Up up down down left right left right B A start

You know the code if you’re ~ 37-47 years old (give or take).

The cheat code for the game Contra you played on Nintendo growing up in the 90s.

You still have it memorized to this day to get 30 lives and have a better chance of winning the game. It didn’t come in the game package, but you heard about it from a friend and then told your friends because it was awesome. The cheat code worked for you, and others wanted to try it out when they saw you having so much fun playing the game. The cheat code was so impactful on your life that nearly 30 years later, you still have it memorized and reflect fondly on those times.

Well friends, there’s a new cheat code. But this one is for the game of life, and I’m here to share it with you.

It’s called Bitcoin, and like the game Contra, you learn about it from friends and pass it on. I’m simply doing my part, just like I did back in the 90s when I told my friends about the cheat code for Contra, and we all had a blast playing together.

Why is bitcoin the cheat code to life?

Everything in life gets cheaper if you use Bitcoin as your unit of account and long-term savings vehicle.

If you save in dollars (fiat) and fiat-based assets (stocks, bonds, real estate), life either gets more expensive/harder, or you just feel like you’re sprinting on a treadmill to keep even and aren’t really getting ahead (maybe slightly). You feel the need to change jobs or get a significant pay raise to maintain or upgrade your standard of living.

Bitcoin breaks that paradigm by simply increasing your purchasing power over the long run. It allows you to break free from the financial repression of the fiat matrix we were born into.

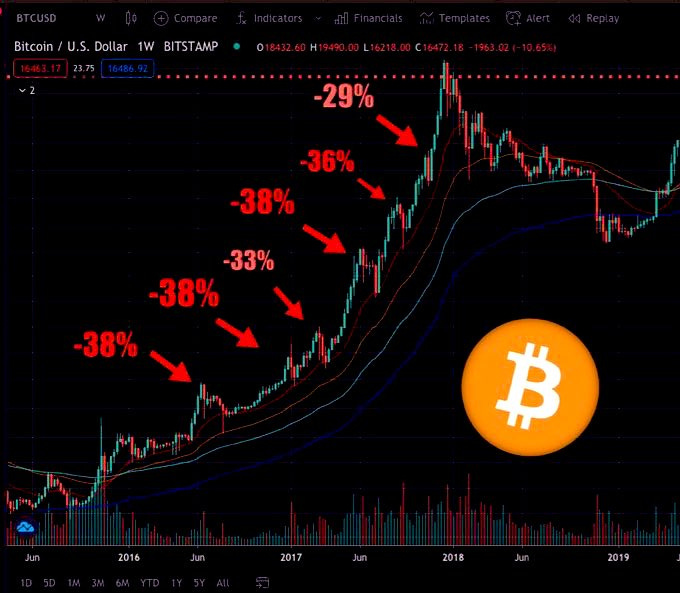

Time is our most precious and scarce asset. Our days are numbered on this planet. Achieving freedom of your time to do as your heart desires via financial independence is the ultimate goal. Saving in Bitcoin to outpace rampant monetary debasement/inflation that we all suffer from is the easiest and fastest way to achieve that goal, assuming your career has reached a near-steady state. It is volatile in the short term, but if you can save with a long-term mindset, it will dramatically improve your standard of living over the long term, and you’ll likely achieve financial independence much sooner (but not overnight).

I’m not saying you can’t live in the present and spend any money now or save/invest in other assets like stocks and real estate. I just think Bitcoin will do the best over the long term, and it’s the easiest asset to buy and hold. I like simplicity in my life. I also view it as a diversifying asset away from the fiat land of stocks and real estate that require inflation (price and profits must always go up) due to debt obligations. It’s a hedge against that system that is unsustainable and on a path to self-destruction, especially with the creation of Bitcoin.

Fiat and all fiat-based assets = Blockbuster. Bitcoin = Netflix.

I’ll say this until I’m blue in the face: Do not be the last person to understand and adopt a revolutionary new technology, especially when your nest egg depends on it.

Take the time and put in the work NOW. New technologies disrupt old models gradually and then suddenly.

You don’t want to be offside during the suddenly phase. It’s coming.

I know most people still think Bitcoin (and not fiat money) is going to zero eventually and that my cheat code won’t work, but at this point, I just feel pity for them as they miss out on one of the greatest inventions humanity has ever seen. It’s like traveling across the US by horse because you think cars and airplanes are too dangerous in 2024. Or refusing antibiotics for Dysentery along the way when you’re dying of sepsis because a human invented them less than 100 years ago, and you need more time and to see more data before you trust them.

After all, praying to the sun god and using magic potions worked for thousands of years. Antibiotics are too novel, risky, and untested in the grand scheme of things. They can even lead to C.diff as a complication!!! The horror! Heavy sarcasm there, obviously.

Bitcoin is simply a breakthrough technology for money and savings. Something each of us needs, uses, and contemplates daily. Money is critical in our lives, and only air is more important than money, in my opinion. Just like airplanes and antibiotics were revolutionary inventions, so is bitcoin. Eventually, everyone will get to enjoy the cheat code as the world moves to a bitcoin standard, but some will just enjoy the perks sooner. I hope that’s you. I’m giving you the cheat code because I want you on my team.

Teamwork

We’re all in this together.

Like in Contra, playing with a partner and winning together is way more fun. I have great memories of doing this with my brother growing up.

As the cheat code to life, Bitcoin facilitates this and unites us all.

How exactly?

My best illustration for this comes from some recent luck I ran into. I won an NCAA March Madness bracket pool (mostly luck), and the money I won went straight into Bitcoin. Everyone in the world who saves in Bitcoin also won that day. Their wealth grew because I won—not in the short term, but in the long term, as is always the case with Bitcoin.

How?

Bitcoin is a fixed-supply, absolutely scarce digital asset, the first of its kind. There are only 21 million coins now and forever. Even if Satoshi reappears today, he can’t change the code I run on my Bitcoin node verifying the network and the 21 million hard cap limit. Given that a significant (but likely not all) portion of that bitcoin purchase will be stored away forever and passed on from Palmer generation to Palmer generation, the supply of bitcoin became more scarce the day I won. Less supply available as demand stays constant or increases means the price must rise. If you save in bitcoin you benefited from me winning. Even if it’s a small amount, you still hoped I won. It puts us all on the same team. If we all save in bitcoin, we’re all rooting for each other to succeed/win. The excess earnings from being successful will flow into bitcoin as savings and benefit everyone who also saves in bitcoin. If someone struggles and is a forced bitcoin seller, we all technically lose, so we are incentivized to help that person out if we can so they don’t need to.

It's an extremely powerful concept that is hard for most to believe/grasp, and it is only possible because Bitcoin is a globally accessible fixed-supply digital store of value. Bitcoin creates an impossible to ignore network and flywheel effect in this way that will attract every single person on Earth. Nobody will want to be left out. It is a human productivity index fund. The world has never known such an asset. It is so profound I am often at a loss for words.

When I won the bracket, the farmer in Kenya who owns Bitcoin benefited. The same goes for the electrician in El Salvador, the billionaire oil producer in Saudi Arabia, the middle-class IT guy in Indiana, the cook in Japan, Michael Saylor, Elon Musk, etc. etc. It’s the world’s first global cyberspace savings account.

Do you see the power in that? Do you see why I believe if you fix the money, you fix the world? How can hate and violence/war be significant if we’re all on the same team trying to win the game together? How can there be endless wars if you can’t print money to fund them?? How can predatory industries like healthcare insurance companies, which benefit the most from being close to the money printer, persist if they have to actually work for the money and provide value to their customers? Bitcoin aligns incentives and aligns the world. It changes everything.

“Nothing is more powerful than an idea whose time has come.”

Bitcoin is human-made perfect money, a revolutionary new technology. It requires work to obtain and is designed to become harder (more scarce) as time passes. How so?

The bitcoin halving

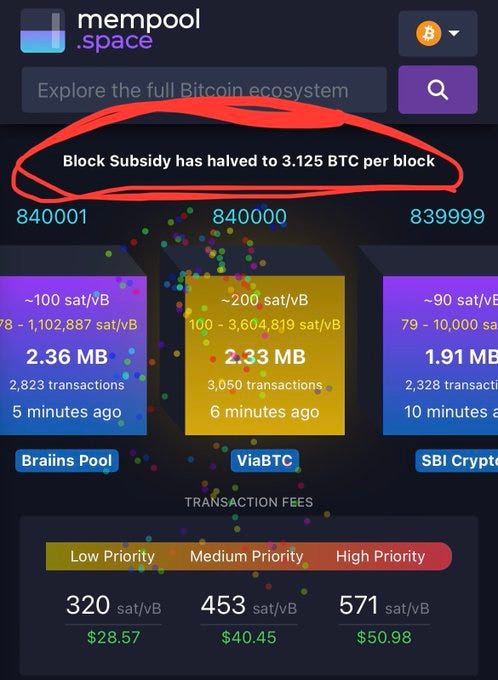

In case you didn’t know, the halving occurred on 4/19.

I’ve been writing about this event since the first newsletter, and it finally came. I mentioned “happy halving” to many people; strangely, only my brother knew what the HELL I was talking about. I cannot begin to tell you how early we are. In a few decades, everyone will know about the halving, but for right now, it’s just us psychos.

What is the halving?

As a refresher, the bitcoin block subsidy/reward for miners gets cut in half every 4 years programmatically. No one can change Bitcoin's monetary policy because the network is decentralized, and no single entity controls it. It’s baked into the code and cannot change no matter what is going on in the world. This past epoch it was 6.25 bitcoin per block, and now it is 3.125. It will stay that way until the next halving in 2028, when it will go down to 1.56 bitcoin per block. The amount will keep decreasing by half until there are no bitcoin issued in 2140 when all 21 million bitcoin are in circulation. Around 19 million bitcoins are in circulation today, so the remaining 2 million will be released over the next ~120 years. Not much bitcoin left to be mined in the grand scheme of things. >90% of it is already in circulation today.

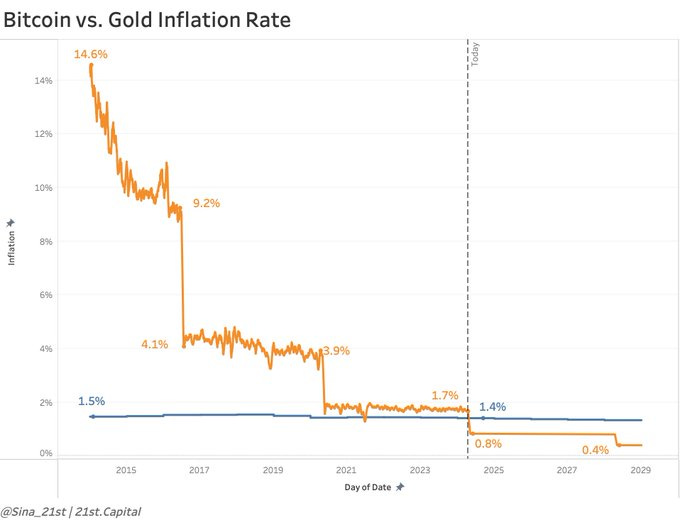

After the halving, Bitcoin became harder money and more scarce than gold. Its inflation rate is near .8%, and gold’s is near 1.5%.

Bitcoin will continue getting more scarce as its inflation rate goes down until 2140, while gold’s inflation rate will fluctuate near 2%, possibly rising as technology advances and we dig more up. For this reason and many others, gold is a far inferior sound money.

The halving is important because of simple supply and demand economics. Most of Bitcoin’s supply is already in circulation (and tightly held by individuals), and as new supply decreases with each halving and demand only continues to increase, the price must go up. If 450 new bitcoins are released into circulation daily and Blackrock alone is buying ~200-400 bitcoins per day, a massive supply shock is inevitable. The price must move higher to meet demand.

Also, unlike the Fed, where I can’t tell you what Jay Powell is going to do with the price of money (interest rates) in the next month, let alone next year, I can tell you exactly what the inflation rate of Bitcoin will be in the year 2028 after the halving—0.4%.

This allows future planning and precise economic calculations. It fosters growth and long-term planning because of the certainty people and businesses can expect. A 2% inflation target is just that, a target. It’s a made-up number with no scientific backing, and the data used in the calculation is highly manipulated to keep public confidence in the Fed. When inflation, whether actual or reported, is constantly in flux, it makes financial planning and calculations businesses rely on extraordinarily difficult. Bitcoin makes it easy.

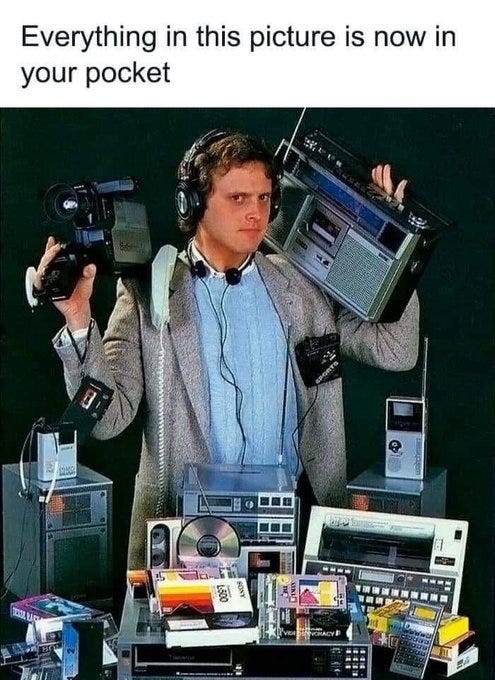

It's critical to reject long-held dogmas that lack any scientific rigor (2% inflation is necessary and “good for you”). Challenge it. Think for yourself. Use common sense. The world we live in and technology is incredibly deflationary IF WE JUST ALLOW IT TO BE AND LET THE FREE MARKET WORK (no tariffs, manipulated interest rates, governments choosing winners/losers). We all seek more value for LESS. Technology brings the cost of goods and services DOWN over time.

Tesla is on the cusp of self-driving cars for crying out loud!!!

The Internet is becoming globally accessible via satellites, and the rockets that send them into orbit are reusable and land themselves! This is insanity!

Prices should be falling, not rising, as we become more efficient at bringing resources online and using them efficiently. Inflation is forced upon us to keep the debt-laden fiat monetary system solvent. Debts must be inflated away, or the whole system collapses as the world is under immense debt. That is why prices are rising when they should be falling – because of monetary debasement. Common sense says we should embrace deflationary money for a deflationary world and enjoy the benefits technology brings us through lower prices. Wake up. Opt-out. Use the cheat code.

The cheat code is NOT investing/saving in gold, stocks, real estate, bonds, and land. Why? Because a cheat code needs to be EASY and positively impact your life AND others. None of these other asset classes do that.

Gold:

A failed sound money. The whole reason we use fiat money today is because gold failed. I don’t know why so many people can’t accept this and overcome the mental hurdle. We’re never going back to a gold standard in a digitized world.

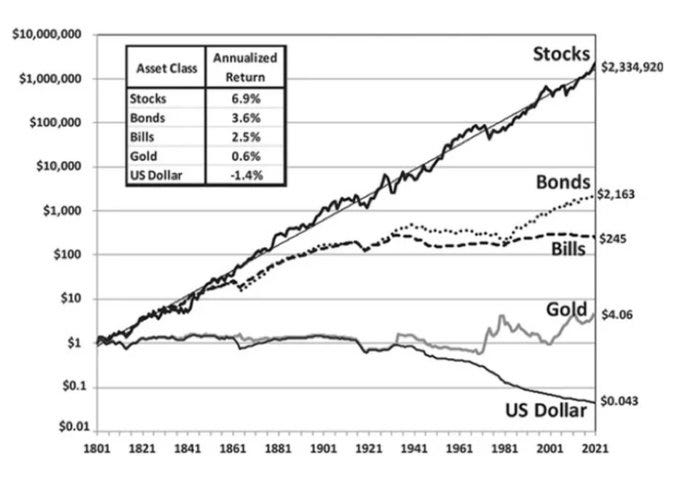

It’s too slow and has too many fatal flaws. It’s also terrible for the environment (mining it) and not really a great store of value statistically compared to stocks.

As technology improves, owning gold will become (already is) a losing bet. New gold deposits are found yearly, and we can extract them more easily with better technology. The supply of gold is going up forever. It’s scarce, but not absolutely scarce like bitcoin. It’s hardly used in any industrial processes, unlike silver. Its primary use is jewelry because it’s scarce, and people like to flaunt their wealth. Thus, it has no real purpose or utility; it’s just flashy. What happens if it’s no longer scarce one day because we find a huge deposit somewhere and everyone can afford gold jewelry? Thus, I choose not to store my wealth in a rock that makes ugly jewelry (in my opinion) with an unknown scarcity that benefits only a select few if I store my wealth in it. To each their own.

Bonds:

Short-term bills earning 5% passively in a money market fund are easy and earn okay returns, but you’re still losing to the monetary debasement of 7-10% a year.

Yes, 7-10% per year.

CPI and monetary debasement are NOT THE SAME THING. YOU MUST UNDERSTAND THIS.

CPI is reported as goods and services inflation, which is affected by many factors (money printing, supply/demand, supply chains, labor costs, etc.).

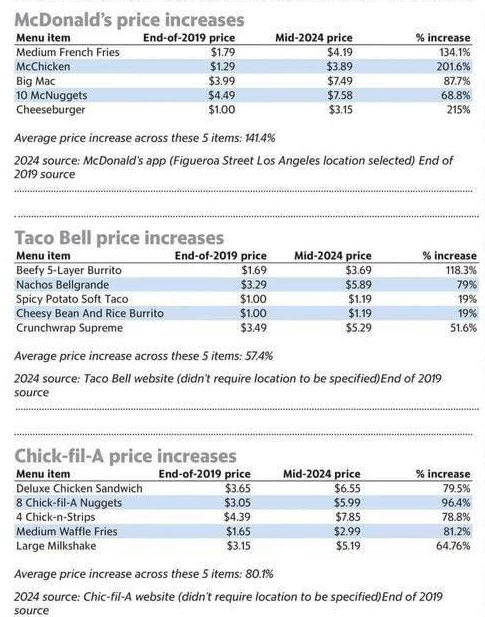

If you live in Los Angeles, has your salary increased by 134% since 2019 to keep pace with french fries? If not, you’re getting poorer.

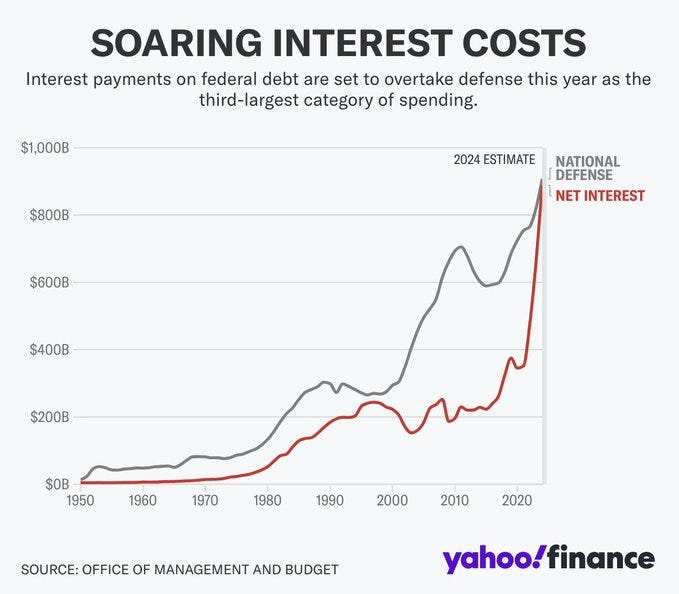

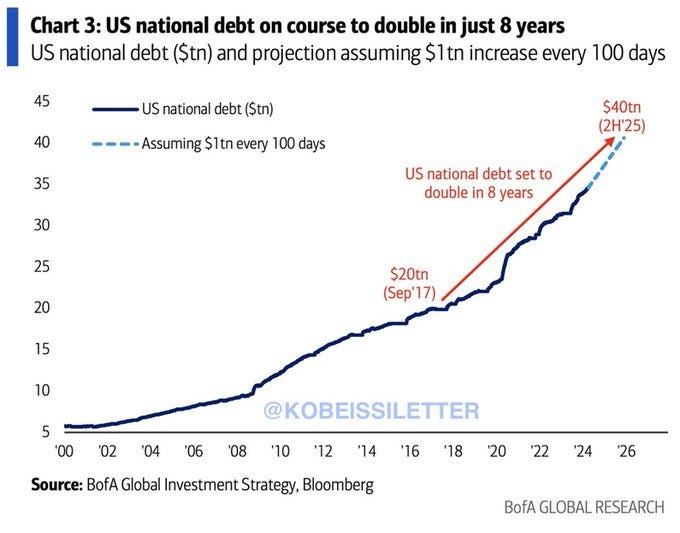

Debasement is monetary inflation (how much they are printing). Yes, CPI and debasement are linked, but they are not the same. Tricking you to believe that CPI = debasement and both are 2-3% is the ultimate fiat matrix ruse. If you knew you had to earn 7-10% just to keep even with debasement, you’d never settle for any yield less than that. However, the government requires low-yielding debt, given the size of the debt burden (34 trillion).

Long-term bonds (10,20,30 years) are a joke, earning you ~4% when debasement is 7-10%. The government is laughing at you when you buy them. Long-term bonds are the anti-cheat code. The “GET WRECKED” code and the “GET POOR” code. Stay away. Far, far away. The only person you’re helping by buying long-term bonds is the government, which is actively debasing the currency and stealing your purchasing power, all while taxing the living hell out of you along the way. No thanks! I know a Ponzi scheme when I see one. Yes, bonds will give you a guaranteed principal return plus interest, but what the purchasing power of that money will be in 10-30 years is the question you must ask yourself. Don’t fall for the trick.

Stocks:

Buying an index fund of stocks is easy, yes. But you’re not beating debasement with 7-10% annualized returns (typical stock market return), and picking individual stocks and going “all in” on Amazon or Nividia 10 years ago is NOT easy. With average stock market returns, you’re just treading water against debasement, maybe getting ahead slightly over the long term. In dollar terms, it looks/seems like you’re doing great, but in HARD MONEY/REAL MONEY terms like bitcoin, you’re getting smoked.

Here is a chart of the S&P 500 index priced in bitcoin. Down 99%. Ouch!

The price is up in fiat (USD) terms, and if you’re okay with average returns and endless sprinting on the hamster wheel of life in the fiat system to avoid the “risks” of a small bitcoin allocation percentage…well, you do you. To each their own, I guess. Life is short. I’m looking for financial freedom ASAP. That’s the cheat code.

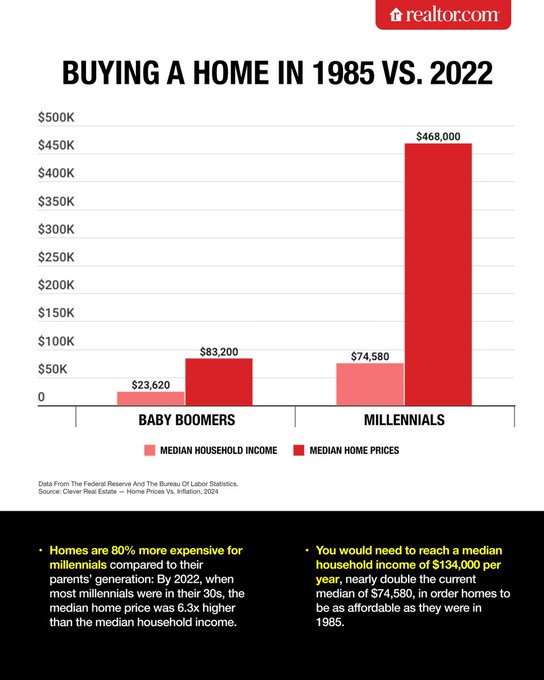

Real estate:

The same is true for real estate. In fiat terms, it’s an okay investment, but in sound money terms, it’s a losing asset.

Plus, it’s stressful to own! There is NOTHING easy about investing in real estate or owning property. It takes massive amounts of time, effort, and capital. Owning a REIT index fund doesn’t count either because you’re not beating debasement with typical 5-10% annualized returns. People think of owning a second home or owning a multiplex to rent out as this incredible passive income generator. After taking on massive leverage to buy the property as most do (mortgage loan) and dealing with property taxes, agent commissions/bank fees, insurance of all kinds, maintenance costs, utility fees, and praying for good tenants who don’t wreck the place, the returns aren’t that enticing for the work in my opinion. That’s not a cheat code. That’s a second job. No thanks. Sure, if you inherit a beachfront house in Malibu, by all means, keep it. That will do well and likely beat inflation (maybe?), but how many of us are this lucky?

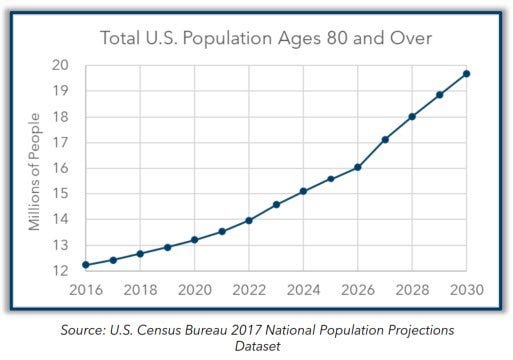

Owning a home is usually a sound financial decision, but there are many caveats to that. As inflation for maintenance costs and property taxes rise and a demographic nightmare approaches in the next 10-30 years when most boomers will be selling their homes…

It’s just not where I want to store my hard-earned wealth outside of my primary residence. I think Bitcoin’s simplicity and absolute scarcity, early innings of adoption, massive total addressable market, and FEWER UNKNOWNS AND RISK (yes, fewer) compared to real estate make it a better investment for me than a second property. Time will tell.

Land:

Land is similar to an investment in real estate, but it has different risks and probably requires less overall effort. Owning land is extremely speculative, as you hope someone will want to build on your property someday, but that day may never come as you chose poorly. Or someone decides to build a waste management facility next to it, and now you’re screwed. There are so many unknowns and headaches with real estate and land that it can’t be considered a cheat code, even with preferential tax benefits. It’s also highly illiquid (can’t sell quickly), and its value is highly subjective.

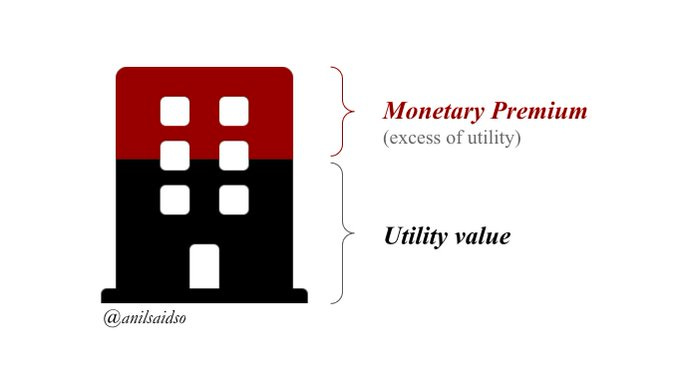

Ultimately, I expect bitcoin to eat a massive amount of the monetary premium each of these asset classes enjoys, eventually leading to their lower valuations.

But you ask, what about my yield? My dividends? My free cash flow?? What will I do without those???

Gold and land don’t have yields, dividends, or free cash flow, but people love and invest/save in them. Why are they considered good stores of value but bitcoin can’t be?

Requiring these things is fiat-minded thinking. You need yield on an inflationary asset like the USD to keep up. Bitcoin being deflationary doesn’t require a yield as its purchasing power grows over time naturally with each bitcoin halving. There will be risky bitcoin yield opportunities soon, but they aren’t here yet. Be patient if you must seek risk and yield. Importantly, unlike inflationary assets like USD or bonds, bitcoin yield is NOT required.

Regarding dividends, not all stocks provide dividends. Amazon doesn’t give out dividends, so is that a bad stock? You’d have done quite well over the past 20 years if you owned Amazon stock and received no dividend as you grew your purchasing power by owning company shares. Dividends are nice but not required. They also compensate you as the company continues to issue more shares, which dilutes your ownership of the company. Many people use dividends to purchase more shares and keep their ownership percentage constant if they can. Bitcoin cannot be debased or have new coins issued beyond 21 million, thus there are no dividends required, you just get an increase in purchasing power, which is what you’re really after at the end of the day.

Free cash flow from real estate is nice, but as mentioned above, getting it comes with a lot of effort and risk. Most of it comes after paying the mortgage, maintenance, property taxes, and all the other home ownership costs. I think owning real estate is wise, don’t get me wrong; some do very well in the space, but they’re doing the work. I don’t have time for that. I’m a doctor with a family. I can barely steal enough time to type out this newsletter. Real estate investing, for the majority of people, is not a cheat code.

A cheat code for saving and growing wealth is something that with the push of a button you can purchase with negligible fees 24/7/365 wherever you are, pay no taxes unless you sell, requires no insurance, has no counterparty risk if you choose, has no risk of dilution, requires no maintenance costs, you can liquidate it 24/7/365 if needed, everyone in the world agrees to its value every second of the day, you can take it with you anywhere you go, nobody can stop you from using it or take it from you, AND you outperform all the other asset classes by a wide margin over the long term as your purchasing power compounds.

The cheat code to life is bitcoin. You’re exchanging infinite fiat for finite bitcoin. It’s really that simple.

It’s like exchanging salt or seashells (as money) for gold back in the day before people realized the value and scarcity of gold. I’d do that trade ALL day.

Update on bitcoin/crypto catalysts and other news:

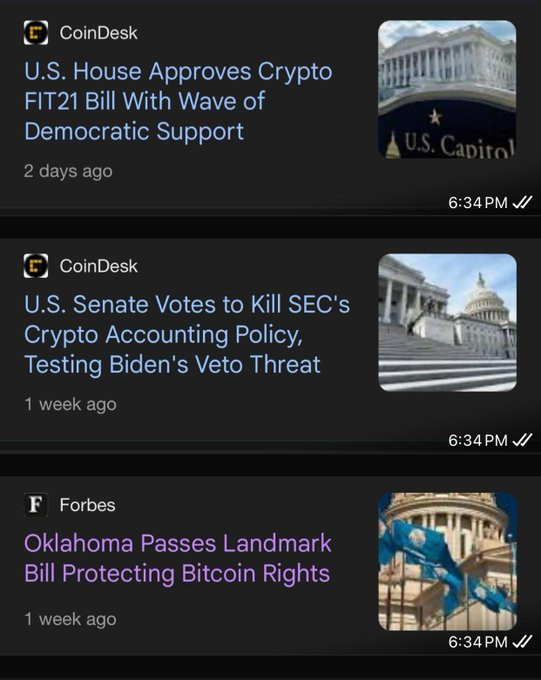

This past week was probably the most insane/bullish week ever for crypto from a regulatory standpoint. Look at all the news!

Presidential candidate Trump had a campaign rally where he promised to protect your right to self-custody and own bitcoin. He is promising to ensure fair and sensible crypto and bitcoin regulation here in America so talent doesn’t leave and America is the leader, just like with the internet. This is massive news. Bitcoin will play a huge role in deciding this election, and I am all for it!!

Oklahoma passed a law that protects you and your right to own and use Bitcoin! Huge! Let the game theory kick in. If one state passes a law, it puts immense pressure on other states as people and their capital migrate to where they are treated best. This is why America rocks. It’s a free country! Pick up and move if you don’t like where you are! Pro-bitcoin laws will attract large sums of capital to their state. Be anti-bitcoin and crypto at your own risk!!

SAB-121 was repealed! Insane!

This rule by the SEC prevented banks from custoding bitcoin by making it cost-prohibitive. Banks weren’t happy. They want to collect fees and to be a part of the bitcoin action. Once banks can start lending bitcoin and accepting it as collateral after they are allowed to custody it – WATCH OUT. The demand for this asset is going to skyrocket. THAT IS BECAUSE IT IS PRISTINE COLLATERAL, THE BEST EVER. Treasury bonds and stocks (the current best) can't compare to bitcoin. I’ve written about this many times, and I truly believe once people figure it out, hyperbitcoinization is near. This is a critical step in that process. For this rule to be repealed, both the House and the Senate, with bipartisan support, had to agree.

President Biden said he would veto the ruling if it got to him, but now he’s in a pickle. BOTH democrats and republicans want this. Banks want it. Nearly 30% of Americans who own crypto want it. Trump has clearly gone on the offensive as pro-bitcoin. Good luck vetoing that in an election year. Once again, America rocks! Checks and balances plus democracy for the win!

FIT-21 was passed! Cray!

This is basically Congress blessing digital assets at large and assigning proper oversight to them. It means they’re not going away. This means that bitcoin and crypto are the future. Buckle up. The bill still has to go to the Senate and likely won’t pass this time around, but it’s still a monumental shift in the US government’s attitude towards bitcoin/crypto.

Everyone is forced to bend the knee to bitcoin, including the US government. Bitcoin changes you. You do not change bitcoin.

This is like in the 1990s when Congress gave internet companies proper regulation to thrive in the US. It allowed the birth of every major internet company we use and love today. It gave America a MASSIVE advantage globally, and it’s happening AGAIN. They’re not stifling the technology but giving it some guardrails to protect the American people. This is EXACTLY what is needed. This will be a pivotal moment 20-30 years from now. I’m pumped up. ‘Merica!

ETH (Ethereum) ETF approved! Bananas!

Literally, a week before, the chances of this were probably 10%. Maybe less. The SEC did a 180, and in the blink of an eye, Ethereum now will have an ETF. I have NO CLUE what to make of this as the ETF won’t offer “staking” rewards, which is critical to the ETH proof-of-stake system. I’m unsure what the institutional interest in ETH is, and frankly, I don’t care. A rising tide lifts all boats and I think more money flowing into crypto is overall a net positive for the space. We’ll see how it plays out, and it will be fun to watch. I expect a “buy the rumor sell the event” for ETH ETF, similar to when the bitcoin ETFs were launched in January. Grayscale trust ($ETHE) has a lot of ETH locked up, NOT earning staking rewards currently (while being charged a fee), and holders are ready to dump it on the market so they can go earn staking rewards through Coinbase and ditch the trust fees. I could be totally wrong, but let’s watch. I will not be purchasing the ETH ETF, full disclosure. Ethereum confuses me. I am still unsure if it has product market fit, and it now has many competitors (Solana, Near, Cosmos, etc.) with zero moat. Not good. Its monetary policy also keeps changing, making it difficult to trust. It will likely do well in this bull market, but in the long term, I’m not sure.

Other exciting news:

On the demand side, Hong Kong officially approved bitcoin ETFs, and they started trading a few weeks ago. Their total inflows aren’t huge, but regardless, more bitcoin ETFs globally = more demand for a finite asset. UK bitcoin ETFs are up next.

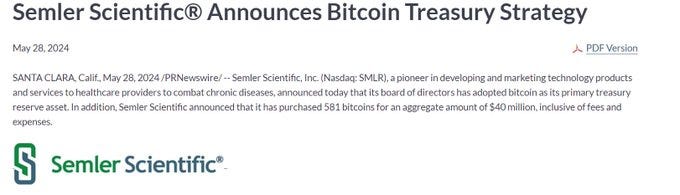

Related to companies putting bitcoin on their balance sheets as a reserve treasury asset like Microstrategy does, a Japanese company (Metaplanet) just reported that they are opting into this strategy, as are American public companies (Square and Semler).

As with many things, it will happen gradually and then suddenly. Imagine when 10,000 companies buy Bitcoin as a treasury reserve asset. Got Bitcoin?

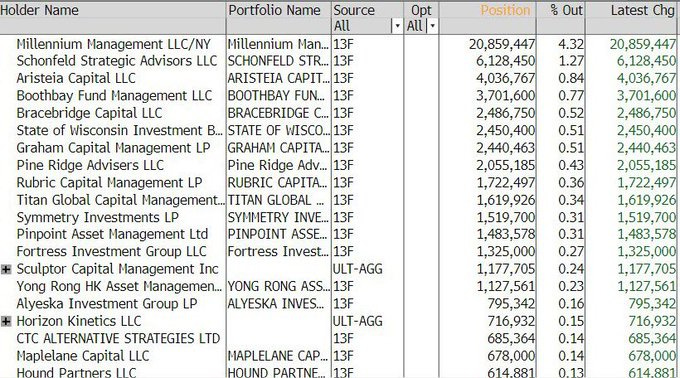

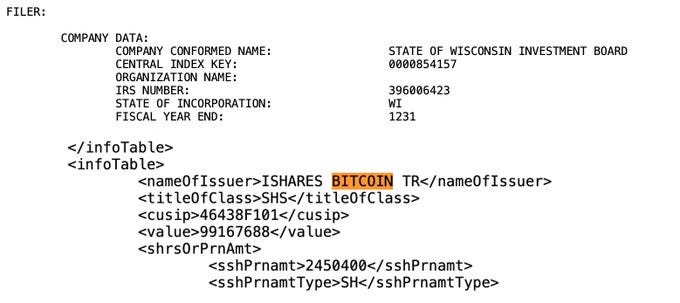

Larger pools of capital are starting to disclose by law (13-F filings) if they have bought shares of the Bitcoin ETF. I expect this list to grow over time as FOMO and game theory kick in among peer groups. Regardless, the institutions have arrived, just not all of them yet, as expected. It will take years to decades or so for all of them, but the success of the Bitcoin ETF is undeniable.

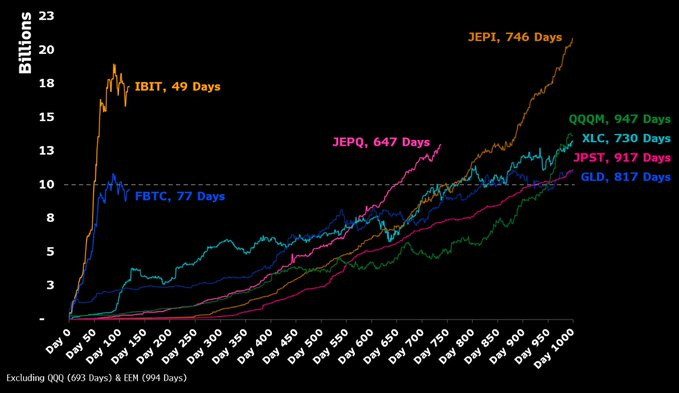

“$IBIT ended up with 414 reported holders in its first 13F season, which is mind boggling, blows away record. Even having 20 holders as a newborn is highly rare. Here's a look at how the btc ETFs compare to other ETFs launched in Jan (aka the Class of 2024) in this metric.”

“Prior to the bitcoin ETFs the record speed for an ETF to reach $10b in assets was held by $JEPQ who did it in 647 trading days (nearly three years). $IBIT got there in 49 days, $FBTC in 77 days. @thetrinianalyst”

MASSIVE NAMES on this list below own the bitcoin ETF (not listed - Wells Fargo, PNC bank, Mass Mutual, Morgan Stanley). The best of the best hedge funds, retirement advisors, and a state pension fund (Wisconsin)!

Learning who is doing what over the next year will be nuts. Get your popcorn ready. Trillions of dollars fighting over a finite asset? Yes, please!

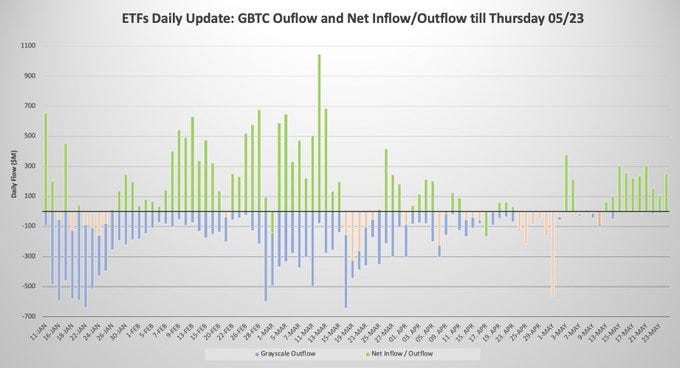

Finally, GBTC unveiled their “mini fund,” a bitcoin ETF with extremely low fees. Reports expect fees of .15%, compared to most other ETFs charging around .25%. Currently, GBTC bitcoin ETF charges 1.5%, and many individuals are selling that, taking a tax hit and either buying another cheaper fee bitcoin ETF or simply not buying bitcoin at all. The newly unveiled mini GBTC fund will allow individuals to convert from GBTC ETF to the mini fund and lock in the lower fee while not taking a tax hit. I think this news is already starting to dramatically lower sell pressure (blue = selling)

which, as discussed in the last newsletter, has really negatively impacted Bitcoin’s price (even with the move up to 70k, believe it or not). This is a very bullish development as, once again – more bitcoin adoption with global ETFs approved plus less supply with the halving and less GBTC sell pressure should equate to higher prices. Stay tuned.

Wrapping up:

If you couldn’t tell, I could not be more bullish on bitcoin over the next 12-18 months.

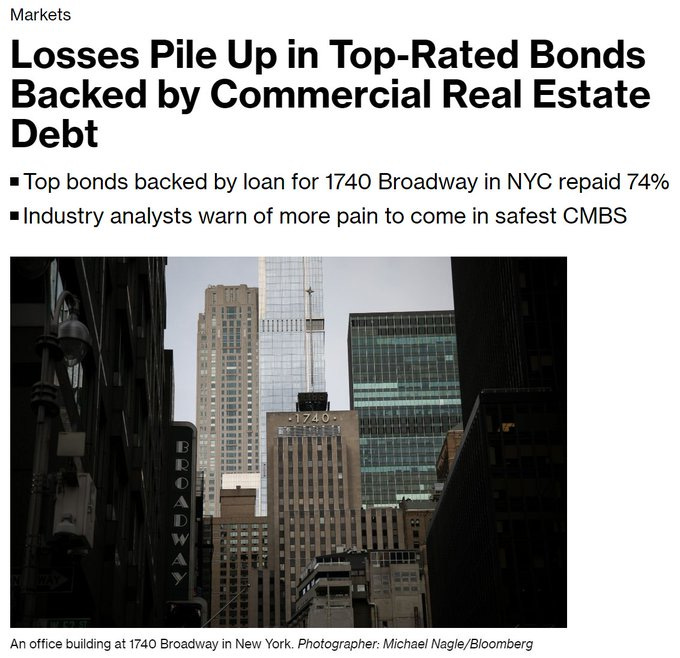

All the catalysts are there to enter the “banana zone.” Central banks have their finger on the trigger to cut interest rates and print money again (they must to keep the party/economy going). It’s literally killing them not to, but it’s coming soon, and the market/bitcoin can smell it. Blood is in the water, and sharks are circling. I don’t know what the catalyst will be (CPI trending down, CRE apocalypse…

more banks failing, consumer spending slowing, etc.), but it’s coming, and soon. They will manipulate the data in any way possible to make it happen. The fiat system REQUIRES IT to function. This is critical to understand.

Money in fact DOES grow on trees for the government, but not for you and I.

The currency is getting debased at >7% per year to fund all these things we can’t afford and keep our economy running. Does a “red hot” economy like we reportedly have need record/wartime government deficits that we’re generating?? Absolutely not, and that tells you everything you need to know. It’s all smoke and mirrors to make people believe everything is “all good.” Your federal taxes are not rising (who would campaign for that and win?), so you’re paying for all these government expenses via currency debasement. It’s a silent tax that you don’t vote for but slowly robs you of your purchasing power over time. It's just slow and opaque/complex enough not to cause riots in the streets. It’s also impossible to blame it on any one person, which we like to do, so that makes it even harder. Nonetheless, it is degrading everything in our lives via inflation/shrinkflation and is the primary reason I believe our society is so broken and people are so upset.

It is NOT politics. It IS broken money. Opting out of fiat and into bitcoin is your only chance to end the madness. No one can debase your money. Saving in a sound money bitcoin standard will dramatically improve your life and your purchasing power. It is the cheat code to life. It’s way easier than memorizing up up down down left right left right B A start.

You can keep playing Contra with 3 lives and never win, or use the cheat code and join me with 30 lives, and we’ll have a blast winning and playing together. The fiat matrix monetary system is designed to steal your wealth so you can’t win/get ahead. Only a select few know the fiat game rules and tricks well enough to beat it. The rest of us need to use the bitcoin cheat code. Improve your chances and have a great time doing it.

Let’s all unite and put aside our red and blue differences. Team Orange has something for everyone and takes everybody. The rules are transparent and don’t change. Your money INCREASES in value over time. Equal opportunity, integrity, and freedom are the core principles. I want you on our team. Let’s go!!

Thanks for reading!

Share if you like it! Orange pill some friends and family!

Until next time…

And remember, volatility is normal! Relax and HODL

THIS is Crypto Pulse