At my brother's suggestion, I’m going to discuss all the different options available to you to get exposure to bitcoin, including a bitcoin IRA. There are a bunch of choices now when buying bitcoin, each with trade-offs, and you can decide which fits your style and risk tolerance the best. As always, none of this is investment advice, just education. For disclosure, I do invest in bitcoin (obviously), some BTC miners, Microstrategy, and GBTC. But first…

Where’s the bull market bro??? Patience Daniel Son.

As stated previously, we’re in the very early stages, and it’s probably a good year-ish away from things really heating up, but if you wait until then to get interested, you may miss the boat. Lots of good stuff on the horizon…

Bitcoin is tracking closely with four year cycles of the past and looks to be right on track, but that does NOT mean up only from here (although October is historically a great month). Unfortunately, Bitcoin is facing some serious near-term headwinds that will challenge your conviction. Bitcoin investing shows…

First, the spot bitcoin ETF ruling was delayed (not surprising at all), and second, I think Binance (a large crypto exchange) is in deep deep trouble. The US Department of Justice seems to be coming after them and trying to rid them of the bitcoin/crypto space. Their completely fabricated useless altcoin $BNB is on the ropes, and I think they are selling bitcoin to prop it up, just like FTX did with their $FTT token prior to their demise. A Binance implosion will likely result in some forced selling and a bitcoin dip. To what range I have no clue but don’t be scared. A Binance implosion would be identical to FTX’s fall from grace. It has nothing to do with bitcoin and everything to do with human greed and deceit. Bitcoin will recover. Seize the opportunity for cheap sats if we get it. Be grateful that the trash gets taken out.

I personally think Blackrock is pushing for this. I think it’s allll actually heavily coordinated. SEC delays the spot ETF long enough for Binance to implode and put cheap bitcoin onto the market for Blackrock to buy. When everyone else is selling, they will be buying fistfuls. Blackrock doesn’t buy the top. They buy the bottom. Binance gets wiped out and the US spot bitcoin ETFs plus Coinbase are the big shows in town. Game on. Spot ETFs get approved, and we’re off to the races. It would actually be MORE BULLISH if they keep delaying the spot ETF until the halving next year. It would be perfect timing. New demand, less supply…

Regardless of any Binance drama, a spot bitcoin ETF will be approved. It is inevitable. You just have to be patient. It’s coming. The SEC and Gary Gensler have NO leg to stand on, and they have been made to look a fool in court. Times almost up.

Another headwind to be aware of could be a credit event like in 2008 or a pandemic like 2020 crash that causes ALL assets to plummet. These are black swans and impossible to predict, but it’s useful to have some cash on hand if the opportunity arises. However, waiting for an event that may never come to “buy the dip” is tricky. The US economy seems insanely resilient to the surprise of everyone, and a market “crash” when there is record employment and a labor shortage crisis seems less likely, but who knows?

2024 is going to be a wild ride for sure, hang on tight. Even if the US is hanging in there while interest rates skyrocket into “the danger zone,” the rest of the world is crumbling fast (China, Europe, developing countries). One thing is for certain, if that credit event does occur, the “plunge protection team” (aka the Fed) will step up to the plate like they always have before and flood the market with QE, low interest rates, and maybe even helicopter money again to keep the party going.

If this times up with the bitcoin halving in 2024 and a bitcoin spot ETF approval….

Buying bitcoin

Buy it on one of many crypto/bitcoin exchanges (Coinbase, Swan, River) and then self custody it (ideally) or leave it on the exchange.

We’ve talked about this option a bunch. You buy bitcoin on an exchange for a fee (and a markup price of BTC), and then you either leave it there or take self custody of it in a hardware wallet. If you leave it on an exchange there is always a risk they are doing something shady with it, or they get hacked, and it’s really just an IOU.

When you want your bitcoin, it may not be there. See FTX, BlockFi, Voyager, Celsius, etc.

Rehypothecation is real. Even Prime Trust (a custodian) swore up and down that they don’t do anything but custody your bitcoin messed up/lied.

They even gambled some of it into the LUNA Ponzi! Basically, as always…not your keys not your coins. Buy bitcoin and move it into cold storage, preferably with a multi-sig setup. Refer to a prior newsletter on how to do that. There are fees associated with buying a hardware wallet and multi-sig, and they vary. However, for peace of mind, I think it’s worth it. Trust no one. Especially exchanges. Even Coinbase.

GBTC (Grayscale Bitcoin Trust)

GBTC is an investment trust that trades publicly on the Over The Counter (OTC) stock market and is the world’s largest bitcoin fund. It allows the general public to get indirect price exposure to bitcoin (by buying shares of GBTC) without forcing them to buy bitcoin on a crypto exchange and dealing with self custody fears. It also provides some other opportunities for high net worth accredited investors to make money(not discussed here). Outside of company stocks and bitcoin miners that have bitcoin exposure, GBTC is one of the only ways investors can get exposure to bitcoin today in traditional portfolios (IRAs, HSAs, taxable accounts) in addition to not having to deal with bitcoin self custody and purchasing it on a crypto exchange (fear of the unknown).

These features make it highly attractive to many investors. GBTC buys bitcoin and stores it with a custodian on behalf of its shareholders, but charges a 2% fee for the hassle and a premium (at certain times). This exposes the customer to high fees and counterparty risk if the bitcoin is lost or rehypothecated (as is often the case despite laws forbidding it). Grayscale owns the bitcoin, you don’t. In current state, you cannot redeem GBTC shares for actual bitcoin that you can self custody (unlike when you buy from an exchange or theoretically with a spot ETF). If you sell GBTC shares you get cash.

GBTC trades on the OTC market, so it’s not easy for people to get access to it. GBTC has similar volatility to bitcoin and loosely (poorly?) tracks the price of real bitcoin. From 2020 to 2021, GBTC’s share price increased by ~220% in value while spot BTC surged by nearly 340%.

Currently, GBTC shares trade at a discount (not a premium) to spot bitcoin prices (~20% discount) for various market reasons. In theory, if GBTC ever transitions to a spot bitcoin ETF with lower fees this discount will vanish, and buying GBTC today could offer a nice return. That’s all conjecture though, no guarantees.

Overall, it’s a complicated product for retail investors with a few perks and plenty of cons. It could make sense in very select circumstances depending on the investor’s goals/timeframe/risk tolerance, etc. Do your homework.

Microstrategy (and other stocks/ETFs where companies have bitcoin exposure)

Microstrategy (MSTR) is basically a defacto bitcoin ETF given they HODL nearly 150k bitcoin and climbing…

Buying MSTR stock is a way to get indirect price exposure to bitcoin in the traditional sense of just buying a stock. No fees, and no self custody issues. Easy peasy. Microstrategy is somewhat of a “levered” play on bitcoin as they take on debt to buy it (or equity offerings via selling shares) or use business free cash flows. They view it as a treasury asset, so instead of holding cash, bonds, equities, or tangible property, they hold digital property - bitcoin. The lack of fees and ease of buying MSTR is great.

Saylor will go down in history as either a genius or a fool for this “strategy.” His conviction is insane, and given his resume and how early he was to see the “mobile wave” coming (Apple)…

…I’m betting he goes down as a genius. He sees the future of bitcoin like no one else does, but time will tell.

However, with MSTR you have no ability to actually hold bitcoin personally by purchasing MSTR stock. If you sell the stock, you get cash, not bitcoin. There is always counterparty risk, and they could go bankrupt or their bitcoin could get stolen, etc. Certainly something to consider as one day in the future you’re going to want to possess actual bitcoin in my opinion. For now, I view MSTR as a way to get price exposure to bitcoin in retirement accounts like my HSA where you can’t buy actual bitcoin. Maybe in the future I’ll be able to buy bitcoin via a spot ETF in my 401k/IRA/HSA, but right now I can’t. I also view it as a high beta (volatile) play on bitcoin. When bitcoin moves up or down, MSTR moves that much more in the same direction. In a bull market, that’s great. In a bear market, that hurts. Something to consider as well depending on your risk tolerance.

Bitcoin miners

They mine bitcoin at the lowest cost possible and sell it for profit. Some miners HODL bitcoin as a treasury asset similar to MSTR, but not all. They generally take on debt or raise equity to build their bitcoin mining business infrastructure and earn bitcoin through proof of work mining. The more mining power they have, the more bitcoin they will earn, so they are constantly trying to buy mining machines and build data centers with low energy costs to mine bitcoin. It’s crazy capital intensive and crazy competitive (it takes work!!!).

Per one statistic, it’s now 57 trillion times more difficult to mine bitcoin than at first in 2009.

Similar to MSTR, you can purchase bitcoin mining stocks via the stock market for no fees and you don’t have to worry about storing bitcoin yourself. Once again though, you are exposed to counterparty risk, and you can’t take custody of bitcoin as you’re just getting indirect price exposure to the asset via a miner. It is also a high beta play like MSTR. Miners do really well (better than bitcoin) when times are good, but worse when times are bad. Not for the faint of heart. Similar to MSTR, in current state I can get exposure to bitcoin price via miners in some of my accounts where I can’t buy actual bitcoin.

Finally, when you buy a stock you’re also buying the underlying business (duh). I’m indifferent on MSTR as a business (not easy competing against Google, MSFT, etc. but I love their BTC strategy), but I like bitcoin mining. Given how new it is, I believe it is underappreciated, and there is a large opportunity for growth ahead. Bitcoin miners are not only earning the hardest money ever to exist at the lowest cost, but they are also integrating with energy and AI companies in various ways to solve real world problems.

They are the BEST flexible load/demand response program (turn off instantly when asked) ever created which is critical for archaic energy grids facing demand issues as EVs get pushed down our throats to save the world along with intermittent/unreliable wind and solar energy. If this green energy revolution comes to fruition, bitcoin miners are going to be essential to make it happen so there aren’t rolling blackouts left and right like in Texas. In fact, a main reason why Texas isn’t having those anymore is because of bitcoin miners!! They’re getting paid to stabilize the grid, and there is no better technology to do it.

Other bitcoin miners are partnering with AI and cloud computing companies to offer access to cheap energy so they can run these expensive, energy-intensive computing programs. Remember, your cloud photos, your email, and your use of ChatGPT/generative AI AREN’T FREE. It requires electricity (not free) to run the data centers/computers. Bitcoin miners (which are really just glorified data centers) seek out the cheapest energy to run their computers to earn bitcoin and generate maximal profits. There’s no reason they can’t partner with businesses seeking low cost energy sources for their energy intensive computational demanding programs like AI. It is a natural synergy, and with how big I think AI is going to be in the future, it makes me bullish on bitcoin miners. Again, time will tell though.

Soap box on bitcoin mining – does anyone ever complain about cloud computing servers destroying the earth/boiling the oceans and worsening climate change? They use a ton of non-renewable energy and fresh water for cooling. They get zero ESG hate. Nobody bats an eye at it because Google Cloud storing the 10,000 pics of your cat that you won’t ever look at again is considered ESSENTIAL. However, oppressed people all over the world with no access to the banking system or are subject to hyperinflating worthless fiat currencies who are using bitcoin (produced by renewable energy resources 50% of the time) to literally SURVIVE AND EAT is considered a WASTEFUL use of energy by many skeptics.

I ask everyone to check their privilege living where they do. Be thankful if it’s somewhere like the US or Europe, which it likely is. Recognize that bitcoin is a global monetary open protocol that is literally a life saver for millions of people TODAY.

For Americans, it allows us to escape the wrath of monetary debasement and the silent tax of inflation that is slowly eroding our wealth and the fabric of our society. It allows you to OPTIONALLY hop off the hamster wheel of fiat life chasing yield and plowing money into index funds you don’t give a crap about or know anything about but are told to do so because that’s the only way to “beat inflation.”

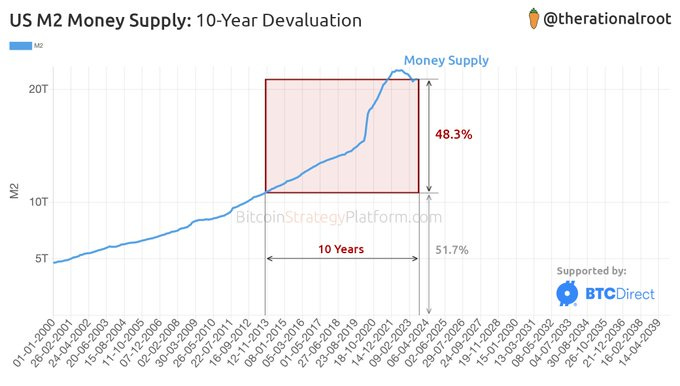

News flash – you aren’t beating it with those 8-10% average annual returns in a diversified portfolio of index funds or a traditional 60/40 (stocks/bonds) allocation.

You’re just treading water as the money supply inflates by 8-10% or more. Your house isn’t magically worth 10-20% more. Your currency is just worth LESS.

Joke’s on ALL OF US.

For most everyone else in the world that aren’t as fortunate to have access to the world reserve currency and US stock markets/US prime real estate, bitcoin is literally their life raft on the sinking fiat currency ship. Yes it uses energy, but >50% renewable energy (no other industry can claim the same) and it’s THE BEST ESG TECHNOLOGY EVER INVENTED.

It is a freaking unicorn as I like to say. Sign me up for that…and the cat pics. I love my cats.

ETF

Much is still unknown regarding the spot bitcoin ETF so much of this is a guess. There will be fees, but likely very low. 0.05 - 0.5%? I have no clue, but it will be a race to the bottom for fees among competitors so eventually fees for the ETF will be negligible. You are exposed to counterparty risk as Blackrock or its custodian Coinbase could lose the bitcoin or rehypothecate it or go bankrupt. You are getting direct exposure to bitcoin so this isn’t a “beta” play like MSTR or the miners or GBTC. I THINK you’ll be able to withdraw actual bitcoin to your hardware wallet, but I have not seen that stated as a fact yet. Technically with ETFs you should be able to obtain the underlying asset. I’m assuming it will be the same with bitcoin but that is something you MUST BE SURE OF before using it as a vehicle to buy bitcoin. Read the fine print. If you can’t withdraw it it’s just an IOU and is paper bitcoin. That’s fine until it isn’t one day. NYKNYC.

An ETF should allow you to have easier access to bitcoin in retirement accounts, etc. If you don’t want to custody bitcoin an ETF is a simple vehicle with low risk, but not zero. There are always trade-offs. Institutions will LOVE this as it’s simple for them and they can buy it the day it’s approved. Buying real bitcoin today and hodling it is near impossible for them and a massive logistical headache. A bitcoin ETF will change everything for institutions.

Speaking of institutions – the FASB decision just came in and was unanimously approved to treat bitcoin via fair value accounting methods starting in 2024/2025.

They can now mark the value of bitcoin up when it goes up, as opposed to currently having to mark it down only. Big institutions will love this and need this for shareholder reporting purposes. It’s a massive massive massive breakthrough for the institutional adoption of bitcoin. Don’t sleep on it. Apple, Amazon, Google, etc. didn’t want to think about bitcoin on their balance sheet before this ruling passed. Now? It’s a legit option, especially with a spot ETF option to buy it coming soon. The stars are aligning, and everyone is sleeping on it. Not Crypto Pulse readers!!

Futures ETFs

I’m not smart enough to understand these. It’s for advanced traders. If you are one, go nuts. More power to you. They don’t track the spot price that closely. Ignore and move on.

Bitcoin IRA

(not financial advice, talk to a financial advisor)

For clarification, I am NOT talking about buying bitcoin via a spot ETF in your IRA. That is not available YET and will change everything when approved. Stay tuned, but for now, we’re discussing bitcoin IRAs offered by companies (Swan, Unchained Capital, etc.)

I have to admit, I was skeptical of this strategy, and IT IS NOT PERFECT, but I have softened my stance after doing the work to understand it better. The downsides are that there are fees to using a bitcoin IRA (0.25% – >1% usually depending on the account size and the company) and there is potentially some counterparty risk depending on which bitcoin IRA company you use.

The fees for using a bitcoin Roth IRA should more than offset not having to pay capital gains taxes later though.

Example – bitcoin roth IRA fees = $250 per year x 20 years (hypothetical) = 5k. Investments can be taken out tax free and spent. Compare to a taxable bitcoin account – no annual fees, but when you sell in 20 years you pay capital gains tax (likely 15-20%). If the net asset gain is 100k in 20 years, that’s a 15-20k tax bill compared to 5k in fees if using a bitcoin roth IRA.

With a bitcoin IRA you CAN withdraw actual bitcoin to cold storage if desired (withdraw the asset “in-kind”). The standard penalties would apply if you withdraw before 59 ½ however. Most importantly though you DO receive actual bitcoin and can put it in cold storage or do with it whatever you like (sell for retirement living expenses, etc.).

Where bitcoin IRAs shine is the tax advantaged shelter they provide. For a traditional IRA, you can buy bitcoin with pre-tax money, it grows tax free, and then you pay income taxes on it when you spend it in retirement after age 59 ½. For a Roth IRA, you buy bitcoin with after tax money, it grows tax free, and you take it out tax free. Hell yea.

Examples: Traditional IRA – you buy $6500 bitcoin today (and get a tax deduction at tax time for it), it grows tax free, and then when you are retired after age 59 ½ you take it out and pay income tax based on whatever tax bracket you are in at that time. If it’s worth 100k at retirement and you’re in the 32% tax bracket (just for illustration, not prediction), you’d have ~$70k to spend.

Roth IRA – you buy $6500 bitcoin today (no tax deduction), it grows tax free, and then you take it out tax free at retirement. If it’s worth 100k at retirement, you have 100k available to spend.

Some important points. Traditional IRAs have income limits that exclude you from getting the tax deduction, but you can still contribute, just without the tax deduction (uncommon to do). Roth IRAs have income limits to contribute to them, but you can currently get around this via a “backdoor roth IRA” strategy. It’s legal, so don’t worry. Myself and many others do it every year.

Also, traditional IRAs have “required minimum distributions” (RMD) after age 72, roth IRAs do not. Another nice perk for Roth’s to allow tax free growth to continue.

So why was I NOT excited about this investment vehicle? First, the fees (which aren’t terrible depending on account size and in comparison to capital gain taxes). Second, the counterparty risk (depending on the company). Third, the concern I had about forced selling for RMDs or upon death. I was WRONG about this last point. Let me explain.

I view bitcoin as generational wealth. I have not been shy about this whatsoever. My kids will likely be reading this newsletter one day and I’m telling you…

DO NOT SELL YOUR BITCOIN IF YOU DON’T HAVE TO

I am extremely passionate about bitcoin because of them. As a father, I want to give them everything possible to succeed and I believe they are going to need bitcoin. Everyone is. There is no price I am willing to sell the hardest money ever created to get funny money fiat US dollars unless I am forced to.

I live below my means and this is money I don’t intend on spending. I’m a diehard saver, always will be. I learned from the best.

My fear was that IRAs require you upon death to transfer them to your heirs as inherited IRAs. Given recent new laws, heirs are required to liquidate the account within 10 years from the date of death. Initially, I thought this meant my kids would be forced to sell their inherited bitcoin IRA for dollars within 10 years, even if they didn’t want to (as it’s possible they would never be able to get the same amount back after selling such a desirable scarce asset). THIS APPEARS INCORRECT.

Upon investigation, they would be allowed to take the bitcoin into custody out of the inherited BITCOIN IRA IN-KIND. In a bitcoin roth inherited IRA they would pay no taxes and the new cost basis would be the price at the time they took the asset out of the IRA. The same goes for RMDs in traditional IRAs. You can take bitcoin out in-kind (you must pay taxes though in a traditional IRA) after age 59 ½ (mandatory after age 72), and are not forced to sell it for dollars.

Example - If I put $6500 in a bitcoin roth IRA today and it becomes worth 2M 50-70 years later (hopefully) when my kids are forced to take it out, the new cost basis for that inherited bitcoin is 2M and it’s tax free. They also can take in-kind custody of the bitcoin. No selling required. No RMDs while I’m alive because it’s a roth bitcoin IRA.

That’s awesome. You don’t sell the most scarce asset humanity has ever created if you don’t have to. You HODL it and borrow against it if you need to. You can take a loan against your bitcoin if necessary and pay it back in inflating fiat dollars. That’s what the mega rich do. They don’t sell their NYC skyscraper scarce valuable property. They borrow against it. I repeat…

YOU DO NOT SELL YOUR BITCOIN IF YOU DON’T HAVE TO

If I offered you a million pieces of monopoly money for a single dollar, would you take it? Of course not, because it’s worthless. That’s what all fiat is trending to…worthless.

That is why you don’t sell bitcoin if you don’t have to. It is REAL MONEY. It is produced with real-world costs (proof of work) and backed by pristine monetary properties and energy. It can’t be printed into existence like fiat (a paper IOU backed by bogus government “promises”) to fund someone’s new unprofitable agenda you didn’t vote for. Someday there will not be a fiat price you will sell bitcoin for because fiat is nearly worthless paper Monopoly money that no one will take. Look at these numbers…

Now remember this…

Sure, the USD is the “cleanest dirty shirt,” but all fiat is hyperinflating against bitcoin. I’m just trying to show you the facts. Those statistics are insane!

I recognize fiat being worthless is impossible for you to believe right now, and depending on your age it may not be relevant to you. If you’re young or do have kids or plan to have kids, take the time to learn about why bitcoin is REAL MONEY. It is critical.

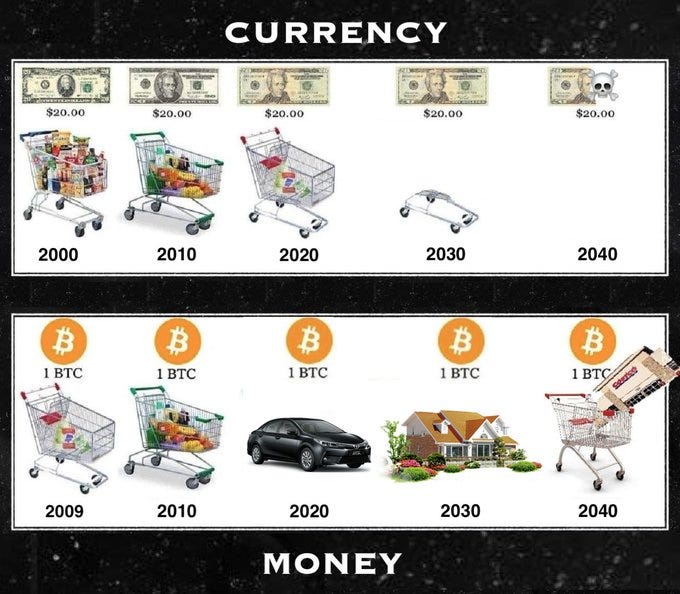

Ignore the dates below. Focus on the purchasing power concept.

You have the option now to store your wealth (which is a product of your scarce time) in an asset with a fixed supply that mathematically and programmatically will appreciate in value. Or you can stick with depreciating fiat and index funds and hope to break even. I’m using bitcoin not just to preserve wealth (like stocks), but to create wealth.

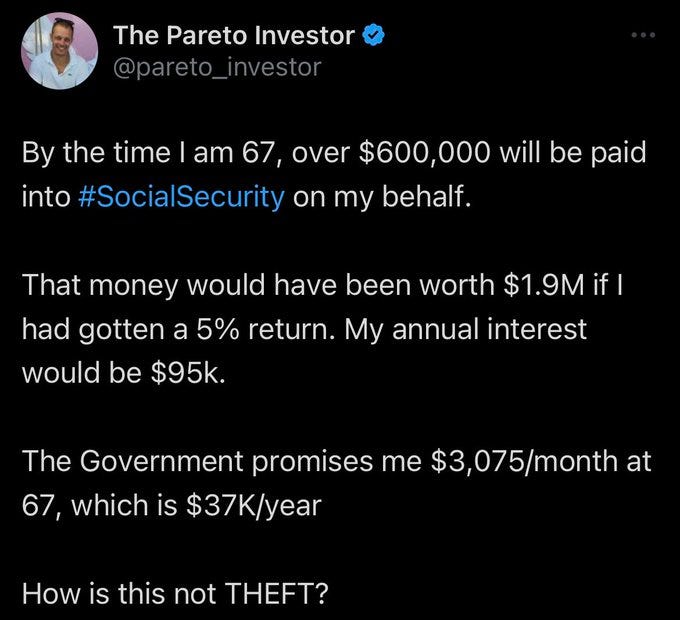

The US has nearly 200 trillion in unfunded liabilities starting to come due in the next 10 or so years. One of those liabilities is Social Security, and despite you contributing to it every paycheck THEY HAVE NONE OF IT. They spent it all. It’s all an IOU, especially now that the government is running budget DEFICITS despite a “resilient, healthy” economy. It is pure theft. Look at the deal we’re getting…

The IOUs MUST be printed. They don’t have the money and can’t possibly get it without upping your tax rate to 90% and not allowing you to take social security until you’re 70 (pure conjecture on my part, not fact). What your purchasing power with those printed dollars will be is anyone’s guess. Consider protecting your net worth and your time NOW.

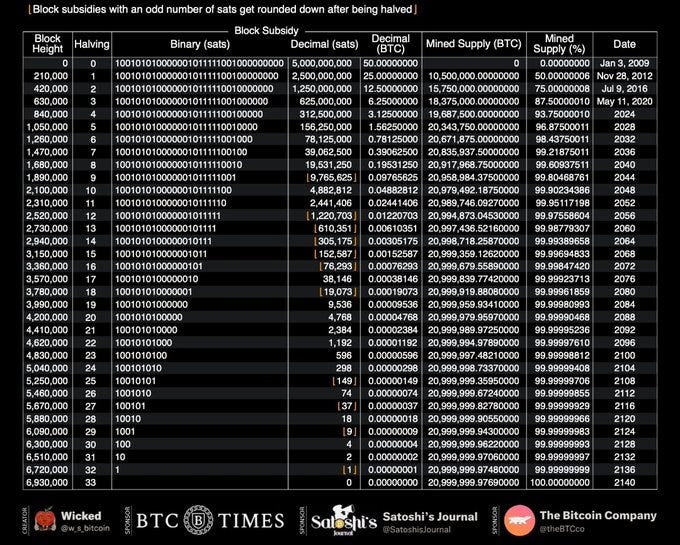

I’m telling you. Blackrock, big institutions, and nation states are coming soon. They are not dumb, they’ve just been held back by regulations and poor education. That is changing rapidly. They are beginning to understand the absolute scarcity of this thing and the inevitability of what the government must do to keep the fiat game going. They are lions looking at an injured zebra (you and your bitcoin) after weeks of not eating. They are going to offer you fiat money for your bitcoin knowing full well it’s worth 10-1000x more than that. I know it sounds ludicrous, but I have full conviction in this. Humans have never encountered an asset everyone needs/wants that we can’t make more of. The last <2 million bitcoin will be mined over the next 120 years! Me and my kids (maybe even grandkids?) will be dead, and there will still be bitcoin left to be mined! If I have grandkids/great grandkids…make me proud! HODL!

In 2139, miners will be fighting to earn .00000144 bitcoin PER DAY. PER DAY!! Hey, grandkids/great-grandkids, fact check me when the time comes! I know this for certainty due to bitcoin’s immutable monetary policy.

What’s the federal funds interest rate going to be in 2139? No clue. It likely won’t even exist!

More bitcoin scarcity facts: we’re talking ~0.0026 bitcoin per person on earth if it were all divided up equally today. It will take approximately 35 YEARS (from year ~2104) of global bitcoin mining to mine the last full bitcoin, no matter how much Blackrock or any nation state wants it.

Do you currently own anything that the world will spend 35 years (24/7/365) desperately trying to acquire? If so, HODL it tight because it’s probably insanely valuable!

Do you get it yet? Do you see what I’m trying to emphasize? Absolute scarcity and a fixed monetary policy is no joke. It’s a technological breakthrough that will revolutionize human history. Bitcoin is as scarce as your time on this earth. It is finite, precious, insanely valuable and should be protected at all costs. It is an extremely low-time preference asset that allows future planning and precise economic calculations. It is also the best performing asset class YET AGAIN in 2023 and since 2010 and people still dismiss it.

“Gotta get those 5% bond returns baby!!!” I say, “Enjoy your ~1% to negative 5% real returns depending on what CPI actually is (Chapwood Index, etc.).”

I have no clue if I’m going to be right about bitcoin (or its price) because there are sooo many unknowns, but I have deep faith it will succeed because I see no better solution to fix the underlying problem in our world - broken money. Bitcoin is extremely fundamentally sound and is thriving/getting stronger despite insane amounts of FUD thrown at it for 14 years. You can’t kill it. It will outlast all of us. It is so elegantly simple in its purpose (yet technically complex and near bulletproof under the hood) to solve our biggest problem today - broken money.

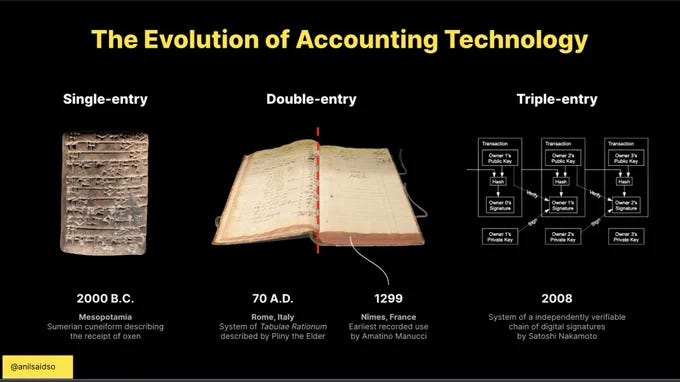

Bitcoin is the first money in human history to be a superior store of value, medium of exchange, and a unit of account ALL AT THE SAME TIME, while also being the rails for GLOBAL monetary settlement! A quadruple point asset. This is PROFOUND. It has better SOV properties (scarcity and seizure resistance) than gold. Better MOE properties (censorship resistant, micropayments, and immediate settlement) than the US dollar. Better unit of account properties than the US dollar or gold (fixed supply asset to easily allow valuation of goods and services across time, immutable triple entry global accounting ledger creating trust and transparency).

Finally, the bitcoin protocol is also the rails for GLOBAL financial settlement similar to Fedwire, and the Lightning network is as revolutionary as Visa/Mastercard/Venmo, etc., but even more groundbreaking given its global availability to every person with an internet connection.

I don’t know what the price of bitcoin will eventually be in 2140, but I believe demand will be much greater than it is today and supply will be much less. The price will sort itself out in the free market, but I’m betting it’s much higher than 25k.

Wrapping up, based on my research, I do think bitcoin IRAs are a legit strategy and a good part of a diversified bitcoin financial plan. The hard part is choosing which company to use and whether or not to wait for other options that become available after the spot bitcoin ETF is inevitably approved. With a spot ETF, you could much more easily purchase bitcoin in a new or existing IRA with lower fees, but you’ll still be exposed to counterparty risk to some extent. Things to consider…

If I move forward I will use the backdoor bitcoin roth IRA as a tax shelter with a company that allows me to hold my own private keys to minimize counterparty risk. I will consider spending from it in retirement if needed (or not spending and borrowing against it), and certainly will pass what’s left on to my kids as an inherited Roth bitcoin IRA.

I also will likely utilize the spot bitcoin ETF in some retirement accounts/HSA when it is available.

I am extremely mindful of counterparty risk and will not risk what I am saving for my children and grandchildren. That is cold storage multi-sig bitcoin. Trust no one. Never selling. There is no price. If you offer me 100 million dollars that means it’s worth 1 billion if you’re willing to pay that much. Start thinking like that now to prepare yourself when Blackrock comes knocking to take yours.

It gives true meaning to the word HODL - it won’t be easy.

Until next time…

Thanks for reading! Share with friends, family, and colleagues!

THIS is Crypto Pulse