IT’S OVER. I promised I’d tell you. I’ve sold all my bitcoin……..and bought gold.

“Oh, I can’t believe it man! You fell for the oldest trick in the book!”

A catchy title always gets the clicks.

Heck no I haven’t sold a single satoshi!!! I couldn’t be more bullish about bitcoin!!

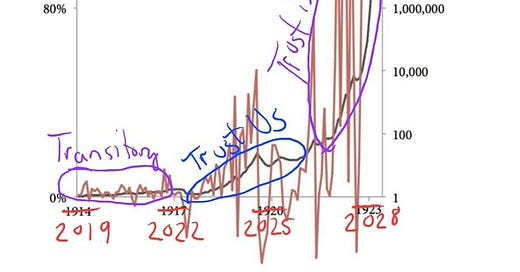

Look at these approximate returns SINCE TRUMP WAS ELECTED (the most important date in my opinion when the market started to price in the future under a Trump regime)!!!

BTC: +22%

Strategy (bitcoin public company): +31%

Gold: +17%

SP500: -6%

Nasdaq: -7%

Long-term bonds: -5%

What the heck is going on lately with stocks and bonds?

The US has been treated like a third-world country (emerging market) lately, as the price of stocks, bonds, and the currency have been down. That never happens to the USA. The reason is primarily threefold: poor policy (with uncertainty and distrust), high debt, and astronomical stock valuations (that were ripe for selling).

To recap:

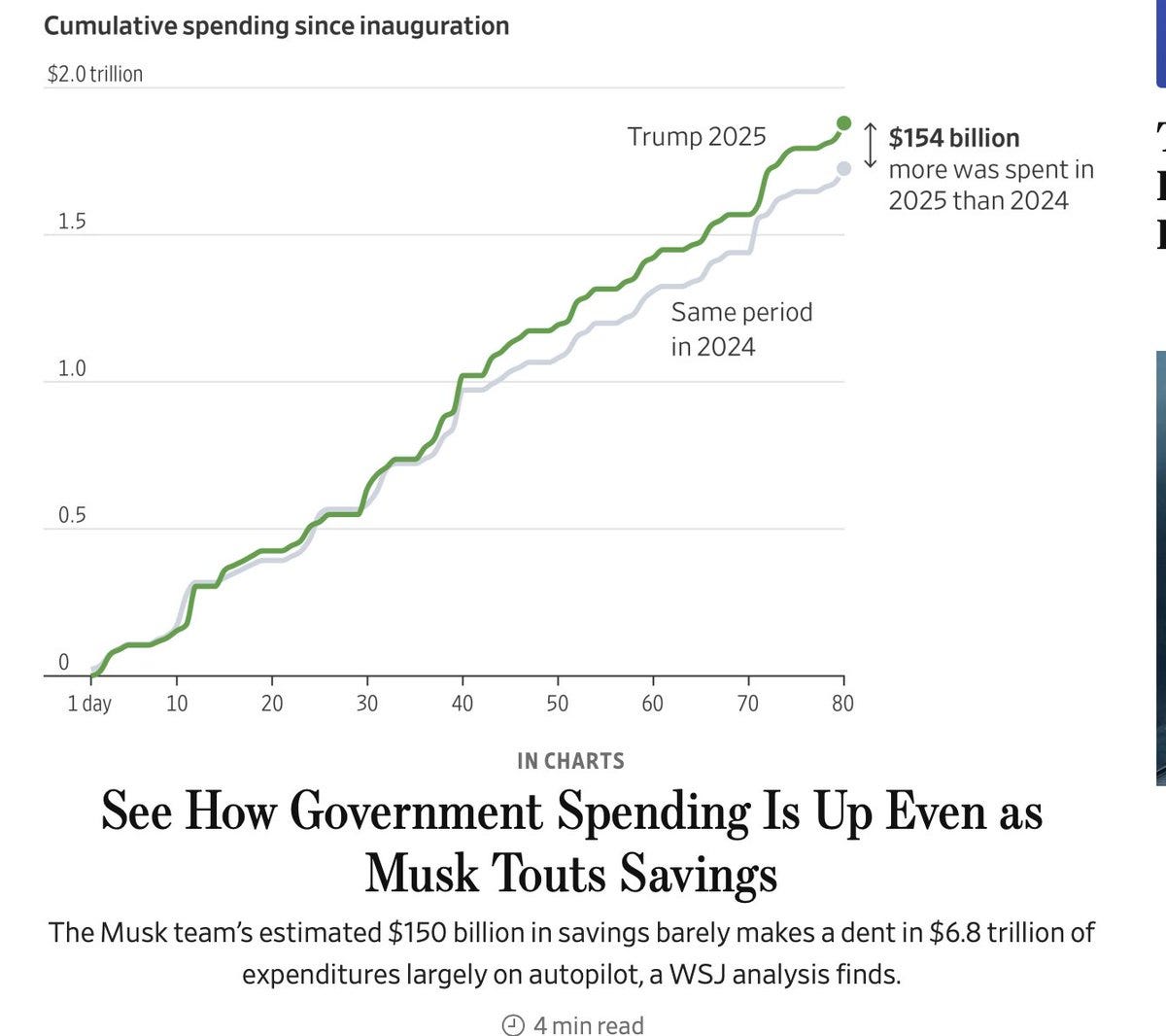

-Trump and DOGE started cutting jobs and government spending that had been keeping the economy afloat for the past few years. It was a good idea to cut fraud, but it was hard to make a huge dent in the deficit in reality. Nice effort, though. Golf clap. Nothing stops this train.

-Trump then pissed off our allies in various ways - bad for trade and trust

-Trump then dropped a bomb with gigantic tariffs no one was ready for - bad for trade and trust

-Trump forgot that the BOND MARKET rules the world, not him, and we’re in debt up to our eyeballs, unlike when Reagan and those he admires were in office. Our economy runs on the stock market now. We’re highly financialized. A tanking stock market tanks the American economy.

Lower capital gains tax collection when stocks are down dramatically increases the federal deficit. Thus, stocks must keep going up. The government literally requires this to function.

-If you cut jobs/spending from the only part of the economy that was keeping you out of a recession and then you piss off your allies and start an unprecedented global trade war (with China who sells you almost everything) that will just further nuke the economy and the stock market.

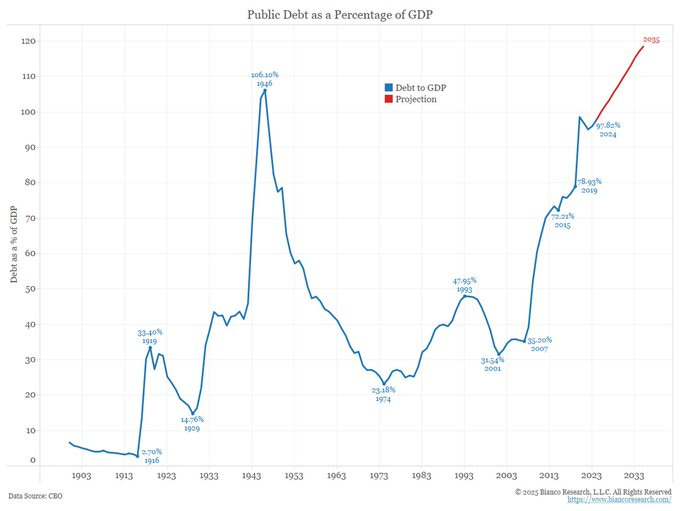

A poor economic outlook with a ~3 trillion annual deficit plus 36 trillion in debt (with a debt/GDP> 120%), and a demographic nightmare of aging boomers is a problem. The bond market gave Trump a tap on the shoulder and said….

The bond market rules the world. Not presidents. Not stocks. Bonds do. Bond holders globally, the past week or so, looked at the US fiscal situation with all the Trump policies plus debt and said…

Bonds were sold and yields rose. Stocks simultaneously tanked with rising bond yields.

(this is despite recession fears, which is a MAJOR RED FLAG as bonds are typically bought in times of fear).

Bond holders looking at Trump:

As a result of the rising bond yields, Trump caved and imposed a 90-day tariff pause (except China, but excluding computer chips). This was not “art of the deal”. This was “oh crap, I’m going to implode the entire bond market and global economy with my brazen strategy, maybe I should tone it down a bit and rethink everything.”

When the entire world owns your debt (bonds) and a massive chunk of your stock market, you don’t call the shots when you are 36 trillion in debt. You may think you have the cards, but you don’t.

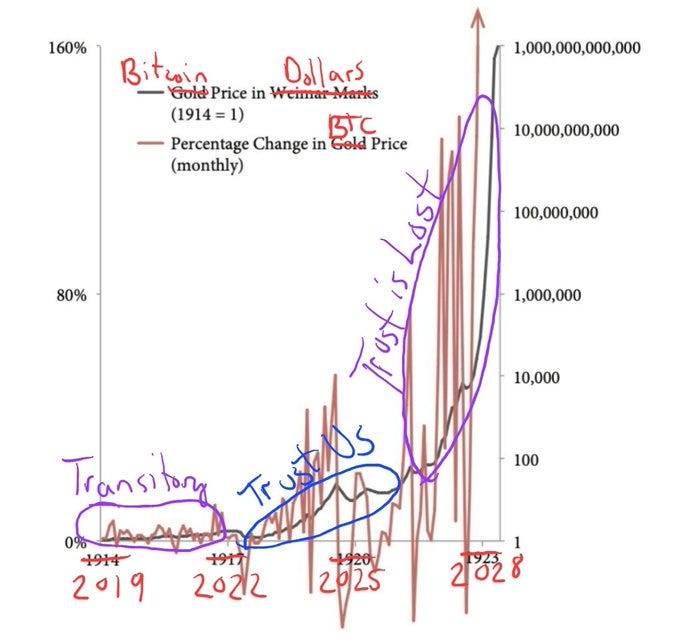

This is the end stage for fiat money. It will be a slow death, but we are much closer to the end today. At this point, it’s just accounting tricks, hand waving, and lies to get you to trust them that they have it under control. They don’t. The options they have left are few. Namely….

This will kick the can a bit further down the road but not solve anything.

And what you’re going to see is a weaker USD vs other currencies as a result. Your purchasing power won’t go as far, and asset prices like stocks and real estate will continue to skyrocket higher. Sure, TVs will still get cheaper. But the stuff that is scarce or in high demand will become unaffordable for most, making you feel poor and depressed. That is what fiat money does to people.

THERE IS LITERALLY NO WAY OUT FOR THE USA OR ANY OTHER COUNTRY, INCLUDING CHINA. They are all insolvent, and it will just keep getting worse as demographics (not enough babies) and deflationary technologies hit harder. The central banks have to step in and print the money, inflation concerns be damned. You will see it in 2025-2026; I will shout it when they do. They are dusting off the printer now.

What does this mean?

The world reserve asset (the USD and the long-term US treasury bond) is dying as the US fiscal situation is out of control.

The 60/40 portfolio is dead. The 40% part of it is up for grabs. Long-term bonds (10Y and beyond) are a losing proposition. During market turmoil, bonds traditionally are the safe haven asset, but since 2022, long-term bonds are ALSO LOSING MONEY (if you sell before maturity)!!!

The bond market is about 300 trillion dollars or more, and Bitcoin smells blood. The challenger (Bitcoin) wants to dethrone the king (long-term US bonds), and it’s happening right before our eyes, but it won’t happen overnight.

Bitcoin is winning when you zoom out. Sure, year-to-date returns aren’t great, but with bitcoin’s volatility, YOU MUST ALWAYS ZOOM OUT (typically years).

As I’ll be describing in detail momentarily, Trump is GIVING YOU MASSIVE HINTS that you NEED TO own bitcoin, not bonds. Everything has changed.

Bitcoin “Liberation Day”

As much as “liberation day” was about the tariffs…

I really think it’s about bitcoin. It was bitcoin’s liberation day. Bitcoin should be down 2-3x more than the Nasdaq as everyone thinks it’s just a “levered tech stock”. Incredibly, it’s down the same year to date, but UP since Trump’s election, while the Nasdaq index is DOWN.

This is incomprehensible to the haters I listen to. Yes, it went down when markets puked together, and EVERYTHING went down, even gold, but it’s all about relative performance, and Bitcoin is holding up well, I think. Eventually, it will trade more like gold on a daily basis, but not yet.

To me, this relative outperformance was inevitable. Bitcoin is primarily a RISK-OFF asset (don’t laugh!), and people are starting to figure it out. It’s the best safe haven store of value humans have ever encountered. Liberation Day and the days that followed were a shining moment for Bitcoin because TRUST IS ERODING.

Globalism is all about trust and the complex relationships that go into trade to develop supply chains and facilitate just-in-time delivery of goods and services worldwide. Regardless of the final outcome of the “Tariff Tantrum”, I believe trust in the US has taken a big hit and will be tough to recover anytime soon. I believe bitcoin is a beacon of light and hope in a world full of distrust and is massively undervalued because of that. It is the solution to trade every country and individual wants and needs, they just don’t know it.

An epiphany

While I was soaking in the glory of bitcoin’s relative outperformance on Liberation Day, I had an epiphany about bitcoin's future while hitting golf balls and working out on my day off. An amalgamation of Twitter posts and podcasts came together all at once, and I rushed home to start writing this.

Inspired is an understatement. My brother then sent me this video of him caring for ELDERLY HOMELESS PATIENTS, AND MY INSPIRATION WENT TO THE NEXT LEVEL.

If we’re building shelters OUT OF SHIPPING CONTAINERS for elderly people who worked their entire lives but now can’t afford the cost of shelter, WE HAVE LOST THE PLOT AS A COUNTRY. THIS SHOULD NOT BE THE SOLUTION!

This video is a screaming endorsement for Bitcoin. Fiat money is DESTROYING lives. The problem isn’t tariffs or taxes or a new President or Congress or China— IT’S FIAT MONEY!

FIX THE MONEY, FIX THE WORLD. Bitcoin fixes this.

As always, you aren’t bullish enough. Nor was I after having this vision!!!

The thesis for bitcoin’s future I’m about to write will sound even more insane than you already think I am. I recognize that I write a newsletter for free about “magic internet money”. That’s literally insane, but I couldn’t live with myself if I didn’t try to sound the alarm. The global tsunami of fiat money printing is coming. The signs are everywhere.

Get on the Bitcoin lifeboat.

Here’s the TLDR thesis:

How bitcoin replaces USD/US bonds as the primary “world reserve asset” (next 50 years):

Build bitcoin infrastructure (ETFs, bank custody, BTC strategic reserve, BTC mining) while both the private sector and government promote it heavily. They cheer for its success as they educate and get people comfortable with the new technology. They build the “lifeboat” and encourage people to get on it, slowly and in an orderly fashion without causing panic.

Pass favorable legislation/regulations for bitcoin and USD stablecoins so that there is no debate and confusion regarding digital asset treatment

US government informs the world that the “old playbook” for trading with the USA is over (private meetings and grandiose Rose Garden tariff presentations). US bonds and US dollars as the primary world reserve assets fade. Begin to develop new strategies and alliances for trade using the “new playbook”.

Aggressively build out AI and robotics technology. This is how the USA will compete with cheap labor abroad to boost their exports.

Inject a tsunami of money into the economy to support this initiative and re-shore industries. Inflation be damned. This will take time and be insanely expensive, but necessary. It’s also a PERFECT COVER to print money for all the debt refinancing required starting this year (6+ trillion). The Federal Reserve will support the stock and bond market at all costs if the pain ever becomes too great (QE, zero interest rates, BTFP programs like in 2023, etc.).

Pump bitcoin price to the moon via massive money printing and other initiatives to explode bitcoin demand (bitcoin bonds, tariffs and taxes collected in bitcoin, sell gold for bitcoin, etc.). Simultaneously, grow USD stablecoin dominance globally to preserve dollar influence abroad. Surplus trade dollars worldwide will START to be saved in bitcoin, LESS in USD, US Treasuries, US stocks, and US real estate (gradual process). Global trade starts to settle on the bitcoin network gradually, then suddenly. The bitcoin and stablecoin cyberspace race is ignited, with the USA in pole position.

Make your country and people fabulously wealthy as you’ve encouraged them to own bitcoin, even if there aren’t many jobs to go around due to technological advancements (AI/robotics) and a less financialized economy (lower stock and real estate prices as foreigners save in bitcoin rather than US bonds, stocks, and real estate).

I obviously won’t and can’t guarantee my thesis will be right, but it makes sense to me—more sense than returning to gold as a world reserve asset. Let’s dive into the finer details of the thesis…starting from the beginning and explaining why we’re in this mess in the first place.

Triffin Dilemma

I’m really sorry I have to discuss this economic paradox (which is boring), but you cannot understand the problems our country has today without it.

After WWII, the US was basically the only country in the world left standing, so the major powers got together and, via the Bretton Woods agreement, basically pegged all fiat currencies to the strong/healthy USD. But unanticipated consequences arose that they did not foresee….

(copied from Investopedia)

For much of the 20th century, the U.S. dollar was the currency of choice. Central banks and investors alike bought dollars to hold as foreign exchange reserves, and with good reason. The U.S. had a stable political climate, did not experience the ravages of world wars like Europe had, and had a steadily growing economy that was large enough to absorb shocks.

Reserve Currency Considerations

By "agreeing" to have its currency used as a reserve currency, a country pins its hands behind its back. To keep the global economy chugging along, it may have to inject large amounts of currency into circulation, driving up inflation at home. The more popular the reserve currency is relative to other currencies, the higher its exchange rate (USD strength) and the less competitive domestic exporting industries become. This causes a trade deficit for the currency-issuing country but makes the world happy. If the reserve currency country instead decides to focus on domestic monetary policy by not issuing more currency and running a trade surplus, then the world becomes unhappy (as it’s harder to fulfill their debt obligations because they need US dollars).

Reserve Currency Paradox

Becoming a reserve currency presents countries with a paradox. They want the "interest-free" loan generated by selling currency to foreign governments, and they are able to raise capital quickly because of high demand for reserve currency-denominated bonds. At the same time, they want to be able to use capital and monetary policy to ensure that domestic industries are competitive in the world market and to make sure that the domestic economy is healthy and not running large trade deficits. Unfortunately, both of these ideas—cheap sources of capital and positive trade balances—usually can't happen at the same time.

Issuing a reserve currency means that monetary policy is no longer a domestic-only issue—it's international. Governments have to balance the desire to keep unemployment low and economic growth steady with its responsibility to make monetary decisions that will benefit other countries. The reserve currency status is, thus, a threat to national sovereignty.

KEY TAKEAWAYS

Robert Triffin (economist in the 1960s) believed the dollar could not survive as the world's reserve currency without requiring the United States to run ever-growing deficits.

A popular reserve currency lifts its exchange rate, which hurts the currency-issuing country's exports, leading to a trade deficit.

A country that issues a reserve currency must balance its interests with the responsibility to make monetary decisions that benefit other countries.

Another reserve currency replacing the dollar (example - Chinese Yuan) would increase borrowing costs, which could impact the United States' ability to repay debt.

US Debt and Deficits

Here’s the current situation today:

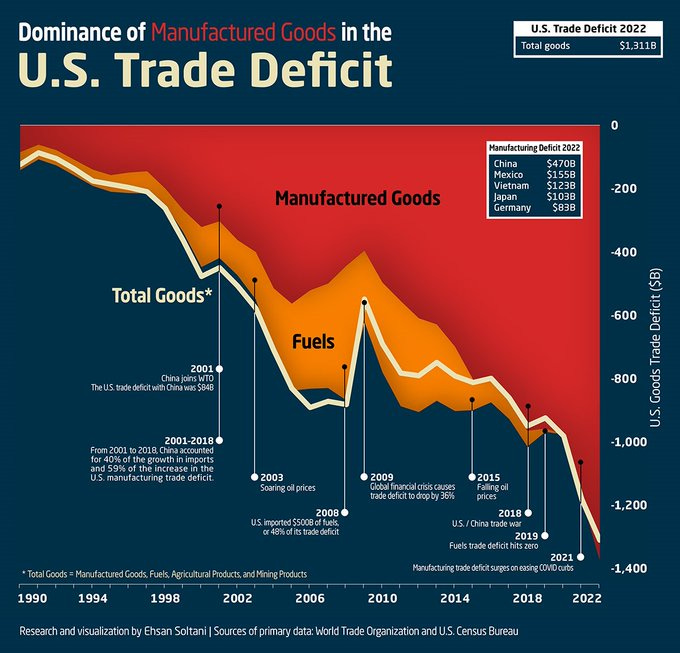

We export US dollars to the world: they sell us more stuff than we sell them (trade deficit), they then take those surplus dollars they have and buy US treasuries and US stocks (but not American products per se) and US real estate. Our middle-class blue-collar manufacturing sector, as a result of the strong USD value due to high demand worldwide, gets shipped overseas to other countries where things are cheaper to make (lower wages and weaker fiat currency compared to the USA). The rise of global trade (globalism) and technologies facilitated this (ships, planes, internet).

We’re left with a country that produces hardly anything and relies on other countries for everything (including in times of war and pandemics). This really came to light during Covid when we needed masks but couldn’t get any because China makes all the masks (I had to reuse mine and store it in a paper bag at the end of shift). If we go to war with China, they won’t sell us the necessary parts to fight them. Get it? It’s a national security AND economic problem.

Do you see how the Triffin Dilemma perfectly describes why we’re in the mess we’re in today (unsustainable debt)?

We’re up to 36 trillion dollars in debt and 2-3 trillion dollars in deficits annually because we import more than we export (in addition to many other issues like prolonged senseless wars, and bloated/mismanaged government programs like Medicare and Ponzi schemes like Social Security).

(Side note - Social security is the definition of a Ponzi scheme because you need new “investors” to pay out the “old investors”. Gen Z needs to pay in so that Boomers get paid out. The money Boomers paid in isn’t there. A lot of it is gone and spent. If Millennials and Gen Z stop paying in (job losses), the Ponzi scheme collapses. They will print the money if that happens, so you still get paid, but at that point, the money is worth much less.)

Importantly, during 2025, the bill is coming due, and the US must refinance nearly 6-9 trillion dollars of debt that was at near-zero rates to now around 4% (the Fed had to raise rates due to inflation). Imagine your monthly mortgage/credit card bill going from 0% to 4%. OUCH. Now imagine your bill was 6 trillion dollars!!!!

Compound interest is REAL and UNDEFEATED. Do NOT play games with it, YOU WILL LOSE.

But who cares about debts and deficits? Life is great in the USA, right?

If you’re in the top 10-20% of the US population and own assets like stocks and real estate, life is good.

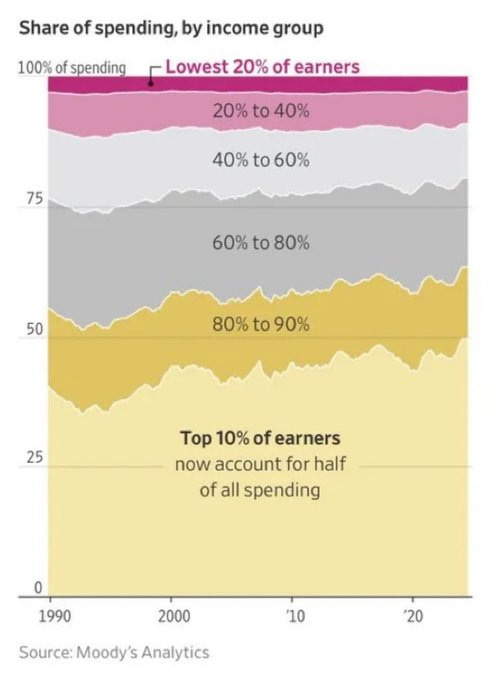

This is why America runs on the stock market. The top 10% of earners have most of their wealth in stocks, and account for nearly 50% of all spending.

Asset prices have skyrocketed as international investment drives up prices due to high demand with all their surplus dollars. If you’re in the bottom 60-80%, things are much, much harder.

The result is a bifurcated and very polarized society with the haves and have-nots, which leads to substantial societal issues long term (homelessness, poverty, drug abuse, health issues, gambling, violence, etc.).

This is all driven by highly manipulated fiat currencies and the Triffin dilemma struggle, which has led our country into unfathomable debt.

Dick Cheney (US congressman) once said, “US deficits don’t matter”. Wrong. They don’t…until they do. The consequences are vast and intolerable to many now. There are NO FREE LUNCHES in life. You always have to pay the piper at some point.

The US fiscal situation is so insane and apocalyptic that only a miracle grand slam in the bottom of the ninth with two outs will save us.

Kill the US dollar and US bond global reserve asset status (and with it the Triffin Dilemma) and transition to a bitcoin reserve asset standard.

America First

Enter Trump. He won in a landslide victory (not an opinion) and truly believes he has a mandate from the majority of the American people to fix the sinking ship with bold action. He has gone on record saying the assassination attempt furthered this belief. The American people know something is wrong. They just don’t know who to blame and how to fix it (hint hint - fiat currency).

Trump is aiming for two things:

America first (which he has spelled out). That means globalism is dead. Deglobalization is here. Every decision made comes with Americans as the first priority, rather than foreign countries. Not just “wall street” and the top 1-10%, but ALL Americans (bottom to top). THIS IS A BIG CHANGE (I remain skeptical, however).

Globalism is based on “trust”. All trust has now been lost. It’s now “fend for yourself” mode and fix your own problems. America has enough of our own problems.

If globalism is dead, there is no need to depend on the USD/US Treasuries as the global reserve asset. This ends the Triffin Dilemma.

This was set into hyperdrive when Biden sanctioned Russian US treasury reserves in 2022 and kicked them off the US payment rails (once again - trust was lost). This was an assassination of Archduke Ferdinand moment. The world changed that day, and the USD/US bond as the Global Reserve Asset more or less ended moving forward.

The Triffin Dilemma is like cancer for the USD. Trump is starting chemo with tariffs. There is likely to be a lot of pain and suffering to get to the other side. It’s not a benign miracle drug, and there will be pain (evidenced by the current massive stock market correction).

Additionally, it’s not just Trump saying these things. Fed chair Jay Powell, Secretary Bessent, and prior Treasury Secretary Janet Yellen have as well. They see the future as a multipolar (multiple superpowers, not just the US) world with the USD's status as the Global Reserve Asset and currency fading. They WANT IT TO. It’s a gift AND a curse. The cons now outweigh the pros.

IT’S OVER.

This has profound ramifications, if I’m right.

But what money will countries trade with, and what will they save surpluses in if the US is pulling back from its current role and we don’t supply the world with excess dollars with our trade deficits?

Enter bitcoin.

I laid out the TLDR bitcoin thesis in the beginning. I will publish part II of this newsletter describing the thesis in more detail, why I think the Trump administration is slyly moving toward a bitcoin reserve asset future, and all the signs/actions that point toward it—there are a ton!

In the meantime, bitcoin is on sale! Get some (or some more)!

Thanks for reading!

Share if you like it!