Vote for Bitcoin!

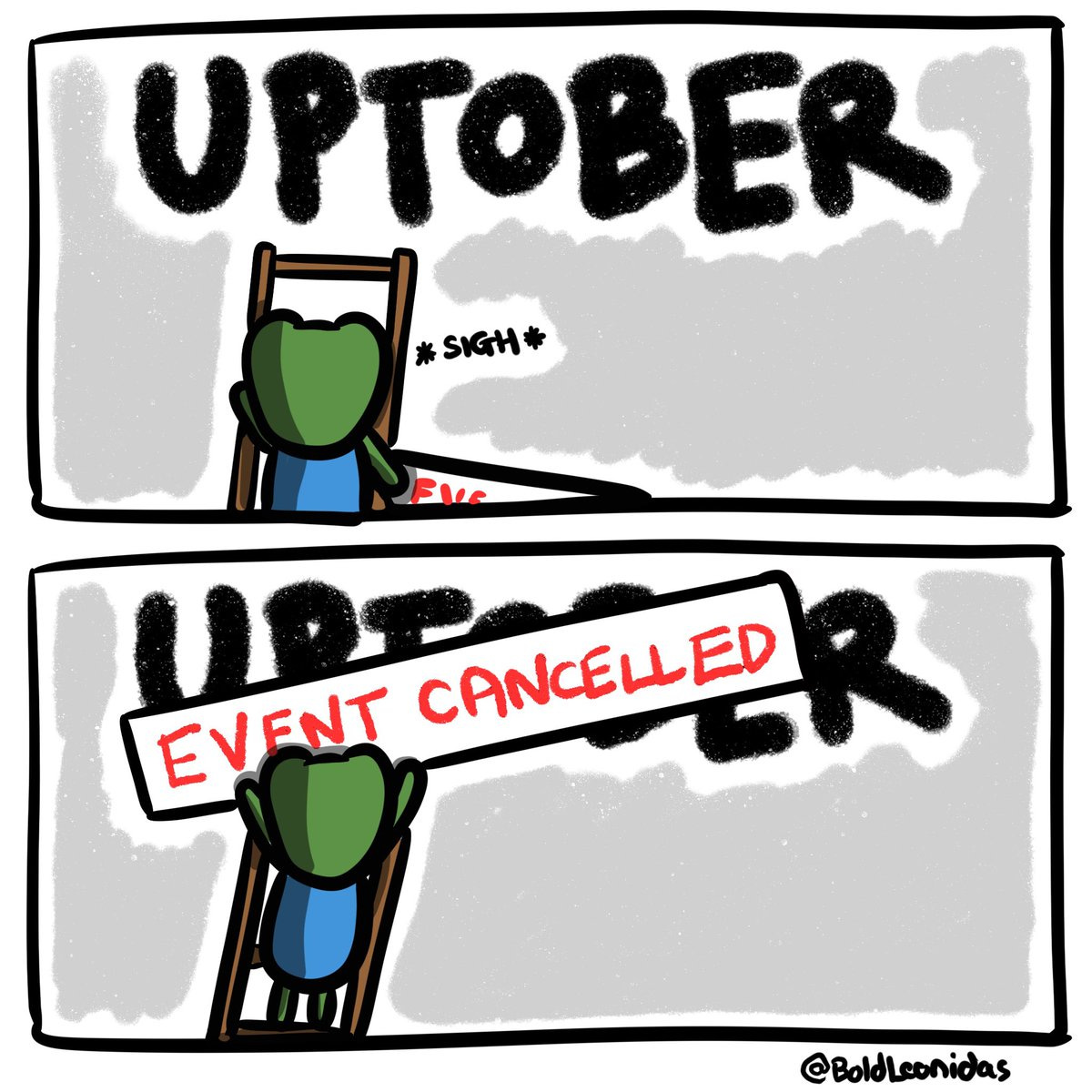

October wasn’t everything I had hoped for Bitcoin. In my defense, “UPtober” technically happened (bitcoin ended UP ~12%), but it was pretty weak in the grand scheme of things, considering Bitcoin’s prior October history.

I know many of you were left asking, “What do you call this? A pump for ants?”

Such is life. Sorry. Mind you, the S&P500 was up only 1% in October, so there’s that at least. #winning

Maybe we didn’t get the true “UPtober” I was hoping for, but I think “NovemBULL” will be better. Patience.

Due to the war in the Middle East and the uncertainty surrounding the upcoming US election, Bitcoin had to overcome a lot of drama.

People are literally losing their minds over the election. Thankfully, the hysteria is drawing to a close. It reminds me of Y2K, when everyone thought the world was going to end that night. Nope, everything was fine, and people went to work the next week. The same thing with the election—no matter who wins, nothing will change, and you’ll go to work the next day, take your kids to their 21 activities, and complain about the price of everything at the store but still buy it.

The financial markets are pricing in some CRAZY outcomes right now as people are hedging their portfolios and doing all sorts of weird stuff. This leads to some weird price action related to bitcoin. Don’t fret it. When the election is over, regardless of who wins, and people realize nothing is different (the economy is okay, and the US government continues to spend money it doesn’t have) - it’s game on, and Bitcoin rips higher, in my opinion. Don’t get left behind.

There’s also some concern over persistent, nagging, sticky inflation (war, Fed lowering interest rates reigniting demand, possible tariffs with Trump), which is causing the 10-year UST yield to rise DESPITE FEDERAL RESERVE RATE CUTS. This typically dampens “risk” assets like bitcoin.

I say “risk” with air quotes because that’s how Wall Street treats Bitcoin today, but in my opinion, it’s the exact opposite. Just because it’s volatile doesn’t mean it’s risky. It just means you must size your portfolio correctly and have the appropriate time horizon to withstand the volatility.

Wall Street will learn this eventually.

Regarding the election, there is so much on the line from a bitcoin/crypto regulatory standpoint based on who wins the presidency that I don’t think anyone wanted to go all-in the month before the winner is declared in a tight race. Thus, all bets are off for the bitcoin price to move substantially higher until the election is over and a winner is declared (hopefully on election night). Bitcoin likely just continues to range from 58k to 73k. Boring.

What’s hilarious is that 58k-73k is boring, and just a year or so ago, 15k-20k was life. Those prices are gone forever, and now most everyone is sad we’re stuck in this much higher range in consolidation mode awaiting the election results. It’s always essential to zoom out. Bitcoin is doing great.

Throughout this next year I anticipate things will get crazy, so I will try to put out more frequent content and keep it simple as to what I’m doing. It’s not financial advice for you, but I get asked a lot what I’m doing so I figured I would share my actions and line of thinking.

I’m a bitcoin diehard/degenerate. Always keep that in the back of your head. I think almost everyone should just dollar cost average (DCA) and not sell. However, I’d like those who read this to be aware of the risks of a steep correction that may happen during the next 1-2 years and avoid “buying the top.”

I predict bitcoin will get extremely overbought in the next 12-18 months and downside will then ensue. Buying “the top” and having to hold for years while you’re investment is underwater and not “sell the bottom” is insanely hard. Trust me, I know from personal experience. I hope I can help others from having to endure such pain, although it made my conviction stronger for sure. I also reject the notion that this is the “final cycle” or “supercycle,” and the volatility and downside are gone forever now that the bitcoin ETFs and ETF options are coming soon.

I almost think volatility will INCREASE as <1% of the world has adopted bitcoin as an actual legit asset class to save in, and the ETFs still only represent ~5% of all bitcoin in existence. That means 95% of bitcoin is still trading like it was pre-ETFs, and that likely means cyclical behavior persists with massive upside and downside. In addition, the supply held by long-term holders like myself is only increasing daily. That means less supply is available on the market, which will increase volatility.

There’s also a good chance the new ETF options trading will increase volatility as well, but that remains to be seen as there are good counterarguments that it will dampen it. We’ll have to wait and see on that one, but on the whole, I’m expecting massive upside followed by a significant downturn once again. Bitcoin will be declared “dead” for the 1000th time, and it will rise from the ashes again next cycle (2027-2028). Maybe the downside won’t be 70-80% like before, but I still expect a sizeable decline (50% +). You need to be prepared for that.

With all that said, my current strategy is as follows:

Bitcoin DCA to cold storage: active weekly (will alert if turning off – probably once BTC hits ~80k). I think bitcoin will get back to ~75k in 2026 and I’ll start buying again. Never selling.

Bitcoin ETFs in Roth IRA: Holding (may consider selling tiny portion (<10%) to test my trading ability. Do not recommend. I may chicken out on this as well).

Bitcoin ETFs in HSA account: Buying and holding (WILL be selling some for medical expenses and will try to sell the top)

Bitcoin credit card: Always earning BTC rewards with fiat purchases—no plans on selling.

Bitcoin proxies (Microstrategy/BTC miners): Holding. Plan to sell for trading purposes and when call options are near expiration.

Altcoins from prior cycle: Holding. Planning to sell everything and test my trading skills. Moving to bitcoin only (or maaaaybe one altcoin, to be determined) after I sell.

Bitcoin loan: I haven’t done this YET, but contemplating it using my universal life insurance policy. I’m very intrigued by it and will keep you posted if I go forward with a small loan to test my personal Microstrategy playbook (see below). Stay tuned.

As you can see, I’m considering selling only a very small portion of my Bitcoin and only in tax-deferred accounts (Roth and HSA). I could regret it, but the amount will be trivial, so I’m not too worried. The best strategy is always DCA and HODL for bitcoin. No selling. That’s what I view altcoins and bitcoin proxies for – selling and enjoying life if you make some profits. Sometimes you need to learn the hard way but I feel like I have a good grasp on when bitcoin is overheated compared to when I first learned about it in 2020. I need to test that out. I plan to update you so we can see how I did in hindsight. Hopefully, it’s not too painful of a lesson.

Microstrategy (MSTR): DISCLOSURE – I OWN SHARES OF MSTR

There’s a ton of debate out there regarding the company Microstrategy and its value compared to just buying Bitcoin.

It’s complicated for sure, and I think an entire section is necessary to discuss this publicly traded company. I urge you to take some time and try to wrap your head around what the CEO, Michael Saylor, is doing. It’s the biggest thing in finance and no one is talking about it. The guy will go down in the history books as either an absolute genius if bitcoin succeeds (what I believe), or the laughing stock of Wall Street if it fails. Either way, it’ll be one hell of a story, and you have to give him mad props for his vision and conviction in bitcoin.

Microstrategy has pivoted from a dying software business to a bitcoin holding/treasury company that is looking to eventually become a bitcoin bank monopoly. Just like Apple, Meta, MSFT, Amazon are digital monopolies in their own realms, MSTR is seeking that title related to digital capital, but backed by bitcoin and will be the first of its kind.

An investor's goal is to be on the lookout for “the next big thing” or the next monopoly before it reaches that stage. You want to own monopoly corporations—they have tremendous network effects, pricing advantages, and staying power since they are so big and were the “first.” MSTR is a multi-billion dollar company that could be worth multiple trillions one day if Bitcoin grows as I expect it to.

Saylor is using intelligent leverage to buy bitcoin and hold it on behalf of his shareholders. He does this through convertible debt and equity offerings. The debt markets worldwide are worth hundreds of trillions of dollars, absolutely starved of yield from bonds that don’t outpace REAL inflation (~8% based on M2 money supply growth).

Importantly, bond investors are not allowed to buy bitcoin or bitcoin ETFs. They can ONLY buy bonds, and MSTR offers bond investors a way to get exposure to bitcoin through his company.

MSTR sells convertible bonds at ridiculously low interest rates (0.6%) that don’t mature for typically 4-8 years to bond investors. He then goes out and buys bitcoin with the US dollar loan. In essence, he’s shorting the USD currency and buying better money (BTC) with inferior money. Current shareholders benefit from this as Saylor buys BTC and increases the amount of BTC/share investors own. At times, the stock gets overvalued, and Saylor then uses the premium the stock is commanding to issue new stock shares. He then buys more bitcoin for his shareholders with the proceeds. He uses the term “accretive dilution” here, which is unheard of in traditional finance. He’s INCREASING the bitcoin/share value for his shareholders while diluting them via stock issuance. Exactly what shareholders want as they realize there is nothing on this planet more valuable than bitcoin. Usually, when a company issues more shares, your ownership in the stock just gets more diluted, and it tanks the stock price. When MSTR issues more shares, you know it’s to buy more bitcoin for you!

It is a novel and brilliant strategy and he’s looking to accelerate it over the next few years. He just announced his plan to buy 42 billion dollars of bitcoin over the next 3 years!!!

MSTR has outperformed NVIDIA, if you can believe that.

The market is signaling something there. I’d pay attention. I think MSTR is like Amazon in the early 2000s. There has already been significant growth, but so much more is ahead. Time will tell, but Saylor seems to be a step ahead of everyone else. I truly believe MSTR will transform capital markets and Wall Street as he forces everyone to understand the true value and power of an absolutely scarce digital commodity that protects companies and investors from the ravages of monetary debasement.

Quick Macro update:

The best macro analysts in the world are at odds with each other regarding the economy. Some say recession soon, others say everything is great. Both have good talking points and data to back up their positions. I’m not sure.

I side with the optimists when it comes to the US.

US economy: slowing from hyper-speed to normal-ish. Despite many calling for a 2008-style mega recession, it appears nowhere in sight. Everyone has a job that wants one. People are out spending money. Boomers are collecting tons of interest on their cash. The stock market is near all-time highs. Home prices are up. It’s hard to be bearish on the US economy as of today. There are some stress signals here and there, but it’s hard to fixate on those right now.

The Fed is also starting to ease monetary policy with interest rate cuts (and more to come) while the US government continues to run wartime deficits at nearly 2 trillion/year. All of this is unheard of, and thus, yes, the cringe-worthy adage of “this time is different” may actually apply to the US economy.

The rest of the world isn’t in such good shape, however. China is really struggling, and they are in a 2008-style recession on steroids with the collapse of their housing bubble. The Chinese government is ramping up its fiscal and monetary policy support of the economy, similar to how it did in 2016/2017. Bitcoin will, of course, be a benefactor of this loose fiscal policy and liquidity injection.

Remember, bitcoin is a global asset. It’s not entirely based on the US economy and financial markets. If a country prints money, it will find its way to bitcoin.

Europe and Canada are also cutting interest rates, and the money spigots are back open worldwide. Let the good times roll.

The fiat system must continue to inflate to stay solvent, so asset prices must continue to go up while debt burdens are inflated away.

Ultimately, the money printer never stops. That’s why you need to stay invested over the long term. Even though they can stop printing for a bit, ultimately, to pay off debts and keep the fiat Ponzi scheme running, they have to inflate the money supply over the long term.

If an actual recession does come and there are massive layoffs and the economy tanks, the money printing response from the government and Fed will be unfathomable. You won’t have time to buy enough hard assets before their valuations go vertical.

QE infinity, rates to zero again, stimulus checks galore as many times as needed, new programs like BTFP for insolvent banks (like March 2023), open swap lines for dollars between countries, central banks buying all things distressed, you name it – it will be done to keep the Ponzi afloat and kick the can. Trust me, they can and will. Otherwise, there will be riots on the streets.

This is similar to the movie Gladiator, which has a quote taken from Roman times: “Give them bread and circuses, and they will never revolt.”

Adapted for 2024: “Give them stimmy checks, stock and home prices rising, and internet/social media/gambling/sports, and they will never revolt.”

Buy the fear as a golden opportunity if it ever comes.

Wrapping up, there has not been much news since the last newsletter. The escalating war in the Middle East is really heartbreaking for multiple reasons. War sucks. Fiat allows for and facilitates war. Bitcoin really does fix this. If you can’t print money, you may think twice before going to war or funding proxy wars. Remember, there were wars on the gold standard pre-1971, but those wars were funded mostly by taxpayers buying war bonds. If the US government came to you today and said, “buy this bond so we can go fight X war/X proxy war”, would you do it? On a bitcoin standard, I believe wars and the threat of them would be less as it would cause financial ruin for said country. They would only be fought in dire circumstances and would require a speedy resolution due to costs.

Overall, I remain laser-focused on Bitcoin and Bitcoin-related proxies for the coming year. Between larger institutions, pension funds, and nation-states acquiring bitcoin, banks being allowed to custody bitcoin, FASB accounting rule changes, new bitcoin options markets for the ETFs, predictable money printing by whoever is elected, and just a general growing awareness of bitcoin, I could not be more bullish.

Yes, I believe that for now, “this time is different” for stocks and the economy. They will continue to go higher because the government and Fed want them to/need them to (otherwise, capital gains tax receipts would go down, and the currently outrageous US budget deficit would explode even higher). That’s not to say there won’t be market “corrections,” but apocalyptic crashes and 2008-style recessions are not my base case. The Fed and the US government will intervene quickly if that’s the case.

No, I don’t believe “this time is different” for bitcoin. Its 4-year cyclical pattern will finish playing out, and Q4 2024 through 2025 will be fireworks. I’m ready.

Let’s hope I’m right. I think things kick into high gear once the election is decided. Good luck to your chosen candidate. I’ll be voting for/buying bitcoin. I hope you do the same.

Fix the money, fix the world.

Thanks for reading! This was our three-year anniversary!

Share if you like it!

THIS is Crypto Pulse