Patience

WTF is going on??? Why isn’t bitcoin at 100k plus by now?? Call the CEO!

I'm sorry, folks, that’s not how it works. It usually involves patience, long stretches of extreme boredom, and brief periods of extreme euphoria. I don’t make the rules.

According to the legend Warren Buffet, “the stock market is a device for transferring money from the impatient to the patient.” This also applies to Bitcoin.

Bitcoin is consolidating after a ~50% increase this year, waiting for the next big move. If that’s not enough for you and you’re stressed out… “you’ve got problems,” as my old high school soccer coach would say. Just R-E-L-A-X. People are freaking out over nothing. Think back a few years.

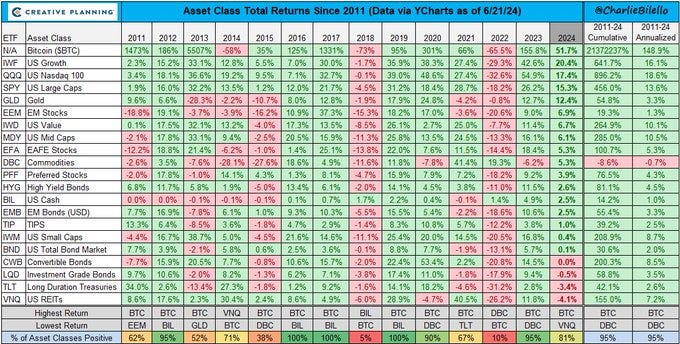

Mind you, the year-to-date percent increase is better than any other asset class in 2024, once again showing that bitcoin is king.

Not only that, but it also has the best RISK ADJUSTED RETURNS (Sharpe Ratio).

Bitcoin is volatile, but more volatile TO THE UPSIDE! Suffering the drawdowns is worth it!

Yes, you could have gone “all-in” on Nvidia as an individual stock and beat bitcoin’s returns this year, but I bet you didn’t. I’m also willing to type out right now (6/21/24) that bitcoin will do better than Nvidia over the next 18 months and 5 years. Nvidia’s current valuation seems preposterous to me.

Do you really think competitors won’t eat into their business and hurt their margins/growth rate?? This new AI chip just launched today! Capitalism and competition are brutal!!!

On the other hand, Bitcoin is back in a DEEP DISCOUNT TERRITORY BASED ON ITS COST OF PRODUCTION, WITH NO COMPETITION.

Does fire have competition? Does electricity have competition? Does the wheel have competition? Does the internet have competition? Of course not. These were zero-to-one inventions that changed humanity. So, too, is the invention of digital scarcity (bitcoin).

“There is no second best!” - Michael Saylor

I know which one I’m buying. I'm excited to look back on this prediction. If I’m wrong, I will buy and wear a Tom Brady jersey when the Bills play the Patriots in 2025 or 2030. The stakes are huge!

But seriously, what is going on with bitcoin’s flat price action? Many things:

Demand:

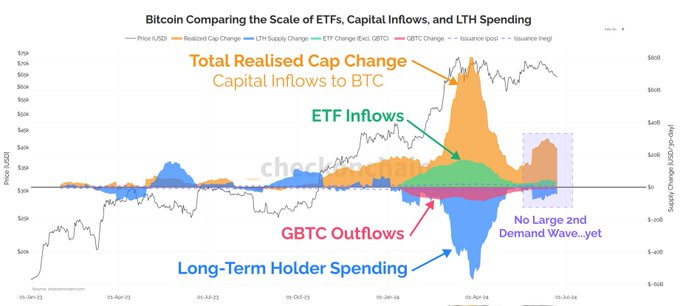

Fundamentally, bitcoin is all about supply and demand. Demand surged with the ETF launch in January. That has cooled off, and we are waiting for the next catalyst/source of demand. There are trillions and trillions of dollars out there still looking for the best store of value.

Just you wait. More demand is coming (401ks, billionaires, banks, pensions, corporations, etc.); it just takes time. PATIENCE!

Mt. Gox

A long time ago (2010-2014), this Japanese exchange abruptly shut down during bitcoin's infancy. Now, a few hundred thousand bitcoins will be rightfully returned to the owners, and many people expect them to sell and lock in huge gains from those early days. I expect some will, but not all. People are freaking out, but it’s not a huge deal. I’m happy for them that they get their Bitcoin back! Zoom out. There are still only 21 million bitcoin. 0.002 per person on Earth if divided evenly. Not much.

Macroeconomics:

The US economy is strong as our government keeps spending like a drunken sailor. Inflation persists near 3% and wages are keeping pace for some, while historical numbers get 2nd or 3rd jobs with ease to keep up given the “gig economy” and ample job openings due to the labor shortage crisis. This allows spending habits to persist.

Things like “buy now, pay later” are everywhere, allowing people to “extend and pretend” and use insane amounts of credit and leverage to maintain their lifestyle. All the excess cash handed out during COVID-19 to people and corporations (PPP loans) is still floating around and driving up prices for housing and anything desirable. Anyone with a savings account is now collecting 5% annualized interest (a pseudo stimmy check), putting more money in their pocket compared to 0% rates in 2020.

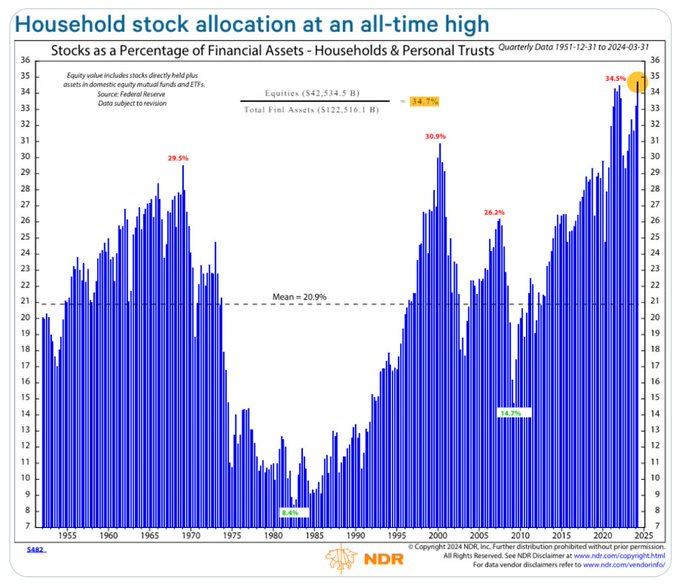

People are being “forced” to invest in the stock market and real estate to preserve their wealth because of inflation—this drives up the valuations to absurd levels that make no sense, but everyone knows “there is no alternative for saving,” so they plow money into their 401k index funds every month without knowing anything about the companies they’re invested in.

High stock market valuations create a wealth effect on the economy, as everyone spends more money objectively when their portfolio is near all-time highs. The American economy and every baby boomer's retirement/nest egg depends on Wall Street now.

All of these things lead to persistent, pesky inflation around 3% (per CPI, but as you know from the last newsletter, the money supply is growing around 7-10% annually, which is NOT CPI). It's funny how non-CPI (non-government-controlled) measures of inflation estimate it around 7-10%. Crazy, right?

This is financial repression at its finest. Convincing and gaslighting you to believe inflation is 2-3% so you’ll buy government debt (bonds) at 4-5% yields, thinking you’re “winning.” Meanwhile, inflation is actually running 7-10%, and no one in their right mind would ever buy government debt (bonds) for any yield less than this! This allows them to inflate away the debt (by printing more money than they are paying out) surreptitiously as bond yields are held artificially low. Reprehensible!

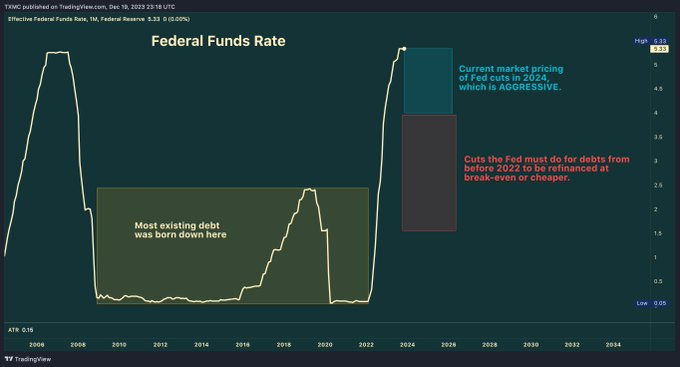

Sticky inflation prevents the Federal Reserve from cutting interest rates back to zero, which they were pre-2022. If they did, inflation would likely go much higher as people spend even more money and take out loans to do so. Bitcoin is still considered a “risk on” investment and is a coiled spring waiting for interest rates to drop. I believe that will start in September-December 2024.

The rest of the world is lagging as the US economy continues to crush it and the Federal Reserve holds interest rates high. Many foreign central banks are cutting interest rates as their economies weaken quickly and need help. Unfortunately, this just makes the US Dollar (DXY) “stronger” because it’s based on relative value.

If the Euro and Yen weaken faster due to their central banks cutting rates while the US does not, the DXY will go higher (but it’s still collapsing against bitcoin, mind you).

A stronger dollar is great temporarily for Americans as we can buy more stuff and travel as our money goes further, but it’s painful for the rest of the world trying to buy nearly everything in dollars with weaker currencies, especially commodities like oil.

A strong dollar also hurts American exports, as our stuff is more expensive in dollar terms. Exports fall off, eventually hurting the American economy when trying to sell stuff to the rest of the world becomes more difficult.

Finally, a strong dollar also causes other foreign central banks to sell US treasuries/bonds to get dollars to buy things like oil. Selling US bonds causes bond yields to go UP, which increases the yield on the 10-year US treasury (the benchmark for the world economy essentially). The higher it goes, the higher your mortgage rate and any other loan goes, INCLUDING the loans the US government is taking out. As you can imagine, that is bad news bears. In my opinion, we are at the maximum that yields can go at this point. Nobody, and I mean nobody, is buying or selling a house that doesn’t HAVE TO at these rates. Banks and big businesses with outstanding loans are starting to feel the pinch this year as debts need to be refinanced, and along with that comes a huge price increase due to higher rates.

All of this is to say that macro is in the driver's seat right now, and the market is waiting for the “all clear” signal from the Fed. They’re waiting for interest rates to start going lower, and for that to happen, inflation needs to show some more improvement from current levels. I’m not sure we’ll get that in the coming months, but I believe the Fed will cut rates regardless, given the upcoming election, and they’ll give some BS excuse about 3% being “good enough.”

Remember, 2% to 3% may seem trivial, but that is a 50% relative increase in inflation!!!!!!!

Macro is king and drives everything. In my opinion, we could be in for some pain over the coming months with bitcoin chopping around these levels or even lower (50s, high 40s maybe), but it’s hard to know. I personally am salivating at these current prices, however. Post-Bitcoin halving, the network and the price of Bitcoin is now UNDERVALUED again at its current state, and opportunities to buy at these discounts don’t come around often.

Take advantage if you can. I’m trying.

Regardless, this meme is not wrong.

BRRRRR is on the way

The global economy cannot survive for long with a strong USD. It’s a chokehold on everything. It must be weak on a relative basis, and BRRR will weaken the dollar as more money is printed, which will be bullish for all assets, especially bitcoin. I have no clue when or what the trigger will be.

(Don’t sleep on the commercial real estate crisis still brewing. I still think this will be it)

All I know is that when the fiat system starts to crack, like in March 2023 with all the bank failures, you don’t want to be sidelined when the money (liquidity) starts flowing. It’s coming, and it will be epic. You cannot keep interest rates at these levels for this long, and nothing breaks.

Every BRRR needs to be bigger than the last to keep the fiat inflationary machine running. When something breaks, you will be scared shitless at the time and want to pull everything out of the market and sell all your bitcoin. That will be a massive mistake as I buy all of your Bitcoin, and it recovers and rockets higher. Stay patient. Stay ready. Stay humble and stack sats in the meantime. HODL. You’re trading infinite fiat for finite bitcoin. It’s a straightforward, no-brainer trade. Don’t “midcurve” it.

Seasonality:

Quite simply, June sucks for bitcoin historically. September is fugly too. Just warning you.

There are many reasons why, and macro is one of them. Corporate tax payments are due in June, draining liquidity from the system, but it all comes roaring back soon enough. Most wealthy individuals who move the markets are on vaca in the Hamptons after May and don’t return until September-ish. “Sell in May and go away” is the phrase. The summer is usually pretty boring, so go outside and live your life and stop worrying about the price of bitcoin (I think I’m just talking to myself here).

Bitcoin miner capitulation:

People say that the bitcoin halving is priced in and doesn’t matter. I still say they are wrong. Right now, we are witnessing exactly why bitcoin halving matters. The weakest miners with the highest costs are selling their bitcoin hand over fist to keep their operations running. This is why Bitcoin is so special: It is ANCHORED TO THE REAL WORLD.

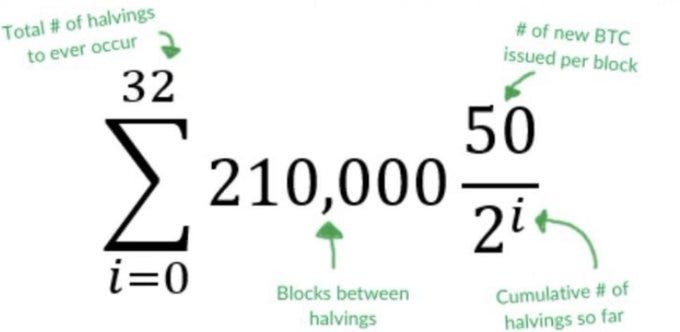

There are costs to mining bitcoin. There are essentially no costs to mining Ethereum or any other altcoin. Ethereum is not tethered to the real world with real costs in any significant way. That makes its true value in my book = approximately zero. There has to be a cost of production, and eventually, all prices trend towards the cost of production if we allow technology and capitalism to do their job. Luckily for bitcoin, due to the halving every 4 years and the difficulty adjustment ~every 2 weeks, the cost of production is going UP FOREVER!! The only commodity ever to have this property! DO YOU GET IT YET??

Electricity and ASIC hardware to mine bitcoin have significant costs associated with them. If you can’t pay your bills, you can’t mine bitcoin. Thus, after the bitcoin halving, where miner revenue got cut in half (6.25 to 3.125 bitcoin per block), they are now hurting for profits and selling any and all bitcoin they have to pay their mining costs. This selling pressure is a huge negative on the market until it abates. When does that happen? When they run out of bitcoin to sell and close up shop. That could take a few more months, maybe longer. At some point, however, they will cry uncle as their costs > profit from mining bitcoin. Then, after they shut down, the most efficient and low-cost Bitcoin miners will remain, and the selling pressure will ease up. Bitcoin price moves higher as now demand > supply/sell pressure. Rinse and repeat every 4 years.

The halving IS and will always be an important 4 year event. Don’t fade it. Only the strongest miners survive.

Lifestyle:

At the end of the day, we’re all human. We have hopes, dreams, and desires in the REAL WORLD. Some people want a nice car or to take a nice trip. Some people have debt and expenses to pay. Whatever it is, we live in a fiat world and need to make ends meet and, at times, buy things that make us or someone else happy.

Bitcoin is the best vehicle for doing that over long periods of time, and that is exactly what is happening right now. People who bought bitcoin 10 years ago are selling. You can see it in the data (long-term holder spending).

They didn’t sell in November 2021 and kicked themselves when it dropped to 15k. They promised themselves or their loved ones if it ever got back to that price they’d take some profit and enjoy their gains. It happens every cycle. Good for them! They used bitcoin as a revolutionary technology for savings, benefiting them tremendously. Now, they get to spend their savings on whatever they want. That is exactly what savings are for. This adds further sell pressure on the market until they are finished buying their lambos or whatever else they desire. It’s the cycles of bitcoin, just accept it and be happy for them.

It’s also how bitcoin gets naturally distributed.

This brings me to a question I received and often hear that I will attempt to explain:

“If 19 million bitcoins are already distributed and owned by a relatively small number of people and the remaining 2 million bitcoins will mostly be bought by mega-corporations, how does that solve anything? Isn’t that just another form of inequality and power/wealth hierarchy? How does the little guy benefit with a fraction of a bitcoin?”

Before I begin, if you’re interested in this, it means you’ve gone deep into Bitcoin. You’re interested in more than just “number go up.” You came for the gains/money but stayed for the revolution. That excites me. That is why I’m still here.

The answer to the question boils down to this:

It doesn’t matter how much bitcoin you have; you don’t exert more control over the monetary network than anyone else.

No one can make more bitcoin, including you, despite however much you have. You also cannot change the monetary policy or influence the rules. Michael Saylor, CEO of Microstrategy, owns 1% of all the bitcoin, and he has just as much say and control of the bitcoin monetary protocol as I do. That is NOT TRUE in the fiat world where the richer you are, the more influence you have on money creation and distribution. In addition, the mega-rich are privileged to the printed money first and all the perks that go with that (Cantillion effect). This exacerbates social inequality, causes the breakdown of the social contract, and leads to civil unrest.

Bitcoin is egalitarian in that it affords everyone an equal opportunity to buy and save it, and then it’s up to them to make the most of it. There are no favorites, the rules are transparent, and the system is audited every 10 minutes to verify them. They don’t change for anyone, no matter how much Bitcoin they may already have.

Contrast that to Ethereum, where the more ETH you have and stake, the more ETH you get! It’s literally fiat reincarnated on the blockchain; no thanks!

Yes, on a bitcoin standard there will be winners and losers. There will be bankruptcies and crime. It will not be a utopia. It will be pure unadulterated capitalism – which is brutal, but ultimately pushes society forward at a blazing pace where good investments are rewarded and bad ones are punished and discarded. Pain and loss are actually realized and not papered over by fake fiat printed without consequence in the short term, but ultimately leading to inflation in the long term. There will be mega-rich bitcoiners and those with much, much less. The key is that it will be fair. All bitcoin will be earned. There will be no favorites, secret deals, or handshakes. Wealthy people will have clearly earned it, and you can respect that. Importantly, per my last article, everyone will be on the same team. If the wealthy bitcoiner makes a good investment and saves excess returns in bitcoin, the little guy who also saves in bitcoin will benefit from that and vice versa because of the fixed supply.

Over decades to hundreds of years, bitcoin will continue to disperse from ‘whales’ to the little guy, and some will be accidentally lost along the way. I know it’s nearly impossible for most people to think past next week, but Bitcoin allows you to think far, far into the future with a fixed monetary policy that can’t be changed.

“Bitcoin is a beacon of predictability in a world where you can’t predict anything.” THAT IS THE REVOLUTIONARY BREAKTHROUGH!

I get laughed at occasionally with my analogies, and rightfully so, as many of them are bad, but I’m just trying to find ways to relate a complex technology to something people get easily.

Recently, the constant that is Bitcoin has led me to fixate on its comparison to a ruler and what that technology allowed humans to create.

Imagine trying to build a house with a ruler that changes every day or every hour. One minute a foot is 12 inches, the next it’s 6 inches. Can you imagine trying to do that?? It would be nearly impossible, and whatever you eventually create would likely collapse and kill everyone.

With the advent of the metric/Imperial system, a standard measuring system was created that never changes, which allowed humans to build unimaginable things with a simple ruler.

1 foot = 12 inches. Forever. Everything can be measured against this for accuracy and used as a reliable reference point.

Similarly, money, which is THE MOST CRITICAL TECHNOLOGY IN ALL OF OUR LIVES THAT WE USE EVERY DAY, NOW HAS A STANDARD MEASURE.

21 million bitcoin. Forever.

Now, instead of measuring things in US fiat dollars with a constantly changing denominator that is going to infinity, the price of everything can be measured against 21 million bitcoin. It’s that simple. Bitcoin becomes your unit of account - a key component to the definition of money (store of value, medium of exchange, unit of account). A fixed monetary supply that no one controls and no one can debase. It may seem ludicrous to you that a fixed reference point for money will benefit humanity, but without accurate/reliable price signals, everything is distorted and confusing (the current USD fiat system). This creates societal unrest, inequality, and capital misallocation (poor investments). Bitcoin fixes this.

Fix the money, fix the world.

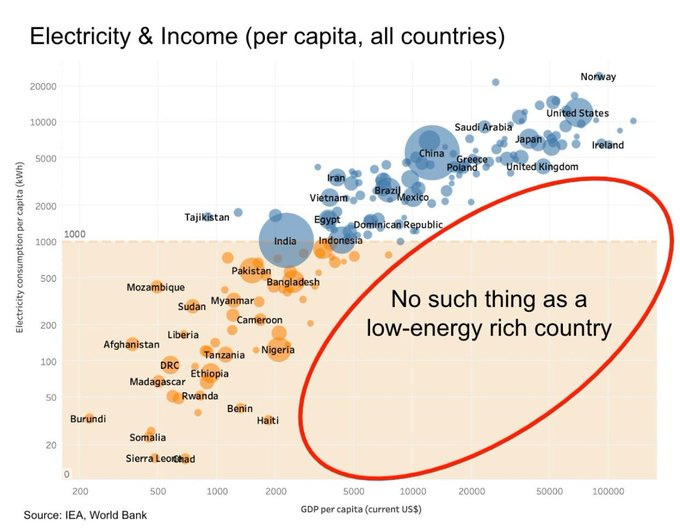

Bitcoin is humanity's most significant breakthrough since the invention of electricity or the Internet. It will change everything because money is critical in our everyday lives. It’s more critical than the Internet and maybe equal to electricity in terms of significance…but you can’t use electricity without….MONEY!

Humanity in 1000 years will look back on this fiat experiment of today with laughter and disdain. “A few fallible humans controlled the price of money?? There wasn’t a fixed supply to measure anything of value against?? The government could just print money out of thin air, give it to their friends, and spend it on whatever they want?? There were > 150 fiat currencies being used in the world at the same time all being debased at different rates?? There was no cost to producing money and no tie to energy?? People put up with this nonsense?? Why?? I can’t believe they lived like that!!! No wonder there was so much social unrest and inequality.”

News and notes:

I touched on it in the last newsletter, but Trump is now full-court press pro-bitcoin and crypto.

He even distinguishes between the two and discusses your right to self-custody them if you want. Do you still think they’re going to ban it?!!

This has put the fear of God into the Biden camp, and they are trying to pivot as quickly as possible, but it’s too little too late. They’ve built their entire campaign and spent the last 4 years being as anti-bitcoin and crypto as possible. Because of that, massive numbers of wealthy pro-bitcoin, historically Democrat, donors are donating and voting for Trump. I always knew bitcoin would sway a presidential election, I just didn’t know it would be this one. It’s insane what a “magic internet money” coin is doing 15 years later when you think about it.

Being anti-bitcoin will be known as political suicide. It is game theory at its finest. It doesn’t help you to be anti-bitcoin (nobody will vote for you because you don’t like bitcoin in my opinion), but it will absolutely kill your campaign if you oppose it as millions of voters WILL NOT vote for you if that’s the case, and your opponent will use it against you. Climb aboard the bitcoin train because you can’t stop it. Vote with your wallet! Vote for bitcoin! Bitcoin is the honeybadger, and it DGAF!

It’s gone from zero to the 13th most valuable money in the world in 15 years with no marketing campaign and no CEO.

Just a pure grassroots movement that is spreading like a virus.

Where will it be 15 years from now? I’ll put it at number 3.

Michael Dell, the 14th-most wealthy man in the world, is tweeting about Bitcoin and its value/scarcity. Is he secretly buying it?

Remember, “all your models are destroyed” when a few billionaires decide to allocate meaningfully to this novel technology. Don’t say I didn’t warn ya.

Given the limited supply, all it takes is a few egotistical billionaires battling each other for who owns more Bitcoin to send the price to the moon. Michael Saylor continues to buy more publicly. Your move, Mr. Dell.

More news has come out regarding university endowments, banks, and pension funds allocating to bitcoin.

This is all bullish. Eventually, every person, business, bank, pension, endowment, nation-state, etc., will own bitcoin. You may even own some now without even knowing it! The other day, I checked my Roth 403b account and looked into the companies in a Vanguard small-cap index fund I own (Ticker: VSCPX).

Microstrategy! 3rd largest holding of the index.

If you own this index fund, you own bitcoin by proxy via Microstrategy since it’s basically a bitcoin ETF holding company. Congratulations! Welcome to the bitcoin club!

Ethereum spot ETF should begin trading the first week-ish of July. Please read the last newsletter for full details, but my TLDR is that I predict paltry inflows and a sizeable price decline as many ETH holders sell. I give this prediction a 50/50 shot, so I will not be betting wearing a Tom Brady jersey on it. Stay tuned.

Bitcoin miners and AI

Finishing up, I’d like to take a minute to gush over Bitcoin mining, how amazing it is, and its synergy with AI.

Like Oreo cookies and milk, bitcoin miners and AI are a perfect match. I could not be more bullish on bitcoin mining and the future of our planet and how it integrates with yet another revolutionary technology – artificial intelligence.

Unless you’ve been living under a rock, you most certainly have heard of AI over the past year and how transformative it will be. Most technologies are overhyped and under-deliver. I don’t think that’s the case with AI. ESPECIALLY IN MEDICINE. I think AI will transform our daily lives in ways we cannot imagine yet, but I can clearly see what it will do in the field of medicine, and it will be insane. More than any other field, medicine will see the greatest impacts of AI as we enter the Golden Age of Medicine. Everything before now will seem incredibly primitive. More primitive than ventilating patients with an iron lung.

AI technology will be mandatory to realize the Golden Age of medicine, and access to cheap energy/electricity is the key to unlocking it.

Enter bitcoin mining.

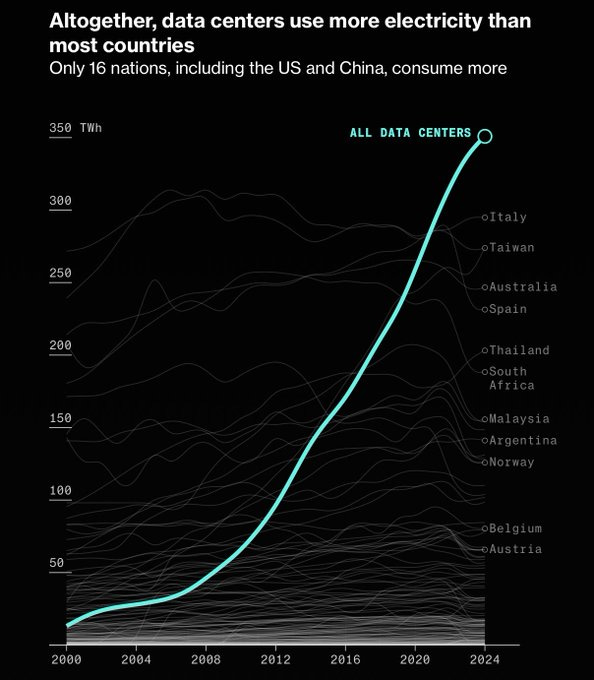

Like most technologies, AI is currently constrained by real-world costs and scaling issues. AI needs energy and lots of it.

These computer data centers require WAY more energy than the Amazon/Google/Microsoft data centers that run the internet cloud services on which you store all your files, cat pictures, and memes.

AI data centers do more intense computing as they train complex models that spit out…HAWK TUAH (I had to)…

images and texts with accurate results no matter what you ask. It is extremely energy-intensive compute, orders of magnitudes higher than current data center requirements.

Now, let’s think for a second. What industry also runs an incredibly energy-intensive business that seeks access to low-cost electricity? Hmmmm….

Bitcoin mining!

Starting to get it? Companies like Tesla, Amazon, Apple, Google and Facebook are racing to acquire energy in order to train their AI systems.

Energy is a real-world constraint, and bitcoin miners know this firsthand. Bitcoin miners are now partnering with AI companies to provide them access to their land, data centers, and cheap (often renewable) energy to train their AI models. Bitcoin miners have been ahead of the pack for years, actively seeking out low-cost energy for their Bitcoin mining operation, and now another mega-revolutionary technology is also in need of that same thing.

Bitcoin mining is the PERFECT SYNERGISTIC TECHNOLOGY to combine with AI data centers training their models because bitcoin mining can be turned off immediately (called demand response program) while simultaneously subsidizing the cost to build and sustain these AI data centers. Why/how does this work?

AI computers need to run 24/7, just like cloud servers today. When you want your cat photo, you want it now, not 30 minutes from now. Similarly, AI models need to ingest and train on data nearly constantly and then answer the questions you ask them without fail or downtime.

Energy is always over-supplied at data centers because you always prepare for more DEMAND than you think you’ll have in case of a surge in demand. Just like electrical grids that supply energy to your house, they OVERPRODUCE electricity so that when there is a spike in demand when everyone turns on their AC, they can meet that demand and not blackout the region. When the demand is not there, the energy IS WASTED. LITERALLY WASTED.

Enter bitcoin miners

Bitcoin miners happily step in and buy/use that wasted energy. You will come to understand that NOT bitcoin mining is WASTING energy. Again…NOT bitcoin mining is WASTING energy.

Imagine if all the wasted energy created by this dam in Minnesota had gone to earning bitcoin. It could have paid for the upkeep of the dam, preventing it from failing over the years (they couldn’t afford the repairs) while simultaneously lowering energy costs for the surrounding counties!

HARNESSING THIS TECHNOLOGY (BITCOIN MINING) IS A NO-BRAINER!!

Bitcoin miners are the energy buyers of last resort. They want the cheap, wasted energy that nobody else wants or can use. It can be the energy produced in downtown LA at a data center or in the Sahara desert, it doesn’t matter to bitcoin miners that can go to wherever the energy is the cheapest and most abundant.

When AI data centers need a partner to subsidize their cost and buy their wasted energy when they’re not using it, bitcoin miners step in. When AI data centers need bitcoin miners to turn off because there is a surge in AI demand, bitcoin miners will happily do that in a few seconds….for a small fee, of course. No other technology today can offer curtailment in a few seconds without significant real-world consequences other than Bitcoin miners. They literally have a monopoly in this realm. Can you imagine a hospital or an office building powering down instantaneously when the grid or a data center hits peak demand and they ask for someone to lower their energy consumption?? No chance!!

It is a match made in heaven: Bitcoin mining and AI. It is a serendipitous partnership that is almost too good to be true. It is hard to believe both technologies came into existence and have real-world demand simultaneously. I’m not really religious, but this is outright divine if you ask me.

The beauty of Bitcoin miners is that it’s not just AI data centers that they partner with and make more resilient and economical. I could go on for hours talking about bitcoin mining and electrical grid demand response programs, renewable energy program synergy, and environmental benefits, but I’ll save that for another day.

Just know that bitcoin mining will change the world and eventually make energy so abundant that it’s nearly free or is free. It does this because it ties money (bitcoin) directly to energy and subsidizes and incentivizes low-cost (often renewable) energy production, making it more abundant, which drives down prices. Can you imagine a world where energy is free? Can you imagine the productivity of human beings in that scenario and the increased standard of living for all?

I can, and it’s coming, hopefully in my lifetime.

It’s not just energy costs going to zero because of AI and bitcoin mining, but many other things, including intelligence. Within a decade or two, AI will be able to answer nearly any question anyone has…for zero cost. I just don’t think anyone can comprehend how disruptive that is to our current fiat monetary system that requires inflation and higher prices. The disruption and DEFLATIONARY FORCE that AI, robotics, and other technologies (including bitcoin) will bring over the coming decades is unfathomable. That isn’t even factoring in the world’s demographic crisis and collapsing fertility and birth rates. Less people = less demand = deflation.

You will want to own something that lives outside the inflationary fiat monetary system and benefits from deflation. Something digital, infinitely divisible, can’t be duplicated for zero cost, and is mathematically finite. A commodity that is engineered for its price to go higher over time. Something that will be used by AI and other machines for payments and energy synergy (as discussed). There’s only one thing, folks—Bitcoin.

Owning bitcoin DIVERSIFIES your portfolio. Your entire portfolio (stocks, bonds, real estate) currently depends on inflation. As just discussed, we have a tsunami of DEFLATION not far offshore. I’m screaming at everyone to run for the hills.

Remember: Fiat = Blockbuster, Bitcoin = Netflix. RUN!

Bitcoin (and bitcoin mining) is a once-in-a-lifetime revolutionary savings technology powering a global, neutral, censorship-resistant monetary protocol that cannot be stopped. You are literally storing your wealth in mathematics and trusting it over human beings.

Do you think 2+2 will equal 4 1000 years from now? Will 12 inches = 1 foot? If yes, buy bitcoin.

Do you believe America will have no debt and the Federal Reserve will still exist and achieve 2% inflation in 1000 years? If no, sell bonds.

Do you believe Amazon will be the dominant internet company in 1000 years? If no, sell stocks.

Do you believe no more real estate will EVER be built in 1000 years to keep the supply of shelter constrained while there is a simultaneous demographic boom to increase demand? If no, don’t use real estate to store wealth (buying multiple homes, etc). Live in it and enjoy it. Not hoarding real estate keeps the supply higher and more affordable for everyone. People should be able to afford shelter (and get medical care). Is that really even controversial?

When people can’t afford shelter, the social contract breaks down, and societal unrest heats up.

Let’s change that. Store your wealth in something with no utility other than being perfectly sound money (a store of value! The entire purpose of money!). 100% monetary premium and no utility premium. Bitcoin.

Understand how lucky you are to be alive to witness bitcoin’s inception and monetization phase. It could be a “BB” (before bitcoin) and “AB” (after bitcoin) history lesson someday, I’m not kidding. This WILL BE an inflection point in humanity where we use technology to solve the world’s biggest problem – money. The ramifications of this will be felt for centuries. Don’t be on the wrong side of history fading this technology. It’s going to change everything. Put the work in NOW to understand it.

As linear thinkers, we have no clue where this technology will take us, but I believe it will unleash unimaginable prosperity for the human race as it gets adopted in an exponential fashion. Of course, I may be wrong, but I’d rather be wrong being hopeful and positive rather than preparing for doomsday and needing guns with gold bullion nuggets clutched to my chest in my underground bunker eating Spam like most gold enthusiasts fantasize about. No thanks. Gold FAILED. It’s why we use fiat currencies today. Time to move on. Just like upgrading from VHS tapes to DVDs to streaming via technological advances, gold is getting an upgrade to digital/exponential gold (Bitcoin) due to technological advances. Human beings are ingenious and incredible problem solvers!

Bitcoin is hope. Bitcoin is freedom. Bitcoin defines what America is all about.

Bitcoin is going to win. I know a life without the USD seems scary, but it’s gonna be okay.

You just have to have a little patience.

Until next time…(probably going to take a few months off unless something massive happens)

Thanks for reading!

THIS is Crypto Pulse