Voyager

Crypto For Everyone

Hello Pulsers!

While the crypto market has been somewhat stagnant, frustrating both long and short positions, us Pulsers are just biding our time and DCA’ing into our positions for the long haul. We know we cannot beat the market, especially such a volatile market, so we sit back, accumulate when we can, and try to enjoy life without too much worry about our investments in these crazy and chaotic times. If you still are not convicted on Bitcoin and the Crypto Asset complex, I suggest going back and perusing our first 9-10 articles; that should educate you, and bring you up to speed.

Last time, Chris walked us through risk, KYC/AML and NYKNYC arguments. If you haven’t read that fantastic article, please go back and do so since today’s article is predicated on proper risk allocation via position sizing.

It’s always a great idea to keep your money in different “pools”. It’s the whole “eggs in a basket” idiom, and it’s so true. Don’t keep all them eggs in the same place lest something bad happens to the basket!

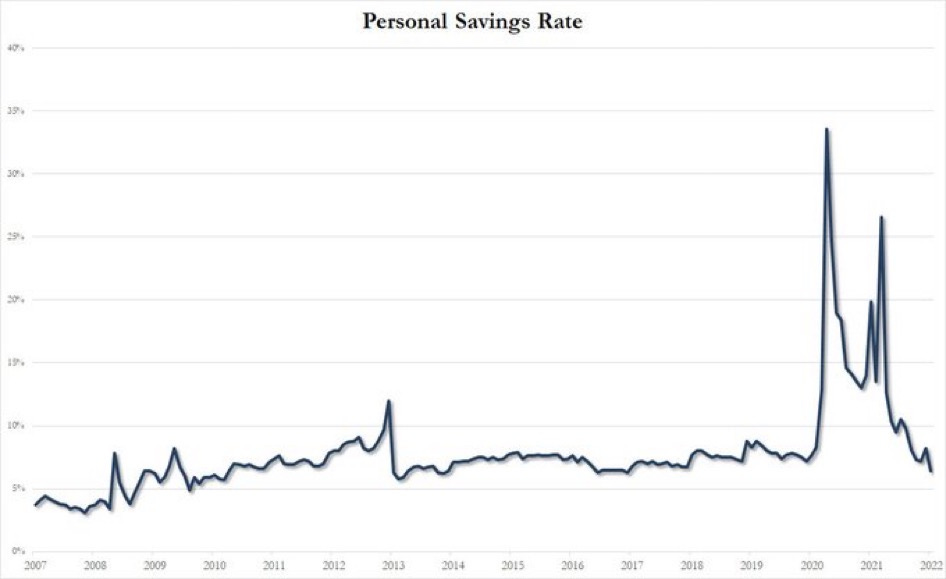

That being said, in a sideways market, in a new asset class that is being adopted and is highly volatile but has over 150% CAGR over the last decade(₿), passive income can be a huge boon. This is why so many of us doctors and investors LOVE dividends and interest. With personal savings at a local nadir, it is more important that ever to save AND try to earn yield to compete with the highest CPI print in 40 years. Especially since bond yields have completely left the building.

ENTER VOYAGER

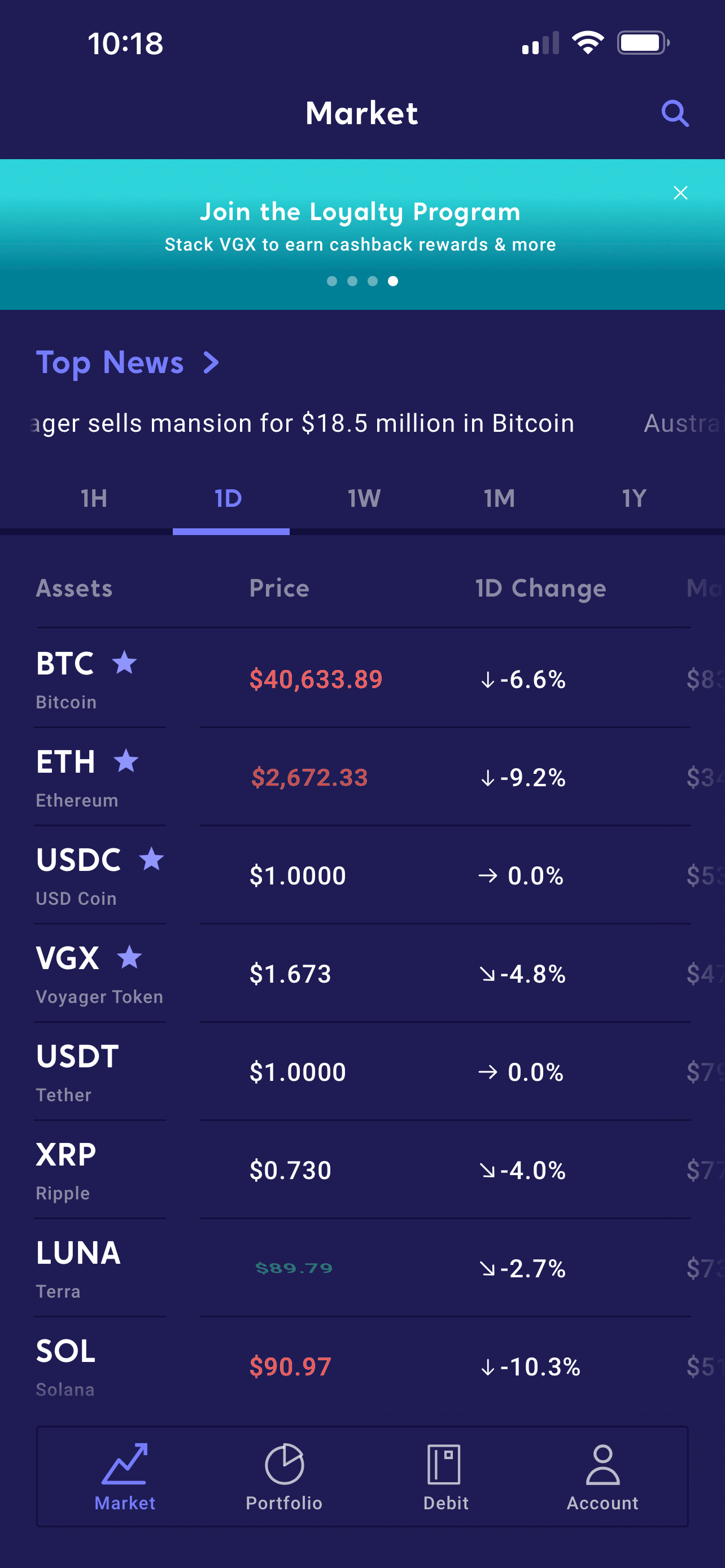

Personally, I am always in about 85% Bitcoin in my Crypto Asset investment allocation. The rest of the 15% is split up mostly between $USDC, $VGX (we will discuss below), $ETH, $VRA and a few dozen others. I earn enough interest off of these investments to live on comfortably at this point, but I keep working in the ER so that I can let compounding growth work its magic.

Albert Einstein is reputed to have said, “Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn't, pays it.”

Every month, I receive interest “rewards” on the Voyager App on my iPhone. This App is incredible and before we begin the ensuing conversation about why I am so bullish on the Voyager ecosystem, stock, token and team, I want to disclose that Chris and I have no financial relationship with this company (outside of keeping a portion of our Crypto Assets with them). We do invest in the stock and token however based on or research and beliefs. Remember, DYOR, understand risk, don’t gamble with money you need, and take responsibility for your own investing.

That said, Voyager is run by an all star team led by CEO Steven Ehrlich, a top executive who helped to build E*Trade in the 90’s. Their CTO is the same guy that built the Uber App, and it shows:

The Voyager App is extremely intuitive and offers the best customer experience and UI BY FAR of any exchange or other Crypto Asset platform that I have seen, and I have used just about all of them.

Voyager is a brokerage, not an exchange. Therefore, it is very different from the Coinbases and Krakens out there. Steve is an incredibly smart CEO and gifted visionary leader who always puts the customer first. The company is one of the fastest growing companies in the world with billions of dollars under management (AUM).

Here are some of the highlights of Voyager, and why I think they will be the number one Crypto platform in the coming years:

No Fees for trading - yep, unlike Coinbase’s stiff fees, Voyager just has a “spread” on Crypto assets (like all other places to purchase, but no hidden fees on top. There are fees to transfer Crypto to cold storage etc.

They partner with exchanges - about 10 currently so they don’t “go down” when you need them the most. Coinbase is STILL notorious for going down under heavy traffic!

They pay us absurd interest - They diversify their company’s holdings and have lending programs and give most of the interest back to the customer. You can opt out, but you can also earn 4.75% on your ₿ holdings (up to 6.25% based on the rewards program) and 9% on your $USDC (a stable coin always pegged to the value of $1, and actually up to 10.5% with rewards).

They have a rewards program called the “VLP” that allows you to earn EXTRA booster interest on your ₿, ETH, USDC etc. Voyager is the only company that has a publicly traded stock AND their own platform token, $VGX. There are different tiers of the VLP and in the top tier, you earn an extra 1.5% APR on your ₿, $ETH, $USDC and others. Naturally, I invested to be in the top tier, and the $VGX token earns 7% APR on its own! It is my second largest holding, and I think it could have a massive appreciation cycle in the future as the company grows and continues to perform with its disrupting model.

Debit card - This is where is gets truly insane: You keep your money in the Voyager checking account in $USDC (again, always pegged to 1 dollar). So I earn 10.5% APR passively, paid every month for just holding money safely in Voyager (They are partnered with a massive bank in NYC to facilitate ACH/routing accounts). The debit card pays 1-3% cash back depending on your VLP tier. You can autopay your mortgage, student loans, credit cards, etc. from this account and GET 3% CASH BACK! Unreal and completely disruptive. So I will get 3% cash back on EVERYTHING autopay from the account AND my money is sitting there earning 10.5% APR. It’s truly insane. I have been a part of this program for over a year and have made over 2 ₿ in interest alone. The debit card is due out in the next 2-3 months or sooner.

You can buy/sell almost 100 different vetted Crypto Assets on their platform, 30 of which earn rewards/interest and soon can trade equities (stocks) and they plan to have options, loans and sorts of other defi products.

The company is growing like WILDFIRE and I own quite a bit of their stock, $VYGVF which will soon uplist to the NASDAQ.

They are launching soon in Europe, Canada and NYC, bringing millions of new customers into the ecosystem.

They have an industry leading security team, and a previous government regulator on their advisory board to make sure they are one step ahead of any coming Crypto Asset regulation.

Look at this Growth over the last year alone:

Owning the Voyager ecosystem, either the stock, the native token or both is like owning Amazon in the early naughts, and while none of us have a crystal ball, Voyager is quickly becoming a household name. Only time will tell if they become one of the juggernauts of the coming DeFi world. Goodbye legacy banks and good riddance!

I recently had a chance to sit down with the CEO of Voyager, Steven Ehrlich, and discuss his company, Crypto Assets and his vision:

RISKS

No investment is perfect and there are risks with every investment in life. To be even-handed, consider these risks:

Crypto Asset regulation - could $VGX be labeled a security? The CEO says no way, but I think this needs to be in the back of our minds and would potentially tank the alt-coin/utility token model and market. In this case, ₿ probably becomes a windfall safe haven.

Team risk - the team could change, lose key members, etc. A risk with ALL businesses.

Execution risk - what happens if they can’t get Canadian or NYC approval? (They already have France approval and are about to start opening the app there).

Security Risk - The only network left unhacked in the world is Bitcoin. Heck, even the CIA and FBI’s computers have been hacked! What if Voyager gets hacked? They have a top security team and are well diversified (see the video above with the CEO where we discuss this) but still… Hacking is always a potential problem and why cold storage is ALWAYS the safest play… if you don’t lose your keys!

Competitive risk - Can someone come along and do it better? Again, always a risk. I think Voyager has plenty of First-Mover advantage and a massive and growing network of happy customers which is a pretty nice moat.

I personally think that Voyager will disrupt legacy banks. Why hold money in a checking account yielding 0.1% interest when you can safely earn up to 10.5% APR PLUS 3% cash back on mortgage, student loan, utilities, tax payments, etc?? IN THE SAME AFFOUNT YOU CAN TRADE 100 top Crypto Assets (and soon stocks and options!?) Voyager is absolutely killing it, and I think you should give the app a whirl and scope the User Interface. It’s free to download.

Here is a referral code so you can get $25 of free ₿, we get that as well on our end, but any referral money that CryptoPulse receives goes to charity:

Referral code: trade $100 to get $25 of free #Bitcoin. Use code 51VP2W or link to claim BTC: https://voyager.onelink.me/WNly/referral?af_sub5=51VP2W

I future articles, we will be moving into alternative crypto investments, but always circling back to the one and only Bitcoin. All roads lead eventually to bitcoin here at CRYPTOPULSE and everything else is a gamble for us to grow our ₿ stack. Let us know what you think, and what your approach is in the comments below! Will you be using the Voyager App? Why or why not?

Take care and until next time!

Noah T. Kaufman, MD & Chris Palmer, MD

I've begun negotiations with a former senior executive of Sheldon Good company; they were 1 of 2 vendors tapped to liquidate the real estate assets of the savings & loan, $1 trillion. Google resolution trust corporations wikipedia page. Launching real estate development stablecoin, 1st round accredited, 2nd unaccredited, contact Noah Kaufman for onramp details...

Have been interested in trying out more staking/yield farming platforms, but worried especially the stablecoins that promise yields in the 10% seem ponzi-ish. Thanks for recommending one in such a way that it sounds more legitimate!