Hi friends,

Welcome back to Crypto Pulse, the birthday edition! I’m 41 today, and everything hurts. Good times!

Not a ton going on in the bitcoin realm since the last newsletter. January was fun though!

Price action has now stabilized. I think bitcoin will head back down, but it’s a 50/50 chance…what a bold call! Getting back to 15k will likely take a monumental negative event, the way I see it, and that could come later this year with interest rates continuing to rise to 5 or, heaven forbid, 6%. I stand firm that something will break at those levels. The UK Gilt market broke in October 2022, and magically things have been better since then. It’s not a coincidence. The Fed and US Treasury are putting on quite the show. Bravo. Another possibility I’m monitoring is that bitcoin from the Mt. Gox exchange bankruptcy years ago could start hitting the market this year which certainly could be a negative catalyst (price standpoint only). A good way to stack cheaper sats IMO. Bear markets are a great time for DCA buying.

Otherwise, it’s mostly hard work by developers building on bitcoin under the surface in a bear market when there is no hype - you love to see it.

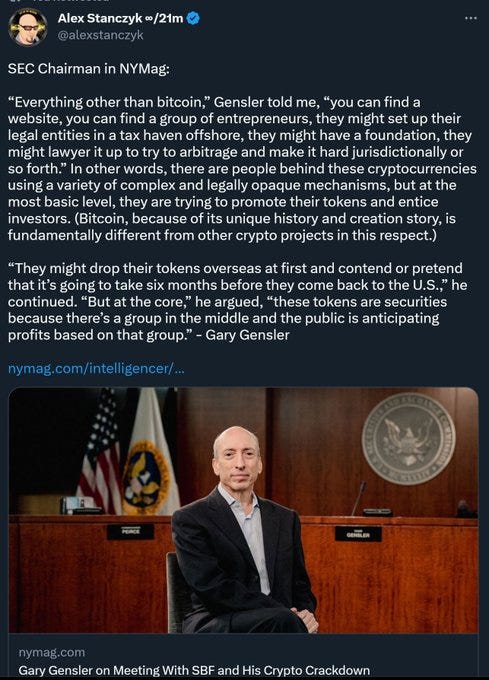

Recently though, there has been a lot of regulation talk driven by the SEC.

This has the potential to be favorable for bitcoin and problematic for altcoins. There will be no quick/easy decisions, so I’m just casually monitoring things. Stay tuned. We’re moving into the “then they fight you” phase of crypto. Things might get ugly, but I think much less so for Bitcoin. Time will tell.

Finally, Silvergate bank seems like the next casualty in the crypto banking world.

Unclear what/who this will impact. Lesson? Playing fiat games in the crypto world will bankrupt you quickly. Play stupid games…win stupid prizes.

NYKNYC. HODL.

On to the newsletter…

I read an article the other day about “how to orange pill a no-coiner” which inspired me to write my own version given what I’ve learned over the years. Orange pilling (because the bitcoin symbol is orange) basically means how to enlighten someone who doesn’t own any bitcoin and likely sees it as a Ponzi scheme. It’s not easy, and many will never take the pill - and that’s okay! It’s a free country; all I can do is offer my expertise free of charge. They can take it or leave it, as I certainly could be wrong. After all, I’m just a simple ER/Crit Care doctor who loves Bitcoin and saving money.

My hope is that this newsletter gives you a more approachable/concise/memorable framework to discuss bitcoin when people ask YOU about it so that you can do some orange pilling yourself.

Start with the “why”

Just like when I teach medical students, residents, and fellows, everyone is different in how they learn and what inspires/motivates them. Each individual is unique in that regard, and you almost have to have some insight into what makes them tick to be successful at orange pilling. No easy task. But just having a basic understanding of where they live (USA for most), their age, their financial status (very generic sense - wealthy, middle class, poor), financial knowledge (high, medium, low), and asking them WHY they’re interested in bitcoin will often be satisfactory. Anecdotally, many people are so fed up with the fiat system they talk themselves into bitcoin. They just didn’t know the answer they were seeking already existed. Those are fun chats.

Why are these points important? At a zoomed-out level, orange pilling a young woman in Nigeria who is poor with minimal financial knowledge is very different than orange pilling a retired, highly financially literate, ultra-wealthy boomer doctor in Arizona. Different conversations will need to be had. Bitcoin is becoming global money though, so both are important.

For the purposes of this newsletter, I’m going to focus on individuals in the USA given that is a much more common scenario for many of us, and quite frankly, way way way more difficult from an orange pilling perspective. For the individual in a developing country, statistically likely living in an authoritarian regime or using a hyperinflating currency, orange pilling is much simpler.

Bitcoin practically sells itself. In countries like Nigeria or El Salvador, bitcoin is already money to them. It’s used like money day in and day out for survival. It’s those of us in a privileged position in our great country of America that look at it primarily as speculative only. Something to consider.

Once I know “why” they’re curious about bitcoin, the conversation is much easier and more productive.

The “Frozen” 10

These are the top 10 things I find are most effective when talking to someone in America about bitcoin as a new digital asset and going for the orange pill.

Facts (bitcoin basics, what is money, store of value)

Fomo (greed)

Financial hedge

Forbidden (it’s not)

FUD (energy mainly. ETH/altcoin competition)

Follow the herd - famous investors/institutions

Future generation impact (kids)

Freedom/fairness

Faux pas minimization (action plan if purchasing. ETH/altcoin discussion)

Feasible to buy/store

Depending on their “why,” I may start at different points.

Why “Frozen”? I’ll explain at the end…

Facts

Some people just want to know what the hell it is. They hear “miners” and think people are digging bitcoin out of the ground or something - no joke! It’s best to stay super simple and high-level if they have no real understanding.

Bitcoin is simply computer software code that runs a decentralized open monetary global protocol. Bitcoin, the asset, has scarcity like gold, but it’s digital, with a fixed supply of 21 million coins (that probabilistically cannot change), and there’s a set distribution schedule. Computers (aka miners) across the world are competing every ~10 minutes to earn a bitcoin reward. If they win the competition, they earn a pre-defined amount of bitcoin for their work and have to update a ledger of global transactions that are approved by other computers (nodes) around the world to make sure no one cheats and every bitcoin is accounted for. This makes bitcoin a decentralized monetary network where truth > trust. That paragraph makes 99% of people’s heads explode.

To be honest, I don’t think these conversations are very worthwhile or productive unless the person is REALLY into the tech and has done some basic reading. People need to go online, read some intro articles and watch some videos to “get” what bitcoin is/how it works. Some of the original Crypto Pulse articles are great for referencing and sharing!! They need to put in the work. Everyone does. If you don’t, the volatility will wash you out.

The hard reality though is that most people will never really understand bitcoin even if given all the facts. It’s frickin’ complicated! I consider myself basically an expert, and yet much of it is beyond me, given the physics and computer programing involved.

It’s an amalgamation of many disciplines and honestly requires a lifetime of study -

and that’s okay. A basic understanding is plenty good enough.

For some reason though, people feel the need to have to understand the intricacies of bitcoin technology to trust it (which is hard), but they buy a stock without ever reading the company’s financial statement and don’t understand what happens behind the scenes when they buy it on Robinhood and are getting shafted. They trust the system implicitly despite endless shenanigans. Bitcoin has been working flawlessly for nearly 15 years despite everything possible trying to kill it, and it runs 24/7/365. Most companies people throw their money at can’t say the same.

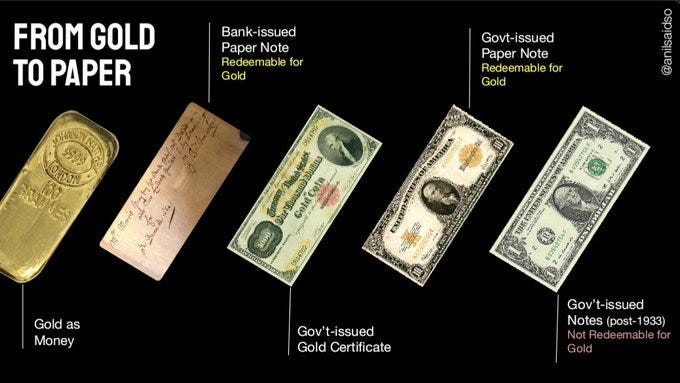

Truthfully, most of the initial conversation needs to be spent on what money is and not the technology. If you pull out a dollar bill and ask what this is and how it came to be, 99.9% can’t answer it.

Once you truly understand what money is, specifically what fiat money is (compared to gold and other historical forms of money), the bitcoin lightbulb starts to flicker on. Money that is backed by energy. Money that has a cost to produce. Money that anyone can earn. Money that no one controls.

The properties of money which bitcoin has are the best that have ever existed.

That is bitcoin’s intrinsic value, its superior properties as money. That’s what it’s backed by (in addition to energy and the largest computer network on earth).

It doesn’t need the guns of the US government, as most believe, just like gold never had any guns backing it. Gold is scarce and pretty and worth 10 trillion as an asset class because of those two things. Bitcoin is more scarce but has no beauty. However, it’s digital and moves at the speed of light on a decentralized open monetary network…a gold killer.

Just like Google maps wiped on Rand McNally maps, digital items have immense value. How much more would you pay for a map that talked to you, re-routed when you got off the wrong exit by accident, told you where a gas station was, updated every day with new roads/construction, and saved you time by offering you multiple route choices to your destination? 10x? 100x? More? That’s bitcoin’s value proposition analogy compared to gold. Bitcoin isn’t a Ponzi scheme or a bubble. In an ironic twist, it’s the needle.

As more people (millions upon billions) agree that bitcoin is the best money, it becomes that. Money is whatever people agree that it is. The government can slow the process down (and they will try), but ultimately, it’s what the people decide. In jail, it’s cigarettes. Before gold, it was salt. Money is simply a technology, and it changes over time. We are just at a fascinating and critical juncture in history where fiat money is failing as trust breaks down and the world slowly transitions BACK to a sound money standard - but this time it’s bitcoin, not gold. Fun times!

As boring/painful as a discussion is about what money is, it needs to be had for any realistic orange pill chance. Almost all subsequent points refer back to that to some extent because that’s what bitcoin is slowly becoming…money. Nothing more, nothing less.

I generally find after a primer on what money is and a brief bitcoin technology overview (if they’re interested), discussing bitcoin as a store of value (SOV) is next up. This makes logical sense to a lot of people in the developed world. Bitcoin isn’t “money” in the US yet because it can’t be exchanged easily given tax consequences and extreme volatility. That will get resolved over many decades. Regardless, what bitcoin is right now is a supreme SOV. The “apex predator,” as some say.

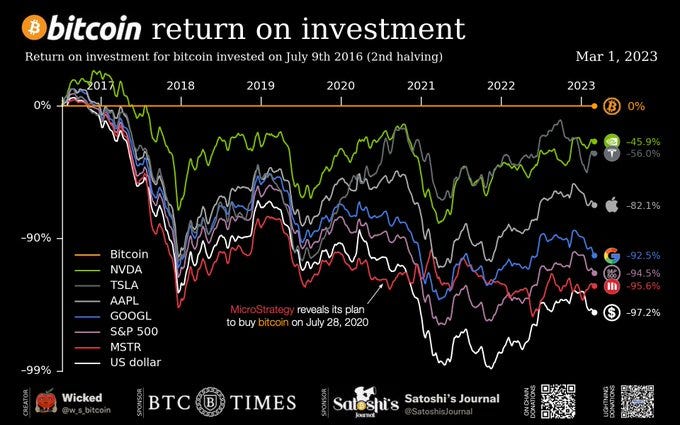

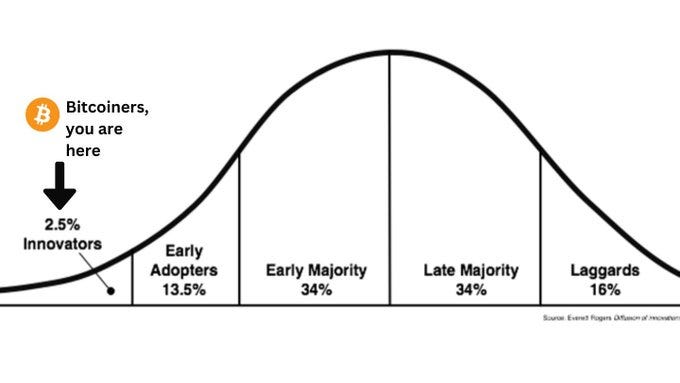

Important to note in the “what is money” segment, something can’t become money until it’s recognized by the majority as a good SOV. Gold went through this same transition that bitcoin is still in. It just makes for volatile times as people learn about this new technology at different speeds. As a SOV, it’s easy to compare bitcoin to any other asset class and claim superiority. Take for instance the returns of investing your bitcoin in something else on the below date. Ouch! Gold is down like 97% (not on the chart).

This is another lightbulb moment for many, but a bitter pill to swallow simultaneously. Over a long time frame, it’s the best SOV and will protect your purchasing power the most. It’s not a quick cash grab. That’s how supreme SOV assets are supposed to work. It’s not about how much the asset goes UP in nominal terms but how much purchasing power it gets you in the end. Nothing beats bitcoin.

Every other asset class has infinite or near infinite supply compared to bitcoin’s fixed supply. Try for yourself! Cash? Infinity! Stocks? Infinite. Bonds? Infinite. Commodities? Near infinite. Real estate? Infinite (just build higher). Land? Near infinite for our population size. Collectibles? Okay, maybe this one has some finite characteristics such as rare vintage cars or baseball cards, wine bottles, etc. But let’s be honest, this is a tiny market in the grand scheme of things and is highly illiquid and subjective. Compared to bitcoin’s liquidity and daily mark-to-market value, it’s no contest. How about other cryptocurrencies? None with a certain finite amount like bitcoin and similar network effects.

So there you have it. You can store your time and energy working the daily grind in an asset with no theoretical maximum limit which ultimately decreases your percentage of the asset pie over time unless you keep buying more/doing more…OR

…you could click a few buttons on your phone and buy bitcoin and avoid all the headaches that come with all these other assets (that basically require you to hire someone to help you they’re so complicated). Your ownership of the pie is fixed, there is no counterparty risk, you don’t have to do anything with it, and you can sell it all on a Saturday night if needed in an emergency. Try that with land/house/stocks.

Bitcoin is a black hole as a SOV asset. It will suck the monetary premium out of all these other asset classes over the next few decades when people wake up to the ease and finite nature (true digital scarcity) of bitcoin. Everyone seeks to store their wealth in scarce hard assets as fiat money prints to oblivion. Bitcoin is simply the best, but 99% don’t get it yet. It’s so easy to do people just can’t believe it. Take advantage of being early.

This conversation naturally leads into…

I always prefer to start with the facts and what is money history, but frankly, most people aren’t interested in that. They want the returns.

As stated before, this is where “know your audience” comes into play the most. A retired wealthy individual or even a middle-class person living in the US isn’t worried about hyperinflation or not having a bank account or having their money seized. They care about investment returns and achieving financial independence. It doesn’t matter how well they understand bitcoin. At the end of the day, if your friend’s portfolio is going up more than yours because of an investment, you’ll want in. Human emotion driven by greed and envy is entirely predictable and repeatable. It will never change. Fear of missing out on the best performing asset class in human history is a powerful orange pill. People ultimately want freedom of their time. They want financial freedom/independence as quickly as possible, and if others are obtaining that, they’ll try to copy the formula. Stomaching the volatility is easier said than done though.

Compound annual growth rates (CAGR) of 20-100%, a total addressable market of 500-900 trillion dollars, a bitcoin price in the millions - these things which are all certainly possible IMO are what draw people in. Bitcoin is SO much more than just the price, but it’s the price that draws attention, and more attention speeds up adoption. They go hand in hand. Predictions like this…

…although seemingly absurd, actually may not be that far-fetched in the long run and draw new people in. Most get washed out with the volatility, but some new HODLers are born every cycle…like me. Fewer coins of a fixed supply asset with growing demand require the price to increase.

Bitcoin has tremendous upside potential and could lead to generational wealth with even a small investment (<1%). To completely dismiss the best performing asset since 2009, and yet it’s still very early on in its monetization course, might lead even the wealthiest American to regret their decision. But if they aren’t interested in the hype and FOMO (which is a GOOD thing, I’d say), they may be more interested in portfolio/life savings protection.

Financial Hedge

Given all the potential bitcoin has to suck the monetary premium from other assets, it’s almost a SAFER BET to consider allocating at least a small percentage of your portfolio to bitcoin to stay diversified in case it does what I think it will do. Staying 100% invested in stocks and bonds is the equivalent of going all-in on Blockbuster when Netflix was up and coming. It’s potentially RISKIER to have zero allocation to bitcoin at this point IMO if your retirement depends on stocks and bond values to keep going up.

Not only is bitcoin a financial hedge and a portfolio diversifier in that regard, but it’s also a hedge against extreme monetary debasement - something we’re all witnessing in real-time.

Endless QE and the forthcoming of the real Ponzi scheme with social security and medicare insolvency, given demographic/taxation challenges, is something everyone should protect against.

This is legitimate financial repression we are facing, and money will flock to the hardest asset that cannot be endlessly produced - bitcoin.

You don’t buy fire insurance when your house is on fire. You don’t buy disability insurance after you break your arm on the motorcycle. You don’t buy car insurance after you run a red light and total a Porche. It’s too late. Similarly, you don’t buy portfolio insurance once everyone else realizes the gig is up and the fiat system is broke and QE infinity is rolling. Although it will never be too late to buy bitcoin, your capital preservation will likely be severely diminished at that point. Life, home, auto and health insurance cost a small fraction for the peace of mind they bring. I see an investment in bitcoin in a similar vein for the most distrusting no-coiner out there. I prefer to focus on all the other amazing possibilities and upside potential bitcoin has, but often I find bitcoin acting as a financial hedge to fiat mania orange pills many people, and I’m good with that because I believe it to be true.

Not forbidden

After the first few points, the conversation inevitably evolves to, “yea, but they’ll shut it down.” Many people get stuck on this - and it’s a tough one because I can’t provide 100% proof that it’s impossible. When you start to understand bitcoin game theory and how decentralized it truly is, you recognize the only way to shut it down is to coordinate shutting down the internet globally.

Even then, bitcoin has backups that keep it going. It’s the cockroach that won’t die.

Unlike every other altcoin, what founder or CEO will they go after to shut it down? That’s right, there is none, good luck with that. Do they want to try to tax it with 90% capital gains? Great! I’m not selling! The price will go higher! Do they want to shut down the on/off ramps (currently what they’re trying)? Practically impossible given the game theory and with fintech apps like CashApp. Also, per the “Streisand effect”, the more they try to censor or prevent access to bitcoin paradoxically the MORE popularity it will gain! Argh!! Human nature is funny, ain’t it? Do they want to confiscate it? Oops, I lost my bitcoin in a boating accident.

The writing is on the wall, and they know it, therefore the US government/SEC has legitimized bitcoin as a digital commodity. There are massive businesses built on it with major government officials who own it and support it. The toothpaste is out of the tube. They know they can’t forbid and stop it, all they can do is try to regulate it, and THAT’S FINE! Starting this election or next, you’ll see bitcoin and crypto will become a single-voter issue. Candidates who oppose it I predict will get CRUSHED at the polls. It’s too popular with prime-age voters. This will spur adoption.

The more regulation the better IMO. The common man will trust it more, just like the internet as it became regulated. More regulations will allow more business opportunities which America needs to bolster its GDP. Bitcoin isn’t trying to do shady stuff, it’s just trying to be a SOV and will coexist with the USD for quite some time I think. Likely my lifetime. Eventually, I think fiat will fail, but it will take time and be a gradual move to a bitcoin standard, and by then, bitcoin will be viewed as favorable as the internet is today. It just takes time.

Importantly, bitcoin is in the business of energy. Regulations will spur bitcoin adoption and a concomitant energy revolution the world desperately needs. This naturally leads to….

FUD

You can’t talk about bitcoin without talking about energy FUD. It’s impossible. Everyone and their mother thinks bitcoin is going to boil the oceans. Stop. It’s pure poppycock, and I won’t be belaboring the point here today. Read one of the many prior Crypto Pulse articles for more details.

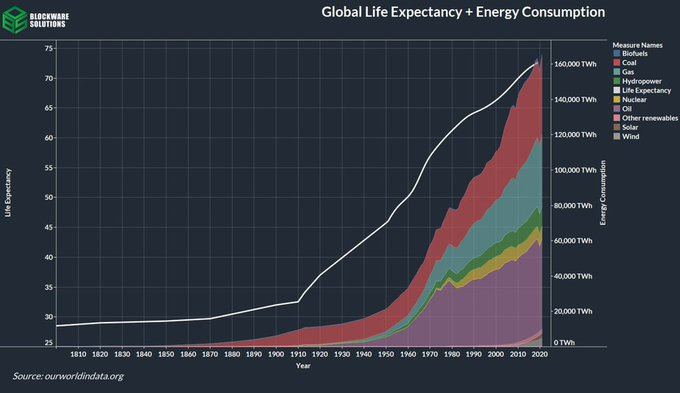

The world needs to use and produce MORE energy to grow and prosper.

Unless you want to go back to the dark ages and use candles and walk everywhere and cook your food over fire, we need MORE energy. Not less. Using less energy is just mean! Imagine if I required you to stop watching Netflix, no cell phone, no hot shower, no microwave use, no dryer use, no Amazon deliveries, and no Christmas lights. What would you do?

Exactly right. I won’t tell you what you can spend energy on, and you don’t tell me. Nobody wants the energy police. If I think using bitcoin as a SOV for my hard-earned time is a good use of energy while simultaneously supporting a global open monetary network, so be it! That’s my prerogative. I won’t tell you to stop watching Tik Tok and using ChatGPT. We must find a way to produce more energy to support the world’s needs and not be energy dictators. Bitcoin is the answer not only to MORE energy production but more efficient energy use (via the use of wasted/surplus energy), and more clean energy use (via carbon reduction techniques and green energy incentives). Whether you’re all about climate change or not, bitcoin mining is a win-win for everyone.

Y’all know if you’ve been reading this that I believe bitcoin and proof of work to be not only the monetary solution the world desperately needs but also the green energy solution as well. I will not back down about bitcoin’s importance to the world when it uses 50% clean energy (more than any other industry and growing)

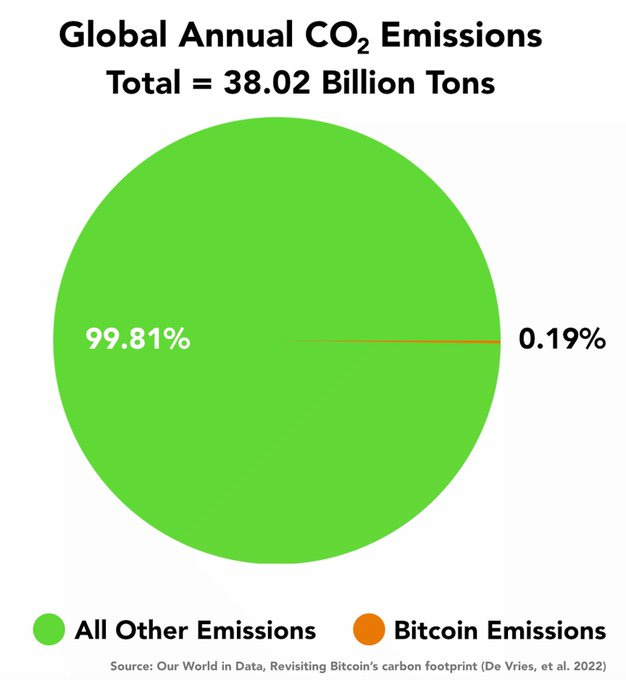

and accounts for .2% of the world’s energy usage.

Give me a break!

And don’t even get me started on Ethereum moving to POS and reducing its energy use by 99.9%. What a load of hot garbage. Congrats on recreating the fiat system with Proof of Stake (rich get richer), eliminating decentralization, and removing the link between the digital and the physical world (energy use via proof of work) which creates actual value amongst all the many other possibilities discussed above. Ethereum knew “they” couldn’t compete with bitcoin, so “they” changed the roadmap to find a new narrative to pump the price. I think that will prove short-sighted.

As the bitcoin mining industry grows, it’s going to become carbon negative (first industry ever to do that - ETH won’t be able to say the same), stabilize power grids (desperately needed for the EV revolution even to happen), produce local jobs, lower consumer’s energy bills, and incentivize new green energy solutions making energy more abundant for all. Watch this video if you don’t believe me.

YES, bitcoin will use energy and a lot of it. GOOD. The more the better. Humans need more energy, not less.

Find the technology that incentivizes new clean energy production while simultaneously mitigating the global carbon footprint and you have the next big thing. Hint hint…it’s bitcoin mining. It already exists.

Follow the herd - famous investors/institutions buying bitcoin

“If bitcoin is so incredible, why aren’t all the smart people buying it? No investment can be that good and so under-recognized; markets are efficient after all.”

Some are, but they’re doing it quietly because the more attention it gets, the higher the price goes given its inelasticity. In addition, given its lack of regulation, many institutions don’t have proper access to hold it on their balance sheet…yet. Advantage - little guy, for now.

Bill Miller, Stan Druckenmiller, and Ray Dalio, three of the most prolific and accomplished investors of all time own it. Not bad.

We’re talking about the who’s who of investors who believe in and own bitcoin for all the reasons above. Even if they’re not 100% sure about it, they own it as a hedge for their portfolio. Rule #3.

Just because Warren Buffet and Charlie Munger don’t own it and don’t like it doesn’t mean it’s bad. They are also 92 and 99 years old, respectively. How easily would your 99-year-old grandfather understand bitcoin if you talked to him today about it? Plus, statistically, at their age, they won’t be alive long enough to see legitimate bitcoin adoption, so it’s not worth their time. Coca-Cola had its days of glory for them and made them billionaires. Coke stock may pay a nice dividend now, but there is no opportunity for generational wealth at this stage of the game. You need to find the next Amazon/Apple/Coca-Cola. My bet is on bitcoin.

Tech-savvy people like Tim Cook, Mark Cuban, Jack Dorsey, and Elon Musk own bitcoin. They aren’t dumb. They’re billionaires who created businesses based on novel technologies.

Obviously just because a famous individual owns bitcoin does not make it a legitimate investment. However, I implore people to understand that some of the most brilliant thinkers this world has ever known buy and believe in it. It doesn’t mean it’s bulletproof, but there is a signal in the noise there. You aren’t the first person to dip your toe into bitcoin waters, there are many others already swimming. The water is warm, it’s okay. If it goes to zero, you, me, and Elon can all have a laugh assuming you didn’t invest your entire life savings. It’s going to be okay.

Future generations

A lot of people when they have kids or obtain a certain amount of wealth are seeking something more in life. They have all they need, and they want to pass something on. They’re extraordinarily lucky in that regard.

Bitcoin is the best answer to this problem, and I find it’s a sizeable orange pill moment for the right person in the right context. They want their kids to be financially unburdened. They want their kids to have a better life than they did. They want their charity or foundation to be able to continue to do important work after they’re dead. They want a legacy.

Setting up a fund earning 0-2% interest is great, but potentially not that impactful in the long run. Sure rates are 5% right now, but not for long, and that’s not even outpacing current inflation! Stocks in an IRA must be sold by their heirs at some point, and most people don’t want to hold on to their parent’s home, paying property taxes and paying for the upkeep.

The only asset that can live on in perpetuity that does not need to be sold (because it’s property), does not incur taxes (unless sold), does not have a physical footprint that is burdensome (like a vintage car), can be easily dispersed and split because it’s digital, cannot be debased like cash, or earn measly ever-changing and likely decreasing interest rates like bonds…is bitcoin.

Passing on an account of stocks to your heirs/beneficiaries is nice and certainly has a place, and is valuable. But subjectively, I don’t think it’s as easy, lucrative, or tax efficient for the above reasons, and most importantly for me, none of these other things leave a mark/legacy. They don’t inspire me at all. “I’ll always remember my grandparents for passing down Autozone stock”…said no one ever. Yea, the money is great, but I want something more.

Maybe it’s just me, but passing on bitcoin literally from generation to generation seems so badass. There’s no way a car or Apple stock will make it that long. Bitcoin will be a prized possession and will leave that legacy mark, I’m convinced.

Freedom/fairness

Not many want to go down this road as it is more of an abstract concept, but to some, it’s essential. They invest with their heart and soul, not just for the returns. I can unequivocally state that investing in bitcoin is investing in freedom and equality. There is no other ESG investment out there that can empower individuals worldwide like bitcoin while simultaneously solving our energy dilemma. We all love America, democracy, and freedom. We’ll even fight for it so others can have it. Buying bitcoin is a vote for individual sovereignty and freedom. It’s apolitical, something I think we need more of in this hyper-politicized world. Bitcoin allows people to vote with their feet. For the first time ever the oppressed can leave with only 12 words in their head and start a new life someplace with their life savings intact. Bitcoin is inspirational in that regard, and despite my coddled life in the US, I buy it in hopes that it is helping others less fortunate as the asset class grows. Remember from a prior article, when you buy bitcoin, you are benefitting ALL hodlers around the world because it’s a fixed supply with increasing demand. The number (price) must go up.

Furthermore, every financial instrument can be used nefariously, including bitcoin. Nobody stops using dollars even though they are laundered and used by a drug cartel, or the internet despite child pornography, because on net they are used for good things and are considered essential. Bitcoin is no different. Sure, a tiny fraction will use it for evil, but they’re dumb because it’s easy to track, so the joke’s on them. They definitely should use dollars, all things considered.

Minimizing the faux pas

I struggle with this one. You can get people close to taking the orange pill, but they juuuuuuust can’t do it. There’s too much fear. They’re frozen stiff.

What do I say?

Reiterate to them you only invest what you are willing to lose. If that’s 10 bucks, great! They get off zero. Use a credit card (I use Gemini, it is legit) and earn some with every purchase instead of airline points which you have endless amounts of, I’m sure. That way, you don’t feel like you’re “buying” it. Some of my BTC rewards are up ~40% from grocery purchases in October 2022. Fiat “points” and cash back can’t compete - soon everyone will realize this. Allocate smart, dollar cost average in. Don’t touch it for 5 years. Those are the rules. Avoid the “buy at the top”, “forced sell” faux pas.

Tell them to consider buying BTC and ETH. Listen, I’m as close to a bitcoin maxi as you can get, but I’m not one. I’m a rationalist. Nothing in life is 100% certain, nor is bitcoin. Most people don’t want to make the wrong choice faux pas - so I tell them to consider dipping their toe in both if it helps. Then, take the time to keep learning and see if you want to change anything. People feel better about this, and I still consider it an orange pill “win”. I certainly explain the risk and the differences between BTC and ETH, hoping it gets people off zero (bitcoin). I think ETH will have a future, exactly what I don’t know, and competition is fierce. Some think it’s destined to obviate bitcoin. I disagree, but I’m not God. I own both, life is about risk mitigation, and this is a tactic. Buying both tends to unlock the paralysis and the journey of endless learning. I support that. They are solving different problems. Bitcoin is solving money, and I think the total addressable market is larger with less competition. ETH is more like a stock trying to expand what’s possible with the internet. A big and noble goal for sure, but fraught with competition (including bitcoin scaling layers) and a roadmap that changes daily. Buyer beware is all.

Is it feasible to buy/store

Yes. See prior article. So easy. Your 99 grandmother could do it.

So there you have it. The “Frozen 10” of orange pilling. Try it out.

At the end of the day, if they still think bitcoin is a Ponzi and going to zero, I give them one more “F”.

JK

Wrapping up…

Oh yea, why “frozen”?

Into the Unknown

It’s kinda corny, but my daughter loves the movie Frozen (shocker), and right now, she’s really into Frozen II.

As pathologic as it is, whenever I hear “Into the Unknown” it makes me think of my first foray into bitcoin years ago and how nervous I was. I stared at it for weeks, frozen with fear! Part of me loves the thrill though, and is always seeking the unknown, so it was a perfect fit for me to buy and learn more. Even still, I had to reconcile these 10 points that froze me to get orange pilled myself. All of these 10 topics have the letter “F” in them, and so does the movie - so I went with it.

Of note, nobody had to orange pill me. I orange pilled myself through voracious reading and podcasts after just being curious about what bitcoin really was. I’m an anomaly in that sense, and I’ve learned what convinced me won’t necessarily work for others. Venturing into the unknown is REALLY scary for most people, ESPECIALLY when it comes to money. People (myself included) get FROZEN with fear. Most can’t overcome it when it comes to money. They’ve been trained that way by financial advisors and the media to “stay with the herd” and buy diversified low-cost index funds. Doing anything else is heresy. Taking a small financial risk is akin to suicide.

Yet people will take risks and skydive, drive after a few drinks, climb mountains, ride a motorcycle, buy lotto tickets and scratch-offs, not wear a seatbelt, never exercise/eat healthy or see a doctor, and try random herbal medicines for their medical issues all day long but wouldn’t dare buy $100 of bitcoin for fear of being “wrong” or humiliated. I just don’t get it.

Thus, one of the final things I discuss is risk and uncertainty. EVERY INVESTMENT HAS SOME DEGREE OF SPECULATION/RISK INVOLVED (even US Treasuries to a very very very small degree). When you buy Microsoft or Apple or some land or a house or invest in a restaurant, there is risk, and you’re speculating that choosing to save your money in that asset will perform better than stashing it in your bank account. Otherwise, why else would you do it? None of those choices are 100% risk free.

The same goes for bitcoin, there is risk for sure. You must accept that and be open minded to the fact that maybe it’s not a ponzi scheme, maybe it does have real-world value that you don’t recognize yet, and it has been legitimized by the SEC and many premier financial institutions you commonly trust today with your money but you just don’t know it yet.

As much as the “why” is important for each individual, embracing uncertainty and risk is equally important. You just have to manage risk according to your life situation and your risk tolerance. A very personal decision.

You also have to admit you could be wrong. I repeat, you have to admit you could be wrong. I was wrong.

You can’t buy bitcoin otherwise, it’s incongruent. Everyone, not one single person, thinks bitcoin is legitimate when they first hear about it. Everyone scoffs and brushes it off. Everyone. As you learn more in your journey down the rabbit hole, your entire understanding of the fiat world suddenly gets turned upside down, and that’s uncomfortable. Given these emotions (uncertainty, fear, humiliation, frustration) are extremely difficult for humans to process and accept, it presents a massive hurdle for many. They freeze. I aim to thaw them and the “Frozen 10” to get them to move into the unknown cautiously. Besides…

That one was for my daughter.

Until next time…

Thanks for reading!

THIS is Crypto Pulse

@cryptofordocs