IT’S OVER (Part II)

Part 1 recap: Global USD dominance is both a gift and a curse due to the Triffin Dilemma. The Trump administration is, in my opinion, willingly trying to transition away from that paradigm. A new solution to global trade and savings is required.

Part II

The solution to the Triffin Dilemma has always been a NEUTRAL MONEY, that no country controls or can print, to settle trade in but also to SAVE in. For thousands of years it was gold, but we are now in the digital age.

Enter Bitcoin

A TECHNOLOGY created by humans to solve this exact problem.

Think about it. Instead of trading in USD, which America controls the supply of as well as access to the payment rails, countries will use bitcoin instead — a money that no one controls the supply of or can restrict access to the monetary network.

Additionally, instead of the USA begging other countries to save their excess dollars from trade in our US treasuries (to drive down rates) and into our stocks (to drive prices up), countries would instead save their surplus trade profits in a neutral monetary asset that has no direct impact on the US financial markets.

Yes, this would change everything regarding the USA’s financialized economy, which is highly dependent on stocks and interest rates; however, there are advantages to this (especially if you hold bitcoin).

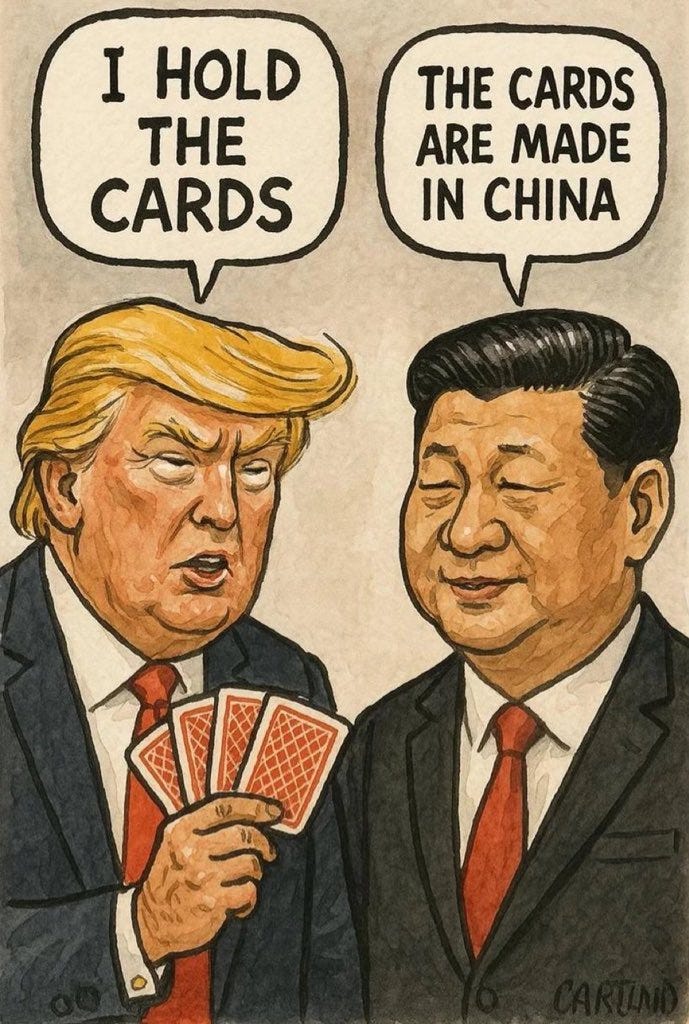

The US would not have to worry about the rest of the world selling dollars, US treasuries, or US stocks in times of conflict, which could wreck our economy and increase borrowing costs (bond yields). They also couldn’t use that as leverage against us if we threatened them somehow (LIKE TODAY!!!). Currently, financial warfare (capital wars) is used against the USA in the above manner by China and others.

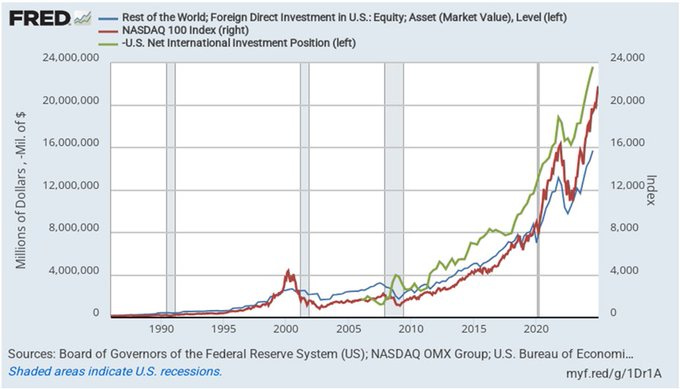

As much as they need us to consume their goods, we are at their mercy because we don’t make anything. We are also indebted to them because they own a substantial portion of our stocks, treasuries, and real estate. Look at the explosion of foreign investment in US equities since 2008. The same year the US started printing money in overdrive. Coincidence? Unlikely.

Ultimately, other countries, such as China, could harm us just as much as we harm them, as you are seeing today. Selling stocks and bonds deals an immediate blow to the US, while they simply change their trading partners to meet their needs (not ideal, but tolerable for them).

Nobody really wins in the end. Everyone is stuck on the sinking ship. It’s a “you die, we all die mentality”. Very barbaric.

Here’s a great idea…

How about settling in a neutral reserve asset where we all can win together, incentivizing cooperation?

I’m tired of people complaining about all the problems and not offering a solution. Bitcoin is a solution.

Historically, the solution was gold. It failed in 1971 officially. That’s the main reason why we use fiat money today.

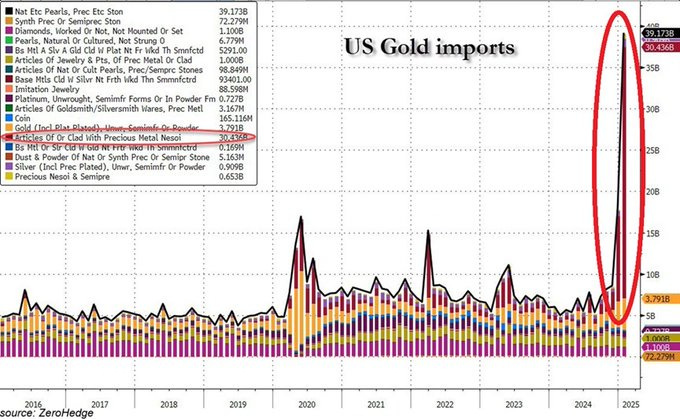

Gold is prehistoric—a rock. Unfortunately, because our elder boomer leaders are still stuck in the past, they are currently shipping or flying it across the oceans in record quantities (to avoid tariffs and stockpile). LOL!

It’s 2025! I mean, come on!!! We live in a digital age. Gold is absolutely archaic. It’s like still going to Blockbuster to rent a movie or using a physical map. It takes weeks to months (years?) to settle a trade in. It’s incredibly time-consuming and costly to verify whether it is even real gold. It gets stolen and lost. It’s not a payment rail like bitcoin, it’s just a rock. Additionally, not every country has gold deposits to extract and profit from, so that’s not entirely fair. There’s also a gigantic amount of it in space and the ocean, just ripe for a new technology to harvest it and send the supply higher (making it a horrible money at that point as it’s no longer scarce).

Case closed. Gold is old. We won’t be going back to it over the long term (decades). It’s the equivalent of the horse when the Model T car was introduced. It’s a relic of the past. We’ll look back fondly at it someday in the museums and say, “People used to use that as money? Crazy!”

Obviously, you can’t use these other assets to settle trade in because they won’t work either, but let’s go through the exercise to make it clear:

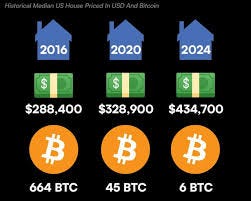

Real estate - you can’t send a home across the country. Additionally, trade surpluses being recycled into real estate is exactly the problem Trump is trying to address. People cannot afford to buy a home (because rich people worldwide buy all the homes to store their wealth in to avoid saving in fiat currency), and this leads to civil unrest and population demise (no sex in the parents’ basement). Storing excess wealth in bitcoin rather than real estate is a great way for home prices to fall and increase affordability. It’s starting to happen.

Oil - you could consider it a neutral form of money to trade in, but it’s complicated. It’s hard to store and transport. Other forms of energy are being discovered, making it less necessary (solar, wind) and scarce. Additionally, when oil prices rise due to high demand, everyone’s lives become more difficult because oil and energy are essential to everyday life. We need energy prices to be lower, not higher. You want the price of money to be higher, not lower. These things are at odds with each other and make oil a bad money for trade and settlement.

Other commodities - silver, soybeans, cattle, corn, rice, wheat. Hopefully, you don’t need an explanation here.

Stocks - the US stock market is essentially the only game in town (more or less). Not everyone in the world has access to the US stock market, and as noted above, the US does not want to be dependent on other countries that might threaten to sell US stocks and hold them hostage, so to speak. Stocks can never be good money for trade.

Hopefully, I’ve led you down the path to the ONLY SOLUTION that the more I think about it, the more divine it seems.

Bitcoin.

A neutral, fixed supply(scarce), digital, easily verifiable, audited every 10 min, decentralized, durable money that every single person on the planet with an internet connection has access to and every country can acquire by harnessing the excess energy (wind, water, sun, oil/gas, etc.) that is abundant and available to them.

It literally checks every box. It solves every problem for everyone.

No trust required. No manipulation allowed. All incentives aligned. Everyone can win together. War becomes prohibitively costly and painful since bitcoin cannot be printed. Trade is fairer because you can’t print money to subsidize your country’s industries (like China does).

Quite simply…

Fix the money, fix the world. Bitcoin.

So, when I say “it’s over,” I’m referring to long-term US Treasuries as the primary global reserve capital asset (US real estate and US stocks are also included, but to a lesser extent). I still think the USD will be the primary global reserve currency, but will slowly start to lose dominance to bitcoin, particularly for large cross-border trade.

Importantly, currency and capital assets are distinct entities.

A capital asset is something you primarily store value in for more extended periods of time (land, real estate, bonds, stocks, gold). A medium of exchange, also known as currency, is primarily used for trade and is not a desirable store of value.

Throughout this rocky transition, I believe that more substantial trade between countries (think billion-dollar transactions, not Starbucks purchases) will settle in bitcoin rather than USD as the bitcoin network grows to accommodate the entire world. This is a multi-decade, insanely slow process as the prior USD-centric system is unwound. Bitcoin needs to become much larger to facilitate this. The bigger the market cap and the deeper the liquidity, the bigger it will get. It’s a positive feedback loop. IT’S STILL VERY EARLY.

That doesn’t mean the demise and death of the USD tomorrow, and we all use Bitcoin from here on out—quite the contrary, as I’ll explain. I actually predict GROWING DIGITAL USD DOMINANCE (VIA STABLECOINS) as a currency amongst people worldwide (but not for large trade between countries), while BITCOIN simultaneously replaces US treasuries as the world’s reserve capital asset. Subtle difference there.

It’s bitcoin’s time to shine, and I think Trump’s administration is willingly and actively preparing for that world.

Their actions seem to indicate it…to me at least.

What bitcoin-centric actions are Trump and his administration taking?

First of all, you have to understand that the administration cannot come out and say, “Buy bitcoin; it’s the new gold or oil, and the USD/US Treasury global reserve status is over, thanks.”

The bond, stock, and real estate markets would implode. Mass chaos worldwide would ensue.

Everything has to be gradual and coordinated. They won’t say it outright; it’s up to you to listen and watch their actions.

Here’s what actions I see happening today:

1. Build the lifeboat first

If you’re going to replace the old system, you need to have something for people to transition to, and it must already be built and well-functioning.

BlackRock, the largest financial institution worldwide, launched its bitcoin ETF services globally, enabling individuals to purchase it. This is especially important for baby boomers who are not comfortable with technology but are familiar with mutual funds and ETFs. Check.

Anyone who doesn’t have access to BlackRock can buy bitcoin online and hold it in self-custody, assuming they have access to the internet or even just a cellphone. This is the original ethos of bitcoin. Check.

Other large financial institutions and banks need to adopt bitcoin, understand it, and custody it for clients. Nothing gets done without the big banks. Check (later this year) once legislation is passed.

I literally LOL when I read headlines like this below and people are BEARISH on bitcoin’s future. THEY ARE SCREAMING AT YOU TO BUY BITCOIN!!

Once the lifeboat is built for the people, if you were to transition to a new reserve asset, your country should probably have some. You know, just in case it catches on.

Perhaps even establish a Bitcoin Strategic Reserve. I dunno.

Check.

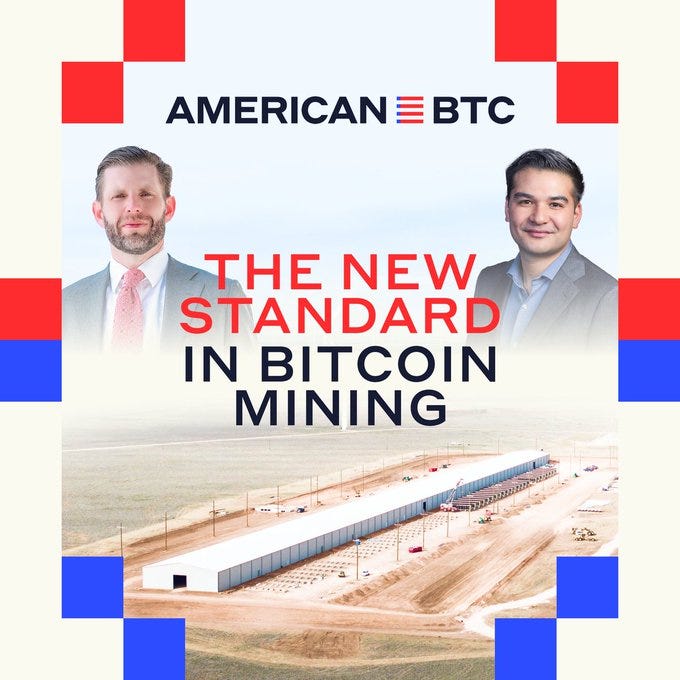

America would probably also want to start mining Bitcoin to ensure dominance and leadership, as well as add to the BTC strategic reserve—just a hunch.

Trump’s sons just launched….

Check.

(Of note, Bitcoin hashrate (energy to mine bitcoin) is currently skyrocketing while bitcoin’s price is crawling higher (relatively speaking). This is VERY ODD, normally hashrate growth follows price. This means the demand for bitcoin is astronomically greater than the current price. Something is up. Someone knows something. Someone knows they need to be mining bitcoin at all costs right now to set themselves up for the new world order. Price will catch up later.)

2. Develop and pass favorable bitcoin and stablecoin legislation

What are stablecoins?

They are essentially digitized US dollars transmitting on blockchain rails, not on the bitcoin network, but on all the other blockchains that exist (Ethereum, Solana, etc.). Soon enough, this will also be available using bitcoin’s layer 2 networks (Lightning, etc.).

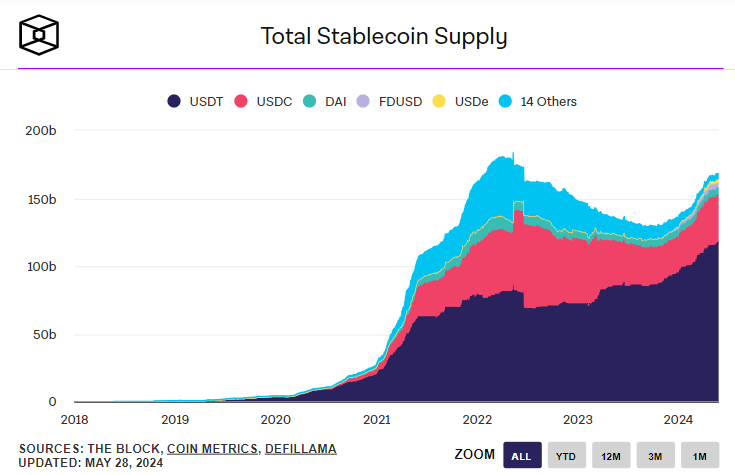

US dollar stablecoins are “backed” by short-term US Treasuries (similar to money market funds). Almost everyone in the world wants digital US dollars, not their local currency (such as the Egyptian Pound, Turkish Lira, Nigerian Naira, or Indian Rupee), which is hyperinflating faster than the USD. The dollar is the cleanest dirty shirt, and as you can see, even without proper approval and regulation, the demand for USD stablecoins is going absolutely vertical….

Now, anyone with an internet connection can get access to the USD. You can live in Nigeria and get paid/save in the USD without a bank account.

This is an incredibly revolutionary and disruptive technology.

Stablecoin demand indirectly drives demand for short-term US Treasuries, which in turn lowers short-term interest rates on bonds. This is a massive home run for the US to lower yields while extending its dollar dominance abroad.

As bitcoin and digital assets explode in popularity and use worldwide, the ONLY way to trade and settle them is with a digital currency on blockchain rails. Traditional Fedwire and ACH settlement times, which can take days, are too slow. Digital assets require speed and instant verification. A USD stablecoin will be in MASSIVE demand for trading purposes worldwide. Great for USD dominance, great for US Treasury yields, and great for the American consumer, as lower borrowing costs and dollar dominance worldwide are beneficial.

USD stablecoins are expected to receive approval from Congress soon, allowing them to extend and promote dollar dominance worldwide. Check.

For the foreseeable future, bitcoin will be for saving, stablecoins will be for spending.

3. Inform your friends and build the new digital economy rails

If the old system is being replaced, you should probably tell your friends. The old USD-centric system relies heavily on the US protecting the world and running a trade deficit.

Other countries that depend on the US for defense need to be warned, IT’S OVER. Europe would need to defend itself and pay for it. Check.

The Saudis can’t depend on the US buying their oil and protecting them. We’ll produce our own oil and natural gas. We have a ton. If they want defense help, they need to invest in America, build in America, and purchase American-made products. Check.

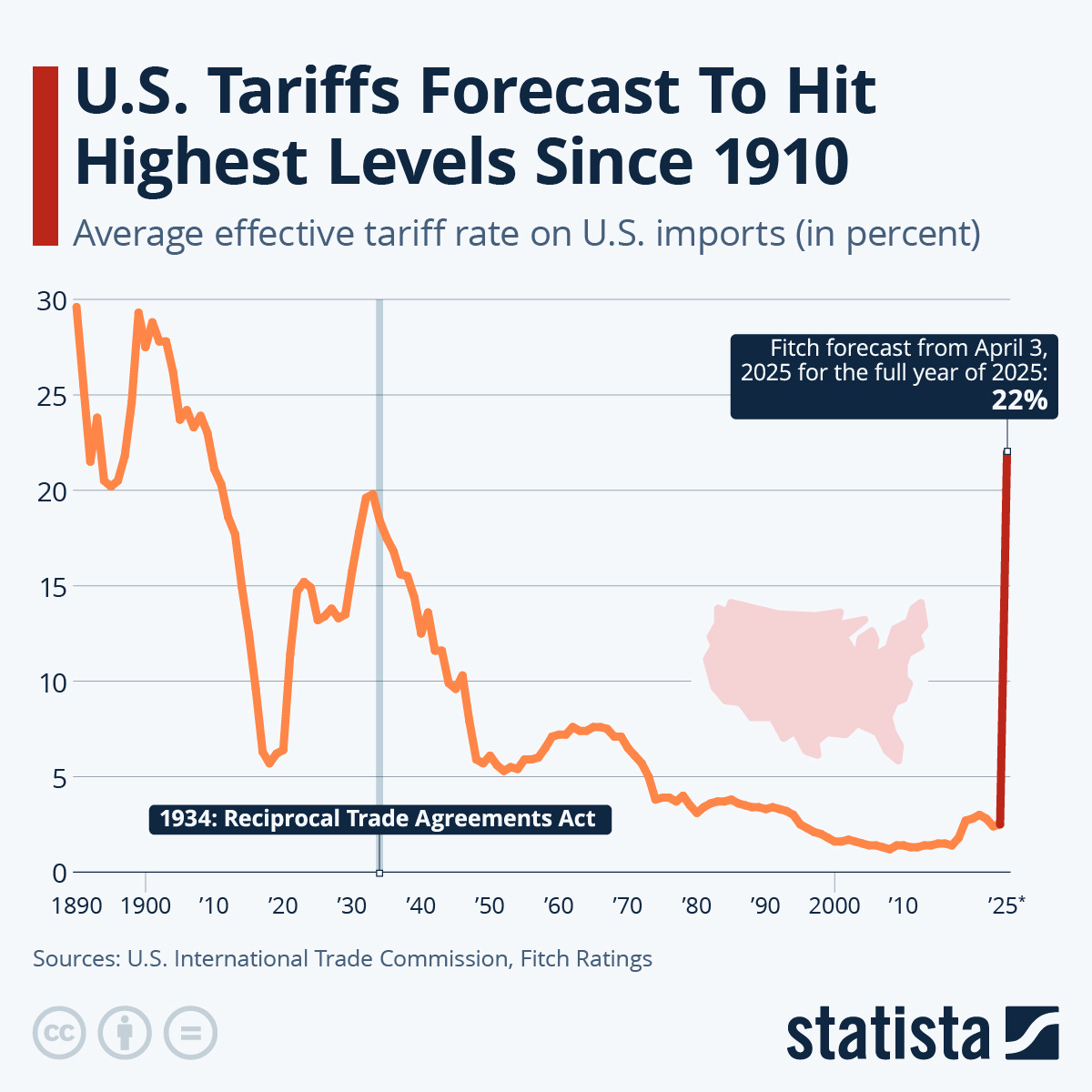

To encourage more goods and services to be “made in America,” tariffs would be a logical way to compete with China and others. Check.

To compete against cheap labor globally and become a powerhouse exporter, the United States must invest significantly in AI, robotics, space, cybersecurity, blockchain, and quantum computing, among other areas, to keep costs low. Check.

This restructuring plan will not be without pain in the markets. This is highly disruptive.

Thus…

4. Do “whatever it takes”

A highly probable outcome of this restructuring of global trade would be a recession, which would cause unemployment to rise and stocks to fall, thereby increasing debt and deficits. As the government receives less tax revenue, it needs to issue more debt to fund itself. The exact opposite of the ultimate plan!!

This would lead to the world suffering a great deal, as the American economy is so influential and powerful globally. Thus, until this transition is complete, I think a very active and complicit Federal Reserve is necessary. I think they will do “whatever it takes” to support the US through this transition and inject boatloads of money to keep the economy afloat and prevent stocks from nuking too far. Their balance sheet will grow tremendously as a result, but so be it. America first, right? If the current administration truly believes this is necessary, then you do whatever it takes.

If the Fed Chair doesn’t comply, find a way to remove him. Check.

When you have cancer, you take chemo. Otherwise, you die.

When you’re the global reserve asset and currency, you need to take some pain if you want to end it; otherwise, you’ll die a slow but certain death (Triffin Dilemma). To get to the other side of this, I expect lower interest rates, quantitative easing, bailouts, new programs being stood up, swap lines being activated, etc. WHATEVER IT TAKES.

This brings me to the fun part…

What does eye-watering money printing historically mean for bitcoin’s price?

5. Bitcoin to the moon

I mean like to insane values you can’t comprehend. And the government will cheer it on the entire time!!!

They will soon start offering novel products to the market, which will send bitcoin demand and price even more parabolic: bitcoin bonds coming soon?

Taxes paid in bitcoin, tariffs paid in bitcoin, and selling federal land/buildings for bitcoin. (all coming soon)

They will also encourage the largest institutions in the world to invest in Bitcoin companies, helping to drive demand and increase the price. Check.

As the price rises, retail consumers become more comfortable with it. They start to see the lifeboat and get on it themselves. Trump and his staff will applaud them for it. This price action, combined with the US pro-bitcoin stance, will likely drive every other country in the world to adopt bitcoin, and the bitcoin cyberspace race will be fierce.

As bitcoin grows in popularity, as mentioned before, USD stablecoin adoption skyrockets to facilitate digital asset settlement and trade, alongside bitcoin.

This entire sequence of events causes the USD value to CRASH AGAINST BITCOIN (since the bitcoin price rises so high). I REPEAT, THE USD VALUE CRASHES IN BITCOIN TERMS.

That’s precisely what they want!!! The NEW WORLD RESERVE ASSET - BITCOIN - IS NOW THE DENOMINATOR of wealth and unit of account. Not the USD! This allows the USD to be weak compared to Bitcoin, making exports more competitive. Simultaneously, stablecoins facilitate payments worldwide and drive demand for our US Treasuries (debt) as people spend and pay for goods in dollars instead of their local, often unstable fiat currency. Meanwhile, countries and institutions start settling large trade orders in bitcoin, NOT USD. They also save in bitcoin, which further limits available supply and drives the price higher…for everyone!

(Yes, everyone who saves in bitcoin can win together. A novel concept!)

USD dominance grows worldwide due to stablecoins, but the VALUE OF THE DOLLAR IN BITCOIN TERMS PLUMMETS.

This allows the US to be competitive exporting goods with a weak dollar, which shrinks the annual deficit. If the US mines bitcoin and, through various budget-neutral means (such as bitcoin bonds, taxes paid in bitcoin, tariffs paid in bitcoin, or selling federal land/buildings for bitcoin), acquires bitcoin, it could potentially pay off huge chunks of debt as the price skyrockets.

The end result is that Americans who own bitcoin get fabulously wealthy and dominate the global financial world. Americans who refuse to get on the Bitcoin lifeboat are lifted up by America's general prosperity (lower interest rates, cheaper goods/services/homes, and a strong stock market, etc.).

This plan checks ALL the required boxes to get out of this mess.

End the USD global reserve status slyly and methodically to kill the Triffin Dilemma. Give hints that bitcoin will be the new reserve asset. Other countries will stop buying US treasuries and stocks with their surplus dollars and instead buy gold or bitcoin. (This is a work in progress.)

Weaken the dollar (DXY index): it plummets vs bitcoin. Makes debt easier to repay since the dollar value is eroded and allows US exports to be competitive on a global stage again.

Shrink the debt - if the US acquires and mines bitcoin and the price skyrockets, this is possible. Reducing waste and fraud to minimize the annual deficit would also be beneficial.

Lower bond yields to keep interest rates low - develop USD stablecoin legislation to drive demand, which in turn lowers bond yields (good for the American people and the debt burden).

Reshore American manufacturing capacity and supply chains - a weak dollar and lower interest rates help this. This will take the most extended amount of time; there is no quick fix.

Heavily invest in technology (AI, robotics) to facilitate it

Grow the economy - if your citizens are encouraged to buy bitcoin and America is an exporting powerhouse, things should be pretty pretty pretty good!

Mind you - as bitcoin price moons higher, it doesn’t stall the economy like if oil or real estate prices explode up. When oil prices rise, people can’t afford to pay their energy or gas bills or fly as affordably. When real estate is at its peak, people can’t afford to buy a home or move. When stocks moon, only the top 10-20% benefit, and mostly just Americans with access to the US markets. Stock prices get insanely overvalued compared to fundamentals, and that’s when crashes occur.

When Bitcoin soars, people can buy more things??

It doesn’t hurt anyone like when oil or real estate prices rise, and it’s more accessible to everyone globally than equities and gold. THAT’S BECAUSE IT’S PERFECT MONEY. 100% PURE MONETARY PREMIUM. NO COMMODITY USE CASE OTHER THAN BEING PERFECT MONEY. THE IDEAL TECHNOLOGICAL SOLUTION.

Importantly, I DON’T EXPECT people to just use bitcoin gains to go buy tons of real estate (2nd/3rd/4th homes) and recreate the problems we have today.

Why would you buy a worse-performing asset (real estate) with all the headaches that come with it? Just buy the EASY winner. Buy bitcoin.

Signs that my thesis is correct:

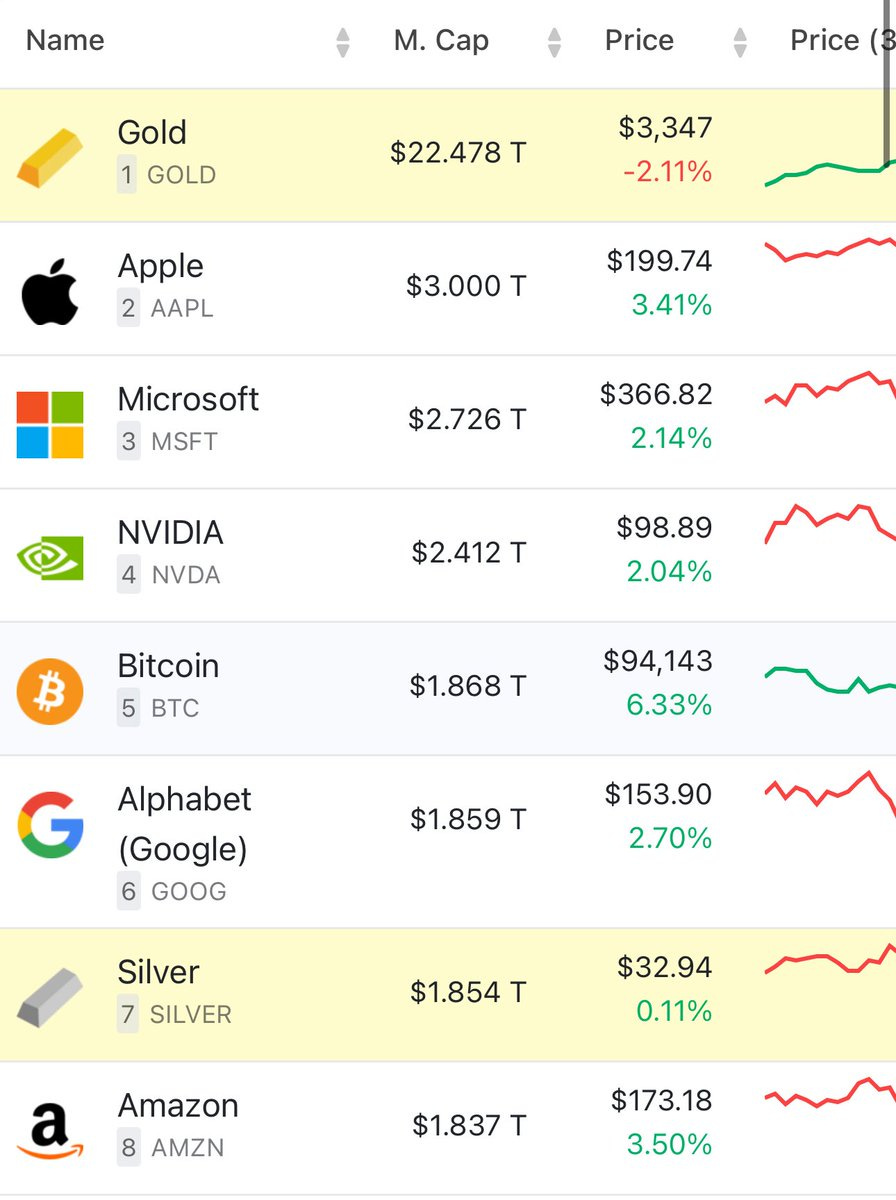

BTC price goes up. Waaaaay up over the next 1-4 years. Gold prices will also increase until all the baby boomers eventually pass away. “Science/new technologies advance one funeral at a time.” You can front-run this trade now, as the exodus from gold at some point during the next 15-30 years will be biblical. It's hard to know when that date will arrive (probably not for at least 10 years), but there will be a tipping point when the majority of baby boomers have passed away and transferred their wealth to their children, who will likely buy bitcoin immediately. SKATE TO WHERE THE PUCK IS GOING.

The US government begins selling bitcoin-backed bonds, and major banks join the initiative.

US government sells gold certificates or other federal assets they have and buys bitcoin

Trade between 2 countries (regardless of the amount) settles on the bitcoin network.

USD stablecoin legislation is passed

The Trump administration cheers higher bitcoin prices openly

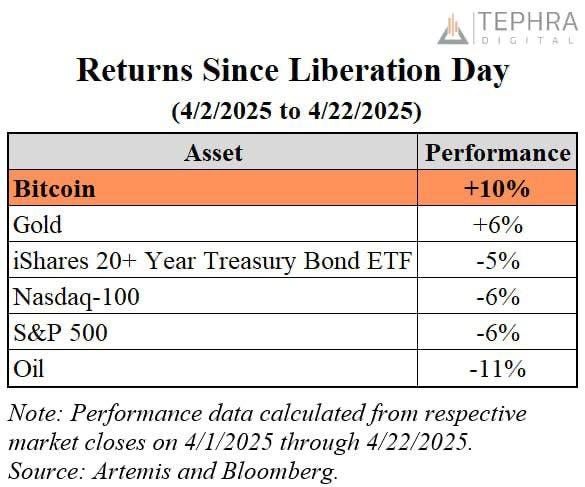

Stocks and bitcoin decouple. Stocks flat to down and bitcoin up would probably be the biggest signal. Especially if DXY index is down.

The Fed steps in and caps bond yields, does Yield Curve Control, prints money/QE.

Signs that I’m wrong:

BTC price tanks. Like really tanks. 30% pullbacks are normal, and volatility will remain. I mean like down to 20k tank.

Trump was all “talk” and completely (not just partially) reverses all tariffs and America First policy.

Stocks outperform bitcoin this year and next

The USD index (DXY) breaks to all-time highs

Wrapping up

Get ready for a POSSIBLE period of persistent sideways price action for the next few months. Summer is coming - “Sell in May and go away” - could be the theme.

All the tariff policy uncertainty and negative economic shocks that come with it could soon rear their ugly heads. No asset class will be spared. I’ll be buying the dip with every penny I can find.

I really think that towards the end of the summer/early fall is when things will get highly entertaining to the upside for bitcoin. Crypto policies will be clearer, and tariff deals will likely be in place. These will be huge catalysts.

It’s always critical to ZOOM OUT.

BTC is UP ~34% in 1 year.

BTC is UP ~26% since Trump was elected

BTC is UP ~50% since the 58K doldrums of the summer

Mind you, the S&P 500 (the benchmark for all stocks and hedge funds) is up ~3% over 1 year.

Bitcoin is outperforming the benchmark index by nearly 10x!

It also just surpassed Google as the 5th largest asset in the world! It’s coming for gold…

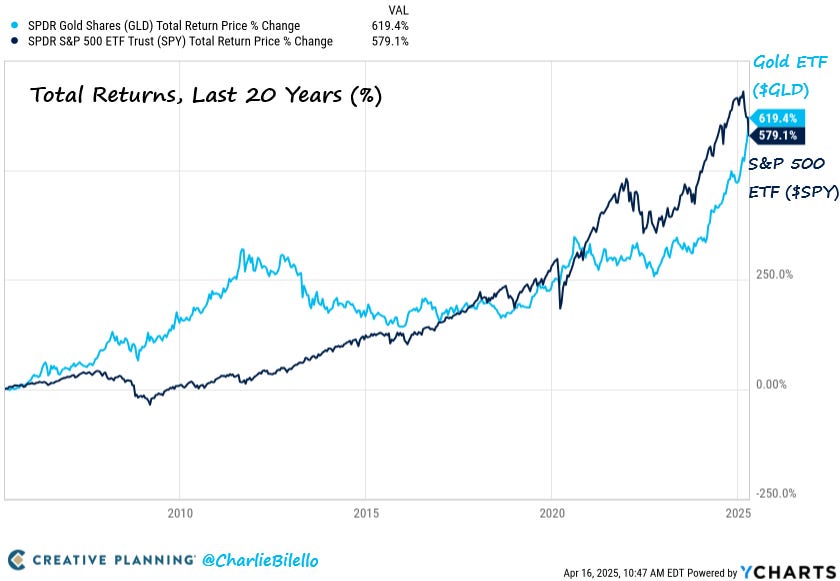

To be fair to its competition, gold has risen 42% over the last year and outperformed the S&P 500 over the previous 20 years.

This is absolutely bonkers when you think about it. A USELESS ROCK IS OUTPERFORMING THE 500 BEST US COMPANIES SINCE 2005!!!

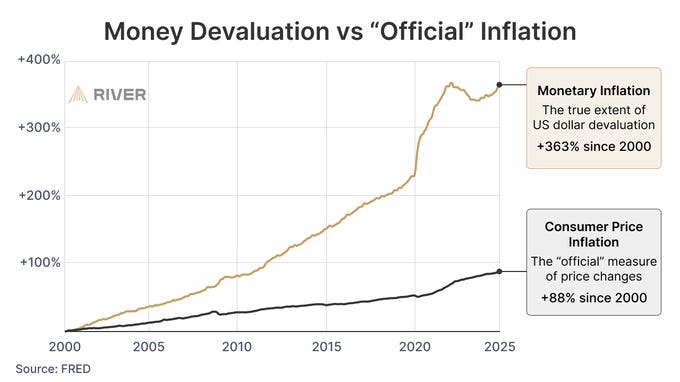

Why? Currency devaluation. You are literally being stolen from for “your benefit”.

The unit of account that we all use in our lives is absolute garbage (the USD). It’s being debased rapidly compared to gold and bitcoin. Stocks are currently priced in USD, and if the denominator you use to price everything in is useless and going to infinity, your ability to measure wealth and real growth becomes extremely distorted.

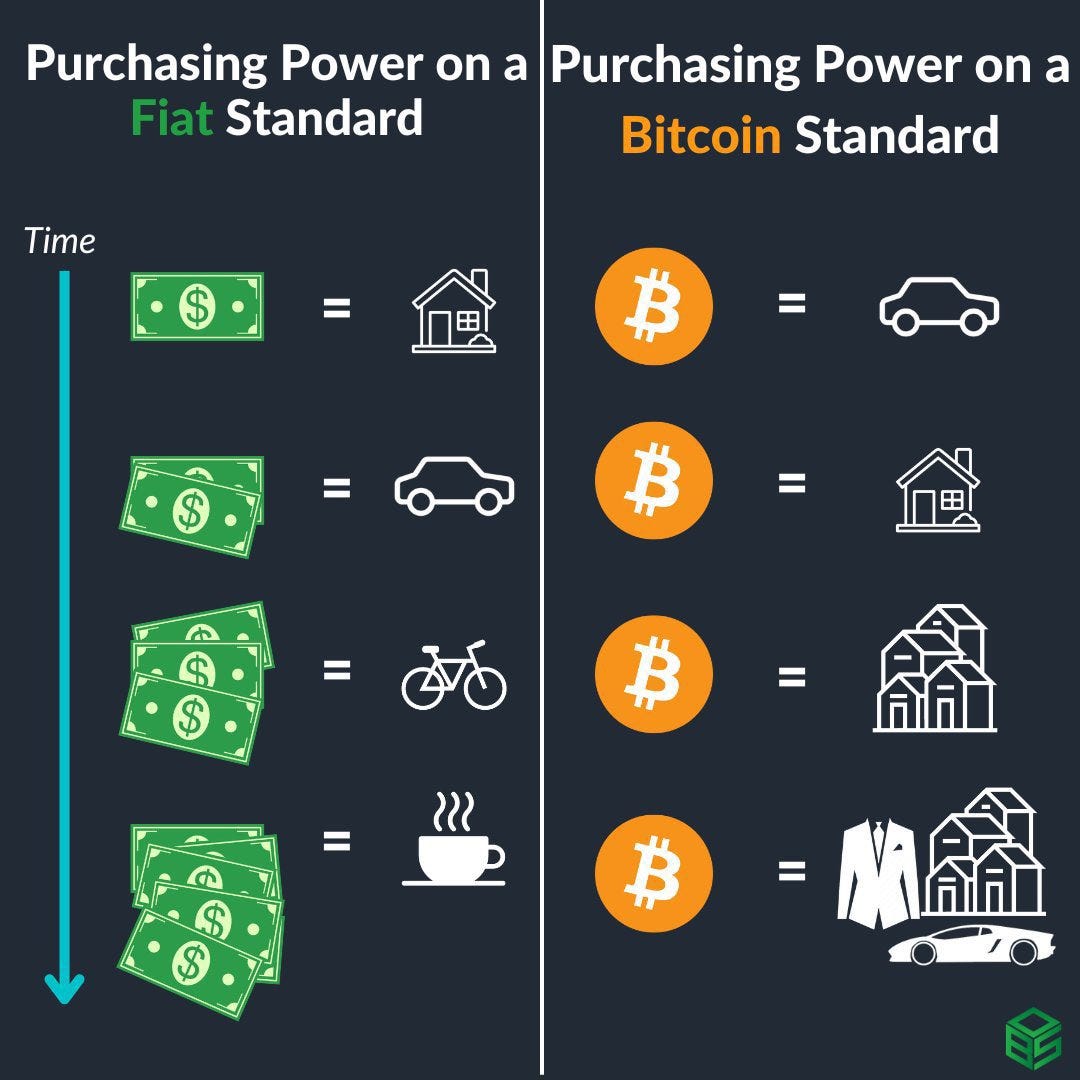

Hence, I use bitcoin as my denominator. A fixed supply of money. Once you value everything in your life in bitcoin terms, you realize prices are CRASHING in bitcoin terms.

Your primary goal is simply to acquire more Bitcoin. If you have more bitcoin than yesterday, you’re winning the game.

It’s so simple, but because of that, people think it can’t be real. I’m telling you it is. Buy bitcoin and chill.

I wrote this many years ago, and I think it’s more true today than ever:

Bitcoin is a RISK-ON AND RISK-OFF ASSET. You ALWAYS WANT AND NEED MONEY IN GOOD TIMES AND BAD. It’s the very best risk-off asset on the planet, and with its fixed supply and volatility, it simultaneously makes it the best risk-on asset on the planet. I know that sounds ridiculous. However, if Bitcoin outperforms during bull markets (2023-2024) and now starts outperforming during stock bear markets, am I wrong?

It’s tough to articulate a thesis that bitcoin is poised to take over as the global reserve asset in a newsletter. I want to be right, but also wrong. Being wrong will mean the status quo. It will be less disruptive and anxiety-filled. If I’m right, that would be cool, and I hope you benefit, but many people who refuse to put the work into bitcoin will struggle.

Bitcoin isn’t about socialism and some utopian society where everyone is equal. It’s actually just pure, ruthless capitalism at its finest, pushing the world forward out of the “Fiat Age” (similar to the Dark Ages). Those who adopt it earliest benefit the most. The laggards suffer, but they will ultimately benefit because Bitcoin is a disruptive technology, like the internet or electricity.

You can celebrate if you’re an early Bitcoin adopter when this thesis suddenly becomes clear as day to everyone, but like he says in the movie The Big Short…

Thanks for reading!

Share if you like it!

THIS is Crypto Pulse

You will make socks and you will like it!!! America!!!