A long-standing joke between my buddies and me is that before my wife and I had kids, I vowed that when we did, nothing would change. Late nights, traveling abroad, going out to dinner, hobbies, etc. Nothing changes!!! Bring the kid with you, or get a sitter. What’s so hard? They all had kids already and would chuckle at my proclamations and roll their eyes.

“I’ll show them,” I figured.

If you have kids, you’re already laughing. As you know, I was insanely wrong. Everything changes. Nothing is the same. Nothing is easy. Sure, you can have a moment here or there where you feel like you’re back, but then you have another kid, an illness strikes, a tooth is coming in, or a tantrum hits over the wrong color cup.

You’d never dream of it any other way, so you just laugh and commiserate with other parents who are also in the thick of it. There have been many text threads where the line “nothing changes!!!!” is repeated often in jest at my expense. It’s well-deserved and hilarious. I own it.

What the hell does that have to do with bitcoin?

Since the election, I found myself repeating a familiar phrase in my life: “Everything has changed.”

When it comes to kids, I was wrong. Everything does change. When it comes to bitcoin and crypto, I was right. I knew there would be massive positive changes if Trump were elected.

Why?

Trump spoke at the bitcoin conference last year during his campaign and said some very positive things about bitcoin and crypto. When it seemed (to me at least) he was the clear favorite to win the election, I became super mega mega bullish on bitcoin and crypto more so than I already was. A pro-Bitcoin White House would be a complete game changer for the asset and likely boost/accelerate global adoption. He’s now delivering on many campaign promises that we’ll discuss later.

Notably, digital assets and users have faced nothing but headwinds since Satoshi started mining bitcoin in 2009. Constant attacks, debanking, regulatory pressures, lawsuits, prosecution, ridicule, blatant lies to drive a narrative in the media, and the list goes on.

Somehow, against all odds, bitcoin monetized from nothing to over $100,000 a coin in 16 years against stiff headwinds to try and kill it and zero marketing dollars spent to grow its popularity. Think about that for a second. Do you understand how impossible that is? The federal government tried to make it as difficult as possible for people NOT to own bitcoin. Still, despite their best efforts and propaganda to deter people, and not one single dollar spent by the creator, it became a two trillion dollar asset. All because bitcoin is a disruptive technology (the best money) and solves literally one of the biggest problems everyone on this earth has – inflation.

That is what you call unstoppable. Bitcoin has perfect product market fit and is a viral phenomenon. Bitcoin is an unstoppable technology, similar to the internet, and just like when all the regulatory and political headwinds for the internet suddenly became tailwinds when regulatory policies changed in the 1990s, everything will change for bitcoin and crypto. Headwinds become tailwinds. Everything changes.

The steep part of the S curve is coming. Mass adoption begins. Just like everyone now has a cellphone with internet access, everyone will use bitcoin as a savings account in some format. Maybe they won’t even know or understand it (like index fund 401k investing). Perhaps even someday, fiat currencies like the US dollar will die. But not anytime soon, in my opinion.

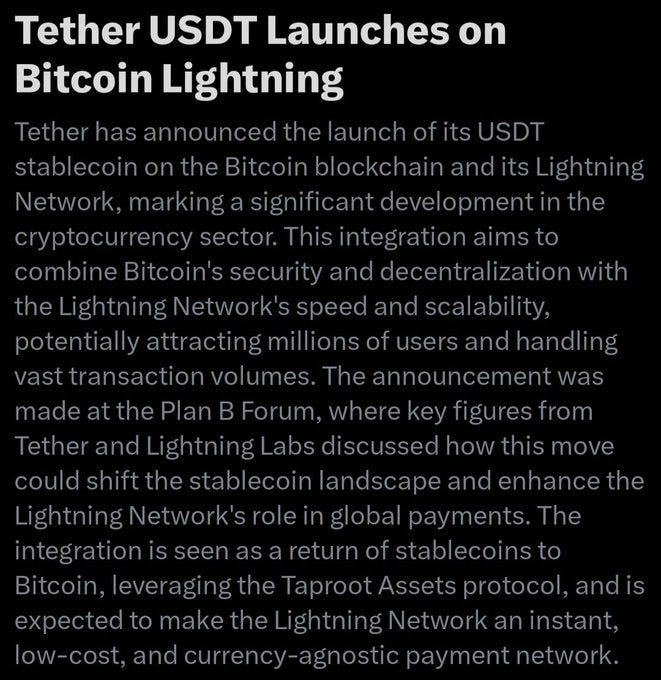

For the foreseeable future, you will want to spend dollars and save in Bitcoin, and THAT’S OKAY. Bitcoin is doing its job, growing your purchasing power. You don’t have to buy coffee with it for bitcoin to be valuable. No one has ever bought coffee with a gold bar either. Relax. Bitcoin is primarily used as a store of value today or for BIG PAYMENTS (like billions of dollars) between two parties. It may never be for donut purchases, or maybe it will be in 50-100 years, who knows. This just happened today…

Stablecoins on bitcoin! Perfect for coffee purchases!

You couldn’t predict streaming movies on your iPhone in 1999 and ordering an Uber or meal delivery from your phone. I PROMISE you in 25 years, the innovation built on Bitcoin will be monumental and look NOTHING like today. It’s EARLY. The key is massive demand and global product market fit, just like the internet had in the early 2000s. The incredible features built on top of it will come later. Patience. This is your chance to OWN a piece of the new financial base layer of the world (like owning a piece of the internet somehow). Do not miss it.

So, what exactly has changed since 1/20/2025?

A lot. By the time I publish this, I’m sure I’ll leave out new things. Here’s a top 10 list.

1. SAB-121 was repealed (Biden had vetoed it previously). Big banks can now custody digital assets like bitcoin. Second only to the ETFs in importance, this is MASSIVE. Like unbelievably huge, you have no idea, unfathomably big, words cannot describe it.

Why? Big companies and institutions that own trillions in assets only deal with big banks they know and trust. The floodgates are now open for them to work with their trusted partners related to buying and holding bitcoin. Everything goes back to supply and demand. This is a GARGANTUAN demand impulse that could create buying pressure for decades to come. This is the iPhone moment for bitcoin. I’m telling you. Just like I said the bitcoin ETFs would be massive for demand, this might even top that. It will go entirely unnoticed by mainstream media, but you heard it here. It’s mega-bullish but won’t have an overnight impact. Do not fade this. This changes everything.

One of the most significant developments from this will be bitcoin yield and loans. Banks can use Bitcoin as collateral and issue loans because they can now have custody of the asset. Instead of posting your illiquid house as collateral that needs a new roof and smells like cats for a loan, you’ll post bitcoin and get a better rate. Would banks rather have a house as collateral or bitcoin? Bitcoin. It has a 24/7/365 liquid market, you can sell it on a Tuesday night in a second, it’s global, digital, verifiable, and incurs near zero cost. Any questions? Of course you’ll get a better rate. It’s pristine collateral. The world has never seen such a thing.

Additionally, banks will want to custody your bitcoin for you and create fiat loans to hand out to others who want a loan. For this risk, you’ll get paid a yield (be careful!!). Hopefully, you understand the significance of what this means.

Bitcoin will be a cash-flowing asset that generates yield and earns you better interest rates than real estate or equities when used as collateral.

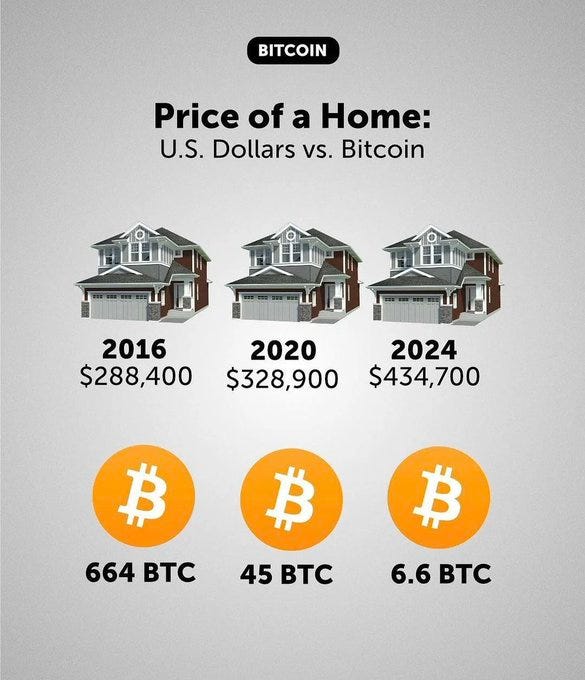

Read it again. I have been pounding the table for years about this. Real estate is already crashing in bitcoin terms and is about to crash harder and faster.

Storing wealth in real estate is a fiat disease that was never supposed to happen with sound money. The choice is simple: you will very soon be able to hold a cash-flowing asset with superior collateral properties, earning you better interest rates requiring no maintenance, taxes, headaches, environmental risks, insurance costs, etc. Bitcoin over real estate.

Homes will return to their utility value, and the monetary premium disappears except for insane prime real estate, which may be unaffordable for most due to insurance costs. The Palisades fire and other recent disasters are prime examples of this and why storing a large portion of your wealth in real estate will eventually end now that there is a better asset/technology – bitcoin.

Over the next few decades, people will sell their extra homes/ABNBs at a historic pace to buy bitcoin instead. That’s good for bitcoin, but bad for real estate prices (Warning! Warning!), but GOOD for people without homes because homes become more affordable. The social contract is restored, people can stop living with their parents and have babies again, and civilization flourishes. Demographics is destiny and the world is literally not having enough kids. It’s a huge problem. Would you want to start a family in your parent’s basement? Fix the money with bitcoin as savings instead of real estate, fix the world.

Finally, if I haven’t put enough emphasis on this rule change, I’ll go further. Because bitcoin will now be recognized as superior collateral to every other asset in the world, these big institutions will never sell it. Ever. You never sell prime real estate in NYC/Miami Beach, and you never sell your bitcoin. They are going to just buy it and borrow against it forever like they currently do with assets like real estate and equities. They understand the game. Buy, borrow, and die. Refinance if needed. Never sell. Especially the best-performing asset over the past 16 years, which is absolutely scarce. If you sell your bitcoin, realize that they are buying it from you, and you’re never getting it back. They know there’s a finite supply and want as much as possible. No one is bullish enough. This is your final warning. Everything has changed.

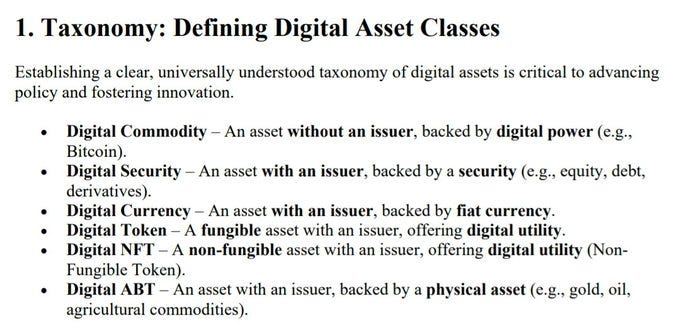

2. An executive order was issued to create a framework for digital assets to provide much-needed regulatory clarity. What defines a digital commodity/security/utility token/collectible/stablecoin, etc.

What is required of those teams that launch a product like a digital security/utility token? A primary reason the US was losing talent overseas related to bitcoin and crypto was the threat of fines and prosecution if they did not “comply” with the SEC’s demands. I use the word comply in air quotes because the SEC refused to clarify definitions of digital assets. They left everything intentionally vague and then sued innovators relentlessly, which made everyone nervous about launching a project in the US. This will change everything. Trump wants to make America the bitcoin and crypto capital of the world. This will encourage that. These are disruptive technologies, just like the internet. America can’t risk falling behind.

Although all digital assets will be winners from this regulatory clarity, I think stablecoins (and bitcoin) benefit the most. I probably should write an entire article on stablecoins, but basically, it’s digitizing the USD and putting it on blockchain rails for the entire world to use. The value stays close to $1 via arbitrage, so don’t buy it to make a profit! Hence “stable” coin. The entity that issues it (USDC, USDT, etc.) holds short-term US treasuries to “back” the stablecoin supply. Given current rates, they’re making a TON of money collecting 4-5% interest. This legislation likely sets up for the USD to be stronger than ever as everyone everywhere wants dollars as their currencies get debased FASTER than the USD (Africa, Central America, etc.). This legislation will likely make that happen even faster as big banks and many others try to get a piece of the lucrative pie. This future is coming quickly…

Remember, at the end of the day, stablecoins are just digital fiat money. It’s still printed into circulation, you’re still getting debased relentlessly at near 6-8% a year. It can be censored easily on blockchain rails. It has NOTHING to do with bitcoin. It is, however, an easy on/off ramp to bitcoin, and thus will likely increase bitcoin adoption globally. Keep an eye on stablecoins. They are coming soon for payments and soon to your bank offering yield. They will likely integrate so seamlessly into payments and banking that you don’t even know you’re using them, which is how technology is supposed to be. I’m annoyed by their ideal product market fit and insane demand because it’s just fiat money (the cancer) on blockchain rails. It will extend the life of fiat money and dollar hegemony. The transition to a full bitcoin standard may never happen, and we simply always spend fiat and save in bitcoin. It’s a hybrid world I’m coming to rationalize and expect for at least the rest of my life. I’m okay with it as long as bitcoin continues to outpace fiat debasement and grow my purchasing power. Spend the bad money, save the good money—Gresham’s law in action.

3. The executive order also called for studying the creation of a strategic reserve of digital assets. I don’t care what anyone says, this is a bitcoin strategic reserve and nothing else.

It may happen, it may not. I have no clue. There are MANY prominent people leading the subcommittee on this that are EXTREMELY pro-bitcoin and own some themselves, so I like the chances, but we’ll see. If a strategic bitcoin reserve bill becomes law and the US starts buying bitcoin to fill the reserve (the current language in the proposed legislation), watch out. That might be more significant news than the ETFs and SAB 121. It would start a global race to print fiat and buy finite bitcoin. Everything would change. Example A…

It’s important to note that just because other COUNTRIES may not adopt a bitcoin strategic reserve, many of the STATES within the US are highly considering it. Below is a graphic (likely outdated) of those with bills currently undergoing debate to become law.

States like Texas and Florida have a GDP that DWARFS MANY COUNTRIES. If Florida were a country, it would be the 15th largest economy in the world and rival Spain. So, just because other countries in Africa and Central America aren’t starting a bitcoin reserve (yet), it’s actually MORE BULLISH that states within the US are—just FYI. No offense to Chad or Niger, but I care more about Texas having a bitcoin reserve.

4. Blackrock just filed to allow for “in kind” redemptions for its bitcoin ETF. The SEC previously refused to allow this (completely irrational).

This seems like a nothing burger, but it does a few things. First, it makes the ETF more efficient and trustworthy for big institutions. Thus, they will be more likely to buy in size, which means there will be more demand. Second, I believe it opens the door to the POSSIBILITY that, in the future, you could redeem ETF shares for bitcoin that you could put into cold storage and vice versa. This creates MORE opportunities for borrowing and lending using bitcoin as collateral, which will be massive in the future. It also keeps the ETFs honest and should prevent bitcoin rehypothecation. If people can withdraw their bitcoin to cold storage on demand, the ETFs would be crazy to fractionally reserve it. A digital bank run could materialize in hours similar to March 2023, causing bankruptcy. This IS what you want as a bitcoiner. It keeps power from centralizing. This would be a great development.

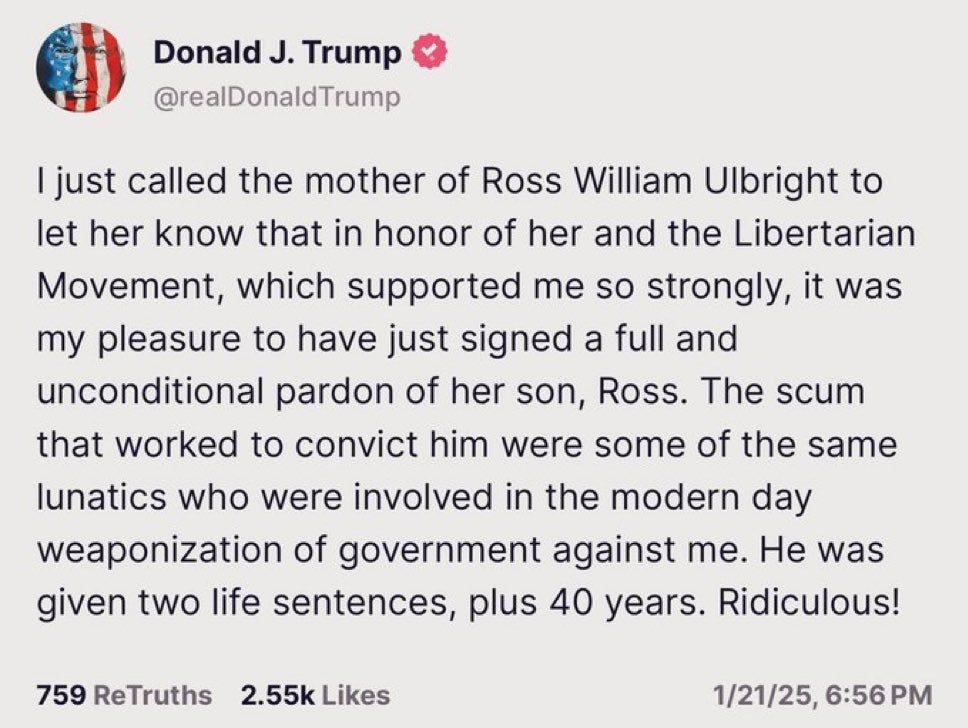

5. Ross Ulbright was pardoned from a LIFETIME in prison for building the Silk Road free market website where people would transact in Bitcoin for goods more than a decade ago (unfortunately, many used it to buy drugs, which was never his intent). He just thought bitcoin was an incredible freedom technology, which it is, and built something so people could trade and use it as money, which they did. The punishment didn’t fit the crime, just as Mark Zuckerberg isn’t in prison for building Facebook and doesn’t pay for the sins of those misusing his creation (money laundering, child pornography, human trafficking). Congrats Ross!

6. Central bank digital currencies (CBDCs) were banned. The dystopian universe where the government prevents you from buying a steak because your carbon limit has been hit and monitors your every transaction is over. You can still be censored easily with stablecoins though, so beware. They aren’t AS BAD as CBDCs, but they are nothing like bitcoin, which is uncensorable. Know the difference!

7. Operation Chokepoint 2.0 will be investigated, and justice will be served. Good actors trying to do business in bitcoin and crypto will not be discriminated against and arbitrarily cut off from the banking system. The SEC and the Biden administration's reign of terror on crypto is over.

8. An executive order to protect Americans’ rights to access and use public blockchains, participate in mining and validating while self-custody digital assets, and transact peer-to-peer without censorship was signed. This changes everything. Bitcoin and crypto will not be banned or made unlawful. That fear is now gone, and demand should naturally increase.

9. Given the new pro-bitcoin/crypto Trump administration stance, dozens of new bitcoin/crypto ETFs were filed. An insane combination of ETFs will be available for investors to purchase, and they will come with all flavors of risk to suit your investing style. This changes everything. Demand will skyrocket for these products, but there is only 21 million bitcoin.

10. Fair value accounting rules (FASB) are now in effect. This is monumental for the Microstrategy companies of the world that hold bitcoin on their balance sheet as an asset (like Tesla). They will finally be able to mark UP the price of Bitcoin to its actual value and reflect that on their earnings statement. Public companies have been afraid to hold bitcoin because of the optics it generates when they report quarterly earnings. With FASB rules now in effect, optics are much more favorable, and new companies are starting to follow Microstrategy’s lead.

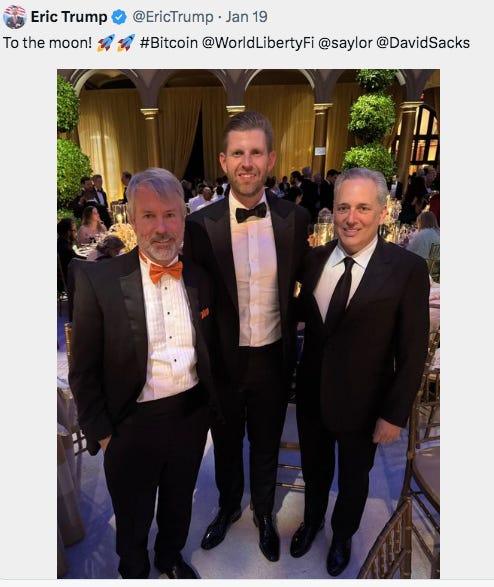

This changes everything. There is more demand for a limited supply of Bitcoin. Fireworks ahead. Can you imagine Saylor posing with anyone from the Biden administration 4 years ago? Let alone the new Crypto Czar?? Bullish…

Not everything from the Trump team is perfect, far from it.

A live look at Trump and his cabinet…

Just kidding. Kind of.

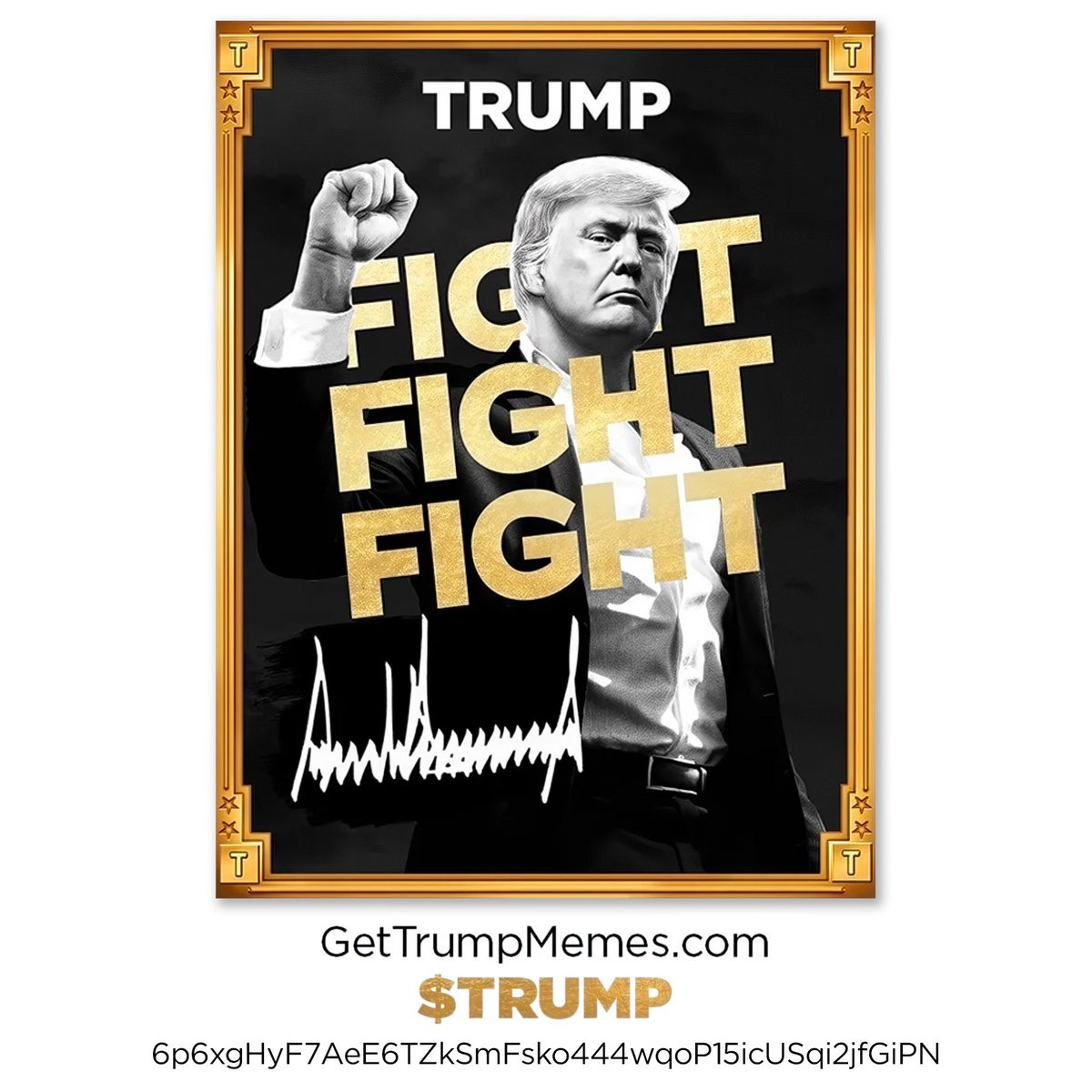

Yes, Donald Trump launched a meme coin ($Trump) that hit 70 billion dollars in market cap in like 24-28 hours.

I don’t love it. Many people will lose money on “scams” like this. However, it’s a free market, and anything outside of Bitcoin is basically like the casino/gambling. Know what you’re getting into. People lose tons of money on lottery tickets every year. This is no different. Buyer beware. Bitcoin, not crypto. If you want to gamble and be a degenerate, have at it. It’s a free country!

Macro outlook

As a 2 trillion dollar asset class, bitcoin is now much more influenced by macroeconomics than by the bitcoin halving, in my opinion. So here are some things I’m thinking about…

-A recession seems unlikely given Trump’s agenda and continued deficit spending. Boomers have TONS of money and are spending it like no tomorrow. Everyone has a job that wants one.

-Persistent inflation seems likely, but not back to 2022 levels. We likely hover near 2-3% unless Trump tariffs really change things.

-Interest rates are likely to remain elevated, but Trump desperately wants them lower as well as a weaker US dollar to ignite the US economy. It is to be determined if that will happen.

-Japan’s central bank just raised interest rates again (which the market didn’t like over the summer, if you recall). This is bad for all asset prices and creates forced sellers as their carry trade goes against them.

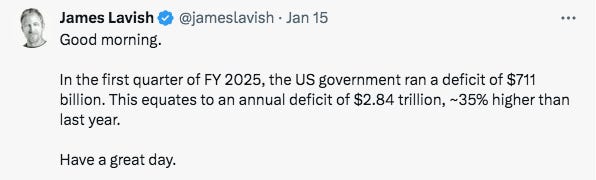

-Massive amounts of debt need to be refinanced this year at higher rates. That’s bad for global liquidity and stocks/bitcoin.

-Trump’s policies with tariffs could be all talk and no bite, or inflationary if implemented. Hard to know. Not good if inflationary for stocks. Unclear for bitcoin.

All this to say, I have no clue, nor does anyone else. Bitcoin will be volatile this year (as always) and may not be “up only.” Hang on tight. Recognize that at the end of the day, the fiat system must continue to debase the currency to keep the Ponzi running and make debt more affordable. That is your North Star with bitcoin.

Just FYI, they are printing again.

They can slow it down occasionally, but not for long!

Notably, 7-10% is your inflation rate per the chart, not whatever garbage CPI reading you are told. Wake up to this lie, and everything changes!!! If you’re investments and savings aren’t beating 7% (on average), you’re falling behind. Life is getting MORE expensive for you unless your wages are also outpacing 7% growth.

I play the long-term game with Bitcoin, and its value in my portfolio is an asset outside the fiat monetary system, which has MASSIVE PROBLEMS both currently and in the near future. Demographics are destiny. AI is not solving this and may worsen it (tremendously DEFLATIONARY…meaning more money printing is needed). Gulp.

Overall, I think the USD will be weaker at the end of the year, 10-year yields will be lower, and quantitative tightening (QT) by the Fed will end. I don’t think a bazooka of liquidity will be injected like during Covid (at least not by the US, maybe by other countries like China). Still, in totality, I think bitcoin does well in conjunction with a resilient US economy and positive net liquidity throughout the year. Hopefully, the 150-300k target will be hit. HODL. No guarantees.

Deepseek

A quick word on this in case you haven’t been following the story and why it matters to bitcoin.

China’s “Deepseek” AI model was just released and is now the number 1 downloaded app. It is apparently as good as all of the US AI models and costs like 50x LESS. This could be a potential pin in the AI bubble stocks that are spending UNGODLY amounts (hundreds of billions) in capex to develop the technology. Meanwhile, China comes out with something just as good for a few million bucks. Rut roh!

Ultimately, it will be amazing for AI as more people will use it because it’s cheaper, but it could be trouble for some AI stocks, at least in the short term.

Unfortunately, almost everyone’s portfolio has a considerable percentage of these mega-cap AI stocks in some form or another. IF (big IF) it gets ugly for US stocks, it will be interesting to see how Trump and the Fed respond. Recall that most of the taxes collected by the US government are based on the stock market going up. It’s a big problem for debt/deficits if it doesn’t.

I think this is also an opportune moment to once again pound the table for bitcoin (shocker). Why? If we let technology, global trade, and capitalism (ironic when talking about China) do their thing, prices will fall, and consumers will ultimately win. It’s AWESOME that China’s AI model is 50x cheaper and just as good. That’s great for users. We should be celebrating that. But because our retirement and net worth are invested in these stocks that are hurt by this news, we may be sad.

As technology and AI/robotics/quantum computing/3D printing/space exploration/software/big data, etc., progress, it will be harder and harder for companies to make money and have healthy margins with competitive moats. Investing and picking winners is going to be a nightmare. Companies could be disrupted overnight, just like with China’s Deepseek AI. This is great for consumers as prices go lower, but terrible for investors trying to store their life savings and retire. Once again, saving in real estate and businesses/stocks was never a good idea. Those are risky investments and a symptom of broken fiat money, which you CANNOT SAVE IN, SO YOU ARE FORCED INTO THESE OTHER THINGS. You should SAVE in sound money, and if you want to invest in a risky business that will have a more difficult challenge of being profitable in the future – good luck; that’s your prerogative and to each their own risk appetite. Most people want to work 9-5 and not have a second job in finance or pay someone tons of money to do it for them.

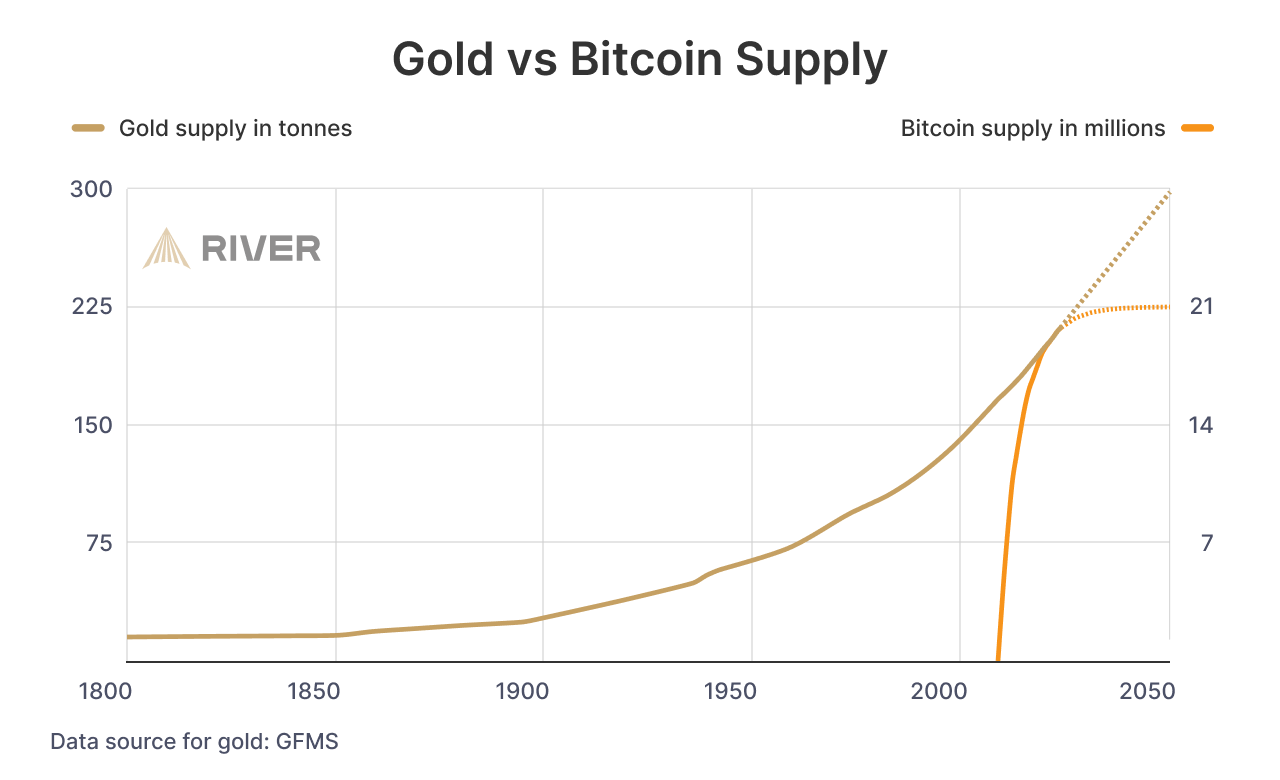

The whole point of bitcoin is that you save in sound money that doesn’t require profits and margins like companies that can be made obsolete nearly overnight, or deal with all the risks of real estate. Savers can benefit from the deflationary nature of technology and the lower prices that it brings while saving in a finite digital commodity that is not exposed to those risks. We all should be celebrating lower prices and lower costs due to technology, globalism, and capitalism, but until we save in a sound money that is absolutely finite (unlike gold)

and grows our purchasing power in conjunction with deflationary technologies, that won’t be the case. I know the value of gold is going up in nominal terms, but just like real estate, it’s CRASHING IN BITCOIN TERMS.

Change your unit of account to bitcoin (instead of dollars), and everything changes!!!

Deepseek is massively bullish for AI and bitcoin because the cheaper AI gets, the more tech will be used to transform our lives, while bitcoin thrives in a deflationary environment (unlike fiat money). People in the future won’t feel comfortable storing their hard-earned wealth in anything other than Bitcoin for fear of disruption.

But I can hear you now! “But..but..but…what if….”

No, bitcoin is not MySpace. Stop it. You cannot “make a better one.” It’s over. It already won. The network effect is cemented. Think of Bitcoin like fire, the wheel, electricity, and the internet. Are you going to use a different internet if it’s created? No. Bitcoin is a zero-to-one open-source technology breakthrough and never gets obsoleted, just built upon/enhanced. Bitcoin will become the global financial base layer upon which everyone builds. Everything changes, and no one is bullish enough.

Last few points before I wrap up:

Like climbing a mountain, Bitcoin is going through an acclimatization process. You start at base camp, hike up to camp 1, head back to base camp, and move back up to camp 1 to rest before heading to camp 2. This may be a corny analogy, but it’s really healthy for bitcoin to establish bona fide support at different price levels. Similar to how 58-68K developed massive support last year, 90-105k is doing that now. It’s just basing before an explosive move higher, and it likely will establish strong support for the next bear market at these levels, which is good!

Don’t get bored by it or shaken out. View it as normal and healthy. Vertical moves higher in a short period of time are unsustainable and usually come right back down. A stair-step approach is ideal and prolongs the bull market to reach higher heights. I think we may be in the 2nd-4th inning of the bull market, but macroeconomics will determine when the game ends.

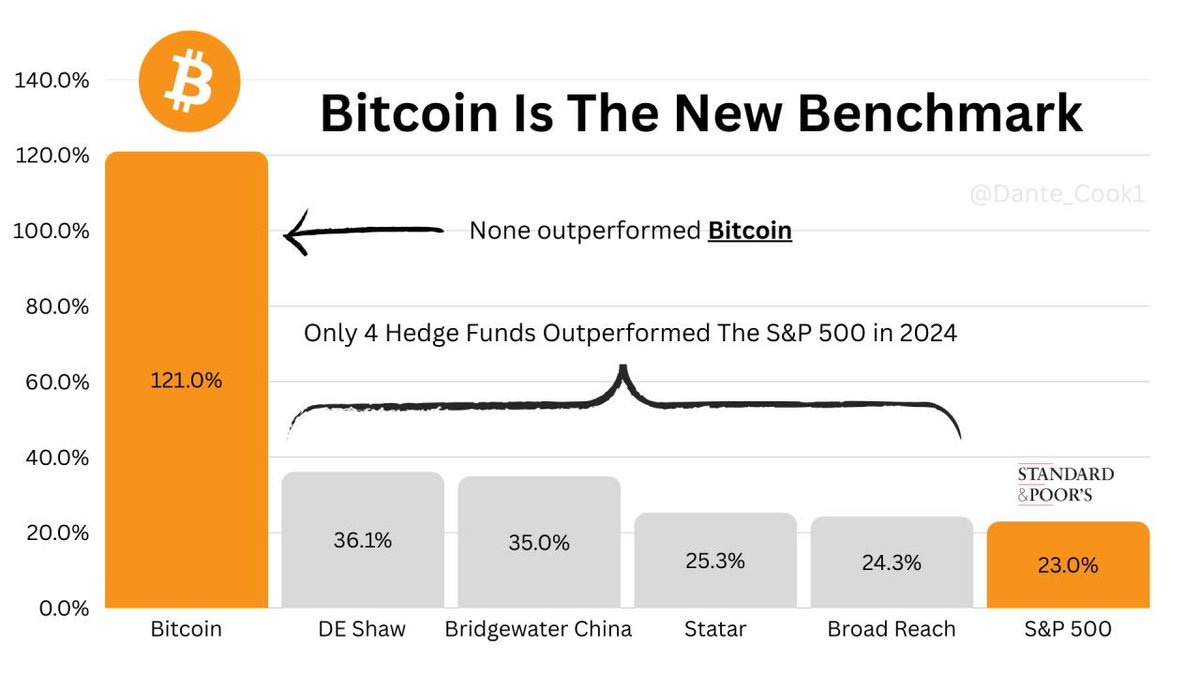

-Gentle reminder: 2024 was a GREAT YEAR. Basically, no one outperforms Bitcoin. Not even the best hedge funds in the world getting paid astronomical fees.

Buy bitcoin. HODL. Win. Who can say no to a 20-60% CAGR asset with almost no fees/costs? Yes, it’s that easy, but much more challenging in practice, given the volatility. Long-term time horizons solve that. Sure, there will be individual stocks that outperform in a given year, but unlikely over 5+ years. Compound your wealth. HODL bitcoin. Long-term bonds and the traditional 60/40 portfolio are dead.

I wouldn’t touch long-term bonds with a 10-foot pole, even during a recession (when MORE bond issuance is required on top of our now 36+ trillion debt and growing!). Given our current debt/deficits/demographics, they are a toxic asset.

I think 50% equities/40% bitcoin/10% real estate or some combination of your choice. Stop laughing, I’m serious! EVERYTHING CHANGES!!! What about you? The only incorrect answer is 0% bitcoin.

Thanks for reading!

Share if you like it!

THIS is Crypto Pulse