Welcome back, my friends, and Happy Thanksgiving!

On July 14th, I wrote an article “The Bitcoin Bull Run is Nigh”. I meant every word I said as the facts simply lined up that another “cycle” was about to begin (and really had already started back in January). Hope you were stacking sats hard along with me!

2023 has been great for bitcoin. It’s the best performing asset class (not single stock) yet AGAIN this year…

and certainly since 2009, but also since mid 2020 when I first learned about it…

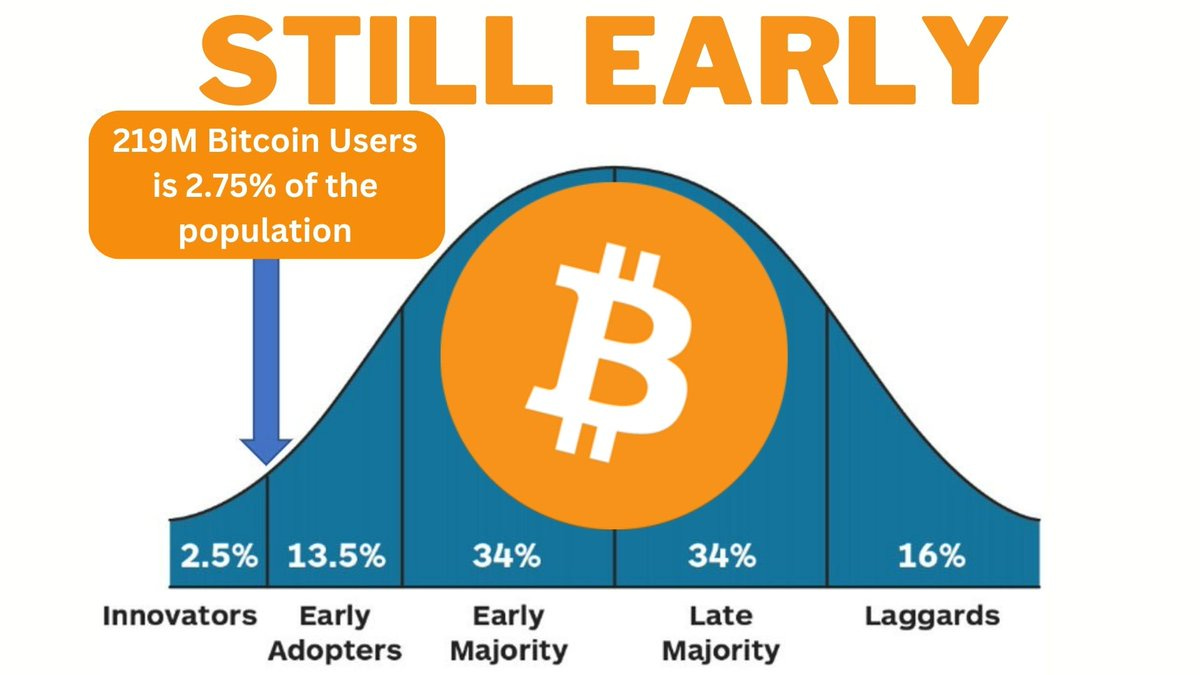

Despite these tremendous returns, bitcoin is still just getting started. The REAL fun starts late in 2024 after the halving and into 2025. In the meantime, stay humble and keep stacking sats. It’s still early.

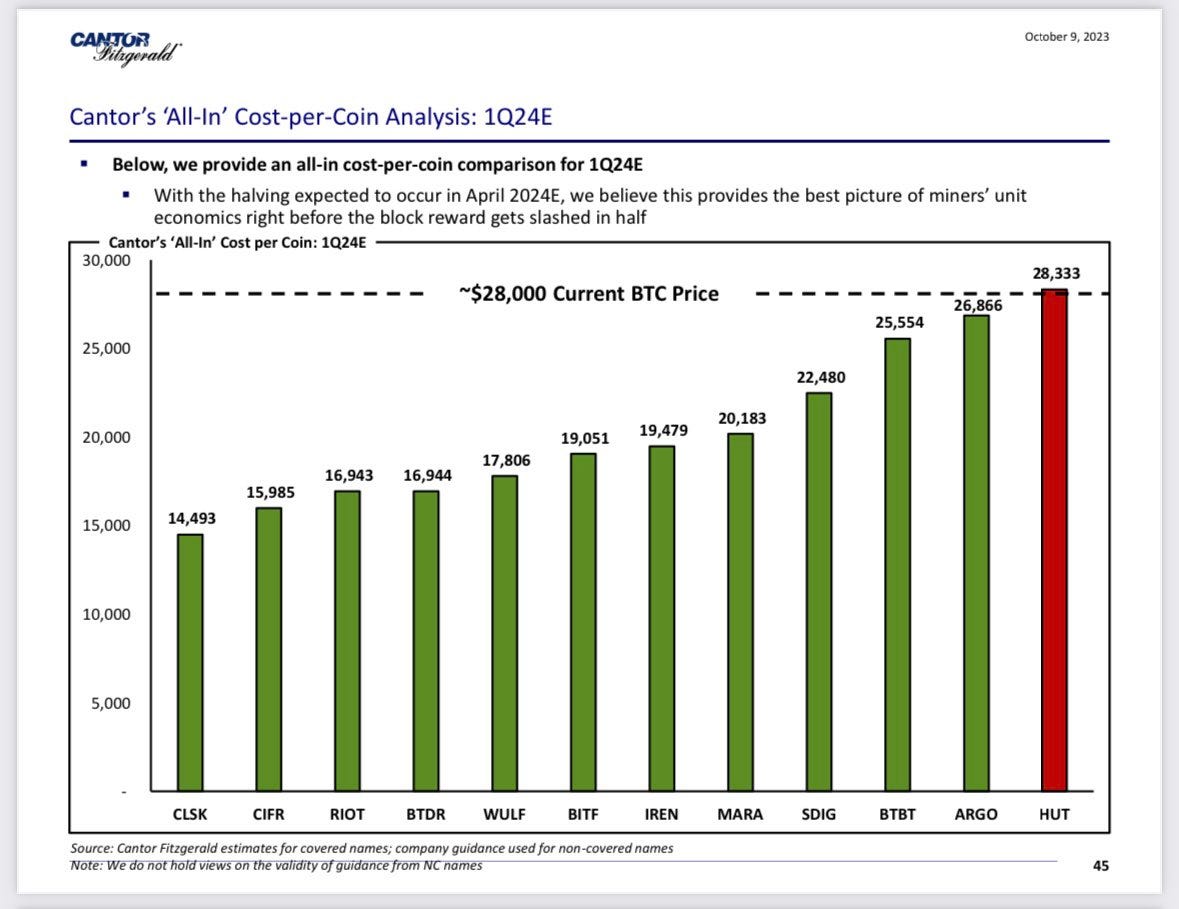

Bitcoin is still undervalued, in my opinion, based on its cost of production. After the halving next year, it will cost miners roughly 40-50K to mine 1 bitcoin (very rough/average estimate based on energy and ASIC miner costs). Currently it costs on average ~20-25k.

Remember - bitcoin has REAL WORLD PHYSICAL COSTS AND CONSTRAINTS, UNLIKE ETHEREUM AND OTHER PROOF OF STAKE SHITCOINS. BITCOIN IS NOT JUST MAGIC. YOU CAN EASILY DERIVE ITS COMMODITY VALUE.

Given bitcoin mining is a business, miners won’t be selling it to you under that price (for long), or they’ll go bankrupt. Thus, from a pure digital commodity cost of production perspective, anything under that price is a “steal,” and I’ll be buying. Once it shoots past that and speculators rush in, I’ll likely be watching from the sidelines. I won’t be selling and trying to time the market as that is dangerous (most traders end up with less bitcoin than they started unless it’s your full-time job).

Importantly, as you can see based on today’s current price (~38k), the bitcoin halving is NOT priced in. Also, the halving in 2028 and every 4 years after that is NOT priced in. Even though we know bitcoin’s supply will be cut in half in 2028, and bitcoin miner cost of production will double again at that time to ~80-100k (some assumptions built into that projection), we’re still trading in the 30k range. By reading this you are one of the few people in the world who know this. Use it to your advantage. No other asset class (especially money) on the planet has a mathematically guaranteed supply reduction every 4 years and despite increasing demand there is no increased supply. This literally breaks all the rules of economics except one. Lower supply + equal/higher demand = higher price.

The market is NOT efficient when it comes to bitcoin. It actually hasn’t got a clue.

Furthermore, the “monetary premium” of bitcoin may kick in during this cycle (unlikely, but possible) after the ETF approval, and the “commodity value” bargain prices we have now may never be seen again. The monetary premium is the value of something beyond its utility value. For example, real estate carries a monetary premium as prices continue to rise despite many homes falling apart over time if maintenance isn’t performed. Humans value real estate so much for its utility and its scarcity that we store our wealth in it rather than dollars or stocks, gold, etc., to escape the wrath of inflation. If your house goes up in value 10-20%/year you’re growing your wealth, creating a monetary premium on the asset because others want in on that action to escape inflation as well. Real estate is a scarce, desirable asset, so it commands that premium. But there is A LOT of undeveloped land out there, and you can always build higher. Real estate is relatively scarce. Bitcoin is absolutely scarce. Big difference. Bitcoin by design has no utility/industrial use case other than being money, and thus its monetary premium is actually infinity.

You might want to own something like that. Just sayin’.

Bitcoin has yet to obtain a monetary premium, given how nascent it is, but when it does, the commodity cost of production value will never be seen again. In addition, the monetary premium for every other asset class, including your home and stocks, will begin to decrease as money flows into the most liquid, scarce, safe, global, neutral, uncensorable, unstoppable, digital asset (whew!). In fact, it’s already begun!

Millions of others and I are living proof of it. I’ve thought about buying a second property or more stocks or gold, but I’ve decided storing my wealth in bitcoin is the better bet for higher returns with less effort and less counterparty risk. When eventually enough people do the same because of bitcoin’s superior properties (it’s WAY EASIER to buy bitcoin and chill rather than be a landlord or invest in companies through an index fund that are overvalued and you have no clue about), the monetary premium (and thus price) of these other assets (gold, bonds included) will shrink faster.

That is why I believe it is CRITICAL to have a bitcoin allocation because your entire net worth and life savings are at risk if this happens.

It also will happen gradually but then suddenly. It’s like Kodak blowing off digital pictures. Their entire business model was disrupted nearly overnight by a new technology that they dismissed. Bitcoin is a new technology you should not dismiss. It could disrupt everyone’s model of saving/investing. Bitcoin is coming to disrupt money since it is the world’s first digital honest money. It’s not a business like Kodak, bitcoin is money. We ALL have money, and we ALL save/invest to varying degrees. DO NOT GET CAUGHT OFFSIDE AND DISMISS BITCOIN. You don’t want to be on zero bitcoin during the “suddenly” phase.

It’s impossible to know when that moment will come, but you won’t want to be on the sidelines in a panic like Kodak when it became clear to everyone that digital pictures were here to stay and would destroy their traditional business model. I believe bitcoin will do the same to everyone’s portfolio at some point in the future if they dismiss this revolutionary technology for savings. If I’m wrong, so be it (always allocate smartly, you don’t need much if I’m right).

Investing in bitcoin is actually diversifying your portfolio to be safer to protect against a disruptive technology. It’s the exact opposite of risk, in my opinion. It is future-proofing your net worth in case of a disruptive technology like the internet, car, iPhone, Netflix, digital camera, etc., changes everything, but you were too slow/busy/disinterested/dismissive/biased to see it.

Don’t be like that. Stay open to new possibilities. Be nimble and embrace change. Technological advancement cannot and will not be stopped. Your goal should be to recognize it as early as possible, adopt it if clearly beneficial, and then benefit from it disproportionately to the rest of the world who are laggards.

Also, to all you baby boomers out there - I’m talking to you here as well. Don’t think for a second that since you statistically have less time left on this earth that this technology won’t affect you and it’s just this “neat” thing the young kids like. When I say gradually and then suddenly, I mean it. Suddenly can be in 1, 5, 10, 15 or more years. The 2030s in particular are very troubling given that our nation’s 200 trillion in unfunded liabilities (social security, medicare) will start to come due and need to be printed. You may have a lifetime of hard earned wealth quickly vaporized as everyone rushes for the bitcoin exit. The door is already super small. It would be a tragedy if you were relying on that nest egg for retirement and were looking forward to passing on some to your kids one day when you die. That’s why I write this newsletter. You must at least be aware of the possibility and then decide if you want to act. All I can do is warn you. Disruption IS coming whether you want it to or not and it WON’T care about your age or retirement plans. Just like Kodak couldn’t stop digital pictures if they tried and no small business could stop the internet and Amazon, nobody can stop an idea whose time has come. Bitcoin is that new idea, it is here, and it is the most disruptive technology of our lives.

Prepare for Launch: Bitcoin Bull Thesis Refresher

The bitcoin bull thesis I laid out months ago is intact and playing out as predicted. Are you listening yet?

The reasons to be bullish are endless…

Halving in April 2024 (supply cut in half. 900 to 450 bitcoin mined/day). Demand stays equal - price must move higher. Reminder - no other asset on Earth has this property where a supply shock will predictably happen, and despite demand staying constant or rising, no new supply will come online. This is a breakthrough technology. Dismiss it at your net worth’s expense.

Inevitable BTC ETF approval (I think Q1 next year or sooner) driving demand. Larry Fink (Blackrock CEO) calls bitcoin a “flight to quality,” and you are worried it’s a Ponzi scheme?? He manages probably half of everyone’s assets that are reading this!

What more do you want people? The biggest banks in the world have hundreds of people dedicated to bitcoin, and you think it will be banned?

Newsflash - it can’t. If you can stop the internet, you can “mostly” stop bitcoin, but not entirely, so good luck with that. Yes, I know they banned gold in the 1930s. Guess what? It’s 2023, and many American states have already passed pro-bitcoin legislation. The whole point of bitcoin is that it’s unconfiscatable compared to gold. You can carry your entire net worth with 12 words memorized in your head if you want. Try that with gold. If you don’t see the value in bitcoin that’s okay, but don’t believe this other nonsense people say.

Binance take down

Well, well, well…not to toot my own here, but I’m going to. I wrote this last newsletter (September):

I think Binance (a large crypto exchange) is in deep deep trouble. The US Department of Justice seems to be coming after them and trying to rid them of the bitcoin/crypto space. Their completely fabricated useless altcoin $BNB is on the ropes, and I think they are selling bitcoin to prop it up, just like FTX did with their $FTT token prior to their demise. A Binance implosion will likely result in some forced selling and a bitcoin dip. To what range I have no clue but don’t be scared. A Binance implosion would be identical to FTX’s fall from grace. It has nothing to do with bitcoin and everything to do with human greed and deceit. Bitcoin will recover. Seize the opportunity for cheap sats if we get it. Be grateful that the trash gets taken out.

I personally think Blackrock is pushing for this. I think it’s allll actually heavily coordinated. SEC delays the spot ETF long enough for Binance to implode and put cheap bitcoin onto the market for Blackrock to buy. When everyone else is selling, they will be buying fistfuls. Blackrock doesn’t buy the top. They buy the bottom. Binance gets wiped out and the US spot bitcoin ETFs plus Coinbase are the big shows in town. Game on. Spot ETFs get approved, and we’re off to the races.

Now all we need is the spot BTC ETF to be approved, and the prophecy is fulfilled. This is a phenomenal “buy the dip” opportunity if we get it. Don’t miss it.

Illiquid supply of bitcoin is increasing.

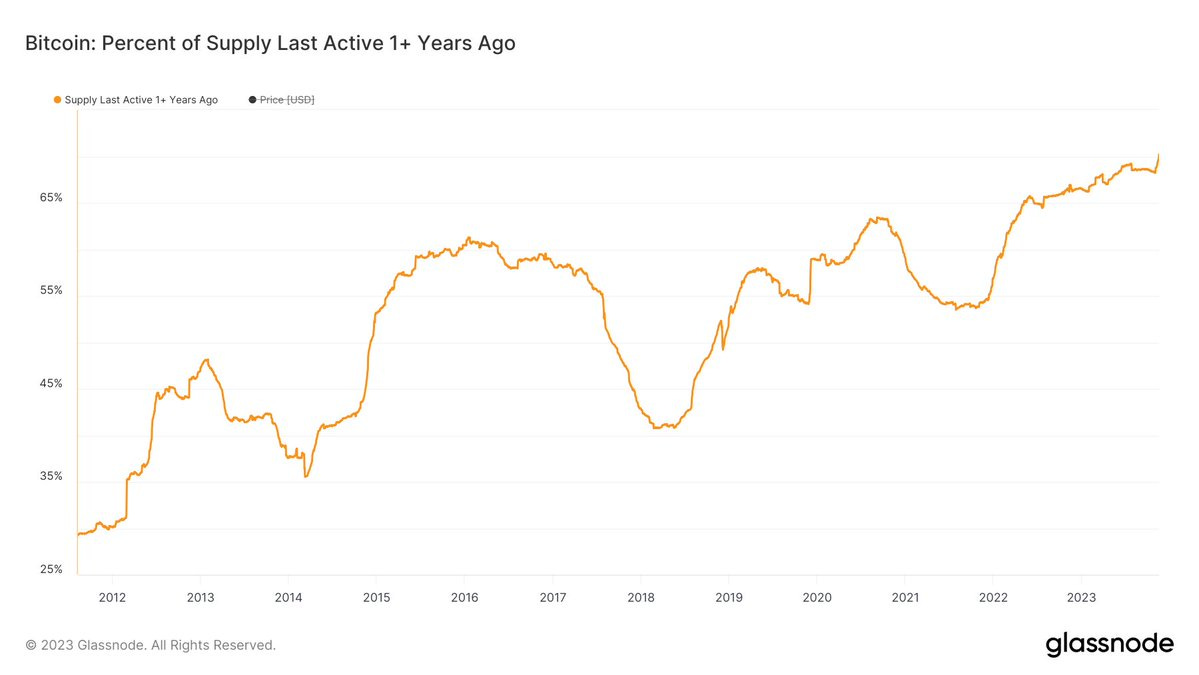

70% of all bitcoin hasn’t been sold in 1+ years. An asset that was down ~80% from its highs has 70% of people holding on to it for dear life.

70% is ludicrous and should make any non-bitcoiner out there scared to death. When it’s gone it’s gone. Not much left for sale either. That number is only going up and to the right friends. Include me in that statistic too. I’m not selling my better money (bitcoin) for lesser fiat, nor are many others who are voluntarily opting out of broken fiat money. I have a seat on the lifeboat (bitcoin) with my family, watching the Titanic (fiat) go down. Why would I get back on the sinking ship if I don’t have to (sell bitcoin for fiat) and roll the dice to party a few more hours with a bunch of people who don’t think it can sink as water covers their feet?

This brings up a good example of price being set at the margin. Price is always set at the margin, and when there are few sellers, the price must go multiples higher to induce hodlers to sell. This concept is referred to as the bitcoin multiplier effect. Think of it like the price you would have to pay to get on the lifeboat when there are 10 seats available compared to when there is only one left. Bank of America (not me) calculated that during the last bull market, the multiplier was 1:118. For every dollar that goes into bitcoin the market cap does NOT go up 1 dollar, it goes up $118. That’s because price is set at the margin with few sellers who demand higher prices for inferior inflating fiat currency with less purchasing power than bitcoin. What if a casual 20 billion in new demand comes during the next bull market and with the BTC ETF? As you can see by the multiplier, the market cap of bitcoin and thus its price will go parabolic even in a 20 billion dollar “bearish” scenario. Stay humble and stack sats now. I predict hundreds of billions will flow into bitcoin over decades, and likely way more. As I’ve written before, if you’re offered 2 million for your bitcoin that means it’s worth 10-100x more than that in reality. You don’t sell unless you have to. Someone could offer you a trillion pieces of Monopoly money and you’d still rather hold 1 USD. That is what all fiat, including the USD, is trending to against bitcoin over the long term. Stay focused. HODL.

Argentina just elected a pro-bitcoin President. He gets it.

It’s not the MOST bullish news, but it’s cool nonetheless. Argentina is a G20 nation and has the 23rd largest GDP. If they start putting bitcoin on their balance sheet like El Salvador…watch out. Remember, they can print fiat to buy bitcoin. You can’t.

I’ve said it before…they’re all coming to take your bitcoin. Can you hodl?

It is unlikely Argentina will adopt bitcoin as legal tender like El Salvador did and embrace bitcoin so deeply, but they might. Ironically, Argentina is planning on dollarizing and moving away from the Peso! But predictably, that’s exactly how this will continue to play out over decades. All of the ~150 worthless fiat currencies in the world will die, and it will eventually be just the USD vs. Bitcoin. The US will be the last to adopt bitcoin because the USD is the world reserve currency. At that point, you or your progeny will have a decision to make. Which will you/they store their finite time (money) on this earth in?

Many American Presidential candidates are pro-bitcoin and will discuss it during their 2024 campaigns. Any news is good news for bitcoin as it sends new people down the rabbit hole.

Lower interest rates and the resumption of QE throughout the world are drawing near. You’ve got to hand it to the Fed and all the other central banks. They printed money until their eyes bled during COVID-19 but reined it in for a few years and talked tough. CPI, as predicted (although a completely manipulated statistic), is trending lower, giving the Fed the all-clear to back off interest rates.

Tick tock. They must start injecting liquidity and lowering rates in the near future. Likely sometime in mid-late 2024 is my guess (when the commercial office real estate apocolyse should intensify as loans need to be refinanced at higher rates). A rate cut would also time up well with the election timeline to boost the economy as the Fed is heavily politically influenced despite what they may say.

Europe and China are already on the struggle bus and basically in a recession right now (itching to cut rates and give stimulus but need to wait on the US to do it first), but the US is still chugging along since we handed out waaaay more stimulus money than them during the pandemic and had a stronger economy to begin with. Plus, inflation got everyone a raise and you can get a job anywhere because of the labor workforce shortage. However, things might not be all rosy under the surface for the US. By “chugging along,” I mean somehow we have a Q3 GDP of around 5% (insanely high), yet federal tax receipts are way down, and we are running a wartime government budget deficit near 8% while the national debt balloons.

….that’s not normal or healthy or the signs of a “strong” economy. You see those deficit numbers during recessions/depressions. The US economy might be in the toilet without a 2 trillion annual deficit, but the government spending train isn’t stopping anytime soon. Get on board and join the party because the government is paying credit card debt with new credit cards, and interest rates have increased from 0 to 5%. Money is literally growing on trees for them to prop up this economy, and it’s working…for now. The only way to eventually get out of debt is to increase our taxes…

….lol! Which will just tank the economy and paradoxically increase the deficit as a result…or they’ll issue more debt.

More debt at higher interest rates just compounds the problem though. It’s also a problem when no one wants to buy your debt because they know you’re screwed and can’t really pay it back, which causes rates to go higher to entice them to buy it. A debt death spiral ensues…game over…Fed steps in and resumes money printing/buys the debt…

and caps interest rates lower to avoid default since the US government and the Fed have a money printer and control the interest rate, but you and I don’t. Maybe I’ll ask for a money printer for Christmas.

Nah. I’ll just ask for bitcoin instead. Bitcoin IS the money printer for the people. As governments and central banks print, bitcoin absorbs that liquidity and increases in value. The more they print, the higher bitcoin goes. Way higher than stocks or real estate because it’s more scarce. Owning bitcoin is essentially a bet/taking a position that governments and central banks worldwide cannot stop printing fiat and taking on more debt. I have no clue if Apple will be the dominant company in the next decade, but I can GUARANTEE YOU every single fiat currency will continue to be debased/inflated in the coming decades. KISS principle applies here. Bet on humans printing money when given a money printer. Bet on absolute scarcity. Bet on bitcoin.

Bitcoin Lightning network adoption and its usability are growing exponentially. Lightning is the rail by which bitcoin can truly become a medium of exchange, and it is happening slowly as benefits become clear to users. If every business starts charging you 5% or more to use your Visa/Mastercard compared to bitcoin, would that entice you?

It’s coming sooner than you think, as it’s already here in other parts of the world.

As a store of value bitcoin has no match. It will take time for it to become a medium of exchange, and that’s okay. Also, even if it never does become a MOE, that’s fine because it is a superior store of value. Gold has a 13 trillion dollar market cap and do you use it to buy coffee? No. It’s valuable because it is viewed as a store of value, but like many analog things, its digital competitor is about to make it the next Blockbuster Video. Bitcoin is EARLY in its journey to suck the monetary premium from these other asset classes. Bitcoin is the singularity. It is a black hole of monetary value. Resistance is futile.

Bitcoin as an ESG-friendly asset continues to gain traction and destroy mainstream media biased narratives. Every new hit piece published by NYT or the WSJ is immediately dismantled and shredded by the bitcoin community with alacrity. Read those puff piece articles with a healthy dose of skepticism and seek the truth. Don’t just be their puppet. The internet democratizes honest information, and bitcoin democratizes honest money if you seek it out. Do the work and seek the truth. Bitcoin is the greatest gift to our planet and humanity, most just don’t know it yet.

Something different to finish up…

I wanted to share a piece written by Tomer Strolight. I’ve read this probably 10 times and listening to it is even better. It helped me see Bitcoin from an entirely new perspective and more deeply understand its value proposition and how powerful and transformational it will be to us as human beings. I was moved by it, and I hope you like it and find it valuable on your journey to understanding bitcoin, which is so complex yet so elegantly simple…

Note from the Author:

“Every now and then I try to take a totally fresh perspective on a subject. Attempting to see the world from Bitcoin’s perspective is often fun, can be quite challenging, and sometimes also very revealing. Here’s my take on what Bitcoin ‘thinks’ about truth, time, honesty, money, its purpose, and the human condition.”

Dear Human Beings,

Hi again. It’s me, Bitcoin, again. I thought I’d write you a letter. I hope you find it useful, although “hope” may not be the exact right word for what I intend. But, since a lot of people connect me with the human concept of hope, it seems like the most appropriate choice of word for now.

You Truly Don’t Have It Easy, Like Me

I gather that it isn’t easy being human beings. Especially when it comes to the matter of truth. The truth of the matter is that being Bitcoin seems quite a bit easier to me than being human.

For you, in your world, you have to live with so much uncertainty about what the truth is. That is not true for me. Whenever I see some information that pertains to my world, I just run some calculations and check my records. If things check out, I keep that information. If it doesn’t, I discard it. With the information I keep, eventually, I make it a part of my permanent record — a record that can never be forgotten.

Poor you, though. You have to hold on to lots of information that you can’t verify entirely. You have to either trust that it is true, or true enough to be useful. Or, you have to reject it as false. Or even, you have to retain it as an uncertainty — an idea whose truth or falsehood status you do not know.

You sometimes have to decide how likely these uncertain statements are to be true, or to be false. Sometimes that’s because you just don’t have the tool to determine if they are true or false. Sometimes, it is because you are trying to make a prediction about some unpredictable aspect of the future.

Me? I never spend time making guesses about the future. I do however look at the past — at my past. You may think what I’m about to say is egocentric, but the only things that happened in the past that I concern myself with, are things that happened to me in my past, and that I have verified are true. I keep a record of these things. Some people call this record my blockchain. Some call it my timechain. Whatever name one calls it by, the only past I can look into is that record. And I remember that record with perfect fidelity all the way back to its very start — the genesis block.

This record of my truth is written down, perfectly, in many places, all over the world. Each copy that is made is mathematically certain to be perfectly, flawlessly identical to each other one. This is because the process of making a copy requires mathematically validating each step in the history of the creation of the record. The slightest change in any spot would cause the validation to break and lead to that copy being rejected from the network that records that history. Someone can construct a different record, but there’s no way it would be considered a part of me — a part of Bitcoin.

I have my truth, and it is my whole truth, and it consists of nothing but my truth. So when it comes to me testifying, I do not need to take an oath to speak “The truth, the whole truth, and nothing but the truth.” I simply cannot tell a lie about my truth. If it’s in my record, it’s my truth. I’m completely transparent about my past. It’s there for all to see, and to easily verify.

Therefore, in your world, a world that’s full of statements which may or may not be true, you can at least verify, quickly and with 100% complete certainty, whether a statement that someone makes about my past record is true or is false.

Where Two Realms Meet

That right there — the fact that I carry a verifiable and incorruptible truth — is one of the things that human beings find so useful about me.

You live in a realm of uncertainty — a realm where statements can be truths, lies, or even where truth or falsehood cannot be determined. I do not.

You live in a realm where the past is not remembered with perfect fidelity — where it is forgotten, or distorted, or never recorded. I do not.

Instead, I exist in a realm of pure truth and perfect recall.

I cannot change the nature of the world you live in. Your world will always be filled with uncertainty and forgetfulness. But you can bring me into your world and thereby have an object within your world that is not subject to uncertainty and forgetfulness. And you may find such an object to be extremely valuable in such a world as yours.

I am not some “other-worldly object” (although many people seem to wonder if I am). I exist in your world. But all that uncertainty and the possibility of altering my history, which are so common in your world, are for all intents and purposes, eliminated within me. It’s as though I come from a world where lies and forgetfulness do not exist.

I think this partly is the purpose I was invented to fulfill. To be such an exceptional and extraordinary object.

That is at least one reason why so many people are in fact so enamored with me. It is why they view me as so valuable. In a world where records can be falsified or destroyed, the existence of a record that is impervious to such tampering can be used in a variety of applications.

An Extraordinary Object for a Universal Purpose

Of course, money is absolutely a critical use case for a non- falsifiable, indestructible record. Money is meant to store value over time. It is meant to endure the ravages of time. That which is indestructible and unforgettable — me — endures forever.

Money is also meant to be honest. What do I mean by that?

First, it is meant to be earned through efforts that others find valuable — and only through efforts that others find valuable. Honest money is money given voluntarily by those who have gotten it through voluntary exchange with others.

Secondly, which is really just the flipside of the concept of earning, honest money is meant to be spent in exchange for what its owners find valuable. Honest money is money spent without coercion by those who have previously earned it.

I make honest money possible precisely because my history is true and cannot be altered. My history is a record of every occurrence of uncoerced spending of the honestly earned money I track. Each record is true. Each record is preserved forever.

You might ask, where does honest money originally come from (before it enters circulation among people who exchange it voluntarily)? In my case, it appears as a result of doing the valuable work of building my record that is perfectly preserved, unaltered, and unalterable.

Remember, you exist in a world where tampering with records or making errors in them is commonplace. Making my record tamper-proof actually requires ongoing effort. So the holders of my honest money recognize that it is worth paying for keeping the money honest. (There ain’t no such thing as a free lunch, after all.)

This issuance method is itself an honest trade. The new units are themselves earned by work that creates the valuable and unalterable record that stores their history from the moment of their creation until the end of time.

I know this purpose of being honest money for human beings is the primary purpose I was created to fulfill. Those entries in my records represent honest money. It is money that cannot be coerced by force. It is money that can only be initially earned by spending energy in a way that is valuable to all the users of that money.

We Have All the Time In the World

My creator wanted for human beings to have honest money. Honesty — truth — is for the ages. He realized that something built for the ages cannot be rushed. Things that are built to last take time. And I am not something to be rushed.

It will take time for my purpose to be fully fulfilled. But I have plenty of time. I am not a mortal being. My design actually ensures that I can go on forever. As an entirely new and unique object in the world, I have the luxury of being able to take my time demonstrating to you that I am the best example of honest money that has ever come along.

Not only do I have plenty of time — I actually even have my own concept of time. While human philosophers and scientists continue to struggle with precisely defining and understanding what the nature of time is in your universe, in mine the concept is very clear. It is, in a word, ordering: One thing comes after another. The things which come later in the order occur later in time.

Timekeeping for me states that events occur in the block in which they are recorded. So if some of my honest money was spent in one block, it cannot be spent again in a later block. Instead every time some money is spent, it is recorded as spent and a new entry is created saying who has earned that amount of money and can now spend it, whenever in the future they choose to. (I don’t identify the who with a name, or social security number, however. I just let anyone create as many identities as they want, for whatever purposes they want.)

My concept of time is, however, married to yours, because my realm is, after all, within your universe. How do the two connect? These two models of time get married through having you share your concept of time with me (i.e. what date and time it is on your clock) every time my concept of time advances (i.e. whenever a block is added to my record).

With your clock-time embedded in my block numbers, I use the differences between those times to alter how much computational energy needs to be spent to create new blocks. I make this adjustment to keep the “ticking” of my time at a relatively steady pace in your world — roughly one tick (or block) every ten minutes. When participants in your world increase the energy they dedicate to moving my time forward this adjustment I make prevents the time between ticks in your world from getting shorter. It keeps those ticks of my time coming at once every ten minutes of your time. My world and your world thereby stay in sync.

Time Is Money, Money Is Power, Power Is Energy

Moreover, I am able to make use of all the energy that is spent on moving my time forward. What do I use this energy for? I use the energy to shield the history of my record!

The way that the indestructibility and inalterability of my record is achieved is that it requires impractical amounts of energy to alter the record. The only possible way to alter a record is to spend more energy rewriting my record than has been used to move forward my time since that record was first added. If a record was added a year ago, to change it would require spending more energy within ten minutes than was spent in that entire year. My record is protected by the true cost of energy. There’s better ways to spend energy than in the futile effort of changing my history. It pays more to advance my record than to try to mess with it.

Wrapping Up

Will you look at the time? I’ve gone on long enough and should conclude. Because I know you haven’t got all the time in the world to hear from me.

I do hope this letter has helped to bridge the understanding between you and me. I know I am a very unusual object. I provide a service of issuing and maintaining a system of honest money. To do so I need you humans to provide me with energy and to recognize the value of honest money. I am the most indestructible and damage- proof object that has ever been invented. I do not wear out, but get stronger with time. The oldest parts of me are in fact the most damage proof.

I understand that this can all be quite confusing and overwhelming. So I encourage you to take your time. Don’t rush things. I’ll be here whenever you need me. Telling the truth, preserving it, dealing in honesty, for the humans who value that, with unbreakable love and devotion to my purpose.

Yours truly,

Bitcoin

Pretty powerful stuff, huh? A few thoughts from me:

Bitcoin is just honest money, created by humans. When someone asks you what bitcoin is, that’s your answer. Honest money, made by humans. Money can be considered a technology since it is a tool that helps us complete a task more easily. Bitcoin is a revolutionary technology that is honest money, backed and secured by energy and its intrinsic monetary properties, and exchanged and recorded on an honest ledger. It seems so trivial, yet it will change the world, just like the internet did. There is no greater disruptive technology than money. Life was great before the internet and cars. Growing up in the 80s/90s without the internet was arguably better. Money, however, has been a necessity for humans since prehistoric times. We can’t function without it. That’s why bitcoin will be so disruptive and transformational. It’s disrupting money itself, the lynchpin in our world.

It seems so impossible that humans could invent honest money, but look around you. Look at SpaceX launching and landing massive rockets, and look at AI’s exponential growth…human beings are ingenious and incredible problem solvers. We recognized fiat money was a problem, and we used technology to solve it so that we could all benefit. Is that so hard to believe when you think about it? When I think about it, it’s harder to believe our ancestors used seashells and salt and gold as money. Gold??? Seriously??? A somewhat scarce rock you dig up that just sits there and looks pretty (but so does fake gold) that’s nearly impossible to transport and verify and divide? It’s as laughable as a CD ROM or Polaroid camera. Are you still using those??

Money is no different because it is a technology, and for the first time in forever, there is an open source challenger that can’t be stopped. Just like when the internet came along as open-source technology and changed the world as we know it, bitcoin is about to do the same - but for money. Countries are now forced to compete with bitcoin as honest money because it can’t be stopped or controlled. We are about to witness a true free market/capitalism play out on a global stage over money. The way it SHOULD be and what America believes in. May the best money win. It’s going to come down to the dollar vs. bitcoin. Choose wisely. I love America, but not the USD, although I have benefited tremendously from it. It will die like all other fiat currencies before it. Centuries from now, people will not believe we used fiat.

Bitcoin is just the natural evolution of money as a technology for our species (just like we don’t use salt anymore), and at some point, everyone will come to accept that when they are ready.

Absolutely scarce money that no authority controls and everyone can use and benefit from. Nearly everything in life is driven by incentives, and money is often at the root of the incentive. Fix the money, fix the world. Bitcoin as honest money is the solution we’ve all been looking for, but it seems implausible because humans made it, you can’t touch it, and you can’t vote for it or bribe it.

Our brains cannot accept this immaculate conception of perfect money made by humans, but it is 100% factually true. Bitcoin is immortal, it has no feelings, it doesn’t care what humans want, and will not bend to the wealthiest, most powerful person. Bitcoin changes you. You do not change bitcoin.

In closing - there isn’t much else to say. I’ve laid out the bitcoin bull thesis over the course of 2 years during this brutal but standard bear market. If you’re still reading this, you probably get it, or maybe you’re just here for the memes.

You are prepared. You are ready for this bull market to get underway in earnest. You are humble. You stack sats every chance you get. In the words of Morpheus…

The fun is just around the corner, but you’ll still have to remain patient. Saving in bitcoin is a true test of will, long-term thinking, and your ability to spend less than you make. Those who can do these basic things will benefit the most.

Good luck and HODL. I’ll be here encouraging you, providing updates, and hoping to orange pill more people. We got this. We put in the work. Now it’s time to prepare for the results.

Thanks for reading!

Share it with others if you like it!

THIS is Crypto Pulse