Merry Christmas ya filthy bitcoin loving animals!

AND HAPPY 100K BITCOIN!!! WE DID IT!!!

Did you have any doubts??

The top most certainly is NOT in.

Next stop: 1 million (timeline unknown)! Do you have any doubts??

Why?

Because bitcoin is DIGITAL CAPITAL, a revolutionary technology, and with a market cap of nearly 2 trillion dollars today, it is well on its way towards disrupting and capturing a total addressable market (TAM) of traditional capital assets worth almost 200-400 trillion (at the bare minimum) in today’s dollar amounts.

That’s a 100-200x gain from here. $10,000 saved in bitcoin becomes 1 million at a 100x gain.

What is DIGITAL CAPITAL?

Bitcoin is two things simultaneously: First, Bitcoin, the blockchain monetary network, is where all transactions occur peer to peer without a trusted third party. Second, bitcoin, the asset, moves on the rails of the open, global monetary network peer to peer and you can own it and custody it. Bitcoin, the asset, is digital capital.

Owning bitcoin the asset (fixed supply of 21 million) gives you access to use Bitcoin, the monetary network, or simply benefit from others using the network given bitcoin’s fixed supply and the resulting supply/demand dynamics as you hold the scarce asset others want/need.

For example, pretend there was a fixed supply token for the internet or the telephone, and the value of that token increased every time a new user joined the network and used it in any capacity due to increased demand. Would you want to own that token? Would it be valuable?

That token now exists as unfathomable as it may seem. Bitcoin is the internet of money, and you want to own as much as possible because it will be insanely valuable and used by all humans AND machines (AI, robots, etc.)!!!

Michael Saylor coined the term DIGITAL CAPITAL to describe what Bitcoin truly represents, which is brilliant, in my opinion. It encompasses everything that bitcoin is.

When you tell someone Bitcoin is perfect money, they scoff at you because you can’t buy coffee with it in the USA (yet), so they tune you out. Their head explodes when you tell them it’s the internet of money. It IS actually both of those things, but you’ve already lost them.

If you tell them it’s digital property, which it is, they tune you out because you can’t live in it. If you tell them it’s digital gold, they don’t care because they don’t own gold and don’t want to own it. It has no cash flows and is a rock. You’ve lost them again. Bitcoin being digital energy is just waaaay too abstract of a concept. Don’t even go there. Pristine digital collateral is also too complicated for 99% of people outside of finance, so that’s a no. I can talk until my head explodes about all the humanitarian benefits of bitcoin and how it will transform energy markets and save/improve lives, but most people just want to make money, so that’s a losing battle as well.

DIGITAL CAPITAL, on the other hand, works better I think, and I’m moving to that going forward (although I will still refer to it as money as well). Capital in financial terms refers to “the money or financial assets used to fund a business's operations and growth, including cash, investments, and other assets that can be used to purchase equipment, cover expenses, and invest in new opportunities; essentially, it's the money used to build, run, or expand a company.” It’s everything you own that increases your net worth and could be liquidated to pay expenses. Thus, examples of non-human capital include cash, stocks, gold, art, bonds, real estate, land, oil, etc.

You can think of bitcoin as a DIGITAL FORM OF CAPITAL, and it’s far superior to traditional forms of capital.

Why is DIGITAL CAPITAL so superior?

It’s no different than why streaming is better than CDs or cassettes, and iPhones are better than pay phones/rotary phones with operators connecting the call.

Venmo and online banking are better than writing checks, digital photos are better than polaroids, email is better than mail, storing information on the cloud is better than on a floppy disk, and within the next decade or so, AI will likely replace/transform >50% of most products/services/jobs available today because it’s just better. Yes, there are some flaws/issues with all of these digitized versions, but on net, the pros significantly outweigh the cons.

Compared to traditional capital assets, DIGITAL CAPITAL is more efficient, practical, and useful and allows you to cover expenses 24/7/365. You can sell bitcoin at 2 am on a Tuesday anywhere in the world, and the price is the same. All you need is an internet connection. It is censorship resistant, and no one can stop you from transacting value when you need to. Volatility is a drawback, but that will dampen with time as the asset class grows.

Bitcoin is the first digital asset with a fixed supply (digital scarcity is the revolutionary invention by Satoshi), and because it is digital it is infinitely divisible (for global utility); thus, your network ownership can never be diluted.

There are no taxes, environmental threats, HOA fees, maintenance/insurance fees, counterparty risks, CEO risks, tenant risks, interest rate risks, employee risks, litigation risks, or seizure risks due to violent acts.

DIGITAL CAPITAL is everything you dreamed a store of value asset could be. Bitcoin has no other value than 100% monetary premium, which is what perfect money is. Its utility value IS its monetary value, unlike every other traditional capital asset, which has both a utility value and a monetary premium due to inflation.

The non-utility monetary premium assigned to these traditional forms of capital today is probably 200-400 trillion dollars.

This is the direct result of the USD being rapidly debased, forcing people to store their wealth in these other forms of capital to outpace inflation. You max out your 401k in index funds not because you know you are investing in good businesses at appropriate valuations, but you do it because you have learned it keeps pace with and typically beats inflation as printed money gets stuffed into the stock market.

Saving in dollars in a bank account is not an option; you know this, and so does everyone else. Thus, your excess earnings must go into scarce and/or productive assets like real estate, stocks, land, gold, etc. This inflates their price well above their utility value, and much of the total cost of an asset is its monetary premium due to individuals using it to outpace inflation.

As a reminder, stocks were never meant for saving in! That’s a late-stage symptom of a disease we all suffer from…inflation/monetary debasement. The same goes for real estate. It is a symptom of a disease.

The disease is fiat money and inflation/debasement. The cure is bitcoin. Eradicate the disease; don’t just treat the symptoms.

Bitcoin is on its journey to drain the monetary premium out of all the other forms of traditional capital because it’s better as digital capital. Think about all the things that are now digital and are significantly more valuable/useful/efficient/accessible as a result…

Anything that can be digitized will be digitized because it democratizes access to the asset/product/service while simultaneously allowing it to scale and iterate exponentially for a fraction of the cost. It is highly disruptive to legacy incumbents who must either adapt or die. IBM, a once powerhouse company, is another great example of a company that rejected digitization (software) at the time, and their business suffered tremendously as a direct result.

Capitalism forces companies to adapt (or their competition will kill them) to the benefit of us all who get access to better products and services at lower prices. Scarcity becomes abundance. The ONLY reason the cost of nearly everything isn’t falling to zero today is because of fiat money and the requirement that prices go higher to service debts. The ponzi scheme collapses if prices go lower (deflation) in a fiat based system. Prices MUST ALWAYS rise.

Technology and fiat are in a battle. Technology brings lower prices, while fiat money demands higher prices. We’re nearing a breaking point as technology accelerates. On the other hand, bitcoin and technology are symbiotic and synergistic because bitcoin is deflationary like technology. If you believe technology will continue to exist and advance, I highly suggest owning Bitcoin and getting on a Bitcoin standard yourself.

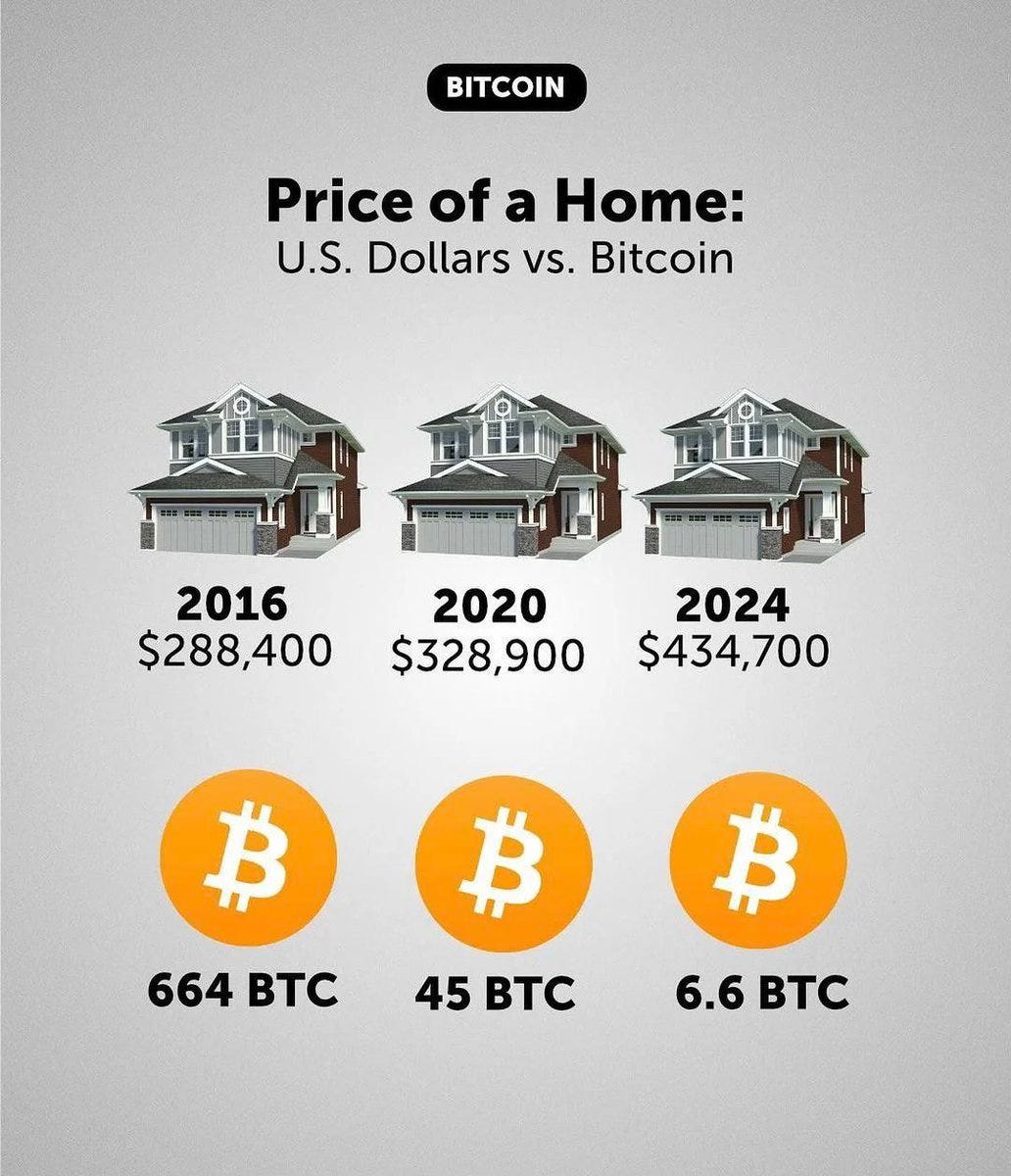

On a bitcoin standard, the prices of everything ARE falling. My house, groceries, travel, etc., all went UP in fiat terms but have PLUMMETED in bitcoin terms.

Life is getting insanely cheap with bitcoin as my unit of account. Bitcoin grows my purchasing power over time while fiat erodes it.

Bitcoin = abundance. Fiat = scarcity.

The monetary premium ascribed to traditional capital assets is next in line to be digitized. The utility value of the capital will remain, and the asset will still have value, but the monetary premium it enjoys today will mostly be taken away by bitcoin. That means lower prices as money flows to bitcoin as superior digital capital.

That’s good for humanity (people can afford to buy a home with lower prices), but that’s bad for your net worth if you own a bunch of houses, stocks, gold, etc., which 99% of us do.

Thus, IF I’M RIGHT, you will want to own some bitcoin to offset the decrease in the value of traditional capital assets as the value of digital capital skyrockets.

I cannot emphasize enough how revolutionary of a technology bitcoin is. That’s why I’m writing this newsletter to make sure people take notice. I am pounding the table for it as hard as I can. Unfathomable amounts of money will be saved in bitcoin.

You think AI technology is amazing? Yeah, sure, but it doesn’t hold a candle to Bitcoin.

I can get by without Chat GPT easily. I can’t easily escape or outpace inflation.

I need good money every day; therefore, BITCOIN IS THE MOST INCREDIBLE/IMPORTANT NEW TECHNOLOGY TODAY.

Nothing even comes close, but 99% of people completely dismiss it because it’s “different.” It doesn’t look like technology they’ve seen before. They don’t understand what it is disrupting because they never stopped to think about what money and capital are. Most people who talk negatively about it are incentivized to do so because it’s protecting their current wealth interests and the status quo.

That’s how almost all revolutionary technologies are viewed and judged initially.

Scary to most until the benefits are impossible to ignore, at which point the adoption becomes unstoppable because it solves a MASSIVE problem EVERYONE has, whether they know it or not….the problem bitcoin is solving is the disease of inflation.

Wrapping up

The bull market is just getting started, folks. I know 100k seems nuts, but we’re still in the early innings if you ask me. Hardly anyone on the street is talking about it, which is just what you want. Try it sometime. Ask 10 people what the price of bitcoin is. When 7-8/10 can tell you, it’s probably time to sell. I bet maybe one or two could tell you today.

2025 should be wild. The bull run likely ends if macroeconomics drastically change and the Fed needs to hike interest rates again because inflation goes >4% or there is a massive unexpected recession. I know many people are in the “inflation is coming back camp,” but not me. Will it stay >2%? Probably. Will it go back to >4%? I highly doubt it. The Fed actually wants and NEEDS inflation to help erode/inflate away the debt. They will look you straight in the eye and tell you they are targeting 2% inflation while they are high-fiving their buddies behind the scenes that it’s 2-4%, which makes debt easier to repay.

Every country around the world besides the US is hurting…bad (China, Europe, UK, Canada). They need to keep cutting interest rates to stimulate their economies and get the money printer going ASAP.

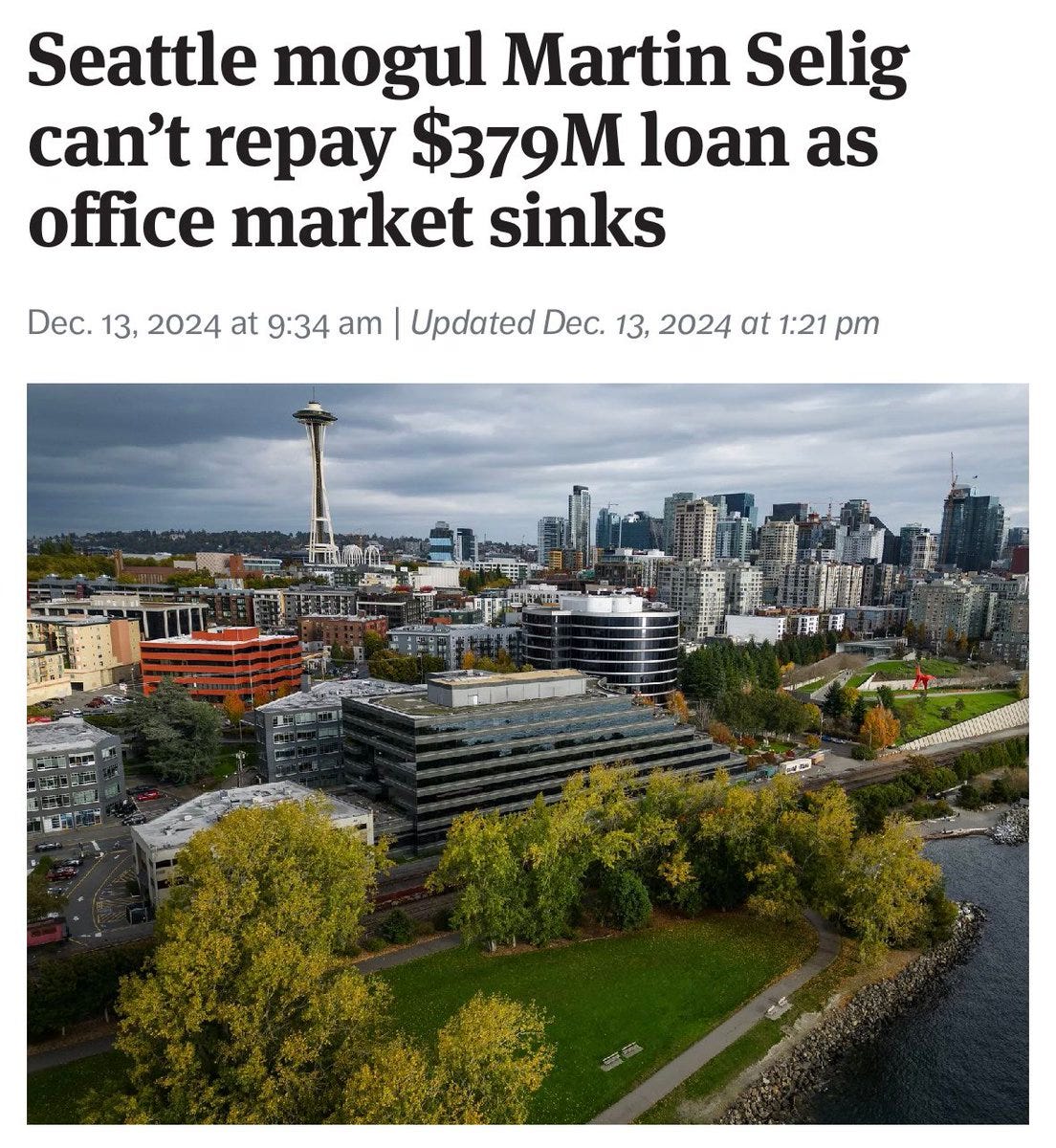

The Fed basically has to keep cutting rates along with other foreign central banks in order to not blow up the entire world economy, and cutting rates in the US also helps with our gargantuan debt payments, as well as the slow-moving commercial real estate disaster that has not been solved.

I think there are equal and opposite inflation and deflation forces on the horizon; thus, we stay in this range of 2-4%. Although 4% inflation doesn’t sound bad, remember its effects compound over the years, and a jump from 2 to 4% is a 100% increase in inflation, relatively speaking. Between the Fed continuing to cut rates and the US government running ~2 trillion dollar annual deficits, it’s hard to see a recession on the horizon. I know Vivek and Elon via DOGE think they will cut spending….I’ll believe it when I see it.

In addition, Trump defines himself by the stock market. You can bet your last penny that if the market tanks, the bazookas come out to fix it. Interest rates to zero, QE infinity, stimmy checks, etc. Whatever it takes. Debts and deficits be damned. America literally runs on the stock market. That’s how a large portion of taxes are paid, which the government needs. If fear and panic comes, buy it.

Finally, I think it’s essential to remind everyone how bullish the next 1-4 years are for Bitcoin and crypto. Eric Trump and his son are touting the benefits of Bitcoin and predicting it will hit 1 million per Bitcoin. Their dad is the incoming President of the United States. Don’t overthink it. They’re literally talking about a Bitcoin Strategic Reserve (which I think is likely) where they will buy 1 million bitcoin to hold. If this comes true, bitcoin will hit 1 million dollars per coin easily in the next 4-8 years. Bookmark it.

Also…

Blackrock is telling you to have 2% of your portfolio in bitcoin. Blackrock! 2%!!! Are you kidding me?? So insanely bullish for the largest wealth manager to say this, and the percentage will only go UP over time. First 2, then 5, then 10. Bookmark it.

Also…

Microstrategy is being included into the Nasdaq 100 (QQQ) index fund!!! (Additionally, FASB accounting rules went live (see prior newsletters). This is BIG for corporate adoption!!!)

Nearly everyone has exposure to this fund in their portfolio in some way or another because it’s the best performing index and has all the Magnificent 7 companies in it. Microstrategy will now benefit from those MASSIVE passive money flows that go into it. What are they going to do with that money? Buy scarce bitcoin and never sell it. Here’s the flywheel…

You aren’t bullish enough on bitcoin as a result of this.

Congrats! If you own this index fund you now indirectly own bitcoin! I’ve told everyone they will own bitcoin directly or indirectly within the next decade. We’re getting closer to that reality!

This is a reminder that when you own bitcoin, everyone else who owns bitcoin works for you. We’re all on Team Orange. I worked and made money last week and bought bitcoin. If you own bitcoin, you benefit, because I’m not selling. Michael Saylor got his company included in the Nasdaq 100. Saylor (a billionaire) works for you, too. Do you see how insane this is and what a positive feedback loop it creates??? Everyone is working hard towards prosperity and bringing every other bitcoiner along. The CEO of a massive public company works for you!! Blackrock works for you!! Bitcoin as digital capital represents a productivity index fund for the world. Trust me, you want to own it.

The adoption of bitcoin and crypto and its integration into nearly everything in your life will go into warp speed over the next 4 years. Like the internet exploding in the late 90s/early 2000s, digital assets will do the same over this decade. Bitcoin will be the stalwart, allowing you to supercharge your savings and be the preferred form of digital capital while other digital assets and blockchain rails disrupt legacy companies and financial services.

Basically, the entire traditional finance system is being gutted and replaced by bitcoin and blockchain technology. Being deep in the space, it is so incredibly obvious to me. The analogy is similar to when the Model T car was invented. People weren’t exactly sure at first, and there was some resistance and hesitation, but pretty quickly, everyone saw the benefits. Horses quickly became pets, and super highways were built for cars.

Bitcoin and blockchain technology is the car, and the roads are being built as we speak, but much more quickly over the next 4 years. 99% of people have no clue. I hope this newsletter puts you in the 1%.

Thanks for reading!

Share if you like it!

THIS is Crypto Pulse