I can see your expression now…

Bitcoin hit all-time highs AGAIN, and CP is back! Here we go. What hype is he gonna sell this time? Doesn’t he get tired of this? It’s so annoying.

YOU’RE DAMN RIGHT I’M BACK! LET’S GOOOOOO!!!! WOOOOO!!

The best-performing asset on the planet over the past 16 years just broke all-time highs, and at that time, not one single person who bought bitcoin and didn’t sell was looking at a financial loss. How can anyone get tired of that? It’s compounding at 30-90% annually based on various time frames!

AND IT’S STILL EARLY.

Ask your neighbor. Ask your friend. Ask a stranger on the street. Did Bitcoin just hit an all-time high? Does bitcoin have a max supply? Do you have 5% or more of your wealth saved in it?

ZERO. The answer will be zero people can answer ALL of these questions with a yes.

Attention! Bitcoin hit ONE HUNDRED AND TWELVE THOUSAND DOLLARS, AND LIKELY ZERO PEOPLE WILL ANSWER YES TO THESE THREE QUESTIONS.

READ THAT AGAIN.

Now ask those same people if they own 5% or more of equities like Amazon or Apple, or 5% or more of US bonds. The answer is nearly 100%.

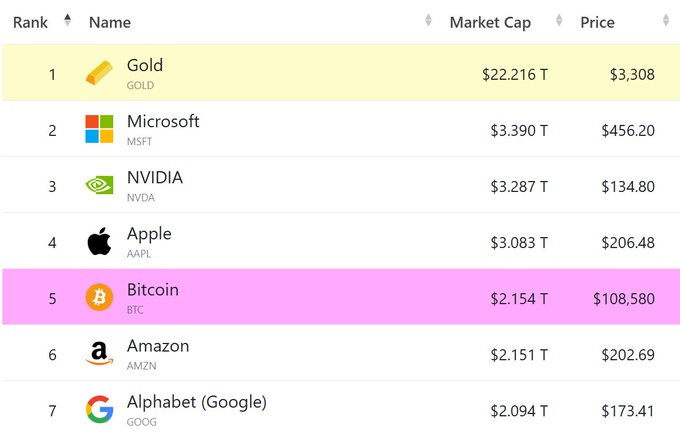

But yet this just happened….

Bitcoin is rising up the charts again! Later Amazon! Watch out, Apple!

Do you get it yet? IT’S EARLY.

How early?

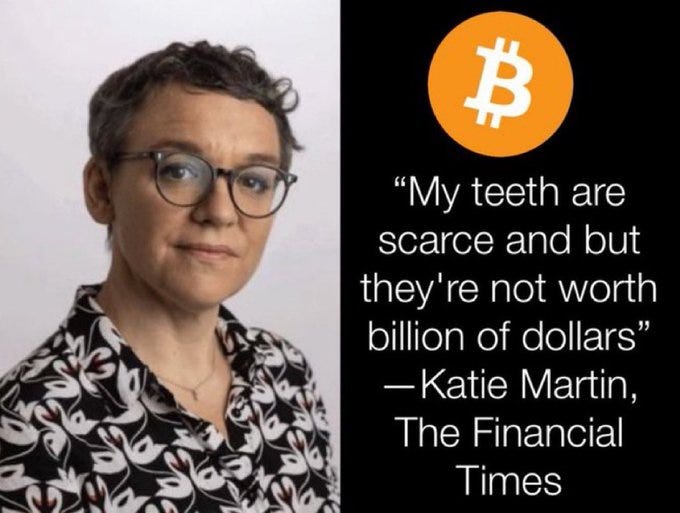

Literally one of the most read and respected financial media outlets just did a piece on bitcoin and MSTR (Strategy) with this as their conclusion. LOL! WE’RE SO EARLY IT’S COMICAL!

Worldwide adoption is <1%. Sure, there are millions of people with .0000004 btc on their phone that they have no clue what it represents or how to securely store it. When I talk about actual adoption, I mean a legitimate amount of your net worth is saved in the asset.

Similar to what you save in stocks, real estate, bonds, or gold. Somewhere from 5-99%. Saving 1% of your net worth in bitcoin is a hedge. It’s insurance. Your home insurance is 1% of the value of your house, just in case it burns down or is hit by a tornado.

When you truly save in an asset, you’re saving at least 5% and likely way more. That’s meaningful adoption, and the world is DRAMATICALLY underexposed to bitcoin as the ultimate savings vehicle. Way less than 1% have meaningfully used bitcoin as savings technology. In the next 25-50 years, that number is going from <1% to >50% in my opinion.

If the price hit $112,000 with <1% worldwide adoption, what do you think will happen when it’s 50% plus with a fixed supply?

STRAP IN.

I AM ONCE AGAIN POUNDING THE TABLE THAT YOU DO NOT OWN ENOUGH BITCOIN. NOR DO I. NO ONE DOES. YES, EVEN AT ALL-TIME HIGHS, THIS THING IS ABOUT TO EXPLODE HIGHER.

I am so bullish I can’t even see straight again. I freakin’ love these moments. Bear markets suck as I have to try and convince everyone bitcoin isn’t going to die and don’t sell. There will come a time for that again, but for now, it’s giga chad moon math banana zone time. Let’s ride!

Nothing stops this train

Sorry Elon, good try.

My biggest fear and the biggest threat to bitcoin (besides quantum computing) is a fiscally responsible government. For about two seconds, I thought Elon and DOGE were going to come in and legitimately cut reckless spending and waste/fraud/abuse. That would stop the fiscally irresponsible train.

It turns out that launching rockets into space and then landing the booster with chopsticks back on Earth is way easier!

Elon and DOGE ran into the swamp, and the swamp won. Easily. There is so much bureaucracy and BS that not even the most genius man on the planet with unlimited money and political capital could make a dent in the bloat of the US government. If Elon couldn’t do it, no one can. This was the one chance. It’s over.

It was entirely predictable, and after I thought about it for a few weeks, I was mad at myself for even considering they could truly cut any significant amount of spending. Cutting spending is a one-way ticket out of office for career politicians. No voter will vote for a politician who says, “I’m cutting your benefits and taxing you more.” It’s political suicide, and Elon found that out the hard way.

Just as I predicted, when the tough got going, political opponents would use Tesla against him and wage a massive social attack against his company. If you drove a Tesla, you literally feared for your life for a while. The stock price tanked. Investors got pissed. Elon hung up the gloves and said,

The result is near-zero savings in the grand scheme of things. The corruption and nonsense will continue unabated. NOTHING STOPS THIS TRAIN.

Furthermore, Trump and company got their dose of reality handed to them as well and capitulated faster than a toddler being bribed with candy.

Phase one for Trump was, “Cut spending, DOGE, austerity, tariffs, trade deficit down, who cares about the stock market, main street over wall street!!!!”

“Everyone has a plan until they get punched in the mouth.”

As predicted, the stock market reached bear market territory due to the ludicrous tariff policy, and the bond market began to implode.

The stock market is the US economy!! The bond market rules the entire world!! Not Trump. Once again, a capitulation faster than a dog tempted with a bone.

They F’d around and found out.

Now phase two – “tax cuts, grow our way out of this, buy stocks now, no DOGE, tariffs (but tons of bargaining and workarounds), main street over wall street (while winking and elbowing his billionaire buddies), etc.”

Once again, NOTHING STOPS THIS TRAIN.

They are going to “run it hot” and spend money until the cows come home.

They are LITERALLY telling you that. They are screaming it in your face in every press appearance.

What’s the lesson?

You cannot taper a Ponzi scheme. I repeat, you cannot taper a Ponzi scheme.

The US dollar and the entire legacy financial system are a Ponzi scheme. They are built on debt and credit. The system worldwide uses unimaginable leverage to eke out a measly yield to try and beat inflation. The system requires more dollar units to be pumped into it to continuously expand credit and prevent the entire thing from going bust. If you try to slow it down/taper it, or stop it for long enough, the system will seize up and unwind quickly.

Hence why “capitulation TACO boy” Trump reversed course so quickly when the bond market tapped him on the shoulder in mid-April after Liberation Day and said, “hey boss, do you want to be the President that is known for destroying the entire financial system and creating the greatest financial depression of all time? Yeah, didn’t think so. Knock it off and print the money.”

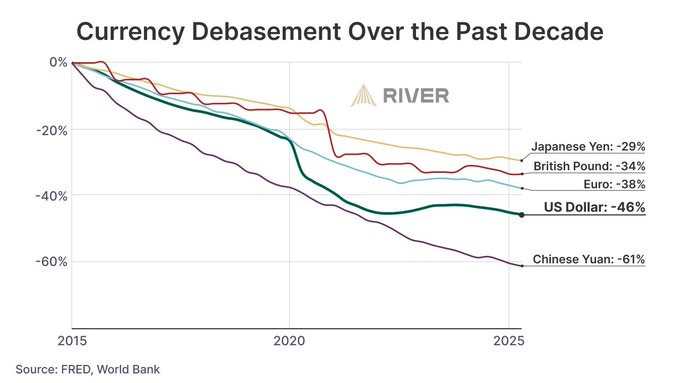

Fiat money REQUIRES inflation.

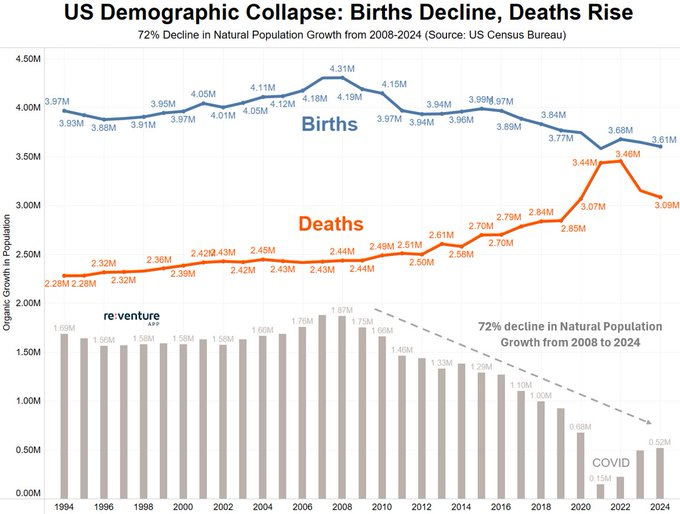

It allows debt to be inflated away and more easily repaid. The entire world is in debt up to its eyeballs. NOTHING STOPS THIS TRAIN. The sooner you realize that, the better off you’ll be. AND IT’S ONLY GOING TO GET WORSE. The cake is already in the oven. It’s baking. You can’t reverse a demographic disaster overnight. It takes at least 20-30 years to make a 20-30-year-old who spends money. Where’s all the demand going to come from, looking at this chart?

This chart should FREAK YOU OUT. It’s not a tomorrow problem. It’s a 15-50-year problem. If you will be alive or have kids, buy some bitcoin.

The sheer amount of money printing to produce the required inflation necessary to inflate away the debt when there is a demographic collapse driving statistically less demand, on top of AI and technology making everything cheap and abundant, will be unfathomable. The battle against DEFLATION due to the factors above will lead to hyperinflation. You have the correct answer to the test (bitcoin). Don’t overthink it.

Additionally, ALL STOCK MARKET DIPS FROM HERE ON OUT WILL BE BOUGHT. The plunge protection team (the Fed and US government) has your back. They have so many tools to keep this party going and trick you into thinking they have it all under control. It’s one big illusion.

I’ve said it before: As long as stocks go up and iPhones and the internet are cheap, people won’t complain. They’ll eat worse and more affordable food (Chick-fil-A and ramen, baby!!) and gladly rent forever as long as those things remain true. They don’t even need a job. Most would prefer not to work. A government handout will do just fine.

THIS IS THE PLAYBOOK.

It’s so sad, but you must open your eyes to the reality.

Hard assets like real estate, stocks, and bitcoin will go way up in price as money is printed. However, the first two will likely KEEP PACE with inflation, while bitcoin will BEAT INFLATION.

That is the situation we find ourselves in today. Stocks and real estate, on average over many years, keep pace with monetary debasement. You are running a full 10 on the treadmill of fiat life to keep up with those assets. The things you truly desire – free time, vacations, education, health care, property, etc.- all get harder to obtain. You feel like you're getting poorer and need another job, or must unretire to keep your standard of living the same or to improve it slightly.

Folks, I’ve got bad news and good news. The bad news is IT’S ONLY GOING TO GET WORSE. These Trump policies are going to be highly inflationary. Yes, I believe we have massive DEFLATION due to AI and demographics ahead of us in the future, but in the short term, I don’t see how it’s not inflationary.

No tax on tips, no tax on social security, tax cuts, business tax cuts, forcing companies to eat tariff price increases and not consumers, SALT tax changes for the wealthy, new real estate perks, crackdowns on immigration(forcing wages up), elimination of federal income taxes for bottom 80% of the population (<$150,000) using tariffs to pay for it, supply chain restructuring, reindustrialization, defense spending, etc. etc.

This, to me, is essentially like a massive stimmy check. The bond market is also saying this as bond yields continue to rise, with the 10-year yield near 5%. If inflation rises, bond holders want more yield to be compensated for that. I have bad news for them too – 5% is a joke. You’d have to pay me AT LEAST 10% per year on a 10-year bond even to CONSIDER it. I’m not sure I’d even do it at that rate.

I’ve hammered this point home, newsletter after newsletter. CPI is a lie. It’s a manipulated metric and if you trust it and use it as your north star of what inflation truly is, the joke is on you.

Monetary debasement is at least 7% per year, and for scarce/desirable items and other necessary things (car/home/property insurance), inflation is >10%. If you don’t believe me, take an hour and look at your own bills from the past few years. Do the work. Understand the game.

Now, what’s the good news? You already know the answer. BITCOIN BABY.

The only asset that is consistently outperforming monetary debasement and has infinite demand ahead of it. There is no max demand for perfectly engineered money. It is limitless. How much money do you want? The answer is all of it! I want all the money I can get. I’ll want it during good times and bad. I’ll give it to my kids, my community, charities, things I believe in, you name it. I've got lots of things to spend money on, trust me.

How many iPhones do you want? I’m good with one. How many TVs do you want? One or two sounds good. How many cars? One or two should suffice. Homes? One is great, two to three if you insist. Apple stock? I got a lot of shares, plus they aren’t growing anymore and are overpriced. I think I’m good. Bonds? Got a lot of those too (not true), but yields aren’t keeping up with inflation, and the government is about to issue 7 trillion more this year, I think I’m good. Want some shares of corn or soybeans? Nah. How about a vintage painting? I hate art, and my kids would ruin it. I’m good.

Do you get it? There is literally no top for good money. Bitcoin demand is infinite. Yet the supply is finite. That’s not the case with any other asset where either the supply is unlimited (yes, that is the case for gold) or demand is easily saturated. I cannot emphasize this enough. In 10 years, 99% of all the supply of bitcoin that will ever exist will be in circulation. The last 1% will be introduced over the next 100 years. If you want some, you’ll have to bid the price up high enough for someone to part with it, or do valuable work for a bitcoiner for them to pay you in bitcoin. Those are the two ways.

I highly encourage you to get some now while it’s easy to do so. You do not comprehend how valuable it is going to be in the future. It’s already insanely valuable, and the number is only going up. When it’s millions of dollars per bitcoin, you won’t care you bought some at 90k vs. 112k. IT DOESN’T MATTER. What matters is that you get off zero bitcoin and start getting allocated in a meaningful way.

Bitcoin is compounding between 30-90% annually and is dramatically outpacing monetary debasement. It’s able to do so because of the finite supply and difficulty adjustment, preventing too much being mined too quickly. It’s the only asset on the planet with these properties and is a technological breakthrough in human history. It is THE most pivotal technology ever developed. Money is the backbone of human civilization, and humans created perfect money with technology for the first time ever. There is nothing more incredible and important. Not AI, not airplanes, not electricity. It’s Bitcoin. Sound, incorruptible, digital money.

The positive catalysts that have hit and will continue to hit throughout the year are bonkers. In no particular order, off the top of my head, here are the top 21:

1. Stablecoin legislation (Genius Act) is getting passed by Congress. Big banks will launch their own stablecoins. This is good for US treasury yields and good for bitcoin. The higher bitcoin’s price goes, the more stablecoins are needed to settle it. More stablecoins = more demand for US treasuries. The US government is GIVING YOU THE PLAYBOOK. THEY WANT/NEED A HIGHER BITCOIN PRICE to drive demand for their toxic US treasuries to extend the life of the US dollar a bit longer. US dollars are like the patient who has coded multiple times with terminal cancer and a massive brain hemorrhage, but we decide to start dialysis (with stablecoins). It’s just delaying the inevitable.

2. A digital assets framework will likely be established by the end of the year, creating a massive tailwind for crypto in general. Rules create clarity, which creates trust and safety, which leads to massive institutional adoption and higher prices.

3. Banks can now custody Bitcoin, which means massive institutional adoption. Big institutions only work with big banks. Case closed.

4. Many businesses are now adopting bitcoin treasury strategies (>100). Within the following year or two, there will probably be an MSTR (Strategy) public company within every capital market across the world. Most of those countries have no bitcoin ETFs. Due to capital controls, their people cannot buy bitcoin ETFs from the American stock market. These new companies will execute the Michael Saylor MSTR playbook and buy bitcoin on behalf of their shareholders so they can get bitcoin exposure in some fashion. The demand shock from this will be insanity. Just FYI, Trump’s media company just announced it’s also buying bitcoin for its treasury.

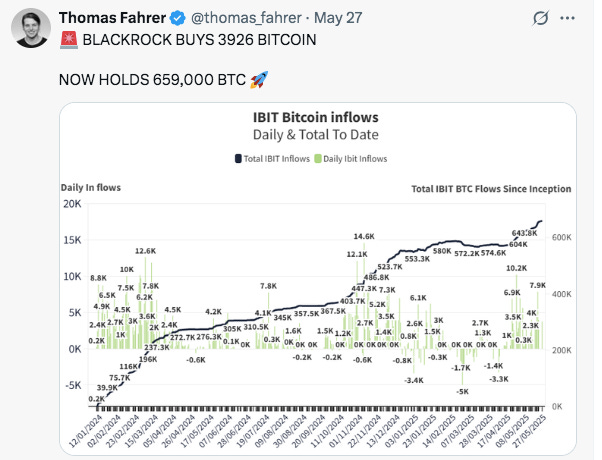

5. Speaking of demand shock, Bitcoin ETFs are sucking up bitcoin at unprecedented levels. Typically, such demand would trigger an increase in supply of the commodity, like when gold’s price rises. Please recall, that cannot happen with bitcoin. The supply schedule is fixed, and the difficulty adjustment prevents faster distribution. Currently, there are ~450 BTC/day mined, and in 2028, that will go down to 225. There is nothing you or anyone can do to change that. Between the ETFs, public companies, and nation-state sovereign wealth funds, thousands of bitcoins are being hoovered up daily.

MSTR is ONE company!!!! One!!!

What’s Blackrock’s ETF doing?

What happens when unlimited demand for perfect money meets a finite supply available? If you can’t answer that, go back to Econ 101.

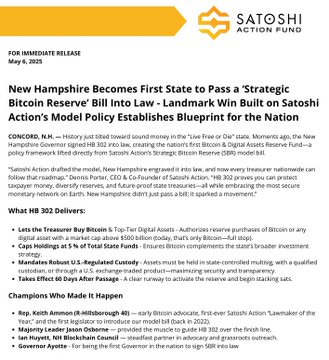

6. Texas, Arizona, and Maine just passed their own bitcoin strategic reserves for the state and will buy bitcoin. Extremely bullish. Cities and counties are next.

7. The national bitcoin strategic reserve will eventually be established, likely later this year, and will buy bitcoin in budget-neutral ways. Bitcoin bonds maybe?? NYC is pushing for them already! Hurry up Trump!

They’re coming! Don’t say I didn’t warn you. This was drive a massive amount of demand for bitcoin from the fixed income markets.

8. There are trillions and trillions of dollars of debt that need to be refinanced this year at higher interest rates = money printing to pay for it

9. Trump’s administration is talking about changing bank rules to force them to buy more bonds via the SLR exemption, since other countries aren’t buying our bonds anymore. This will artificially lower interest rates and is essentially Quantitative Easing (QE)…aka money printing. They’ll dress it up and say it’s anything but that. Don’t fall for it. Asset prices are going to the moon if they do it.

10. Countries globally are moving into easing cycles, lowering interest rates, and stimulating their economies with money printing. The US is lagging since inflation is persistent, but it will eventually bend the knee. Bitcoin is a global asset and doesn’t care who prints fiat money.

11. It looks like “capital controls” are coming to the US, which is scary as hell if you ask me. It’s really for foreigners and is essentially a tax for them to hold and own US assets.

This will cause a flight of capital OUT of the US and out of the dollar. A weaker dollar is inflationary. That money that leaves also must be saved someplace. What are they going to do, buy bonds issued from Niger or Chad? Invest in Italy? Cambodia is so hot right now. Japan looks like Greece circa 2009 with a debt/GDP of >250%. Tempting! I hear South Africa business is booming lately!

Of course I’m joking. They’re going to buy neutral, hard, scarce assets like gold and bitcoin. Eventually just bitcoin, but for now, both. They aren’t going to reinvest in their local countries because that would drive their local fiat currency higher and make their exports less competitive. In addition, most of these countries have no legitimate businesses to invest in and are corrupt as hell. Dollar down, stocks down, yields up = money being saved in bitcoin. Look out for it.

12. Oregon passed a law officially recognizing bitcoin as collateral. A nothing burger to most. A massive development if you read my work. It’s happening. Bitcoin as pristine collateral. You don’t own enough. When bitcoin becomes recognized as superior collateral, no one will ever sell it. It’s like Manhattan real estate. YOU NEVER SELL IT. Hmmmm, fixed supply asset…everyone needs it to beat monetary debasement, but no one is selling it…hmmm. I wonder what will happen to the price? It’s going UP. That’s what.

13. On that note, bitcoin-backed lending, where you post BTC as collateral to get a fiat loan at some % rate, so you never have to sell your BTC to buy stuff, is about to go parabolic. This is what rich people do. The mega millionaires. Cantor-Fitzgerald (you know, the Secretary of Commerce guy) is a mega millionaire and mega bitcoin bull, and he just launched this…

It’s about to get stupid.

14. Steak N Shake now accepts bitcoin for payment. Square - you know the thing that hooks to your phone and tons of small businesses use for payments? They are now integrating bitcoin lightning payments.

Stop complaining you can’t buy anything with bitcoin. Go get a burger and calm down. Don’t forget to bring your gold bar and tell me how that goes when you try to scrape off some flecks for a shake. PS - The fries are cooked in beef tallow now. Get some.

15. Missouri just passed a bill to exempt bitcoin from capital gains tax. The beauty of the United States and game theory in general will commence. Eliminating taxes like this attracts people and talent from other states. Soon, others will do it to compete. Also, it’s inflationary. Everything is good for bitcoin.

16. Bitcoin credit cards. I love mine. I keep trying to spread the word. 1-4% bitcoin back on every single purchase every single day.

It’s a risk-free way of acquiring bitcoin because you’re already spending the fiat money, you’re just getting bitcoin rewards back instead of fiat cash or airline miles. You don’t feel like you’re “investing” money this way, which makes it easier for people to stomach the volatility. I know you Delta lovers out there love your points, but as bitcoin returns compound over time, you could purchase more flights/upgrades with the bitcoin you earn than your rapidly debasing airline miles. It’s just math. Getting “sats back” instead of dollars is going to be THE hot thing over the next decade. You heard it here first.

17. I’m fairly confident MSTR (Strategy) will be selected for the S&P 500 later this year. Coinbase just got in the other week. When MSTR gets in, that means billions and billions of passive money that automatically buy the stock every month, and the percentage purchased is based on its market cap relative to other companies in the index.

Nearly everyone owns the S&P 500, and hundreds of billions of passive flows go to it every year. It’s the benchmark index fund. When you buy it, a percentage of that money will go to MSTR if they get in. Most will “own” bitcoin via MSTR and never know it in that case. MSTR will then, in turn, go out and buy more and more bitcoin with the passive money it receives. Its market cap will, in turn, rise as it acquires more bitcoin and the price rises. It will then receive more passive flows given its growing market cap relative to others. This is called reflexivity, and you are not bullish enough. I repeat, you are not bullish enough, especially if Strategy gets into the S&P 500, and I think it’s >90% chance. Buckle up. I don’t own enough Bitcoin, and I don’t own enough MSTR. Look what happened to Tesla pre-S&P500 inclusion. MSTR will be that on steroids.

a. A quick mention – MSTR is just now getting capital to flow from the 300 TRILLION dollar bond market into their bitcoin security instruments ($STRF and $STRK). That’s right, I said 300 TRILLION dollars. He’s aiming for 1% of that, a mere 3 TRILLION DOLLARS. Bond market investors are so starved for real yield and can’t get access to bitcoin any other way than through MSTR. The absolute bewilderment and hysteria by traditional market analysts when MSTR is the most valuable company in the world and overtakes the Mag7 stocks will be fun to watch.

18. Rate cuts? Certainly bullish bitcoin if so, but it’s hard to predict if cuts will happen. Where does everyone hiding out in T-bills and cash put their money as rates head down? You guessed it – bitcoin will undoubtedly be one desirable option. The Fed is in a massive bind. They’re going to need to cut rates as the economy and housing in particular can’t function at these levels. However, if inflation ticks back up, they’re really screwed and won’t want to cut rates. Also, if the economy rolls over a bit and high rates plus AI innovation lead to job losses, they’ll need to cut rates during inflationary conditions. NO BUENO! I don’t envy their position because they’ll be wrong either way. My advice – eliminate the Fed, replace it with Bitcoin, and let the free market figure it out. Problem solved.

Bitcoin is coming to your employer’s 401(k) options.

I have begging for this and it’s going to happen at scale over the next few years with this new policy. There are TRILLIONS of dollars in 401k employer plans unable to access the power of bitcoin savings. It’s only a matter of time until the walls come down and the money flows.

The Vice President of the United States just gave an incredibly bullish talk at the annual bitcoin conference. And people still think they’re going to ban it????

Pakistan just announced a strategic bitcoin reserve. EVERY COUNTRY will have an SBR. Game theory is in full effect. All of these countries know they need to accumulate and hold bitcoin, fast. They’re doing so by harnessing excess power, mining Bitcoin, and printing money as well. That’s right - the playbook is out and so simple. Print garbage fiat money - buy bitcoin. Win.

Like I said, that’s just from the top of my head. There’s definitely more, but you get the point. The coming positive catalysts are mind-boggling. Since I learned about bitcoin in 2020, this is by far the most bullish setup EVER, and most who have been around longer than me would agree. This is the dream scenario. It was UNIMAGINABLE in 2021. Never in my wildest dreams would a President be tweeting and promoting bitcoin in 2025. It’s simply ludicrous, and 99% of the world has no clue and could care less! They’re like, “How’s my Apple stock doing today? Did they come out with another emoji? So cool!!! I heard Pepsi is a steal right now! What a great PE ratio, I definitely need to invest in a company poisoning me with sugar so I get that sweet sweet 5% dividend! Give me stability or give me death!

Mind you, bitcoin is growing at an obscene CAGR (30-100%) and is at all-time highs with bond yields near 5%. This is preposterous to most who wrongly assumed bitcoin was simply a zero-interest-rate phenomenon.

Sorry, bro, Bitcoin is actually real money, and fiat money is the Ponzi scheme. You had it backward this whole time. The higher rates go, the higher bitcoin is going to go because high rates put fiat money and trillions of dollars of debt into a debt death spiral. If rates come down and fiat money is easier to obtain, bitcoin will also go higher as people exit the fiat Ponzi scheme more and more every day and buy bitcoin with “Monopoly money” fiat paper. Take a loan out at 0-1% and buy bitcoin growing at 30-90%? YES PLEASE.

Buy the good money, spend the bad. Yes, it’s that simple. However, 99% of people won’t do it.

It doesn’t matter what the situation is, bitcoin wins. Inflationary spike? Own bitcoin. Deflationary bust? Own bitcoin. It’s outside the fiat monetary system. It’s going to slowly replace it because it’s a radically disruptive technology that can’t be stopped and is going viral. It’s the safest and most uncorrelated asset on the planet. Yes, it’s volatile. That’s by design. The invention of perfect money in the 21st century doesn’t rise in price in a linear/predictable/stable way because you want it to. Human beings are crazy and greedy and fearful and emotional. They’ve never encountered an absolutely scarce money with exponential adoption. It’s going to be a bumpy ride. Just HODL and touch some grass. Go golfing with friends. Drink a Maker's and Coke or some port. You do you, just R-E-L-A-X.

It’s actually easy to relax with bitcoin compared to stocks. I’m actually quite NERVOUS about stock returns this coming year. Ultimately, I do think they’ll go higher, but probably not greater than 7-10% (thus losing to monetary debasement). US stocks have some serious headwinds:

-tariffs: bad for company margins and consumer demand. When Trump randomly assigns some tariffs one day because he’s in a mood, the stock market doesn’t react well. Currency wars, as predicted, are also heating up. A weaker US dollar isn’t good for Americans’ purchasing power.

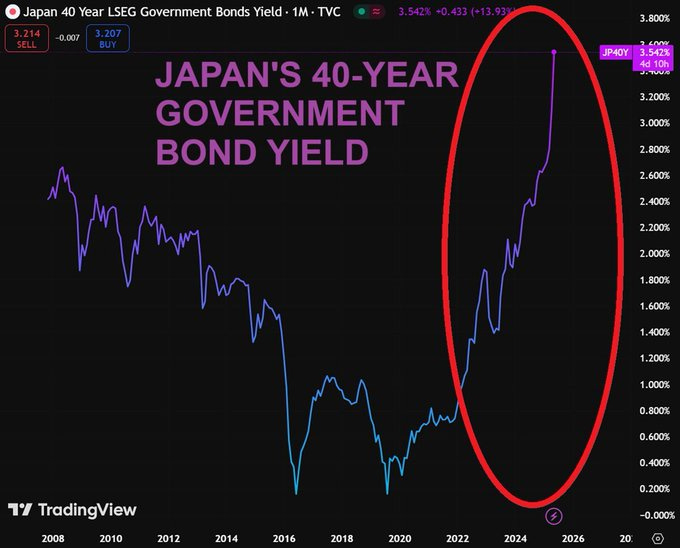

-Japan’s bond market is a utter tire fire. The Yen carry trade that has been propping up stock markets for decades is in trouble (borrow in Yen cheap, invest elsewhere to earn higher yield). Danger.

-rate hikes??: uncertain, but possible. If true, bad for stocks. Why buy a risky stock when you can earn 5-6% risk free with the US govt?

-capital controls: bad for stocks. Foreigners sell stocks to avoid taxes.

-Inflation: could be good for stocks, but the US consumer is living on the edge using BNPL (buy now pay later) for Doordash. Higher prices may lead to lower demand compared to Covid times when US consumers were flush with cash.

-Weak dollar: could be good for stocks, but a weak US dollar also reduces US consumer purchasing power as everything they buy globally is more expensive. Not great when they aren’t flush with cash.

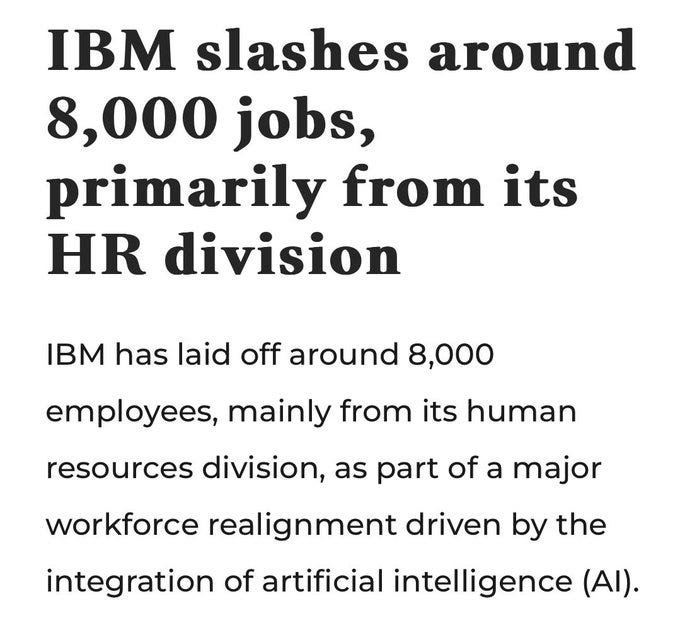

-Layoffs/unemployment: Bad for stocks if continues to creep up. The Trump administration is gutting Federal workers which were the main reason for employment growth in 2024. Artificial Intelligence is just now getting to the point where it WILL displace white collar workers and prevent young college grads with no experience from getting a traditional entry level job.

It’s QUICKLY going to replace Uber drivers, and truck drivers – some of the easiest gig economy jobs people resort to when they get laid off. This is going to cause problems. Universal basic income handouts are INEVITABLE. But when the checks get handed out, ask yourself, WHO’S PAYING FOR IT??? You are, via monetary debasement. Got bitcoin?

-Student loan repayments restarted: not good for stocks when typical high income earners must now repay debt rather than invest.

Those are just a few, in addition to a ton of unknowns. Trump needs the market to go up, so it probably will. It’s practically IMPOSSIBLE to have a recession even with all these worrisome things with a 7-8% budget deficit. The money printing keeps the economy alive. There are plenty of reasons to be nervous for a slowdown (not a recession), yet certainly valid reasons to be very bullish (tax cuts, etc.). The point is, I can make a bullish case for bitcoin with every single point I made above that was bad for stocks. Bitcoin is on autopilot. Buy it and forget about it for 10 years.

So, yeah, there you have it. Bitcoin to the moon. Inflationary impulse (3-5% CPI) is likely headed our way (>10% real for desirable/scarce items). Nothing stops this train. Long-term bonds are a flaming pile of dog sh!t. Stock returns could be dicey moving forward. Gold is old. Real estate was the boomer wealth-generating machine. Bitcoin is for us (and boomers too, god love them). Capiche?

Orange is the new gold.

I actually need to go buy some more bitcoin after writing this. LET’S GO!!!

Until the next all-time high…

Thanks for reading! Share if you like it