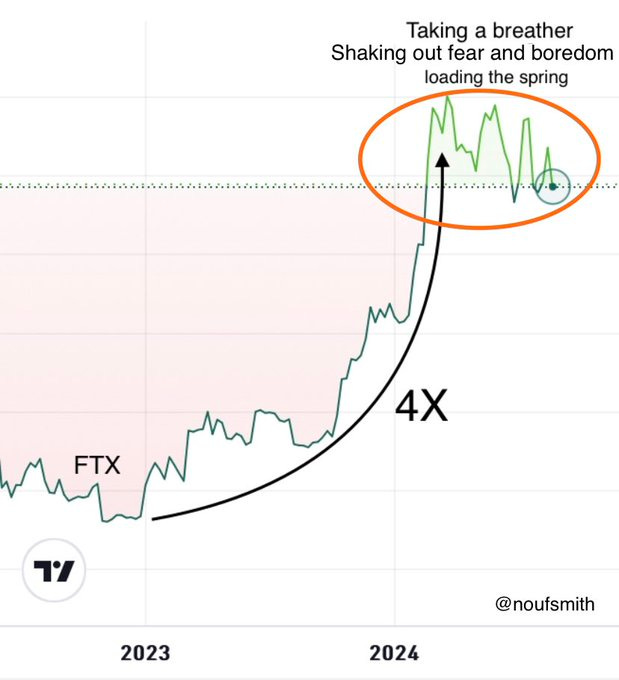

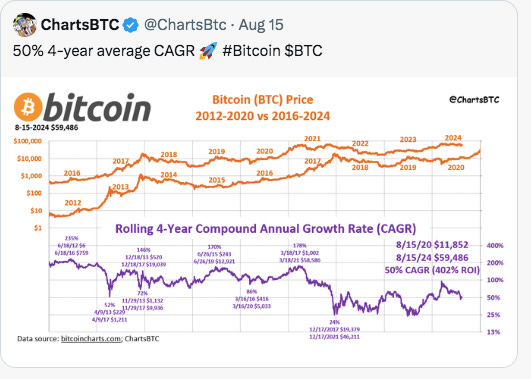

Q4 of the halving year into the following Q1 (2024 into 2025) are typically the highest quarterly returns. Bitcoin is already up 50% this year and 137% year over year. Not too shabby! The best performing asset yet again this year, and the best is yet to come (usually)!

The pattern will likely eventually break in the future, but I am not one to say this time is different. EVERYTHING looks identical to the past.

I fully expect a massive bull run to commence around and likely after the November election, but it usually kicks off in October. The month fondly referred to as UPtober in the bitcoin world.

The main reason for this is that globally, central banks are about to print a ton of money in an essentially coordinated effort now that inflation is back down to near target. It’s actually quite a cyclical phenomenon, as debt gets rolled over every 4-5 years since the 2000 dot-com bust, and new money MUST be printed to refinance it all without the entire fiat system collapsing. Take advantage when you know the cards they're holding! Here comes the BRRRRRRRRR….

The time for buying was the past few years when I said this day was coming. If you listened, I’m happy for you. If you didn’t, the best time to buy was yesterday. Otherwise, it’s today. As long as your time preference is 4-5+ years, you should be just fine. I’ll be buying with you all along the way, just like Michael Saylor does and says, “I’ll be buying the top forever.” And we mean it!

The goal isn’t more fiat. The goal is more bitcoin. If you own more than you did yesterday, regardless of the price, you’re winning in my book. Your goal is to increase your bitcoin stack, similar to how you desire to increase your USD stack today. It's a crazy concept, but stay open-minded and think long-term!

How much bitcoin have you stacked while I was gone this summer? The correct answer is NOT ENOUGH!

It’s not always easy or possible, and I feel your pain…

…but we’ve had some nice price dips this summer. Did you take advantage? I hope so. Your future self and progeny will thank you.

Why the price dips from all time high?

1. We had a nice run-up to the all-time high bitcoin price in March 2024 with the approval of the ETF and new demand for the apex predator asset.

That has since cooled off (a little), and the price has reflected that. Regardless, the bitcoin ETFs are THE MOST SUCCESSFUL ETF LAUNCH IN HISTORY. DON’T LET ANYONE FOOL YOU. THERE IS MASSIVE INSTITUTIONAL ADOPTION AND BUYING. THE NUMBERS DON’T LIE.

Another reason for the mild sell-off is that many traders booked profits, and some long-term bitcoin holders also sold some coins for lifestyle purposes (good for them; you can’t take it with you to the grave). This is very typical behavior, and we are consolidating in the 50ks-60s and building a massive base for the NEXT bear market in a few years.

I expect the price to return to these levels in 2026ish (hello 58k!), but I could be very wrong and we never see these prices again. Those are the risks you take if you wait to buy. Regardless, I think bitcoin is undervalued at these current prices today by a wide margin and I like buying things I love on sale.

A quick side note on the Ethereum ETF launch. I don’t get everything right, but this one I did. Putrid, pathetic, no interest, a dud. Compared to the Bitcoin ETFs there is essentially no demand as predicted.

That may change by next year, but I’m not so sure. People don’t understand what Ethereum is, why it’s useful, why it’s better than any of the other 20,000 + crypto tokens, etc., etc. Its monetary policy changes yearly, its “roadmap” is daunting, and the leaders/ETH foundation keeps selling more tokens to fund themselves. ETH is not money. It is digital equity, insanely risky, and potentially overvalued. ETH may have some value as digital equity, I just don’t know what that is. I know it’s not sound money and isn’t competing with bitcoin. Bitcoin is the best money, and that’s ultimately what we all need/want. Do your own research and decide.

2. The best price dip of the summer was due to the Japanese Yen carry trade imploding and creating a ton of forced sellers who got margin called/liquidated and had to sell anything they had to cover their losses.

In very brief, people borrow Japanese Yen fiat at very low interest rates (0.1% or less) and buy US dollars or dollar assets like US stocks, earning significantly more (US bonds yield ~5% today). Easy money, right? Trillions of dollars are involved in this trade, but when the Japanese Central Bank (similar to the Federal Reserve) increased interest rates to combat inflation over there, suddenly, the trade went against them quickly as their cost to borrow went up. In addition, as the US Federal Reserve was signaling they would be decreasing rates from ~5%, that also went against the trade. Suddenly, everyone panicked almost simultaneously over the weekend in early August, and the dominos started falling.

You can’t be the last one out of the trade, so the selling was fast. Bitcoin is the MOST liquid asset on the entire earth. It trades 24/7/365 and can be sold overnight at 2 am on a Saturday if you need cash. That’s why it’s the world’s best money and that also brings with it volatility. You need to EMBRACE volatility, not fear it. When degen traders are forced sellers of a pristine asset like bitcoin you take advantage of their foolishness and buy it from them! That’s what I did. Cheap 49k bitcoin? Thank you, yes, please.

They didn’t WANT to sell it, they HAD to. I bought it from them at a discount, they’ll never see it again, and there’s only 21 million. No new supply, no matter how much demand there is. They’ll have to offer me a stupidly high price, and even then, I’m probably not selling – sorry, I’m not sorry. That’s how this works, folks. The world’s best money eventually finds its way into strong diamond hands like mine and out of weak lettuce hands like degen traders who don’t understand what they hold. The data on chain backs it up.

It’s like taking candy from a baby. Capitalize on it. Punish them. This isn’t the last time this will happen, either. It’s going to happen countless times over the next decade. Know what you own, know why you own it and its true value, and buy it when it’s on sale.

I ask myself these three simple questions if the price dips and I’m ever in doubt: Is bitcoin still decentralized? Is bitcoin still secure? Are there still only 21 million bitcoin? IF the answer is YES to all three questions, I buy. If that changes, all bets are off and I’d have to rethink my savings plan. I don’t see those things ever changing, so I’m quite confident but always reassessing. I keep it simple, which is how saving your money should be. INVESTING IS HARD. SAVING SHOULD BE EASY. Bitcoin is saving. Buying stocks and real estate is investing.

3. GBTC ETF selling billions of dollars of bitcoin for many reasons will certainly drop the price. Eventually, they’ll run out of bitcoin to sell or change their fee structure for the ETF, likely within the year. They can’t keep selling forever!

4. Finally, Germany seized a bunch of bitcoin from someone and market-sold it over a few weeks this summer. I bought bitcoin from the German government—how awesome is that?! I’ll tell my grandkids that someday. Idiots!!

Why is the price seemingly stuck at 58K?

It’s partly seasonal, so I signed off for the summer, recognizing that not much would take place in the way of legitimate price action to the upside. Markets and those who invest in them professionally take off for the summer, chill out in the Hamptons, and don’t engage much. That all changes in October when they’re back to work and trying to ensure their end-of-year returns look good for those who invest money with them.

They are looking to ideally beat the S&P500 and Nasdaq returns, the baseline they are compared to. If you invest money and pay someone to do it for you, they had better beat those returns because otherwise, you could just put your money into those index funds for free. How did your returns do compared to those benchmarks? (20% so far for both).

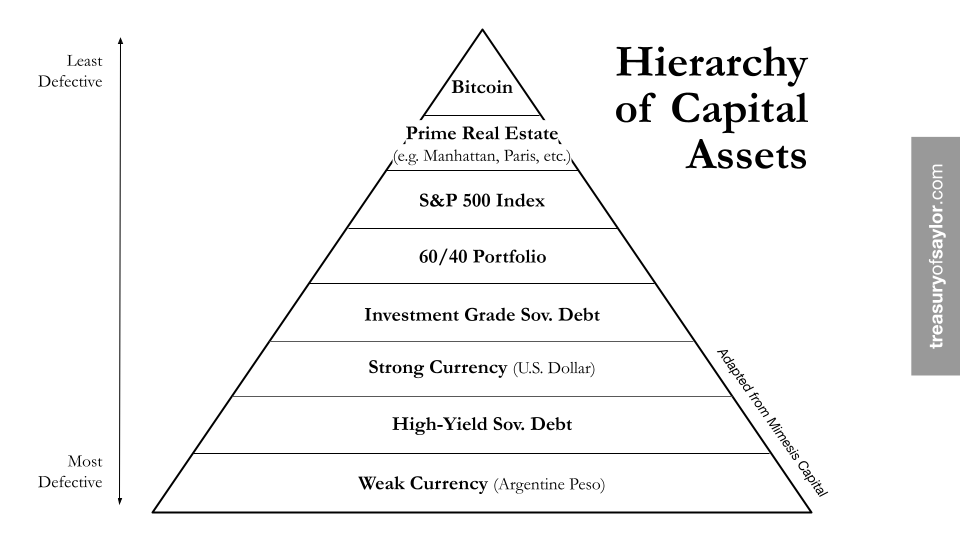

Eventually, their fund’s returns will be compared to bitcoin, the baseline I compare everything to because it’s the best money. If you can’t beat bitcoin’s annualized returns of ~50% per year at no cost, I’m not really interested in what you’re selling.

I would rather just buy Bitcoin myself and not lose out on all the fees you charge and take on all this risk investing. Notice how I said I did NOT want to take on the risk of investing. Bitcoin is the least risky thing. I know that is blowing your mind right now, and that’s okay. It did for me too, at first, but eventually, you’ll see it as I do. Heck, even Blackrock agrees with me now!

The largest asset manager in the world admits that he was wrong about bitcoin and it’s a flight to quality and SAFETY.

Maybe I’m not crazy after all?? Eventually, this is how everyone will think and make rational economic decisions. It would be ludicrous to see your friend/colleague/family member making 50% annualized returns on their investment at almost no cost and no effort with less risk (compared to real estate management or stock picking) while you earn ~8-10% or less (on average with a diversified portfolio) with massive fees attached, reducing your returns to BELOW INFLATION (real inflation is around 7-10% based on money supply growth, not the widely reported and highly manipulated/biased CPI of 2-3%).

That’s what is happening right now and <1% of the world understands it. Will you do the work? Most people are too lazy and scared to. Don’t be like that. Seize the opportunity. You don’t have to go all-in, but at least put in the effort and consider a small allocation.

If you didn’t take advantage of the price dips this summer, well...99% of the world didn’t either, so you’re in good company, don’t feel too bad.

For example, I’ve been listening to a lot of insanely smart traditional finance people lately screaming at the top of their lungs why bitcoin is so dumb and why they couldn’t possibly ever invest a dollar into it. They swore up and down that it was a low interest rate/easy money/speculative phenomenon and that it would vanish when the Fed raised rates and stopped QE (money printing). Well, here we are at 5.25% interest rates, the Fed is doing the opposite of money printing (QT), and bitcoin broke ATH in March and is sitting comfy in the 60s ready to break higher soon. Once again, they were WRONG. Don’t listen to these fools, they don’t understand what money is.

They also proclaim:

It has no cash flows

It has no CEO or management team

It has no income statement

It has no earnings

It has no product

It has no employees

It’s digital, there is nothing tangible to it, you can’t hold it

It’s backed by nothing

It has no other utility, like gold or silver or oil

My response: EXACTLY!! IT’S JUST MONEY!!!!

Everyone in this world, including those working in traditional finance (the so called experts), work their entire lives for money, but haven’t ever stopped to think about what money is for even one second.

Isn’t that crazy? You spend your days potentially doing something you don’t even love to earn something that you don’t even know what the hell it is?? You work hard for that money, and the government prints it out of thin air, diluting your wealth because “inflation is good and necessary,” they tell you.

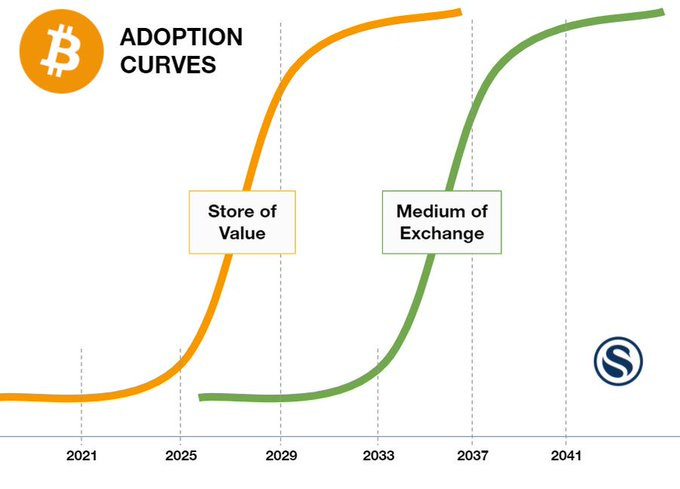

Everyone thinks of money as a medium of exchange, but that’s such a trivial aspect of its actual use case and value. First and foremost, it needs to be a store of value, and for that to occur, it needs to be scarce and in demand. Eventually, it will become a medium of exchange, but it will take time for people to make rational economic decisions.

I’m certainly not spending my bitcoin as its value skyrockets since it is so early in its monetization phase. I technically could if I wanted to. Donald Trump just bought a burger with bitcoin. Try that with gold!

In addition to losing out on price appreciation, I’ll have to pay capital gains tax when I spend it due to US tax laws. I’m thus incentivized NOT to use it right now as a MOE, you’d have to be irrational to do so, which most people aren’t. Finally, there’s this thing called the US dollar that’s depreciating in value exponentially, is not taxed when I spend it, and it’s current ONLY use case is a good MOE (not SOV). Of course I’m going to spend dollars and save in bitcoin for the forseeable future. I’m acting rationally.

When tax laws change (they will over decades) and bitcoin reaches a less hypergrowth stage, it’ll be time to spend it, as fiat currencies are seen as useless/worthless. Open your mind to money being something other than just a MOE. That’s where people get stuck. Study the history of money, and you’ll see bitcoin is right on track to disrupt every money we’ve ever known and kick it to the curb. The USD will not go down without a fight though, but bitcoin is designed for that.

Perfect money should have none of those things listed above by that traditional finance bro (except being digital – which is critical). These are the properties of perfect money. Acceptability will come with time.

THESE PROPERTIES ARE WHAT BACK IT AND GIVE IT INTRINSIC VALUE AS THE BEST MONEY. It should be absolutely scarce with zero debasement, no single entity should control it, it should be safe and secure, you shouldn’t have to trust anyone else to hold it for you if you don’t want to, it should be censorship resistant so you can always spend it, and it’s ONLY FUNCTION should be being used as money (not for electronics or jewelry or gasoline). THAT’S IT! NOTHING ELSE!

If you’ve been reading this newsletter for a while, I’ve just articulated what bitcoin is and why it is perfect money.

Why is money important?

THE WORLD RUNS ON MONEY. IT IS THIRD MOST IMPORTANT THING IN YOUR LIFE.

1. TIME – ABSOLUTELY SCARCE. WHAT EVERYONE WANTS MORE OF

2. OXYGEN – YOU DIE WITHOUT IT IN MINUTES, BUT IT’S FREE AND ABUNDANT

3. MONEY – BUYS YOU FOOD, WATER, HOUSING, CLOTHES, MEDICINE, AND ULTIMATELY TIME (AND FREEDOM OF YOUR TIME)

HUMANS ALWAYS NEED AND WANT MONEY (DURING GOOD TIMES AND BAD). HUMANS ULTIMATELY CHOOSE AND CONVERGE ON THE BEST MONEY OVER TIME.

When you pull up next to a houseless person on the street, what are they asking for? Money to buy things. Not your Nvidia or Apple stock or your US bonds.

Right now they want dollars. At some point, as impossible as this is to imagine, they will want bitcoin. They will not want your fiat as it is useless/has no value. This takes time though and you have to be patient.

It may not even happen during your lifetime (my base case scenario), or even your kids’. That doesn’t mean it’s worthless until that point, the exact opposite in fact. That day will likely just be at the end of bitcoin’s monetization (massive price appreciation) phase, and then at that point it’s all people will know as money.

History is littered with examples of the evolution of money. Stones, salt, seashells, silver, gold, fiat, and now bitcoin.

THIS TIME IS NOT DIFFERENT.

The best money to ever exist is available to you at the click of a button, with nearly zero transaction cost. If I gave you a chance to trade in your seashells for gold at no cost, would you have done it back then? I certainly hope so. Today, you’re trading a dying money (fiat dollars) for a superior monetary asset, bitcoin.

This trade is open to everyone globally today. It will end suddenly, I can promise you that. I have no clue when that day will be, but at some point, people will no longer take dollars for bitcoin. Just like people no longer accept seashells, salt, arrowheads, or many other things for gold.

Don’t be the last person to figure it out.

Spend the time now. Bitcoin is money. The best money. That’s it. That’s all you need to know. Trade your crappy dollars that you don’t need for 4-5 years (preferably longer) in for better money. Then sit back and laugh as they print dollars into oblivion and you hold the better money. It’s that simple.

WHEN bitcoin crosses 100k, I think things are going to get nuts. That could happen late in 2024 or early 2025.

Can you imagine all the people in the world simultaneously saying the same thing, “Bitcoin??? 100K?? Hasn’t that died like 100 times?”

“What the hell is this thing that won’t die??!! I need to look into it more, maybe everything I was told by the media was wrong. Maybe that crazy guy writing Crypto Pulse is on to something.”

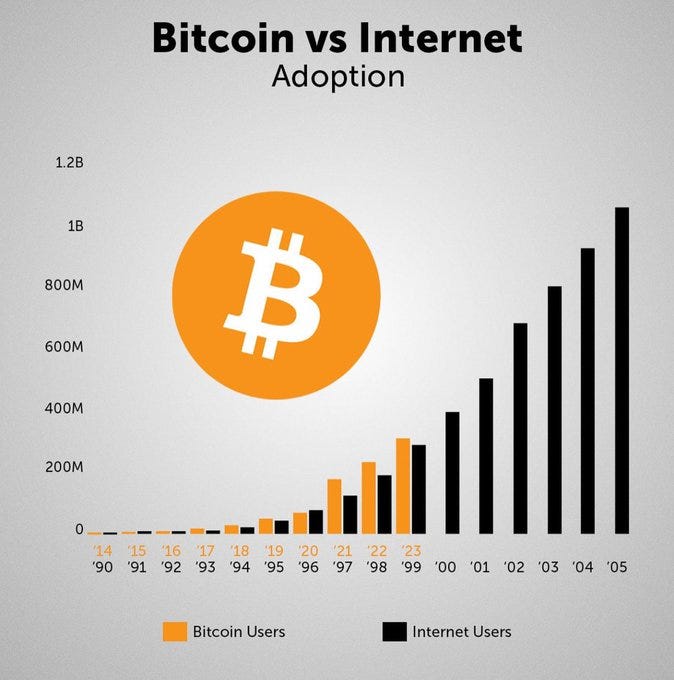

Right now we’re at ~1% global adoption, similar to the internet in the early 90s.

After 100K, I predict that percentage goes up substantially, and remember, bitcoin is built on flywheel effects and Metcalfs law. It’s a network, like the telephone or internet. The more users of the network the more the network grows in value. It also grows exponentially.

Imagine owning a fixed percentage of the internet back in the 90s. Yes that’s impossible with the internet, but not with bitcoin. That’s what makes it so revolutionary. You can verifiably own a piece of the network.

You’re going to witness an exponentially growing monetary network for the third most important thing in all of our lives, and that “thing” everyone wants – bitcoin – is absolutely scarce. The supply is fixed, and it will be distributed on schedule ~10 minutes until 2140. 94% is already in circulation held by people who actually understand what perfect money is and why you always want it and need it. 99% will be in circulation just 10 years from now. You get it yet? Starting to feel any anxiety? Fomo? I am.

Exponential demand meets absolute scarcity.

An unstoppable force meets an immovable object.

You are not prepared!

Nor am I. As a simple human I fully recognize I cannot comprehend exponential technologies nor possibilities. I am a linear thinker by design. I’m at peace with that though and just plan to enjoy the ride.

But what about the election? What if the newly elected ban it?

First, you honestly can’t. Second, Blackrock would like to have a word…

Third, and most importantly, the results of the upcoming election make no difference to bitcoin’s adoption. Exactly what you would expect if bitcoin were truly perfect money. It’s apolitical. It’s adoption is not determined by politics, but rather by people simply making rationale economic decisions over a long enough time period.

Do you save in bad money or good money? Do you save in a money that gets continually debased without your consent (aka stealing), or do you save in a money that is designed to prevent that? As more people save in good money (bitcoin) and spend their bad money (dollars), eventually everyone figures it out and no longer takes/wants dollars. As someone early to bitcoin, you honestly want that to take as long as possible selfishly, but be as short as possible for the world to course correct and get back on a sound money standard.

Remember, gold failed for a reason as sound money. It wasn’t portable enough in addition to many other things. That’s why we have fiat dollars today and people still trade in their gold for fiat! It’s because gold is NOT perfect money, it has MANY flaws so you’re willing to trade it in for dollars. Gold failed as sound money (because it’s a naturally occurring rock in the Earth and nothing special and primitive humans chose it because it was the best option as money at the time), and so here we are, in an even worse spot with fiat now.

The solution is bitcoin. Technology humans developed to solve the world’s biggest problem – broken money. It’s what humans do best. We are incredible problem solvers and invent incredible technology to do it. Bitcoin is perfect money technology. Are you really going to trust a useless rock over a human invented solution? Bitcoin is just better money than gold.

Do you walk to your destination using the wind and the stars and the sun to guide you or Google maps and a car? LOL! Sometimes I make myself laugh it’s so ridiculous when you think about it. That is the perfect analogy, I will use that more going forward!

Remember, gold is a massive asset class, nearly 20 Trillion dollars worth, and you can’t buy coffee with it!! I thought that meant it was worthless? Guess not…

Bitcoin is 10-1000x more valuable and useful as money than gold, and I COULD technically buy coffee (or a burger) with it today in certain locations. Bitcoin is a 1 Trillion dollar asset today. Do with that information what you will.

How was the debate?

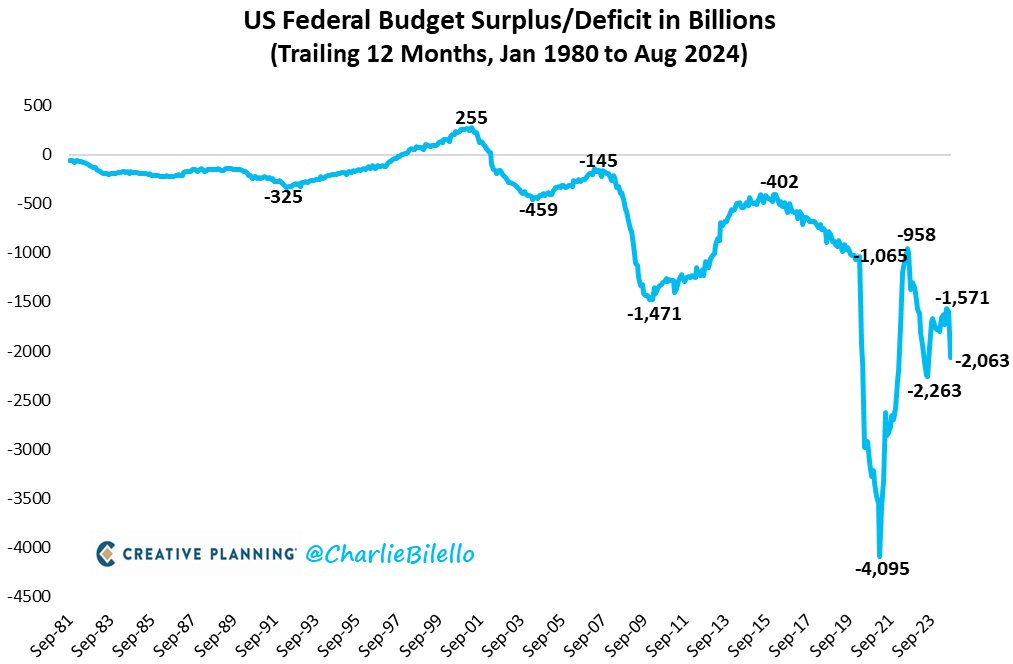

Whether you vote for Kamala or Trump, they will both worsen the problem by printing more dollars we don’t have. Our debt and deficit will continue to rise, exacerbating the debt spiral we can’t escape. The government (aided by the Fed) is OUT OF CONTROL RIGHT NOW…

I will be voting for (buying) bitcoin because both politicians and their parties don’t understand the real issue – broken money. The money is broken, and incentives are not aligned. Inequality is rising. The social contract is breaking down. People can’t afford basic needs like food, medicine, shelter, and childcare. They’re constantly lied to by the media, and the blame is diffused so they can’t point a finger at the cause.

Price gouging??? Pure nonsense. Those greedy grocery chains are barely making a profit as their expenses rise—enough with the gaslighting.

Notice the US money supply expanding, though (blue line). That’s not the cause of inflation—not a chance (sarcasm)!

Ironically, the answer is right there in front of everyone. Hiding in plain sight so unassuming they’d never think to question it.

Money. The money is broken. The money is causing 90% of the problems.

Fix the money, fix the world.

Over the next few decades, Bitcoin will be the black hole of store-of-value assets and will eat away at the monetary premium of gold, stocks, bonds, cash, real estate, etc. as a disruptive monetary technology.

At a 1 trillion dollar market cap currently, I don’t care if I buy some today when I believe the market cap is going to 100-500 Trillion plus in the future. That’s a 100-500x return from today’s prices, and that is me and my linear thinking brain. It’s not that stocks, bonds, gold, and real estate are going to zero. I have no doubt that they will actually go UP in USD nominal value over my lifetime as the money printer chugs along. Bitcoin will grow purchasing power faster, and these other assets will continue to fall in value when priced in bitcoin, which will mess with many people’s heads.

Bitcoin is what you need to supercharge your savings and buy you more freedom of your time. You can be smart about it and choose a 1% allocation of your portfolio, dip your toe in, and then increase from there as your confidence grows in the asset and technology. Something that lets you sleep at night but gets you some exposure to an exponential technology coming to disrupt one of the most important things to everyone in the world – money.

I’ve personally come to terms with having a higher allocation to bitcoin because of my conviction in the hope it brings for our world. I’m riding this thing to zero as a result. If bitcoin fails, I will have no hope for our society until humans invent something else that gives us a chance. Bitcoin has to succeed. It has to win. The money is broken, the money is leading to societal decay, thus we need new money. My kids need new money.

Bitcoin can be that new money and the higher my allocation the stronger the network grows. I’m doing my part. I will buy every last bitcoin for 1 cent if I have to so that it doesn’t go to zero, and I’m not the only one. No other asset class in the world has an army of people so determined to see it succeed, but that’s what you need when you’re trying to take on the almighty US dollar, the US government, and the Fed with a new money monetizing from ZERO. No fear. No compromises. Full conviction. The more you attack bitcoin, the stronger it gets. It was designed to be anti-fragile. It was designed to be relentlessly attacked. Good luck beating that.

And no, bitcoin is not a cult. I know what you’re thinking. A cult is something that requires you NOT to ask questions. NOT to think critically. There is NO transparency. There is an authoritarian leader. Bitcoin is thus the exact opposite of that. It makes you question EVERYTHING and start thinking critically. It’s the most transparent ledger in the world, audited every 10 minutes for truth. No leader is telling you how to think. Bitcoin encourages healthy debate and dialogue, which is how humanity evolves and improves.

Yes, I admire bitcoin, but don’t conflate it with being in a cult.

Wrapping up

Lots of bullish catalysts on the near horizon, I can’t keep up!

1. Rate cuts: The Fed cut 0.5%!! The whole world has been cutting interest rates as economies outside the US are literally falling apart. China (in particular) and Europe are disasters. They DESPERATELY needed the US to cut rates so they can print more money and inject it into their economies without destroying their currencies. The US printed so much money during Covid and had so much fixed interest rate debt (like your house) compared to other countries that our economy has just kept chugging along. That and the baby boomers are responsible for essentially all the wealth in our country and they are retiring and spending it like mad as they realize they’re going to die in the next 10-20 years. Now they’re also getting 5% free money on their savings and that’s just a massive stimulus check for them that they spend into the economy. The US economy is slowing from hyperspeed post-Covid to normal speed. It’s not falling off a cliff yet despite what anyone tries to sell you with fear and our demographics have led to a labor shortage, so there are plenty of jobs. There is so much money to deploy that’s still on the sidelines and if things really do tank….you guessed it! Interest rates to zero and BRRRRRRRR.

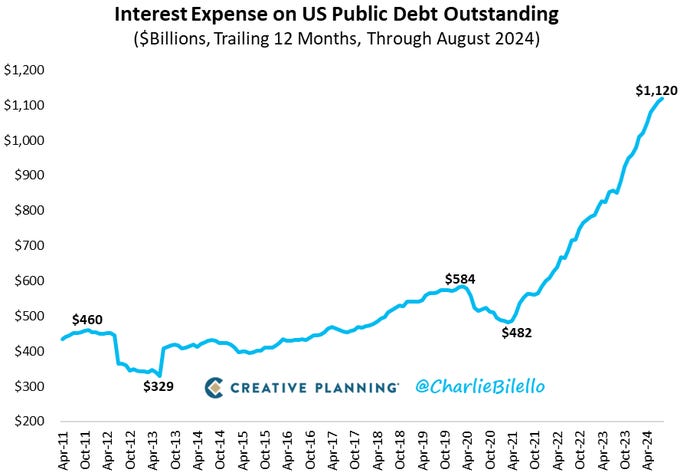

If you truly understand compound interest you also realize whether the Fed cut .25 or .50%, IT DOESN’T MATTER! Imagine your credit card debt goes from 18.5 to 18 or 18.25%. Who cares!! You’re still screwed! Interest compounding on 35 Trillion dollars at 5 or 4.75% also doesn’t matter. It’s going exponential regardless unless they take rates to zero.

They have to print money to pay the debt, which worsens everything. Annual interest payments on the debt just crossed 1 Trillion this year! Debts and deficits don’t matter…until suddenly they do. They didn’t for the past 50 years, but now we have problems. The government collects PLENTY of taxes; they just have a SPENDING PROBLEM.

Hard choices are to come in the future (social security, Medicaid, Medicare), but you can bet they are going to print money to try to appeal to the general public who don’t understand what the hell is going on. If you’re reading this, I hope you are waking up to reality! NOTHING in life is free. Everyone ultimately has to pay the piper. Opting out of their game of inflation and money printing into bitcoin allows you to smile and nod and laugh. Not on your TIME, because that’s what is at stake, your finite time. TIME IS MONEY. Inflation is theft of your time. Bitcoin is better money and respects your time.

2. Election over – doesn’t matter who wins. Financial markets want clarity, and whoever wins is going to print a shit ton of money to appeal to the voter base. Populism reigns supreme.

3. FASB accounting rules are mandatory starting in 2025. See prior newsletters for more detail, but those companies who hold bitcoin on their balance sheet (aka MSTR) are going to see a massive repricing to the upside.

4. More and more investment advisors and banks and pension funds are buying bitcoin which will lead to increased institutional adoption (big money players…think trillions of dollars).

5. Options trading on bitcoin ETFs will likely come within the next year bringing more liquidity and demand. It will be for the more sophisticated players in finance as well as the degen traders, but regardless, it will bring demand for the underlying asset and added safety (hedging) for institutions. It will also offer the chance for real yield.

When I say that bitcoin is going to eat into the monetary premium of all other assets this is exactly why. What if you could earn 20-50% annual returns on an investment with essentially zero cost to own it, no taxes, no effort, no counterparty risk, AND YOU CAN MAKE SOME YIELD FOR FREE CASH FLOW?

Say goodnight to bonds, stocks, real estate, land, etc. People aren’t dumb. They do the thing that’s the easiest, safest, and generates the highest return. I’ve been telling people this for a while to be patient, yield opportunities are coming, and here they come!

6. Countries like Bhutan and El Salvador are mining and stacking bitcoin with cheap and abundant electricity. El Salvador is going to be free from debt in like a year because of their bitcoin strategy (they buy 1 BTC every day)!! Every developing country on Earth is taking notice and many have MORE cheap renewable energy available to them than El Salvador and Bhutan. I’ll say it again. YOU ARE NOT BULLISH ENOUGH!!!!

7. Gold is at an all time high. The S&P500 is at an all time high. Governments and central banks around the world are printing money whether they say it to your face or not. I’m here to remind you one last time…your stock portfolio and home value is rising nominally in USD making you smile, but it is rising in correlation with how much money is being printed, so in real terms you are just breaking even or getting slightly ahead/doing worse depending on your investments. Even though your house is RISING in USD terms, it is FALLING when bitcoin is your unit of account.

Same with your 401k. You can’t measure anything with an improper hyperinflating and constantly changing denominator like the USD. You need a new measuring stick. That’s bitcoin.

The time is near. We are so back.

Get ready for the fun part. See you on the moon.

Any day now…

I’m ready!!!

Don’t quit now!

And remember, stay humble, keep stacking, and HODL

Share if you like it, thanks!

THIS is Crypto Pulse