Ladies and gentlemen,

BITCOIN!!!!!

Ho ho ho! Merry Christmas and Happy New Year, you filthy animals. I hope this is on your New Year’s resolution list:

Nice little “Santa Rally” to finish 2023 (and to start 2024) as Bitcoin once again proves to be the dominant asset class.

How many first place finishes will it take for people to catch on?

I’m trying!

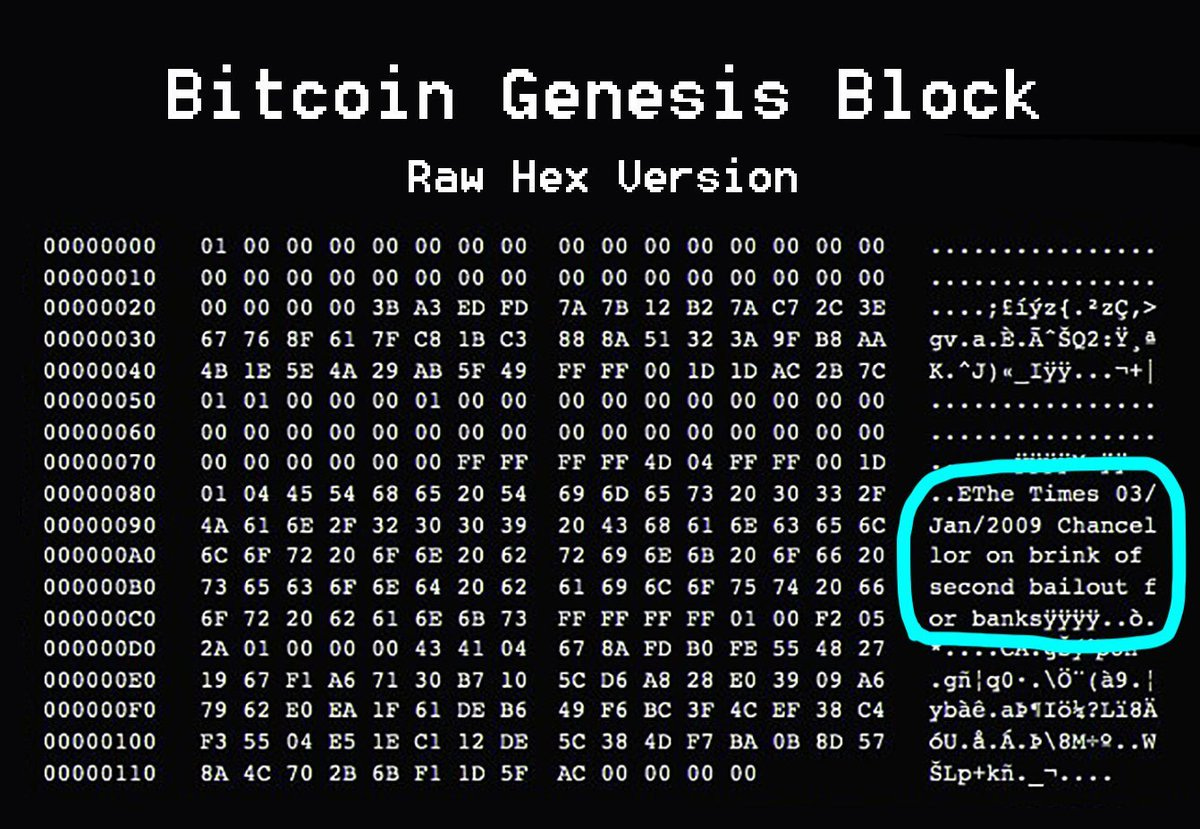

It’s been 15 years since the bitcoin genesis block was mined in January 2009.

Despite the 15 years and parabolic price increase, no, you’re not too late. I still think the biggest growth is ahead of us by a mile. 99% of the world hasn’t a clue about the hardest money ever. Look what the “experts” say on CNBC! I can’t even! LOL!

And people say the 2024 halving is “priced in???” LOL! Can you imagine the yearly returns when just 5-10% of the world understands bitcoin? You’re about to find out...if you thought 2023 was good for bitcoin, get excited about 2024. Remember, if you’re reading this newsletter...YOU’RE EARLY.

I was thinking the other day that I have been waiting for nearly four years for this year. I found/learned about bitcoin in July 2020 (months after the halving) and have likely consumed some type of content about it every single day since then. I had zero clue what the “halving” was at that time, but as I fell down the rabbit hole, I vowed to stack sats as hard as I could before the next halving in 2024 as I realized how scarce and desirable bitcoin would become. Time will tell how it all shakes out, but my money is on bitcoin going much much higher. I’m excited. Adoption is about to kick into high gear.

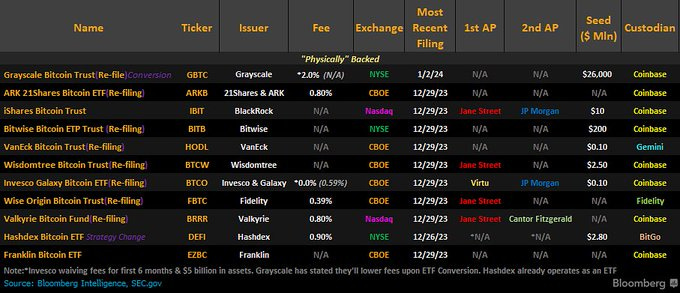

That is why I am URGING you to get serious about bitcoin if you aren’t already. Likely, within the next 10-14 days, there will be 10+ bitcoin ETFs approved all at once.

We are about to witness a marketing campaign the likes of which we have never seen.

The largest financial institutions (Blackrock, Fidelity) will be throwing ads at you from every angle, trying to get your business. Internet, TV, Super Bowl commercials, radio, billboards, TikTok, Insta, Facebook, you name it. Google even updated their policies to allow it!! They are looking to attract customers and keep them for life because with that comes massive fees to which they will make BILLIONS. Bitcoin is big money to these institutions, and they are out for blood. Luckily, you, as the consumer, will win with competition driving lower fees.

This publicity will cause the hype train on bitcoin (and by proxy crypto assets like ETH) to go bananas in 2024/2025. You are going to hear everyone talking about it. Unlike any other asset on the planet, the more people that want bitcoin, NO more will be produced. Starting in April 2024 – 3.125 every ~10 minutes. Demand increases 10-100x with billions entering Bitcoin ETFs? 3.125 every 10 minutes. Bitcoin doesn’t care.

In addition, >50% of the supply is held by psychopaths like me who aren’t selling to you for anything under millions of dollars, and even then, I’ll probably just HODL because that means it’s worth 10x more than what you’re willing to pay me. I don’t want fiat. I want bitcoin. Bitcoin is money. Everything else is credit.

You think I’m joking? Go back and read the last two years of Crypto Pulse when everyone thought bitcoin was dead and see if I’m selling my bitcoin for fiat unless I have to. I’m not here for the fiat gains. I’m here for the monetary revolution and the separation of money and state that bitcoin brings after studying it for ~4 years.

I’m here to help do my part to solve much of what ails our world and my profession (healthcare)...broken money.

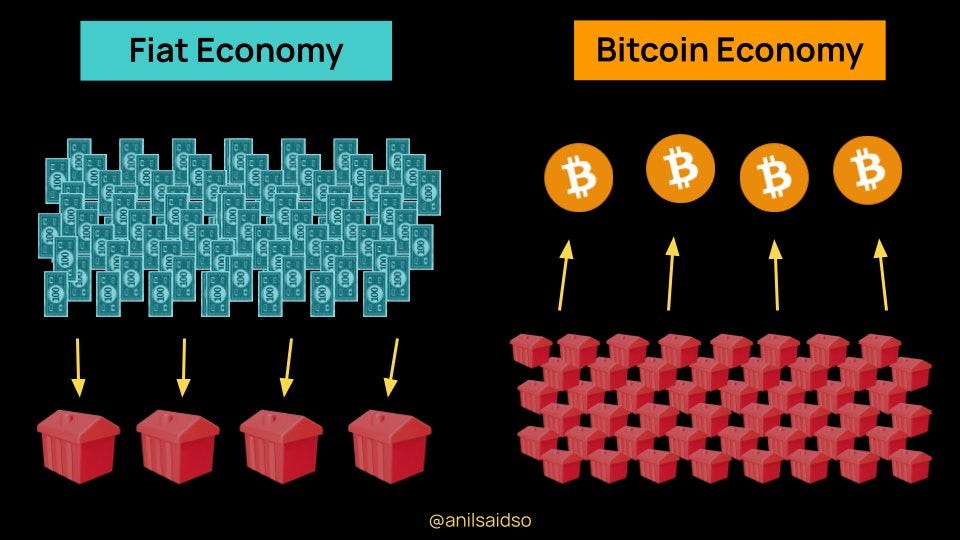

Bitcoin is that solution. It has never been clearer to me. Through our new ability to save in honest, scarce money that everyone GLOBALLY has equal access to, humans will no longer have to save their wealth in other things like homes, healthcare stocks, etc., which drive their price to levels most cannot afford. When the money is scarce (bitcoin), everything else becomes abundant, chasing the scarce money.

You’ll produce as much as possible and work as hard as you can to get it. All other assets are then reduced to their utility value without a monetary premium attached (much cheaper). When the money is abundant and easily printed (fiat), everything else becomes scarce (houses, stocks, cars, art, etc.) to preserve wealth from inflation, but money printing isn’t distributed evenly, nor is access to hard assets like stocks/homes.

This drives wealth inequality, scarcity in basic human necessities (food, housing, transportation, healthcare), and leads to civil unrest and a breakdown in society we see today as most people cannot escape the wrath of inflation.

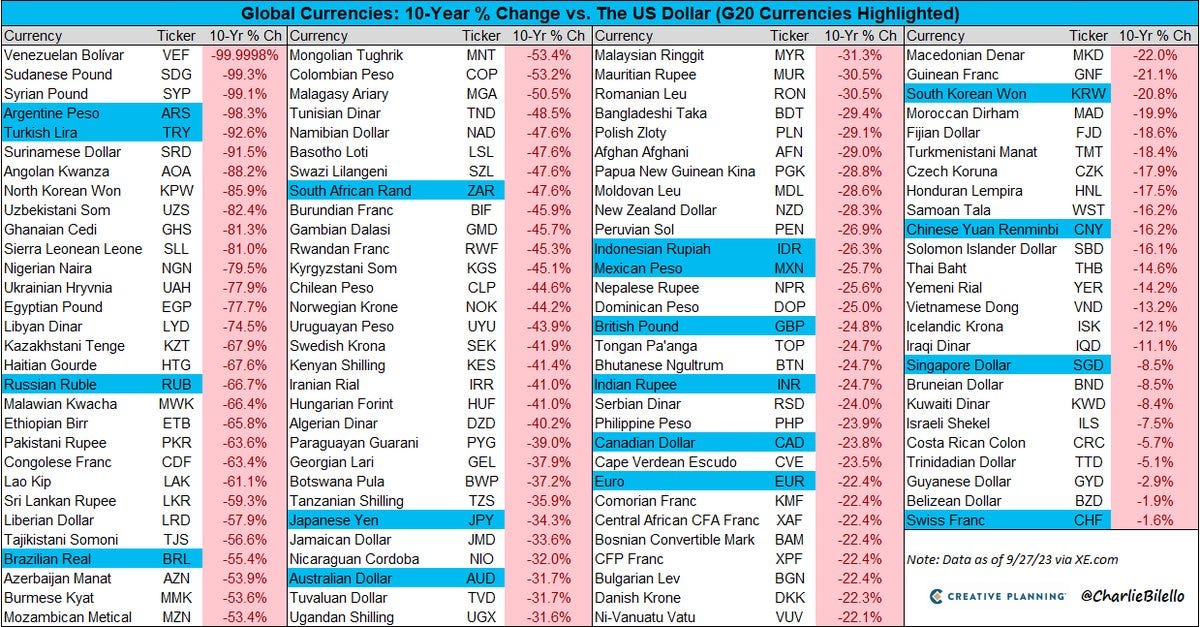

Remember that the US dollar is down 99% to bitcoin, so you can imagine how bad it really is for all these other global fiat currencies people are stuck with.

Rules go out the window when you can’t feed yourself or put a roof over your family. People also develop mental health disorders and turn to drugs and violence as their lives appear hopeless. The world is different now because our money is broken.

I see it in the emergency room every day. I know it seems overly simplified, but I firmly believe the root cause of society’s problems today is broken money.

Fix the money, fix the world. If you save in bitcoin, you’re increasing everyone else’s purchasing power who also saves in bitcoin. This creates a global positive feedback loop that becomes impossible to stop. That’s all you have to do to help fix the world, and you’ll benefit simultaneously. A win-win. Easy right? It’s peaceful, optional, and will take time, but that's okay, as the world isn’t close to ready for a bitcoin standard yet, but it’s coming whether people like it or not.

Two pieces of advice for 2024 if/when mania arrives:

Send them to Crypto Pulse for education. We focus on Bitcoin for a reason.

Be careful. The ideal time to buy was the past two years. We are now near fair value to slightly below (in my opinion), but FOMO and mania can kick in quickly. This is when the price goes parabolic to fundamentals, and people get hurt “buying the top” and using leverage (taking out loans to buy Bitcoin). I’m warning you now to keep your head on straight when euphoria kicks into high gear. Have a strategy and stick to it.

The best way to avoid getting hurt with bitcoin is not to get too cute and try to time things. It is a volatile asset, with much of its growth coming in just a few days/weeks out of the year. Sitting on the sidelines is costly. Trying to trade is costly. For the average investor – DCA and chill. HODL. Enjoy your life and beat every other portfolio/asset class by a wide margin without the stress or work. Yes, it’s really that simple. Yes, that means you will buy the top. Yes, I also bought the top. Yes, you will buy the bottom, as did I. Yes, DCAing can lead to tremendous returns if you can stay patient and not sell in times of fear. You MUST have at least a 4-5 year time horizon when saving in bitcoin.

Superior returns and simplicity are eventually why everyone will own it. No, those who adopt it later will not benefit the same as early adopters, but they'll benefit nonetheless. Bitcoin is about equal opportunity, not equal outcomes. If you put in the work now to learn bitcoin, you get the results you deserve. That could mean generational wealth, but there is also a chance it could mean a big fat goose egg. There are no guarantees in life, just opportunities with variable risk. You must decide what’s right for you. I’m willing to fail in public because of the thousands of hours of work I’ve put in to learn bitcoin at a deep level, and I trust my gut instincts. Just like I trust myself as a doctor due to the thousands of hours of hard work put in, bitcoin is no different. Once you do the work, any fear/doubt mostly subsides.

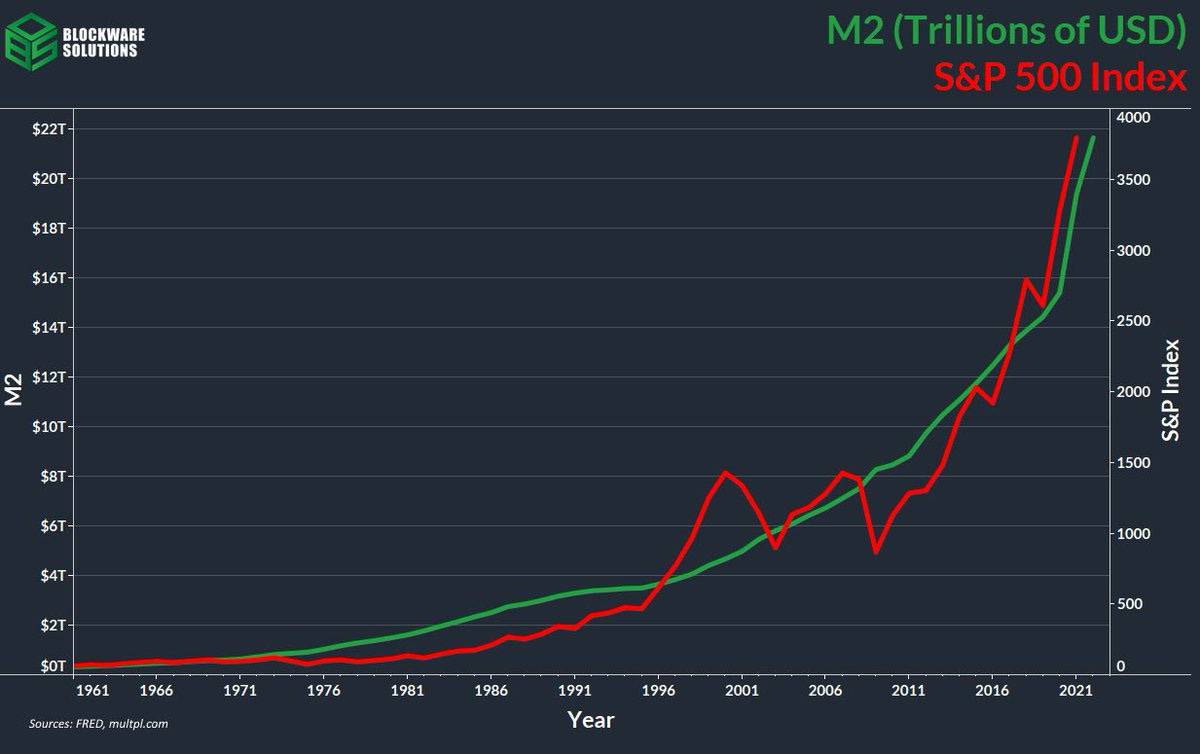

Allocate wisely and recognize every decision comes with some risk. If you want to keep running on the fiat hampster wheel and maintain your standard of living – keep investing in stocks/real estate. Your wealth is growing, but no faster or greater than all the money that is being printed. You’re just keeping pace on average. The data is clear (M2 is money supply).

This makes sense as average stock market returns are 8-10% annually, and the USD is inflating at ~9% annually.

That means that if ANY of your savings/investments aren’t beating 9% per year, your wealth is melting. That’s insanity!

If you want to “opt-out” of fiat and improve your standard of living/increase your purchasing power and protect your time and energy spent working in this life – save in Bitcoin. That “risk” is worth it to me, and I sleep soundly knowing the superior monetary properties of bitcoin, the world’s most powerful computing network (bitcoin miners), along with all the bitcoin nodes (including my own), protect my wealth. I can’t say that about anything else I own. Bitcoin’s most recent rolling 4-year CAGR is 56%, and I think it has a good chance of going UP from here based on future adoption/catalysts.

As it stands, that’s like turning $10,000 into $60,000 in 4 years, $350,000 in 8 years, and 2 million in 12 years if it stays constant. Now, THAT is beating inflation and growing your purchasing power. That is the power of bitcoin and absolute scarcity.

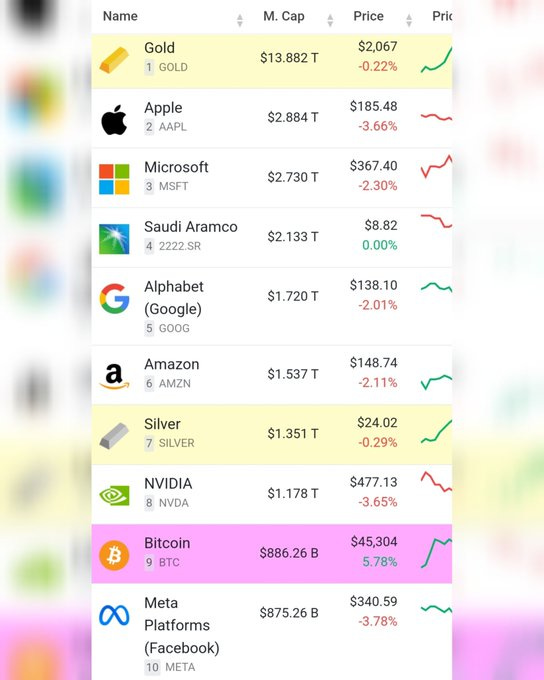

I know many of you may think Bitcoin is risky, but it’s now the 9th most valuable asset in the world, with likely <1% of global adoption.

Read that sentence again. Now, read it out loud. Say it LOUDER. Pinch yourself as you say it out loud for effect.

Do you see any other Ponzi schemes or snake oil on that list?

Now realize that <2 million coins remain available for purchase on exchanges, and <2 million coins will be mined over the next 120 years. YEARS I said.

These statistics are literally unfathomable. It is a global asset that everyone can own that is absolutely scarce and is at the very beginning of its adoption curve (<1%). If you’re at zero bitcoin, GET OFF ZERO. Find a way.

Why am I so passionate about this?? Because I want you to be able to grow your wealth and protect the time you spend working.

News flash: Governments worldwide will never stop printing and debasing your hard-earned money.

The debts are too high at this point.

No amount of taxes or fiscal responsibility can pay it back. It’s only going to get worse with mathematical certainty. To make sure you “survive” this financial repression unleashed upon you (inflation) that you don’t get to vote for:

Stay invested in stocks and own a house if you can. This will maintain your purchasing power with real inflation (which is higher than CPI, which is manipulated lower intentionally). Real inflation that you personally experience is probably 8-20% if you do standard things like eating out, have car and health insurance, pay childcare, pay property taxes, travel, get groceries, pay tuition, go to events for fun, etc., etc. My healthcare premium is up 25% this year. What about you? Did your salary go up 25% to keep pace?

Save in bitcoin to grow your purchasing power.

If governments decide to wise up and TRY to get their budgets and deficits in order (or simply default without inflating the debt away), a financial armageddon (severe depression) will ensue like never seen before, and bitcoin will go to infinity when a new leader elected promises to print all the money necessary to “make it better” to appease the mob. The die is cast. There are no other acceptable options other than to inflate away the debt.

It’s painful, but often seen as the “least painful” option. Depends on who you’re asking if you ask me. Regardless, Bitcoin will protect you better than anything else. Don’t overthink it.

I know I keep writing this, but I cannot overstate how massive this next year is for bitcoin. You should not dismiss these things or say they’re “priced in” already.

Halving is approaching. Mid-April 2024.

From a pure cycle perspective, this bitcoin cycle is identical to all the others. Expect a price explosion in late 2024 after a new supply-demand balance is reached or possibly before due to ETF approvals, likely very soon. Less supply + stable to higher demand = higher price.

BTC ETF – it’s coming very very soon (January), and with it new demand from normies and institutions who don’t know anything about bitcoin other than they want in on the price action. That’s fine. Some will likely sell due to the volatility, but others won’t and will become hardcore bitcoiners. That’s how bitcoin works. The price draws you in, but you stay for the monetary revolution once you “get it.” Some get it sooner than others.

The ETF is just such a huge deal that I can’t overemphasize it. It legitimizes bitcoin as an asset and makes it easy for big money to gain exposure in seconds/minutes. Sure, there could be a “sell the news” period early after approval, but make no mistake - the ETFs will bring massive amounts of capital into a globally traded finite asset over the long run. Buckle up. Don’t say I didn’t warn you.

Even currently traded non-bitcoin ETFs are updating their prospectuses, indicating that their funds may allocate X% of their assets under management to bitcoin ETFs (they want the higher returns)!! Everyone will own bitcoin in their stock portfolio and might not even know it! The game theory is going to be next level. In the financial world, you cannot be the last mover. The race to be first is on. Over the next few decades, I predict hundreds of billions to trillions of dollars will flow into these bitcoin ETFs. Now might be a good time to buy some before that happens.

Boomer money – This is a new one on my radar, but speaking to my father made me realize there is a new bitcoin buyer in town with two unique qualities. They have a TON of money (trillions), and they DON’T sell...like ever. They buy hard assets, and they ride them to infinity or zero. They look at them as an inheritance for their kids/grandkids. They tell their financial advisor - “get me X% bitcoin in my portfolio.” They don’t care about the price. They just know they want exposure to an asset as a certain percentage of their nest egg. This could drastically alter the 4 year cyclical behavior of bitcoin with booms and busts as big buyers who don’t tend to sell as easily could keep bitcoin’s price elevated. This is the main reason why I am not even thinking of trying to time/trade this cycle. That’s a dangerous game with boomer money coming in and buying bitcoin ETFs and never selling.

Unit bias – let's face it, people hate buying bitcoin because they don’t understand you can buy as little as a dollar. They see the price of $45K and say, “too high, missed it/can’t buy it”. With the ETF approvals, the “share price” will be what people are more used to. Maybe under 100 dollars for a Bitcoin “share.” It’s no different as you will get the same amount of bitcoin, but people are fixated on owning lots of shares because that’s what they are accustomed to (fiat mind games). If they can own ten shares of bitcoin versus .022 bitcoin for 1000 dollars, they’ll be much more likely to buy some. I don’t make the rules; I just know how human brains are wired.

Election year – the economy must look good for the incumbents, voters must be happy with the stock market zooming higher, and gas prices must be low. That’s what gets you re-elected, and the Fed + the current administration will make darn sure that happens. Expect more money printing to make it so on voting day. Bitcoin thrives as leaders make these short-sighted, dangerous decisions to keep the mob happy with bread and circuses.

Nation-state adoption – El Salvador is back in the green on their Bitcoin investment as a reserve treasury asset. They were mocked. Bullied by the IMF. They are now billions of dollars in profit, their bonds are in high demand for the first time ever, and their GDP is growing substantially. Other developing countries are watching this experiment and have more money and natural resources to mine bitcoin cheaply than El Salvador does. They can also print fiat to buy bitcoin….and game theory begins.

Who will figure it out first? DO NOT FADE THIS NARRATIVE.

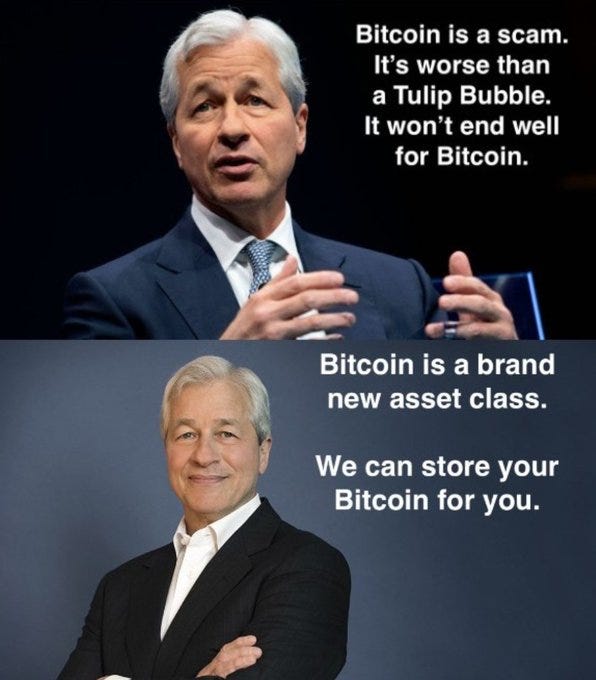

Bitcoin in the news. All news is good news for bitcoin. Bitcoin asked about during a Presidential debate? Check. Jamie Dimon hating on bitcoin to protect his own interests? Check. I mean this guy can’t be serious, can he? One minute he says, “I’d shut bitcoin down.” The next minute, he’s the lead for multiple bitcoin ETFs.

You can’t make this stuff up. If you get fooled by the narrative that bitcoin is only for criminals, money laundering, and terrorists, I feel sorry for you. Does Jamie Dimon’s bank get shut down when he commits financial crimes and facilitates sex trafficking? Nope, just some fines.

Do US dollars and iPhones finance and facilitate terrorist activities? Absolutely.

Do bad people use the internet for bad things? Of course! Does it mean the negatives outweigh the positives? Heck no! Banks, the USD, the internet, the iPhone, and bitcoin are used for good 99% or more of the time. Bitcoin is an open-source technology. It’s completely transparent and traceable. It’s the worst terrorist financing vehicle of all time, especially compared to the opaque fiat monetary system. Jamie Dimon has no clue what he’s talking about. He’s protecting his vested interest in his business (banks) and the USD which has made him a billionaire. He’s probably just hoping to buy bitcoin cheaper by spreading FUD!

The energy and AI revolution are upon us, and bitcoin mining will help usher it in. The more hash rate online, the more secure Bitcoin is in addition to raising the floor price of the asset itself. The harder it is to mine bitcoin due to greater competition means miners must sell it for a higher price to earn a profit. This is the commodity/cost of production value of bitcoin, and as mentioned in prior newsletters, it is around 40-50k AFTER this upcoming halving. With each halving, the floor price is designed to go UP until at least 2140. Not bad…

Rates – the market is sniffing out Fed funds rate cuts coming in 2024 and is frontrunning them. I’ve said from the beginning that rates in the 4s to 5s are too high. It’s the danger zone. Neither the economy nor the government, as it is currently constructed with this much debt, can function with rates this high for too long. It has surprised me we have been able to handle rates at these levels for this long, but the gig is nearly up. Big businesses and property owners (commercial real estate) must start refinancing their debt in 2024 and 2025. China and Europe are begging for the US to cut rates. As inflation continues to wane in 2024, the Fed will need to loosen monetary policy to avoid being too restrictive. If inflation starts to return to the 2% range, it would be insane to keep rates near 5%. They could cut to 4% or lower and still be “restrictive” if CPI keeps on this trajectory. That’s a big IF (inflation falling) for many, but it's something I do expect personally. I think the inflation boogie man is gone unless some massive supply chain issue creeps up again or stimulus checks start going back out. Low rates = bitcoin and tech stocks to the moon.

Liquidity - i.e., money printing. Every government around the world has reached the end of the rope. They must print in 2024. Temporary programs like BTFP that the Fed created to bail out banks in March 2023 end in March 2024. Recessions are looming for Europe and China. Central banks globally coordinated to slow down their reckless liquidity injections for a few years, but not stop entirely (BTFP by the Fed, UK GILT crisis bailout, China outright printing due to housing bust, Europe bank bailouts). To keep the system solvent they must pick it back up significantly in 2024-2025. Bitcoin, as the hardest, scarcest asset, will rise first and the most because of these properties (stocks and real estate will also do well). That doesn’t mean other lower market cap altcoins won’t outperform bitcoin, but that game is for traders/speculators. If that’s your skillset and you have the time for it, good on you, go for it. 99% of people don’t.

FASB accounting rules change officially in 2025 for companies holding bitcoin as a treasury asset. They can adopt it early in 2024 if they desire. Apple/Google/Microsoft - who will be the first to put it on their balance sheet? Stay tuned.

At the end of the day, I am insanely mega mega bullish on bitcoin for 2024 and 2025, and I’m not ashamed of it or hiding it.

In fact, I AM POUNDING THE TABLE FOR IT.

I will rest easy knowing I did everything I could to bring awareness and educate others about the magnanimity of this still nascent and highly misunderstood asset.

It’s the only credible, neutral, bearer asset that can’t be seized or debased and can be held without counterparty risk if you so choose. A novel savings technology that will unleash untold new human prosperity. It is literally a productivity index fund for the entire world. Anyone, anywhere that produces something and earns income for it and saves in bitcoin increases the wealth of everyone else globally also saving in bitcoin. Human beings are incredible and innovative. Bitcoin is a bet on humanity prospering and yearning for freedom. I’m all for that. How could you not??

Most importantly, as Michael Saylor said it best, "#Bitcoin will never die as long as there's one person alive in this world that yearns for freedom." I like those odds!

In a world with rising conflict and distrust with infinite fiat debasement by all given global insurmountable debt, bitcoin will be the most desirable asset on the planet sooner than you think.

It is the Internet of money, and you have been given a once-in-a-lifetime opportunity to front-run major institutions before they can buy it. In a few weeks, that will no longer be the case. The floodgates will be open.

Time is running out for Bitcoin at these fair-value commodity prices. The big boys with billions and trillions of dollars will be here soon, and with that will come a bitcoin monetary premium that gold, real estate, and stocks also enjoy. This is not meant to be hyperbolic or scare anyone. It’s just the facts. They’re going to buy it and never sell it. Michael Saylor of Microstrategy has been telling you this, and he’s just the CEO of ONE small public company. Wait until every company, bank, nation-state, millionaire/billionaire, etc., adopts his playbook. The supply is fixed no matter how badly they or you want it. 21 million. That’s it.

I believe it to my core. The invention by Satoshi of digital absolute scarcity will go down as one of the most important technological breakthroughs of all time. It’s a gift to humanity, and I hope by reading Crypto Pulse and lending me some of your time, you benefit from it.

Overpriced equities, real estate, and bonds will be brutally repriced into finite Bitcoin sooner rather than later. Everyone laughs at Blockbuster for missing the digital/streaming technological revolution. This time around, ALL OF US AND OUR PERCEIVED WEALTH/NEST EGGS ARE BLOCKBUSTER, AND BITCOIN IS NETFLIX.

If you have any savings, stocks, gold, real estate, or bonds, those are at risk of being repriced lower by bitcoin as they begin to lose their monetary premium to bitcoin. Bitcoin is a massively disruptive savings technology. Don’t let your hard-earned wealth be the next Blockbuster when you knew disruption was coming/inevitable. Benefit from the disruptive technology instead and adopt it early.

The ETFs are revving their engines at the starting line. The light has moved from red to yellow. The halving is ~100 days away. Guess what happens next.

I’ve been waiting nearly four years for it. I’m ready.

Thanks for reading! Happy holidays!

Please share if you like it!

THIS is Crypto Pulse

HODLing since 2021 right here. DCA buying every month. Set it and forget it.