(Phil Collins singing…)

“I can feel it coming in the air tonight. HODL.”

“And I’ve been waiting for this moment, for all my life. HODL.”

Hey friends! Happy Thanksgiving! How are we feeling?!? Pumped up like I am??? Step aside UPtober, MOONvember it is!

Bitcoin is doing bitcoin things and up to nearly 100k! So close!

If you’ve been following me for the last 3 years you were EXPECTING THIS and prepared for it…congrats! As crazy as things have been the past few weeks, the best is yet to come. We’re just warming up. 2025 is going to be lit! Nothing stops this train! 100k is not the top!

Why the sudden price surge?

First of all, that’s just what bitcoin does. Most of the gains in bitcoin come in something like 10-30 days out of the year. If you are impatient and/or get bored and wait on the sidelines for an entry point you generally get left behind. You have to buy bitcoin and HODL it through the volatility. The volatility will eventually be to the upside dramatically over 4-5 years if you can wait that long, which you must.

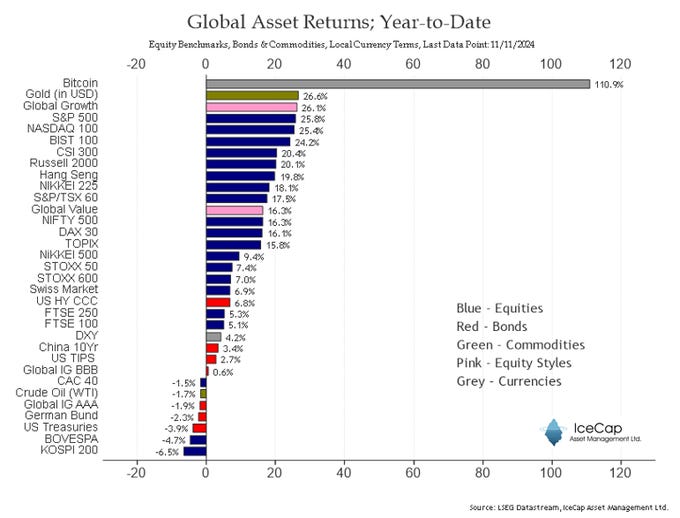

Warren Buffet once said if he didn’t want to hold something for 10 years he didn’t want to hold it for 10 minutes. Bitcoin is similar. You need at least a 5 year time horizon, 10+ is better, and forever is ideal. That’s how you win and outperform every other asset class and hedge fund manager while hyper-scaling your purchasing power. Bitcoin crushing the competition again…

Remember…bitcoin isn’t the “bubble” despite costing ~100k/bitcoin. Global sovereign debt (bonds) earning negative real returns are the bubble (>300 trillion), and bitcoin is the pin popping it. Don’t forget that when the uninformed, biased, and agenda driven mainstream media spouts some nonsense about bitcoin trying to scare you and get you to sell. Know what you own and why you own it. Fiat currency is terrible money.

Article outline:

“Super cycle” dynamics and mega-bullish talk

Price targets and timelines

Significance of Trump’s win and the “red wave” for bitcoin/crypto

Bitcoin Super Cycle

What’s a super cycle? Why a super cycle? I think it’s possible, so hear me out…

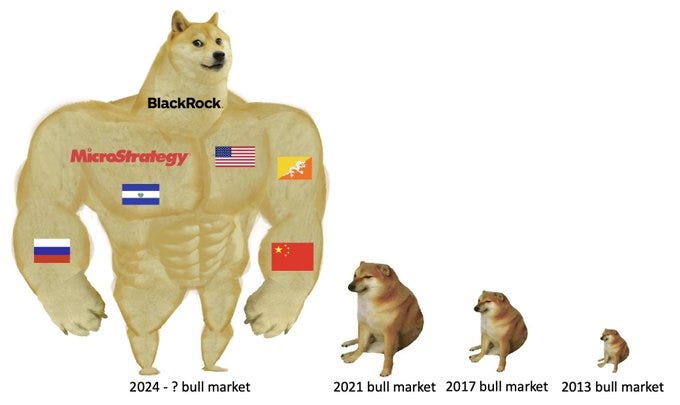

Consider that in the 2020-2021 bitcoin bull run cycle, the only way to buy bitcoin was to go on some “exchange” (many of them were shady and went bankrupt, like FTX, Voyager, Celcius, Blockfi) and make a purchase, and many had dollar limits which limited how much you could actually buy. That friction limited participation significantly, including nearly all institutional investors and many/most retail investors.

Only true hardcore believers found ways to buy bitcoin despite the challenges. It wasn’t easy.

Fast forward a few years, and now, in 2024-2025, you can buy bitcoin via the ETFs in nearly any brokerage/IRA/HSA account you already have and are familiar with (Fidelity, Schwab, Robinhood, etc.) with no limits. What does this mean?

In the last bull run, hundreds of billions of dollars were probably available to buy bitcoin. Now, there are hundreds of trillions facilitated via the ETFs! This includes pension funds, endowments, company treasuries (both public and private), and investment advisors that can now talk about bitcoin and recommend an allocation to their clients.

Despite a large portion of wealth management firms (like Vanguard) still NOT offering the ETFs to their clients yet, the success of the bitcoin ETFs is a sight to behold. Below is a chart highlighting IBIT - just one of the bitcoin ETFs

And here is a comparison to the Gold ETFs…

This type of demand is completely insane and it’s literally like the first half of the first inning as a baseball game comparison. Get excited.

Other super cycle developments are that the bond market (100+ trillion) now has access to bitcoin via Microstrategy convertible debt offerings (see last newsletter), and as of this past week, the derivatives (options) market is now live on the bitcoin ETFs, allowing even greater possibilities and institutional participation.

I’m not even counting the futures market that went live at the peak of the last bull run in November 2021.

These are all critical products for the financialization of bitcoin. Wall Street needs access to these products or they won’t touch the underlying asset in any meaningful size.

If that’s not enough, just the other day, bitcoin’s ULTIMATE use case as PRISTINE COLLATERAL was discussed on TV. A must listen.

Summary: Institutions are now issuing hybrid fiat-bitcoin loans. Bitcoin is being used as PROTECTION. It is the RISK-OFF component of the loan!!! Do you see it yet??? Bitcoin is a RISK OFF ASSET!

Once again. BITCOIN IS A RISK-OFF ASSET! It is NOT just a high risk tech stock.

What does this mean for bitcoin? More demand! Imagine every loan in existence, including your home mortgage, having Bitcoin be a part of it, locked away for years in escrow to protect the bank. I’m not joking.

This is what I’ve been shouting for years is coming. It was so painfully obvious given the superior collateral properties bitcoin has. Nothing holds a candle to Bitcoin’s decentralized, lack of counterparty risk, 24/7/365 global liquidity, divisibility, transparency, final settlement, and programable properties.

The credit markets will incorporate bitcoin into EVERYTHING because it solves problems for them that fiat currencies and inflation/debasement cause. The world is STARVED FOR GOOD COLLATERAL (US treasuries are the current best). Bitcoin is the solution they’ve been desperate for, and now big institutions are testing the waters.

THIS. IS. MASSIVE.

Also, see the guy on the right below? He’s the new Secretary of Commerce under Trump. Tether is the largest global USD stablecoin provider (USDT). You aren’t bullish enough regarding bitcoin-USD hybrid loans!

Want more good news for a super cycle?? I got you

This coming year, big banks will likely be able to custody bitcoin, increasing access even further to the Apple and Microsofts of the world (they only deal with big banks) to put bitcoin on their balance sheet. More demand!

In addition, we now will have a PRO BITCOIN government, given the red sweep result of the election, and they are talking about creating a BITCOIN STRATEGIC RESERVE. LITERALLY BUYING A MILLION BITCOIN TO HOLD SIMILAR TO THEIR GOLD RESERVES!!!

That’s at the Federal level. On the state level, some states are actively drafting bills to create their own state bitcoin strategic reserve, like Pennsylvania and a few others.

All this good news isn’t just bullish from the United States point of view, but globally as well! Bitcoin ETFs and MSTR stock open up opportunities for foreign companies, nation states, and sovereign wealth funds to accumulate bitcoin and shares of US bitcoin public companies (which buy bitcoin).

It is pure madness what has transpired over the past year since the launch of the bitcoin ETFs. I am so bullish I can’t see straight.

That’s not even considering the current macro environment where the Fed is starting a rate-cutting cycle, and Trump historically prefers a weaker dollar and lower interest rates. This is wildly bullish for assets like bitcoin. Plus, the annual deficit and total US debt continue to go parabolic with unchecked spending (it won’t stop) and high interest rates! We just hit 36 TRILLION!

In previous cycles, bitcoin had access to retail traders, a tiny fraction of the equity market via MSTR and bitcoin miners, and one insane small nation-state (El Salvador). In addition, most bitcoin exchanges like FTX were fraudulent, selling customers bitcoin illegally and suppressing the price. Those days are over. Those people are now in jail.

This cycle, Bitcoin now has full access to the bond market, equity market, credit market, derivatives market, retail traders, institutional traders, public companies, private companies, pension plans, endowments, insurance corporations, wealth management firms, nation states, and yes, even global central banks. At the same time, the macro environment seems optimal, and central banks need to continue pumping liquidity (fiat) into the system to keep it solvent as old debts (from 2020) need to be rolled over at higher rates while the US government continues to have a massive spending problem.

Simultaneously, bitcoin/crypto are now much more mainstream than before and are constantly in the news with the “bad actors” behind bars.

Hence…I believe this to be the BITCOIN SUPER CYCLE.

What does that mean exactly? I like this framing:

It’s not the “last” cycle, as I expect volatility to persist and sizeable dips to occur with some cyclicality. Still, I think that Bitcoin’s base price resets MUCH higher from where it is today, and we experience a blow your socks off/no one is prepared/face melting/holy sh&!t/this can’t be real/are you kidding me/WTF?!?/all your models are destroyed/ SUPER CYCLE.

(not financial advice; strong chance I’m wrong, but who cares if you’re a long term holder)

Notably, there is always a ton of backlash and skepticism because of all the calls for a bitcoin super cycle in 2020-2021, I remember it vividly. Bitcoin wasn’t ready for that moment back then, as I understand now. None of these developments were even REMOTELY possible at the time. They were literally pipe dreams.

Bitcoin was valued as a speculative digital commodity and traded as such. When the price went way above its commodity price (the cost to produce it by mining it), it crashed back to the floor.

In 2024-2025, everything is different. In your wildest dreams, you couldn’t have asked for all these things to happen over 4 years.

Bitcoin is now moving from its commodity value to its monetary value, which has no theoretical top (I’m serious).

Gold has a relatively low commodity value when digging it out of the ground for usage in electronics and jewelry (<$1 trillion), yet its monetary premium/value makes it worth nearly 20 trillion dollars as an asset class despite all of its limitations as sound money!

Recall that we use fiat currency today because of the failure of gold as money, but it’s still incredibly valuable as an asset class.

Now that bitcoin is more scarce than gold (mathematically after this recent bitcoin halving) and more portable, divisible, programmable, and verifiable and has been legitimized by the financial world (via ETFs, options, credit markets, bond investors, nation states, pension funds, and public and private companies) there is no turning back.

This is bitcoin’s IPO moment (when a stock is listed on an exchange). This is when it goes global for real. This is when it turns from shady magic internet money to:

OH MY GOD, I HAVE TO OWN THE BEST MONEY IN HUMAN HISTORY.

The commodity price sets the floor for bitcoin (and it is designed to go up forever, unlike any other commodity due to the halving and difficulty adjustment), but once escape velocity is reached and bitcoin crosses the chasm (which is where I believe we are at now)…bitcoin’s true potential and monetary premium/value can be realized.

What does that mean?

HIGHER PRICES. Like much higher.

Somewhere around $800K or so per bitcoin would put bitcoin equivalent to gold’s monetary value/premium. That is the long-term worst-case scenario, in my opinion. I doubt we’ll reach that this cycle, but I’m starting to believe it’s possible.

The market loves to compare assets and assign value based on favorable comps, just like in real estate. Bitcoin is more scarce and more useful than gold by a factor of 10-100. Maybe more? It’s soon to be more popular and desirable among younger generations. Wall Street is beginning to price that in.

Bitcoin will reset from it’s commodity value (~50K cost to mine), to the BEGINNING of it’s monetary premium value. That is nearly $800k per bitcoin… similar to gold’s market cap of around 18-20 trillion. From there, I remind you, that is the BEGINNING of price discovery for bitcoin. Just the beginning. From there, we figure out as a human race how valuable perfect money is in a world of hyper-speed fiat debasement EVERYWHERE. We explore via supply and demand economics and free markets what humans are truly willing to pay for perfectly engineered human money that is significantly better than gold. My bet is a lot.

The correct answer is that there is no top price for bitcoin. It’s infinity. That’s where the meme comes from:

All the world’s value, divided by 21 million bitcoin (bitcoin replaces the dollar as the new “unit of account”). You measure everything in bitcoin terms instead of USD. The human race will never stop producing value, and it can all be stored in Bitcoin, which is infinitely divisible (which doesn’t change the fact that there will be only 21 million Bitcoins forever).

It’s challenging to wrap your mind around this possibility, but when you think about it from first principles, it is not only rational but is the most likely outcome. Humans always gravitate and converge on the single best money. For the longest time, that was gold (5000 years +). Then world trade got too big and fast, and gold couldn’t keep up with the speed necessary to settle transactions, so fiat currencies took over, and throughout our lifetimes, the USD has been the dominant one.

As crypto usage takes off and the world gets easy access to the USD via stablecoins like Tether (a newsletter for another day), the USD is going to get stronger and destroy every other fiat currency as the top dog, but then it’s going to face its ultimate competitor in bitcoin and get utterly destroyed.

It’s similar to a March Madness NCAA basketball tourney where bitcoin and the USD face off in the final showdown at a date far in the future after each has vanquished all their other opponents. The USD, a fiat currency that can be printed at infinitum, cannot ultimately compete with money that is fixed in supply. The battle is already over. You KNOW the winner. Humans WILL ultimately choose bitcoin as the single best money at some point in the future to store their value and use as their unit of account. Can you simply HOLD the winning ticket through the volatility?

I’m warning everyone that this is where things could start getting crazy (if they haven’t been already). Once 100k is broken, the next psychological barrier is 1 million. At that point, bitcoin will be entirely derisked as an asset class when it overtakes gold’s market cap, and then the bitcoin market will be deep and liquid enough TO SETTLE ALL GLOBAL TRADE.

Example:

“You want a few hundred barrels of oil? Cool. Pay me in bitcoin.”

THE HIGHER BITCOIN’S PRICE GOES, THE LESS RISKY IT GETS, THE MORE USEFUL IT BECOMES, AND THE HIGHER THE PRICE WILL GO.

That is in complete contrast to stocks, real estate, bonds, and other store-of-value assets, which can be assigned a value based on profits, earnings, interest rates, inflation, taxes, materials, market comps, etc. That’s why Bitcoin is so valuable, because it’s just money, and its value relies on none of that. It’s just supply and demand, and there is unlimited demand for perfect money at all times, but there is a fixed supply of bitcoin.

Bitcoin’s value is simply being the best money, and besides abundant free oxygen, it’s the most important thing in your life. You need money for everything, every day. Money is a technology and has allowed the human race to flourish and grow as we no longer need to barter for everything. Money is THE critical underpinning of society and is currently broken with fiat currency.

Bitcoin fixes this. It solves broken money. It’s human-engineered, perfect money. No debasement, transparent rules without rulers, digital, censorship-resistant, seizure-resistant, and much more.

It puts all of us on the same team. Team bitcoin. You work for me, and I work for you. We store the efforts of our labor and productivity in a single money and mutually benefit given the fixed supply. You WANT me to succeed. I WANT you to succeed. We win and lose together.

Just like with internet adoption, it happens gradually and then suddenly. The Internet is an open-source freedom tool (for information and trade). It can’t be stopped, and humans love it. Similarly, bitcoin is the Internet of money and is an open-source monetary freedom tool. We might still have 10+ years until that “suddenly” moment for bitcoin. However, given the recent developments, I’m getting nervous that it’s coming faster than I had imagined.

Blockbuster went out of business in about a decade after Netflix launched. Bitcoin has been public for nearly 16 years now. In the internet era, information moves FAST. Things happen faster as a result. Just like in March 2023, a few banks were insolvent in nearly 24-48 hours, given the hyper-connected nature of the financial markets. When the lightbulb turns on for Wall Street about Bitcoin, and they wake up to the realities of fiat currency shenanigans and lies, it will be a sudden move into Bitcoin at any cost. You won’t have time or even the ability to get a buy order in. They’re not going to save any for you. Now is your chance.

Quite frankly, I’m ready for that day. I hope you are too. I put in the work. It’s not luck.

There will be a time in the future when people will call you lucky for getting into Bitcoin when you did. Tell them NO. You put in the WORK. It was HARD. You got the results you DESERVE.

There is NOTHING easy about bitcoin, including HODLing it during the lows and not selling at the highs, and all the FUD you have to deal with daily.

Oh they’ll ban it. WRONG

Oh, it wastes energy and is bad for the planet. WRONG

Oh it’s just a Ponzi scheme. WRONG

Oh it will die when they raise interest rates and stop QE. WRONG

Oh it’s just a levered tech stock play. WRONG

Oh someone will copy it and it’ll be "MySpace”. WRONG

Oh it has no intrinsic value. It’s worth nothing. WRONG

Oh it’s not backed by anything. WRONG

Oh no one will use it for anything, you can’t even buy coffee with it. WRONG

Oh no serious traditional institution will ever put money into it. WRONG

Oh it’s just a bubble. Once it pops it’s dead. WRONG WRONG WRONG

Oh it’ll never scale to 8 billion people. WRONG

Oh I’ll just outpace inflation with my bonds earning 4-5%. WRONG

Oh I’ll just outpace inflation with my stocks earning 8-10%. WRONG

Oh I prefer the cash flow with real estate. BTC will never provide cash flow. WRONG

Oh physical gold has been around for 5000 years. Digital gold has no value. WRONG

After you put in 100 hours of work into bitcoin you literally feel like you’re taking crazy pills sometimes when you listen to others talk about this revolutionary technology. Alas, that’s the path forward if you want to fix the money and fix the world. It’s going to be hard. You have to be willing to go against the grain.

And here’s the inconvenient truth. It’s only going to get harder.

As the price goes to unimaginable heights that only those who truly understand the asset can predict, people will get mad. They’re going to be jealous and frustrated and angry. That’s just human nature. ESPECIALLY when mainstream media has been telling them lies about Bitcoin for the past 15 years and telling them NOT to buy it, and as a result, they miss out on a huge portion of the upside. They were misled AGAIN.

And this time, the stakes are high. When Blockbuster went out of business, it became a meme and a joke. Hardly anyone besides those employed and invested in the business were hurt.

Conversely, Bitcoin is a breakthrough technology coming to disrupt FIAT MONEY and primarily store of value assets like stocks, real estate, bonds, gold, art, etc. Basically, the majority of everyone’s net worth.

This impacts nearly everyone on the planet. Each person’s nest egg could be the new Blockbuster as money flows from inferior stores of value into bitcoin. It will happen gradually and then suddenly until traditional assets like stocks, real estate, and bonds return to more rational (lower) prices, but not zero (they are mind-boggling overpriced today). That will be painful for many people, but you can’t stop an open-source technology like Bitcoin or the Internet.

Bitcoin will be a harsh reality check. There will be some pain in transitioning from the old fiat system to the new Bitcoin standard. It’s not going to be blissful for everyone. That’s how free markets and capitalism work. There are winners and losers. Think of all the brick-and-mortar stores that didn’t adopt a digital/online strategy and went bankrupt. Or Kodak that blew off digital pictures. Painful for them. That’s how disruptive technologies and capitalism work. That’s what is coming with bitcoin, but for money.

It’s on you to put in the work now and figure it out for yourself before you’re the last one at the table, and your wealth is melting in fiat currency. No one can do this for you. You have to tune out the noise and distractions and make the mental leap, check your ego and admit you were wrong, swallow some humble pie like myself and every other bitcoiner had to, and start buying. It’s hard. It takes courage. It’s uncomfortable. It’s scary at times. Bitcoin ALWAYS SEEMS EXPENSIVE (trust me). Protect yourself now while it’s still cheap. Yes, it’s still cheap.

There is finally an exit from the fiat currency kleptocracy. The bitcoin door is small, and at some point, there will be a panic for the exit door. I suggest everyone head there now while the building is burning and before anyone yells, “FIRE!”

When does this super cycle end??

Markets have a way of extracting the most pain on the most individuals. Currently, most people (99%) have no exposure or minimal exposure to bitcoin, so max pain is higher prices. Given the favorable tailwinds into 2025, I think the bull run could extend throughout 2025, maybe longer.

I wouldn’t be surprised for many nice dips throughout 2025 (>10-30%), especially around tax season, and that also could very well be the top, but I doubt it. I will look closely at on-chain metrics during that season to help decide. If it’s just a dip, the explosion into year-end 2025 could be breathtaking.

If the bull run ends around Q1-Q2 2025, I think 150k or so will be the top. Maaaaybe 200k. I’ll be disappointed if that’s the case, to be honest. That is not a super cycle.

If it continues until the end of 2025, I think 300-800k will be the top. Some have called for a 1 million top, but I think that is even too bullish for me, although it is not impossible. That’s more like a super cycle. Bitcoin’s price will fall back down, but it should reset to much higher than 70K.

So there you have it. Bitcoin should top somewhere between 150k and 1 million sometime next year! Ha! How’s that for specificity? Not helpful, right?

Yes, it is actually. It means you should just buy and hold. Don’t get cute and try to time it because you and I aren’t that talented. No one is. This is the world’s first encounter with an absolutely scarce digital asset disrupting traditional finance. No one has any clue what is going to happen. The worst thing is being stuck on the sideline.

If you make some life changing money and have goals you’ve set and experiences you deeply desire, take some profit and live. That is what money is for, to live. You’ve used bitcoin appropriately and grown your savings and purchasing power. You only live once and can’t take your Bitcoin with you.

Experiences and happiness are everything. Money is not, but money will and can facilitate those things to a degree. Most importantly, money buys you time to do what you genuinely want, unencumbered by the weight of all the mandatory bills and expenses that keep you stuck at your current job. Use bitcoin as money to preserve your time and increase the freedom of the most scarce thing we all have…our time.

Some people will never sell their bitcoin and only borrow against it. That is not for most people and can be tricky and anxiety provoking. I know I always say HODL forever, but I will applaud anyone who sells some to live their dream and enhance their life. Bitcoin will always be there for them, just at likely much higher prices. There are trade-offs for everything in life. Bitcoin forces that reality upon you. Nothing is free. No one can print money out of thin air. The rules of bitcoin are set and no individual can change bitcoin. Bitcoin changes you.

The “Red Wave” Significance to Bitcoin:

Regarding bitcoin and crypto and making money, there could not have been a better outcome from the election (personal views aside). Indisputably, the current administration and the Democratic party, in general, were EXTREMELY toxic and hostile to Bitcoin and all digital assets.

They literally tried to end the industry and took out multiple banks in Operation Chokepoint 2.0 to try and kill it in one of the most diabolical plots in the history of governments. In doing so, they almost collapsed the entire world economy in March of 2023 due to bank failures greater in dollar magnitude than in 2008. Bitcoin and crypto survived, and the internet never forgets. In the 1960s, they probably could have gotten away with it unnoticed, but now there is WAAY too much info online, in emails, texts, etc. to conceal the truth. Justice will be served.

In addition, the SEC and Gary Gensler (who is now resigning), advised by the White House, prohibited any new useful rules and regulations related to digital assets. Meanwhile, they tried to sue nearly every cryptocurrency founder under laws created for stocks in the 1930s! They were FORCED to approve the bitcoin and Ethereum ETFs after the courts found their arguments absolutely ridiculous. Bitcoin and crypto yet again persevered.

The list of transgressions and senseless obstructions are a mile long, and I probably don’t know the half of it. It was 1000% a democratic objective and stance to stifle and kill bitcoin/crypto so that innovation would be squashed and the “old guard” (USD, banks, etc.) would be protected at all costs. Bitcoin and crypto were drug money and energy hogs to them. Absolute pests that needed to be killed.

To the informed, bitcoin and crypto were just revolutionary freedom technologies.

Well, the Democrats lost, and badly. PARTLY, because of their anti-crypto stance and all the swing voters who flipped Republican because of it.

Trump and his new administration ran on a platform that was EXTREMELY positive towards bitcoin and crypto. Multiple people in Trump’s cabinet own bitcoin and truly understand it, including the Vice President and RFK Jr. They want to provide clear rules and regulations. They want to increase its adoption. They want America to be a leader in the space, including bitcoin mining. They’re even talking about a “STRATEGIC BITCOIN RESERVE”. Global game theory is now taking center stage as countries race to acquire the scarcest asset on the planet.

Why does the new administration support bitcoin and crypto?

At the end of the day, bitcoin is simply freedom technology. America stands for freedom. If you are against bitcoin, you are literally opposed to freedom. That may sound hyperbolic, but I believe it based on what I understand about bitcoin.

It’s freedom money that allows you to save your wealth in money that can’t be debased against your will, spend it without fear of being censored, and store it without risk of unlawful seizure. It is an absolute breakthrough technology.

We all have many differences in what we believe is right, but at the core, we ALL have a deep desire to be free. That is why you can’t kill bitcoin, and it will never die. It’s an idea (monetary freedom) whose time has come to disrupt the traditional monetary status quo that is suffocating and extracting value from everyone. Yet, hardly anyone cares because we’ve been born into the fiat system and have been conditioned all our lives to just “accept” inflation as necessary.

Bitcoin’s value proposition is something 100% of people will get behind once they understand it. It just takes time since it’s a novel technology, and there has to be an event that impacts THEM to wake up. For me, it was the 2020-2021 money printing/inflation madness. For most privileged wealthy Americans with bank accounts, large stock portfolios, and a house, it’s VERY hard to see the need for bitcoin, but that is myopic and dangerous. Kodak thought digital pictures were dumb, and Motorola thought the iPhone was weird. Bitcoin is a similar disruptive technology.

Many people now do understand bitcoin, and that is why the bitcoin and crypto industry went out IN FORCE to promote Trump and all other pro-crypto candidates, including RFK.

This was a tectonic shift in the world. If things play out as I anticipate, it will be discussed in history books forever. You are living through history as Bitcoin monetizes from zero to the world’s global neutral money and store of value simply because of its superior monetary properties.

Freedom wins again. Is that even surprising?

I can only write this newsletter because I live in a free country. Whether you agree or disagree with what I write, the key is that I can write it and speak what I believe to be the truth. From there, we can debate and agree or disagree at the end of the day. THAT’S OKAY. We’re free to do that.

Thus, a word of caution to all future election candidates/parties:

DON’T BET OR CAMPAIGN AGAINST FREEDOM, EVER.

THANK YOU FOR COMING TO MY TED TALK.

I hope you all have a wonderful Thanksgiving. Try to orange pill some friends and family around the table and share this newsletter, please! I’m grateful to every person who reads this, and I hope I’ve orange-pilled a few of you along the way. The best is yet to come, and I’m incredibly excited for 2025. Price dips are meant for buying. Don’t be scared, and HODL!!! You own the best money!

Thanks for reading!

THIS is Crypto Pulse