PANIC!!!!

Bitcoin volatility is back, baby!!!!

From all-time highs about a month ago, and now a “crash” down to 80K as I write this! That’s what I’m talking about! Let’s gooo! For many, volatility is scary. When it comes to bitcoin, you WANT that volatility. It brings action/interest and BUYING OPPORTUNITIES, if you can!

Taking bitcoin from the lettuce hand sellers and putting it into your diamond hands is a wonderful feeling. Highly recommend.

If you’re looking for some grade A “hopium” from me about bitcoin’s future price, I’ll try to give it to you with a dose of reality on the side. Things don’t look great right now, and further downside is possible, but bitcoin often looks dead right before it rips higher. Sellers beware. I feel like this is just a standard Bitcoin bull-market dip. Still, the timing is scary at the end of Bitcoin’s typical 4-year cycle, shaking even the most confident Bitcoiner’s conviction (in the short term).

Without a doubt, it’s been a frustrating year for bitcoin, I get it.

ESPECIALLY with gold being a top performer.

But such is life. Unfortunately, if you want the outsized returns, you have to ride the roller coaster that is bitcoin. There’s no free lunch. It’s a novel technology that is widely misunderstood. You’re just early. You have to endure the volatility.

Suck it up and only save money in bitcoin that you don’t need for at least 5 years. That’s the rule. If your time horizon is shorter than that, you’ll sell at the worst time when I’m buying. Like right now, when there is blood in the streets.

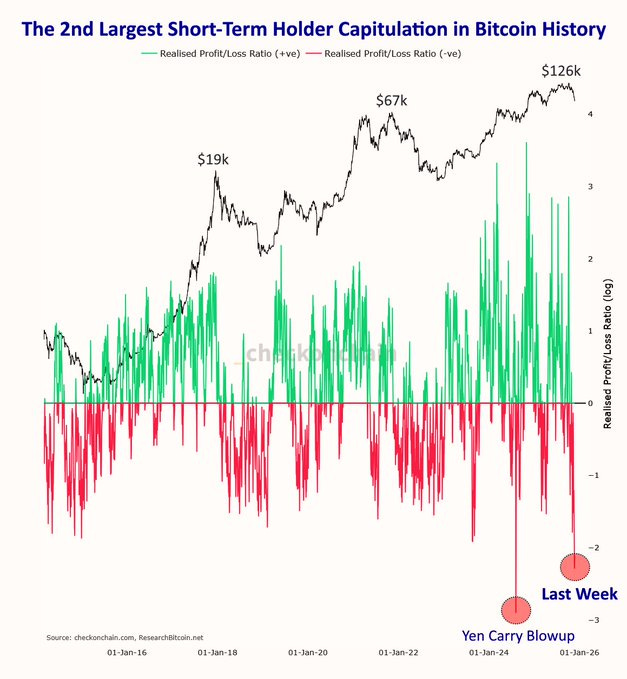

Bitcoin loves to test the short-term holder's (recent buyer) conviction. Most don’t stand a chance, as you can see all the red sellers throughout history. Don’t be another statistic.

If you bought in 2024-2025, you’re being tested. Will you get shaken out like most who have capitulated, or buy the dip? I hope you put in the work to understand why Bitcoin is so valuable, and you BTFD!

I know bitcoin’s price action looks scary, but there’s still 1 month left to close out the year, and it can do crazy things. Most of the gains come in like 10 days out of the year, which is why you just HODL and DON’T TRY TO TIME OR TRADE IT. I personally think we’re near a low of around 80k. 70-75k wouldn’t surprise me. Lower than that would be pretty epic, but not unheard of. I’m mentally ready for it, I can tell you that, but I think it’s unlikely. Going back to 58k would be the most hilarious and ironic outcome. I will be taking out a mega loan to buy more bitcoin if that happens. Part of me wants it to happen so I can buy more; the other doesn’t. Regardless, it’s a win-win scenario if you’re a bitcoin sicko like me.

A primary reason I write this newsletter is to reassure myself and embolden my conviction in bitcoin when times are tough. If I help others out while doing so, great. There’s a reason people call bitcoin “the hardest trade.” It helps me to write down everything I believe to be true at the time to make sense of it all (or at least attempt to) and stay invested.

With that said...

What’s with the bitcoin “crash”?

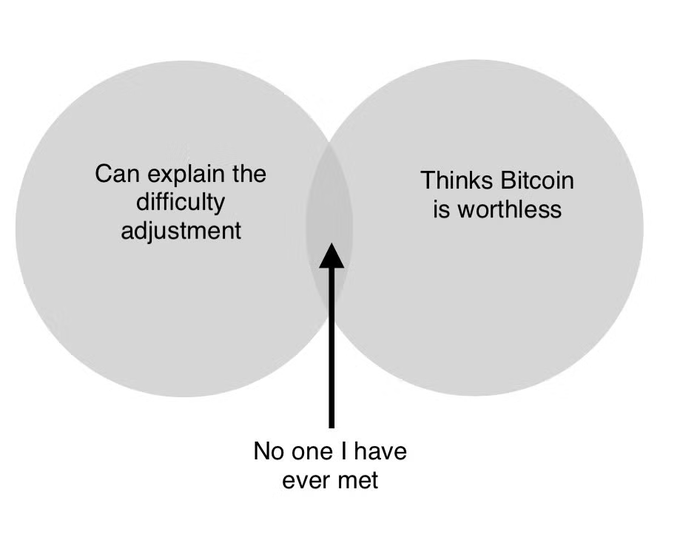

I have NO CLUE. Nobody knows. It’s one of the stranger pullbacks in bitcoin’s history. Certainly, the most confusing for me since I started in 2020. Bitcoin’s fundamentals have never been stronger. Money printing is on overdrive all over the world. Hash rate is at an all-time high. There’s still only 21 million coins. Adoption is growing. Thus, the sell-off is super weird.

There are some likely reasons, though:

Bitcoin typically “crashes” ~30-50% in BULL markets.

This would be a typical painful drawdown. It sucks, but it’s part of the process. HODL. Much of this is just due to excessive leverage that builds up during the bull market, and big market makers rinse them clean for tons of profit now and again. Once the leverage resets, up we go. People love to gamble. Some get lucky, most get wiped out. Avoid leverage/margin and use these dips to buy cheap bitcoin, if you can.

The Fed was somewhat hawkish in its last meeting regarding expectations of a December rate cut (who cares, they’ll just in January). The market was pricing in a rate cut, but after the meeting, it began pricing it out. It just goes to show you, “don’t fight the Fed” is real. It also shows that markets are now one gigantic liquidity and momentum trade, with valuations far less relevant. With Bitcoin being heavily liquidity-driven, I think this triggered some panic and selling.

Big money institutions rebalance portfolios at year's end, even if diehards like me do not with bitcoin. If they started investing in 2024, they may want to book some nice profits.

Maybe they bought the top and want to tax-loss harvest, so they sell. It’s what TradFi does, and even though Bitcoin is new to them, they treat it like every other asset on their books. They’re not looking to make 10- to 100x returns. 20-30% returns are PHENOMENAL to tradfi, and they will book them regularly. It’s a new era in bitcoin, the tradfi/institutional era.

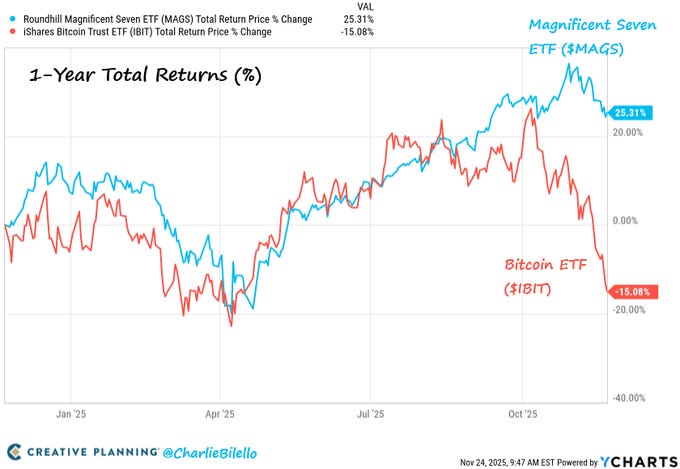

Everyone is flipping out about bitcoin down ~30%, but most stocks besides AI-related plays are down this year too. The Mag7 stocks are pulling the big indexes up single-handedly. It’s a one-sided trade this year. This is bound to reverse at some point.

OG bitcoin whales (from 2009-2015) are selling. A lot. They bought bitcoin for $1 to $1000 and are realizing massive gains. When they bought it, they had a thesis that it could hit 100k. It would change their lives if it did. It has, and so now they are selling some for generational wealth. They won. Can you blame them? I don’t. If bitcoin goes to 200k, would they REALLY be upset not having 2 billion dollars instead of 1 billion?? I think they’ll survive with 1 billion. The bullish part is that DESPITE THE HISTORIC SELLING, which typically would have driven bitcoin down by +80%, THERE IS ALSO HISTORIC BUYING. That is SOOO bullish. There is such a massive appetite for Bitcoin that the price is still around 80-90k, and was at 125k just a month ago. The selling WILL eventually stop. There are only so many OG bitcoiners. However, we are in the EARLY days of institutional accumulation. The demand is only just beginning. Once the selling tapers off, bitcoin rockets higher. Patience.

For the first time, bitcoiners feel at ease under the Trump administration, thanks to his pro-Bitcoin/crypto stance. This allows them to realize gains and sell without fear. I have heard countless stories of individuals “debanked” by prior administrations due to their bitcoin exposure. Imagine realizing millions of dollars in gains from selling, only to have the IRS and your bank hound you and make your life miserable. No thanks. That’s no longer the case in 2025. Banks/ETFs actually WANT their bitcoin, and the IRS is cool with you selling it for profit as long as you pay your tax bill.

The traditional 4-year cycle narrative would advise you to sell Bitcoin in Q4 of the year after the halving (which is now). Many people believe in bitcoin’s cyclical behavior and are just selling based on historical timelines. They may be right, or they could be very wrong. Time will tell. I’m not selling.

There was a massive liquidation event on 10/10 that nobody really understands.

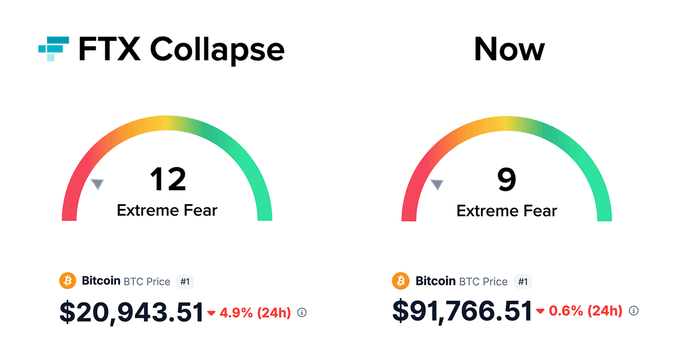

Since then, Bitcoin has sold off hard from all-time highs. There are rumors that a large institution is now a forced seller to cover a hole in its balance sheet. We may never know, but the selling seems forced and very odd. Similar to when FTX blew up in 2022. That was a GREAT time to buy, just FYI.

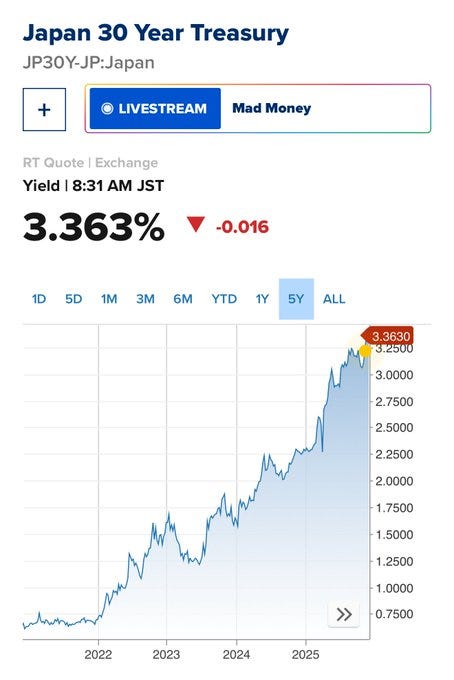

Japanese Yen carry trade likely blowing up again as long-term Japanese bond yields rise due to inflation and money printing.

Similar to the 8/2024 bitcoin “crash”. Weirdly, only bitcoin is selling off, so I’m not sold on this narrative.

Some FUD about MSTR getting delisted from major indexes. Hard to know what’s true there. Just something to monitor.

Fear that bitcoin treasury companies like Strategy and others will go bankrupt like FTX in 2022 and sell all their bitcoin. Specific to Strategy, this is the biggest lie ever told, purely to create panic. No chance. For other bitcoin treasury companies, they may be in a precarious spot if bitcoin keeps nuking and stays depressed, but they hardly own any meaningful amount of bitcoin, so it’s a non-issue in my opinion. Just FUD.

Bitcoin quantum FUD. Yes, I do think quantum computing is a threat to bitcoin. No, I don’t think it will materialize anytime soon. Yes, bitcoin can “upgrade” to combat this. Whenever there is a dump in price, it’s easy to attach a sexy narrative like a quantum computing threat to scare off the tourists.

Other investments, such as AI (primarily), gold, and emerging markets, have been the stars of 2025. Capital rotates to the “hot” thing and the undervalued thing. That’s normal. What’s bullish is that if gold is at an all-time high, bitcoin usually follows and is MASSIVELY UNDERVALUED RIGHT NOW. Yes, even at 80k. Capital will rotate to it, I’m pounding the table on this. Patience. Also, with how deflationary AI is going to be, the amount of money printing to keep the fiat ponzi alive is just going to be mind-boggling. The more money that gets invested in AI and the bigger/better it gets, the higher bitcoin’s price will go, reflecting the money-printing response to AI’s success and concomitant rise in unemployment and deflation. If AI “fails”, a stock market recession of epic proportions will ensue, and the resultant money printing to “fix it” and prop it up will be gargantuan.

The easiest AI trade? Bitcoin. It wins in both scenarios. Bitcoin is the best AI trade out there. You heard it here first.

Tariffs and fear/uncertainty. Bitcoin can be seen as a risk-on AND risk-off asset. When there is fear, risk-on assets get clobbered.

The US government shut down. When the government is shut down, a lot of the normal liquidity (cash) provisions the market relies on stop, causing stress in the system. Bitcoin is actually most sensitive to this (liquidity), not stocks or gold. I think Bitcoin is still feeling the effects of the shutdown, but it will get moving higher here shortly. I could be wrong, though. Nobody knows anything.

Finally, bitcoin is often the canary in the coal mine. It sniffs out issues long before other assets do. Stocks and other asset classes may be about to experience a similar nasty drawdown; it’s just that bitcoin usually goes down first.

There are fears of an AI “bubble,” which is keeping investors on pins and needles as valuations seem awfully rich, but Nvidia keeps crushing it, so the show goes on for now. Bitcoin may be the smoke alarm there, as well as for the private credit markets and commercial real estate.

Also, many parts of the K-shaped economy look dreadful. The wealthy are doing fine, but many are not, and the economic data is starting to show cracks (phenomenal article about the “real” poverty line of 140k for a family of four).

Bitcoin could be sounding the fire alarm there as well. Time will tell.

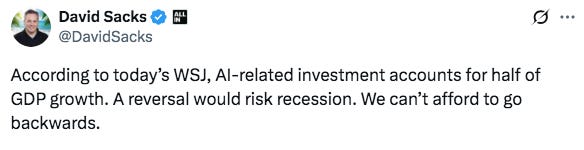

Just a reminder though - the worse it gets, the more they will print to try and “fix it”. If Nvidia and other Mag 7 stocks plummet, it would be an apocalypse for boomers’ retirement, pension funds, insurance companies, etc. These few mega stocks make up nearly 40% of the major index funds. A historic high. They are literally moving into “too big to fail bank territory” if you ask me. Even Trump’s “AI czar” says the same thing:

Ludicrous to think in a capitalist society, but true. Some AI companies are already asking for a federal “backstop/bailout” if it doesn’t work, like OpenAI, even if they now deny it. What does this all mean? The fiat ponzi show must go on at all costs. A steep and sustained >20% market correction is intolerable to the government at this point. This is not debatable. Tax receipts MUST stay elevated to fund the government.

So as you can see, plenty of reasons for a “crash”, but…

What about the bull case?

Whenever Bitcoin’s price is going down or sideways, I look at Bitcoin’s fundamentals, and they are rock solid as ever. Nothing has changed. Everything for the bull case has only gotten stronger. Typically, the bitcoin “cycle” would be over this year, but I think it extends WELL into 2026, and maybe beyond. Maybe even the 2028 election season, I kid you not.

Why?

Trump is going to RUN IT HOT.

He knows we need to grow our way out of debt. Spending cuts don’t get you (or your party) re-elected. Mamdani just won the election in NYC, promising free everything. Think Trump noticed that? Suddenly, he floated the idea of 2k stimmy checks...how timely. Even if the checks are from tariff revenue (which is a tax), that negates any impact on shrinking the deficit = more money printing = bitcoin’s best friend.

Fed HAS BEEN CUTTING RATES AND WILL cut interest rates MORE (DESPITE INFLATION ABOVE TARGET).

Does that make any sense? Yes, if you want to RUN IT HOT!

Trump is bullying the Fed to get rates even lower, and the current Fed chair, Jay Powell, is leaving in May 2026 to be replaced by someone Trump prefers. RUN IT HOT!

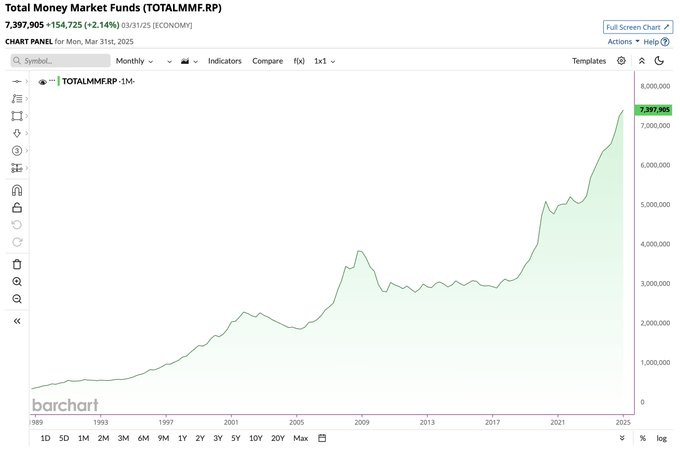

As interest rates gradually decline (a 2-3% target, I predict), the $7 trillion in money market funds getting ~4-5% now will seek to move elsewhere as yields drop to earn a higher return than inflation (2-3%).

Trillions of dollars…say hello to bitcoin/stocks/real estate/gold. Say it with me. RUN IT HOT!

Stimmy checks/housing support likely on the way. How timely right before midterms!!!! Shocking! 50-year mortgages!!! Debt for life!! Woohooo! It’s so sad, but this is what fiat money does to society. Housing is completely unaffordable for the younger generation, and boomers require home prices to stay elevated to fund their retirements. Governments also need property taxes to remain elevated. I don’t know how this resolves, but I believe the only solution they’ll consider is lower interest rates and longer-term mortgages to make payments more affordable, along with other buying incentives. That means higher prices forever. Just what the fiat monetary system requires. They should allow more houses to be built, but hey, what do I know!?!?

End of QT December 1st, per the last Fed meeting.

Fed will likely resume QE or whatever they call it this time in early 2026. I’ll write a newsletter on this when it happens. RUN IT HOT!

Persistent multi-trillion-dollar annual deficits are not going away anytime soon.

US government approval of digital assets (GENIUS and CLARITY bills) in 2026, most likely. Big for bitcoin and crypto.

Bitcoin global adoption is accelerating (banks, countries, pension funds, muni bonds, payments via Square terminals)

.

Bitcoin is getting the green light to be custodied by big banks, and they will recognize it as legitimate collateral.

This is the holy grail for financial SOV assets. Once SOV assets are deemed legitimate and can be used as collateral in traditional finance, their adoption grows exponentially. Taking out a loan against an asset is how the world operates. To get a loan on favorable terms, you need good collateral. Bitcoin crushes all other forms of collateral. It’s pristine. The entire financial system will be rebuilt on Bitcoin as collateral, and it hasn’t even started yet. You’re early.

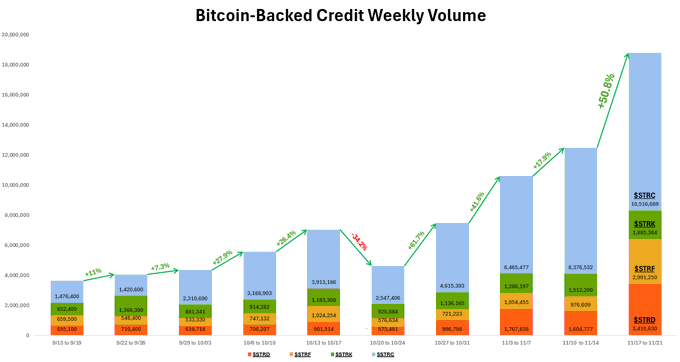

Strategy, which offers digital credit instruments backed by bitcoin, has finally received an official rating from S&P of B-. Although not a great credit rating, an official rating, regardless of its level, opens the door to hundreds of billions of dollars in new capital. Eventually, access to hundreds of trillions of dollars in the fixed income (bond) market. Not only in the USA, but they also just launched their first product in Europe and will soon launch globally. Strategy will buy bitcoin with this new money. Very Bullish. As you can see, bitcoin-backed credit demand is ramping up!

Trump’s OBBB kicks in starting in January. There is going to be so much new money flowing into the economy. RUN IT HOT. RUN IT HOT!

The democrats just won some major early election battles (NYC especially), and you KNOW that won’t sit well with Trump. Why did Democrats win? Mainly because young voters who are broke and can’t afford food, housing, etc., voted for them because they are fed up with the current state.

The candidates promised a bunch of “free” stuff or “cheaper” stuff, just like your high school class president. Nothing is free, though; they’re going to find out. Meanwhile, Trump will do what every party in power has always done when faced with defeat...RUN IT HOT. PRINT DAT’ MONEY. Nothing gets people more excited to vote for you than “free” handouts and stimmy checks, etc. Expect stimulus and promises galore in 2026 to win the midterms. Money printer go brrrrrrrrrrrrrrrrrrrrrrrrrrrrrrrrrr

IF the bitcoin price rises in 2026, people will realize the historical “4-year cycle” narrative of bitcoin is finally dead. So many people right now are afraid that bitcoin has topped because “it always has before in Q4 of the year after the halving”. Thus, they are selling out of fear and historical precedent. They will be wrong in my opinion, and once it is obvious that “cycles” are dead, a massive headwind becomes a tailwind. 2026 might be bananas for bitcoin. I actually hope this happens and bitcoin finishes 2025 with negative returns, just to rip higher in 2026 when everyone is on the sidelines expecting a down year. Bitcoin seeks out max pain for the most holders, and I think this is it.

Finally, a Cold War 2.0 is underway between the US, China, and Russia over trade, energy, and AI. I’ll write about it in my next newsletter. The result? A LOT OF MONEY PRINTING TO WIN THE WAR. WHATEVER IT TAKES! RUN IT HOT! Look what they just released today! Do not fade this!!! It’s no joke.

So there you go, the bull case for bitcoin in 2026. Whatever your targets for Bitcoin are, raise them; just don’t bet on the timeline. That’s my advice. When it comes to absolutely scarce digital gold, which is now being finally recognized as pristine collateral in the traditional finance system, no one is bullish enough, not even me. If bitcoin isn’t going to zero, it’s going to multi-millions per coin on a long enough time frame.

You just gotta zoom out, remain calm, and handle the volatility to get there. Live your life, get outside, touch grass, work hard, and do what makes you happy while stacking sats in the meantime. Don’t save so much that you never enjoy anything because you never know when your time is up, but a long-term savings mindset in bitcoin will treat you right, and your kids, if you have them.

Since 2020, bitcoin is up ~5-25x depending on when you bought it. Returns most investors would kill for. The S&P500 is up in dollar terms, but down badly measured in hard money, like bitcoin. Unit of account matters!

I strongly believe the best is yet to come when bitcoin supply gets even tighter in the coming decades, but it’s still just so early. Every dip is a buying opportunity for me right now. You’ll be the first to know if that changes, but right now, I still see massive asymmetric upside since 99.9% of people I meet have no clue what bitcoin is…

the problem that it is solving…

Or the fact that it hit all-time highs just one month ago!

They like “fartcoin” better.

Either I’m the idiot, or I’m going down as a legend. I wouldn’t want it any other way. Let’s gooo!

Thanks for reading!

Let’s HODL together, no panic. If it keeps dipping, BUY THE DIP!

THIS is Crypto Pulse.