Hey hey! Happy belated St. Patty’s Day and Happy Easter!

Sorry for the prolonged absence. Life got busy, and I was doing a lot of prep for a Bitcoin lecture I gave to the Emergency Medicine residents at our hospital. Overall, it was well received with plenty of anticipated skepticism, but in the end, I definitely think I orange-pilled a few and, at the very least, opened up some eyes to the fiat monetary system “Matrix” that we all reside in. Looking forward to doing more bitcoin lectures in the future!

Before we get into the fun part of this newsletter, I need to do a mea culpa. I wrote about bitcoin ETFs under the assumption everybody knew what an ETF was. I heard from a few friends and family that there were some basic questions, like, " What the heck is an ETF?”

So let’s start over and discuss what an ETF is and why it’s so important. Then we’ll get into the fun part: why I think bitcoin is primed like a rocket ship!

Exchange Traded Funds (ETFs) 101

For the longest time, people would just invest in individual stocks like Apple, IBM, and Microsoft. This works out great if you pick the winners, but it’s risky and hard to do. However, many people wanted stock exposure but with less risk and more diversification, so the concept of index funds was created so that you can buy a basket of stocks (hundreds to thousands of companies) with broad exposure to a sector (like tech, industrials, semiconductors, oil, commodities, etc.) and own a piece of many different companies and profit if the entire sector does well. You won’t profit as much as you would if you pick only the best company within the sector, but you also won’t lose as much if you pick the wrong company to invest in. It lets people sleep better at night while still getting stock exposure, and it’s WAAAY easier to do. You just pick a sector you think has potential and buy the fund. Then you can also buy many different sectors so you have VERY BROAD and diversified exposure.

Ex – small cap value, small cap growth, mid cap value/growth, large cap value/growth, total stock market exposure, international, emerging markets, etc. etc.

FYI – small cap, etc. refers to the market cap of the asset class. Small businesses worth small amounts (millions) compared to large businesses like Apple, worth trillions.

99% of you have exposure to these in your 401ks/IRAs/taxable accounts. You also likely just invest in a target date fund that gets you broad stock index exposure based on your retirement age and risk tolerance level. Higher risk when you are young, less when you’re about to retire. Towards retirement, the portfolio shifts more towards bonds and cash automatically. It’s so simple even a cave man can do it.

These strategies were made for employees because, historically, people had pensions. But when companies stopped offering pensions (due to high cost), and it became the employee's responsibility to fund their retirement, many financial institutions like Fidelity and Vanguard realized the average Joe had NO CLUE how to invest in the capital markets, and so things like target date funds were created to help us out. How nice of them! It also made them super rich.

These index funds you buy are managed by someone else, and for that work, they charge a fee. That way, you can just work and live your life while paying someone else to help manage the funds you are invested in. You pick the fund, they do the rest, but there is no free lunch. You are paying for it to be clear, albeit minimally, depending on the fund.

That’s where mutual funds vs. ETFs come into the discussion.

Mutual funds have been around for nearly 100 years, while exchange-traded funds (ETFs) launched in 1993. Here are some key differences and why ETFs have EXPLODED in popularity over the past few decades.

Mutual funds are usually actively managed.

For this reason, they charge higher fees to “beat” market returns. However, there is no good data to support this. Most data shows that actively managed funds don’t outperform the index.

ETFs are usually passively managed and track a market index or sector sub-index.

ETFs can be bought and sold just like stocks, while mutual funds can only be purchased at the end of each trading day.

Actively managed funds tend to have higher fees and higher expense ratios due to their higher operations and trading costs.

Mutual funds usually have a minimum investment amount ($500-5K). With ETFs, you can buy as little as $1.

ETFs are more tax efficient (capital gains taxes).

Given people generally want access to things that cost less, are more tax efficient, with lower barriers to entry, and get you similar to generally BETTER returns…ETFs have become a huge part of traditional finance markets today. Mutual funds are a dying breed. Financial advisors earn commissions and perks for getting you to buy these funds and keep you in them (not always, but often). ETFs have no such conflict of interest. Which seems like the better option?

Bitcoin ETFs

Before their launch, you couldn’t buy bitcoin via your brokerage account on Schwab or Fidelity, etc. You could buy GBTC, but that was an “over-the-counter (OTC)” trust that really only the most sophisticated investors could get access to, and major institutions are not even allowed to trade OTC securities legally, so it was a very small minority who bought it.

To buy bitcoin, you had to go to an online exchange like Coinbase or Binance, etc. For the majority of people (and institutions with tons of regulations placed on them), this was WAY too much work and too scary. Plus, with exchanges like Voyager and FTX going bankrupt and losing people’s bitcoin, most people wanted no part of that nonsense.

However, throughout 2023, the signs were there that bitcoin ETFs would be approved by the SEC and that the superhighways for bitcoin investment would commence soon enough. I was right, and on January 11th, 9 new bitcoin ETFs were approved for trading.

Now, instead of going on Coinbase to buy bitcoin, you can just go on your brokerage account (that you’re used to and comfortable with) and buy it there (IBIT, FBTC, BITB are ticker examples). Big institutions can also buy the ETFs because they are US regulated. This unlocked literally trillions of capital that didn’t have easy access to bitcoin before the ETFs were launched. IRAs, HSAs, 401ks, traditional brokerage accounts, etc. Trillions and trillions of dollars now with an easy button option to buy a fixed supply of bitcoin. What’d you think was going to happen?

The bitcoin ETFs work like other ETFs. They have low fees, you can buy as little as $1, they are tax-efficient, you can buy/sell all day when the market is open, and they track the price of bitcoin extremely closely.

When you buy shares in FBTC (Fidelity’s bitcoin ETF), Fidelity buys real bitcoin on the open market and will custody it for you for a small fee. Each stock share you buy is worth a small percentage of bitcoin, and there is a website you can visit to determine the conversion of shares to bitcoin if you want.

For example, 1000 shares of FBTC = 0.874 BTC.

IBIT is similar and has low fees, but they use Coinbase as their custodian of bitcoin and you are paying a fee for that.

1000 shares of IBIT = .579 BTC.

Overall, each ETF is nearly identical in terms of fees, although there are some differences with custody, but overall, each one will track the price of bitcoin incredibly closely. THEY ARE ALL SOLID OPTIONS; HOWEVER, BEWARE OF GBTC'S HIGH FEES. Why would you pay a 1.5% annual fee when you could get the same service for a 0.2% annual fee? GBTC decided to keep their ETF fees high for various reasons (not discussed here) when it got converted from a trust selling on the OTC markets to a bitcoin ETF, but if you’re just now going to purchase a bitcoin ETF, I wouldn’t be choosing GBTC due to the fees. All the others are fine/similar. You are paying the fee for simplicity and peace of mind (someone else is responsible for custody). Because of this, the ETFs are a great product and will be a game changer.

It’s like when roads were built for cars. Before that, people would claim that horses would always be better. Once the roads were built, nobody used horses anymore. ETFs are the roads for traditional finance to get exposure to bitcoin and the floodgates have opened. There is no going back, hyperbitcoinization has begun.

You MUST be aware of what you are giving up by buying the ETFs though. Not Your Keys Not Your Coins. You are now TRUSTING a third party to store your wealth. If Coinbase or Fidelity gets hacked or somehow they replicate some FTX scam (highly highly unlikely given US laws and regulations), you could be out of luck.

With fiat money and stocks, if that happened, the traditional finance system would just alter the ledger and give you your funds back. THAT’S NOT THE CASE WITH BITCOIN. IF YOU LOSE IT, IT’S GONE. NO ONE CAN PRINT MORE OR CHANGE THE LEDGER. Most people cannot grasp the magnitude of this, and it is unlike anything we have ever seen before.

THIS IS SERIOUS BUSINESS. THEY/YOU CANNOT MAKE A MISTAKE.

So, by all means, trust these ETFs. I will and do, but not entirely. I still prefer REAL bitcoin that I buy and store on my own with no counterparty risk as it is literally freedom money.

By REAL bitcoin I mean bitcoin that I hold in cold storage. Bitcoin ETFs are buying real/actual bitcoin, don’t get me wrong. It’s all legit. But I don’t trust them entirely to not F it up. I trust myself more. Also, remember in 1933, via Executive Order 6102, the US government required people to hand over their gold or face prosecution. They could, in theory, do that with the ETFs someday, although I highly doubt it. With the way our judicial system works these days and with the internet and how politically motivated all parties are (can you imagine how unpopular seizing people’s bitcoin ETF would be???), I just think those days are gone where that could happen.

However, the chance is not zero, and thus I hold REAL self-custody bitcoin where no government can seize it. Bitcoin is the BEST money ever to exist because you can self-custody it EASILY and not trust another third party. It’s sovereign money in that regard. Ultimately, though, I think having a balance of REAL bitcoin (self-custody) and some exposure via the ETFs is a great mix for me personally.

With the ETFs I can now use money in my Roth IRA and HSA to buy bitcoin and get exposure to the bitcoin asset class. Before the ETF, this wasn’t possible. I still don’t have access to it via my 403b/401k plan, but that is inevitable within the next few years or so, I’d say.

I also think the bitcoin ETFs will open up new possibilities to bitcoiners in the traditional finance world. People don’t realize it yet, but bitcoin is the most pristine form of collateral ever to exist. Bitcoin’s price is marked to market 24/7/365 and can be sold 24/7/365 and is easily verifiable, infinitely divisible, digital, and has no counter party risk and cannot be debased. THIS IS PRISTINE COLLATERAL. IT HAS NEVER EXISTED BEFORE. The world hasn’t figured this out yet. Your opportunity is to figure it out before they do. When they do, the demand goes to infinity. Right now, pristine collateral are US treasuries. It won’t be long until people realize those are just IOUs that will get paid back with Monopoly fiat money (the USD) printed into oblivion. What do you think will be viewed as superior collateral?

You will be able to post your bitcoin ETF as collateral for loans to get lower interest rates and have other opportunities to earn yield on your bitcoin ETF for passive income if you want (selling options, etc.) This will be possible with REAL (self-custody) bitcoin as well, but likely with much more friction and difficulty compared to bitcoin ETFs. Life is all about trade-offs. There could be some benefits to trusting another party…until you get burned. Then it really sucks. Each person has to make the choice. I choose both!

Are we all good with ETFs and Bitcoin ETFs now? Sweet! Let’s talk about fun stuff now because we’re in a bull market, and life is good. The bear market was brutal when I was shouting into the void.

THE BITCOIN BULL MARKET HAS OFFICIALLY ARRIVED

Since I last posted a Bitcoin newsletter on January 4th that the Bitcoin ETF launch was near and inevitable and would be a MASSIVE demand driver, guess what happened?

Nine new bitcoin ETFs launched on January 11th, and the price has gone from around 44K when I wrote on January 4th to now ~71k.

It’s just CHILLING THERE, a few thousand above its previous 11/2021 all-time high of 69K. No hype, not being covered by the media, Google searches for bitcoin aren’t going parabolic, no one is calling me about bitcoin, etc.

This could not be any more bullish. This is EXACTLY what you want: Apathy and boredom at all-time highs. And that’s with HUGE CATALYSTS coming down the pipeline over the next few months to years!

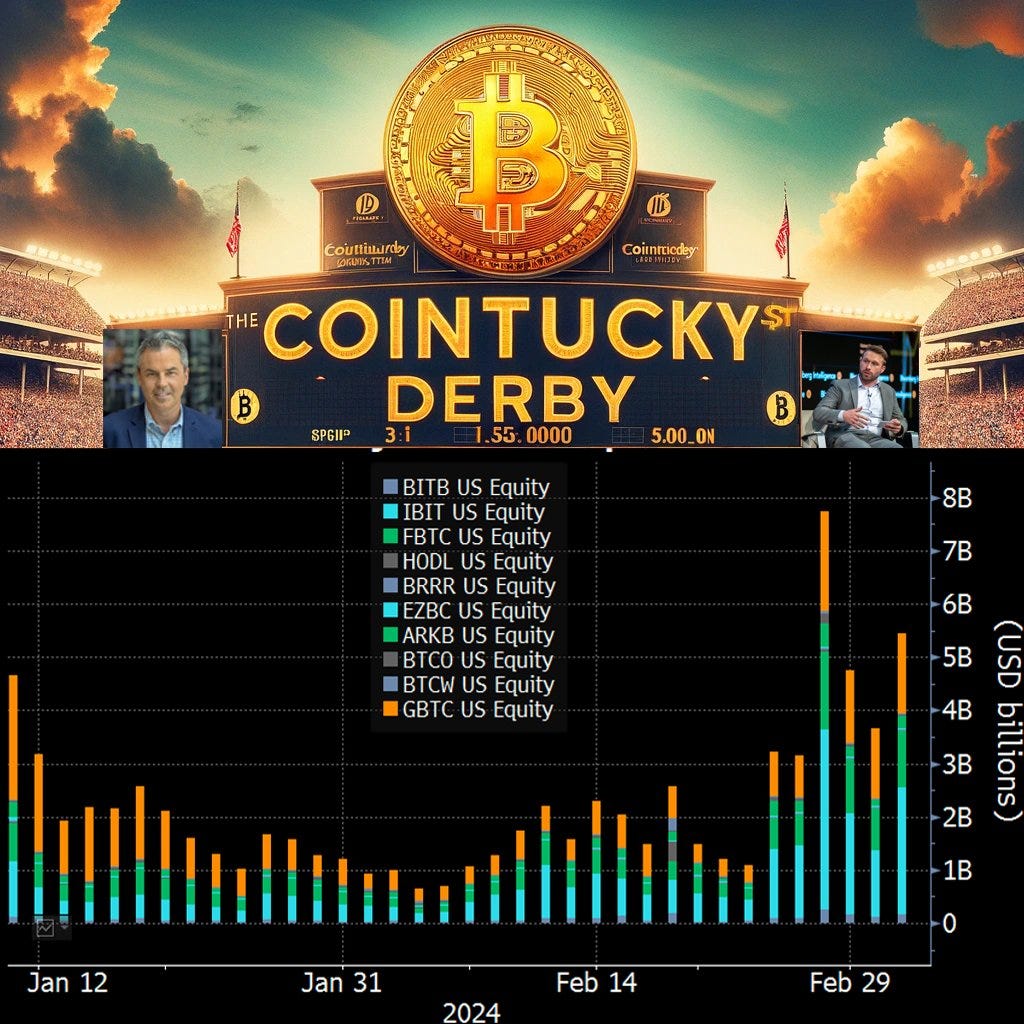

We’ll talk about those in a minute, but let’s just reflect on how huge and successful this bitcoin ETF launch was.

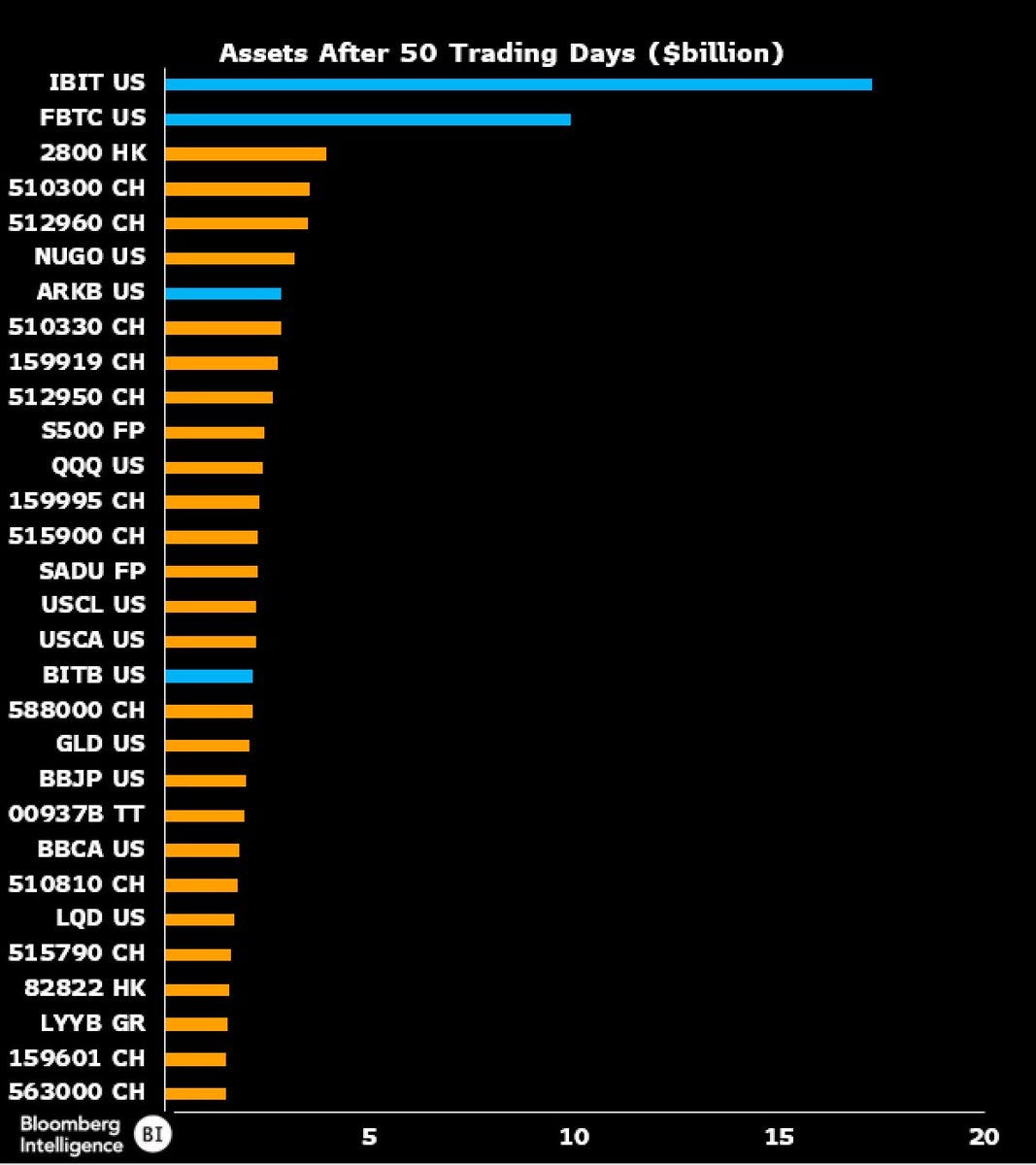

Quite simply, the bitcoin ETFs are the most successful ETF launch of all time at this point in their nascent life. Think about that. Of all the ETFs to have ever launched, bitcoin tops them all.

“Here's a look at Top 30 ranked by assets in first 50 days on market. Went global for this so this is out of 11,338 funds. Four BTC ETFs made the list. $IBIT and $FBTC in league of their own. $BITB > $GLD!”

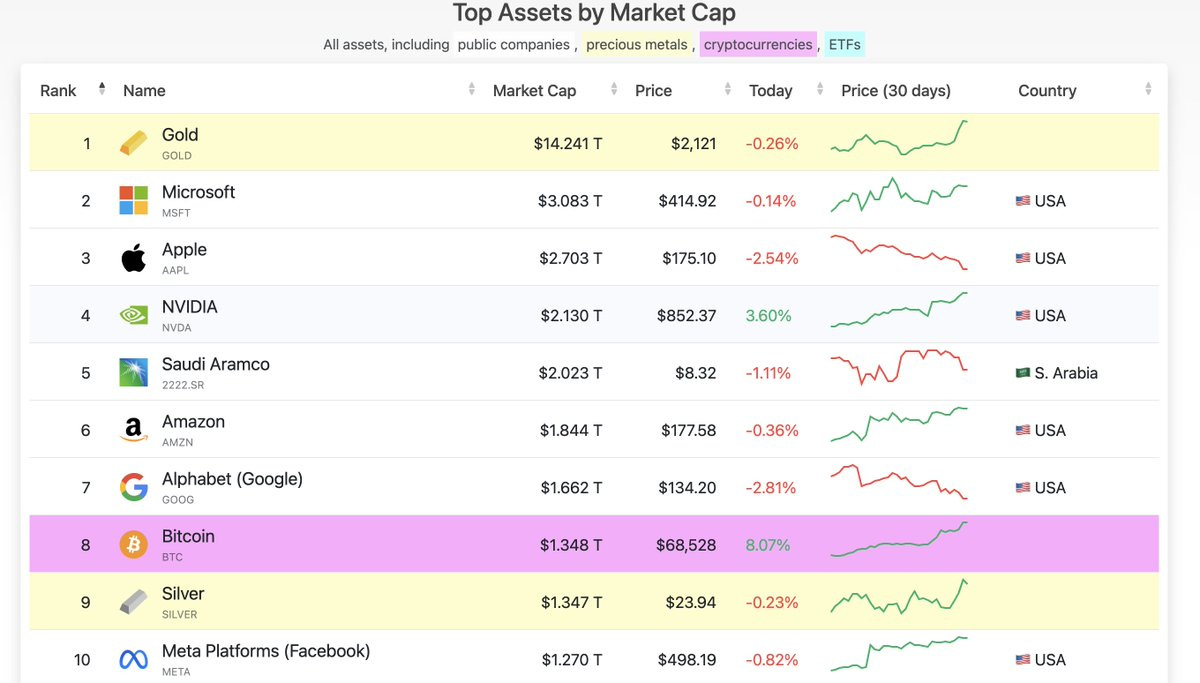

And the majority of people STILL have no exposure to this asset??? The same asset that Larry Fink of Blackrock and Fidelity are telling you is a “flight to quality and safety” and are pounding the table for??? The same asset that now has the 8th highest market cap in the world, and yet only ~1% of the world even remotely understands it???

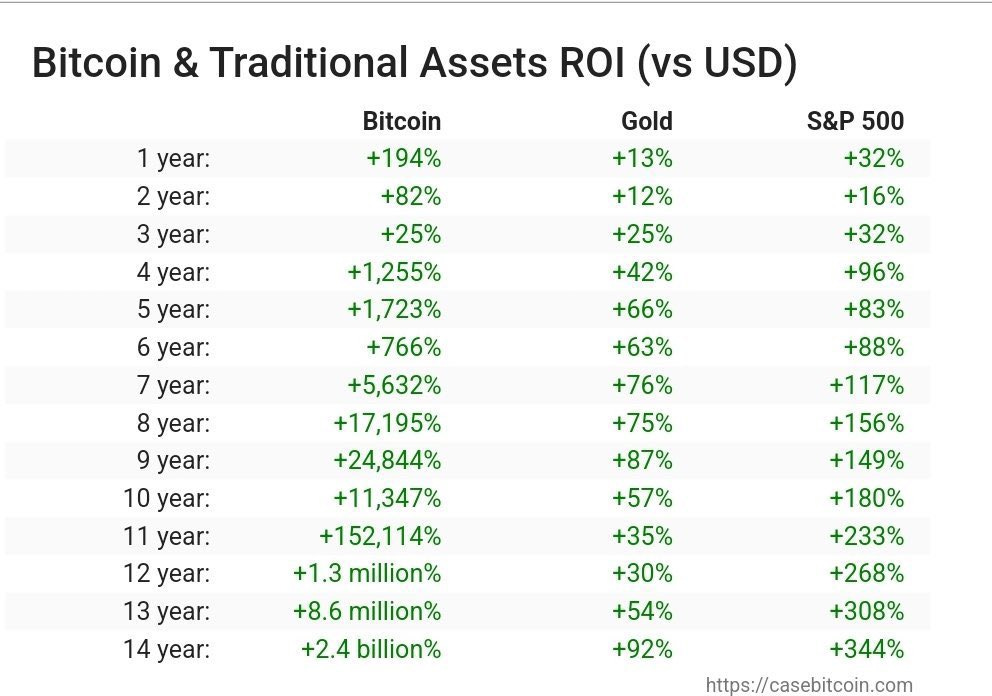

The same asset that is the best performing asset by FAR over the past 15 years???

I mean, come on folks. That’s like saying you have no exposure to the biggest and best tech companies like Apple or Nivida. That would be considered ludicrous!

NOT owning bitcoin in the coming decade will be considered ludicrous. You heard it here first. And you can quote me.

While bitcoin is at 1% or less adoption, these monopoly tech companies are valued in the trillions, and 99% of the world already understands them and has exposure to them. Given currently stretched valuations, their future potential for growth probably isn’t that crazy high. They also constantly face stiff competition.

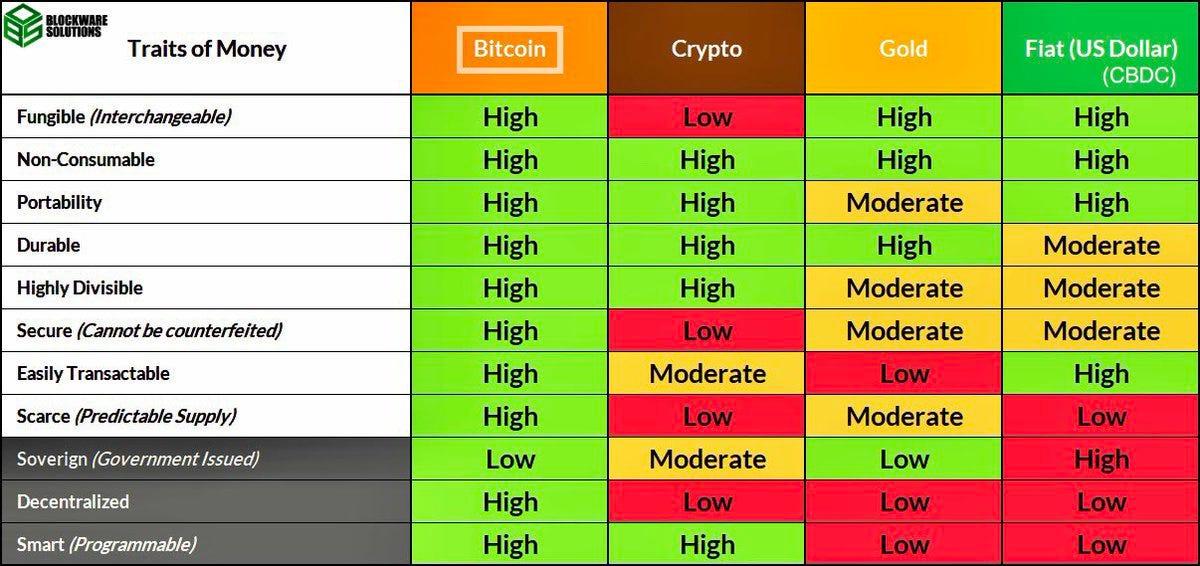

Bitcoin is similarly a disruptive technology, but it’s not a company (it is money),

has no competition (no, not Ethereum/other crypto), and is at 1% adoption. It doesn’t have cash flows and dividends and a P/L statement and all the things YOU’RE USED TO, but those are FEATURES of bitcoin, NOT flaws. It’s a new asset the likes of which the world has never seen. Stop forcing it into a box that fits your historical view of traditional assets. Bitcoin is new, it’s different, and it’s disrupting traditional finance and models; you can’t put it in a category because it’s its own category. The sooner you realize this, the quicker you’ll understand it. It’s not a tech company. It’s not gold. It’s bitcoin.

If Bitcoin were a company, and suddenly 10 trillion dollars of new capital were invested into it, you would have to look at its earnings and decide if it’s overvalued based on that new price or if the company could eventually get to that level of earnings/revenue generation in the future. More often than not, the valuation gets stretched, and eventually, investors sell because the company could never deliver such an incredible performance indefinitely to warrant the asset price.

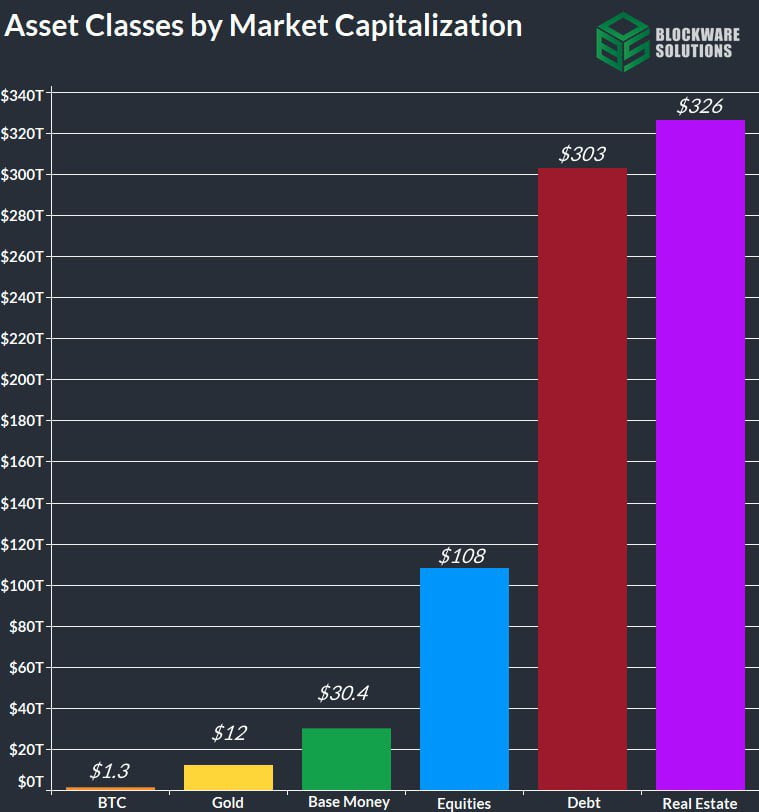

Because Bitcoin is just money, it doesn’t have that problem of earnings, taxes, lawsuits, CEOs quitting, defective products, and all the other headaches companies deal with. Millions/billions/trillions flow in. No problem. It’s just supply and demand. Supply is programmed and fixed. Demand is variable. Bitcoin can absorb all of the world’s wealth (500-900 trillion) and it wouldn’t even blink an eye. For comparison, do you think Apple would be fairly valued today as a company at 10 trillion dollars? Of course not. As a company, it could never justify that price relative to its earnings. Could bitcoin similarly be justified today at 10 trillion? Absolutely. That’s still less than the market cap of gold which bitcoin is 100x better. And as long as demand is present for the best money and store of value ever to exist, then its market cap will continue to rise indefinitely and reflect where and how people choose to store their hard-earned wealth. Because it’s just money that allows it to absorb all the monetary premium of all the other hundreds of trillions of dollars in assets out there like stocks, gold, real estate, etc.

There is no limit to how high Bitcoin’s price can rise as long as fiat money continues to be printed and debased. It’s that simple.

That is why it is the apex predator and a black hole as a store of value asset to which no one is prepared for. But you will be!

Upcoming catalysts

More ETFs are on the way!

Asia and the UK are about to open their floodgates in the next few months. This will likely replicate the current total demand of the US markets. Take whatever demand we have today and maybe double it. Yikes!

Sloooow Institutional Adoption

Despite the Fidelity’s and Blackrock’s of the world being progressive and providing their customers access to this revolutionary technology, institutions like Vanguard and others still refuse to. Vanguard is a massive fund manager (trillions), and there are many other large funds out there (Morgan Stanley, etc.) that have not allowed their clients to buy the bitcoin ETFs since January.

If you are in this boat (like I was with my personal Roth IRA) and could not access the bitcoin ETFs through your financial institution, MOVE. That’s what I did.

I withdrew assets to Fidelity and purchased the ETFs there. Took a few days. Simple stuff. It’s YOUR money. Do not let someone else dictate what you can and can’t do with it. I’ve done more work on bitcoin than Vanguard and Morgan Stanley. That’s like a patient reading up on heart attacks on Web MD and telling me how to practice medicine after years of training. NOPE!! Sorry!

I know I’ve stated that the superhighways are built, but not everyone is using them yet. Again, that is INSANELY BULLISH given the recent price action. Eventually, all these institutions will capitulate and open the doors for their clients to buy the bitcoin ETFs, but it will be slow and take months to years, to be honest.

“Vanguard is coming. Morgan Stanley is coming. Merrill Lynch and Wells Fargo are coming. Everybody is coming.”

It will be considered their fiduciary responsibility to do so, and they could open themselves up to serious litigation if they keep their clients from the best-performing asset. I’m not going to wait for that to happen because I believe the price of bitcoin will be many multiples of what it is today by then and that is an opportunity lost.

I know the ETF inflow has been insane, but you haven’t seen ANYTHING YET. Most of the world still hasn’t even dipped their toe into bitcoin. My 403b plan, and likely yours, doesn’t offer you access to the ETFs. Blackrock has nearly 10 trillion in assets under management. Somewhere between 1-5% of that is going to eventually end up in the ETF. And that is JUST Blackrock.

One final point – as bitcoin’s market cap grows, THE MORE ATTRACTIVE IT BECOMES TO BIG MONEY. Read that again. The bigger it gets, the bigger it gets. Big money doesn’t love to invest in million to billion dollar asset classes. They’d move the price too much when buying in size, and it would be hard for them to stay anonymous. Once assets get huge, like where Bitcoin is JUST GETTING TO, then they enter the market. This feeds on itself. Apple and many nation states look at bitcoin as a baby whale in a big ocean still. It’s cute, and they smile at it but mostly ignore it. When it becomes a giant humpback, everyone takes notice.

The halving

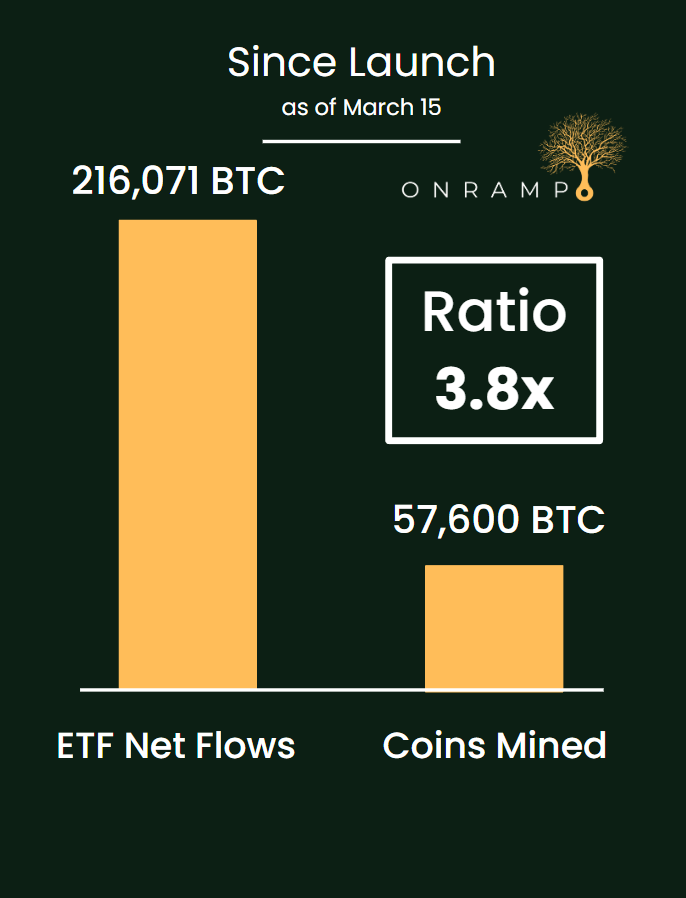

Oh you thought I forgot about the halving??? Ha! It’s like 20 days away. YOU ARE NOT BULLISH ENOUGH. This ratio below doubles in 20 days if demand stays CONSTANT. It’s not going to. It’s going UP, A LOT.

~900 bitcoin mined a day goes down to ~450. If demand more than doubles with worldwide ETF access and supply gets cut in half, WHAT DO YOU THINK IS GOING TO HAPPEN? I suck at math and economics, but even I get this!

Many people think the halving makes no difference since so many coins are already in circulation. I disagree. Bitcoin miners are impacted tremendously by the halving and they help set the price floor. Let’s watch and see.

FASB ACCOUNTING RULES

This relates to how public companies report bitcoin on their balance sheet every quarter. I’ve spoken about this before, but people keep ignoring me. Well, it’s happening.

Previously, the old treatment accounted for Bitcoin as an intangible asset, which meant if the price went lower than what companies bought it for, they had to take an impairment charge on their books, even if they didn't sell. But if the price went up, they couldn't receive any benefit on their books unless they sold. Now, with fair value accounting, periodically (i.e. every quarter) companies can report the unrealized gains and losses to get an actual benefit on their books if the price of the asset increases (without having to sell to capture it). This could make companies more likely to add bitcoin to their balance sheet and become long-term holders as they can report the appreciation without having to sell anything.

Bitcoin miners and Microstrategy will benefit the most from this change in accounting rules, and it will open the doors for others to dip their toes in the strategy, which will increase bitcoin demand.

Also to point out, Microstrategy is outperforming Nividia this year. I repeat. Microstrategy, a bitcoin holding company, is outperforming Nividia this year. A bitcoin company is outperforming the hottest stock on the planet. DO I NEED TO REPEAT MYSELF?

Every company will eventually hold bitcoin on its balance sheet. It is inevitable. Now is your opportunity to front-run them. There are only 21 million.

Interest rate cuts + Quantitative Tightening slowing + fiscal largesse continues

The first two are likely coming later this year and fiscal dominance/recklessness keeps on keeping on. That’s good for every asset class. It’s going to lead to a crack-up boom if you ask me. Very bullish. Why?

Interest rate cuts lead to people taking out loans and spending more money, fueling GDP growth. That’s good for the markets. Quantitative tightening is the process by which the Federal Reserve sells bonds to the market that they have previously purchased during Quantitative Easing. QT is bad for markets because it leads to higher bond yields (supply and demand principles) which is bad for stocks all in all. Tapering QT thus would be good as yields will go lower all things being equal. Fiscal irresponsibility is amazing for stocks because running wartime/2008 crisis budget deficits…

when the economy is hot as can be and everyone has a job just fuels GDP growth, and markets love that. When times are good like they are now, we should be saving for a rainy day and having surpluses if anything. Instead, our government is spending like drunken sailors, like we’re in a crisis, and exploding the deficit as a result. The economy is not going to crash when the government adds 1 trillion to the deficit every 100 days.

So wait, who cares then, right? Print money with no consequences, right? Everyone wins, and the economy roars along!

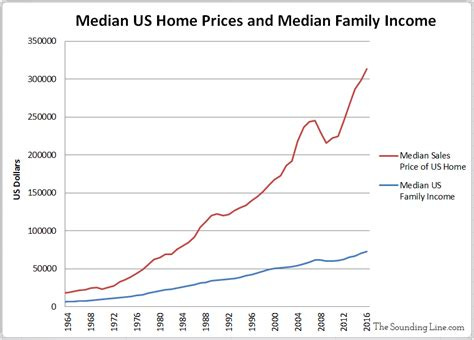

For now…yes. But there’s always a price, and likely not forever. Just like a drug addict experiences temporary highs. There eventually comes a crash and consequences. Nothing is free. We’re all paying for it now via inflation and the loss of purchasing power. Asset prices are going up faster than our salaries, and anyone not in the top 1-10% of the wealth brackets is getting absolutely destroyed.

When people can’t afford their basic needs, this leads to societal dysfunction, inequality, decay, disorder, mental health issues, drug/gambling addiction, violence, homelessness, and health issues (obesity, cancer, heart disease). When you watch the news or just observe the world in front of you and see things that defy logic and seem incomprehensible and you ask yourself, “What the heck is going on with the world?” The answer is simple and right in front of you, but 99% will never see it.

The money is broken. End of discussion.

We’re robbing Peter to pay Paul. History will look back on these past 50 years with complete and utter disdain due to government monetary policy that was vile, inhumane, insane, reprehensible, irresponsible, manipulative, and many other choice words. The problem is most of us were born into fiat money as it exists today. It’s complicated by design. Most have no clue it’s even a problem and are tricked into believing it’s both necessary and “good”. We can’t vote for it. We can’t “see” it. Inflation is a silent tax on purpose. But once you see it, you can’t “unsee” it. Bitcoin gives you that new perspective. It’s both horrifying and liberating. My goal is to wake others up to the real-time destruction that I see. My kids deserve a better world. I recognize that I and many others have benefited immensely from this destructive money policy by understanding how to play the game we’re in. Not everyone has that luxury, and although I don’t believe in equal outcomes, I believe in equal opportunity, and that is not how the system is designed today for people to achieve the American dream.

Fix the money, fix the world.

I choose to fix it using Bitcoin as the technology solution.

Sorry for the rant there. I get easily fired up and am a passionate dude; I can’t help it. Moving on!

Cash on the sidelines

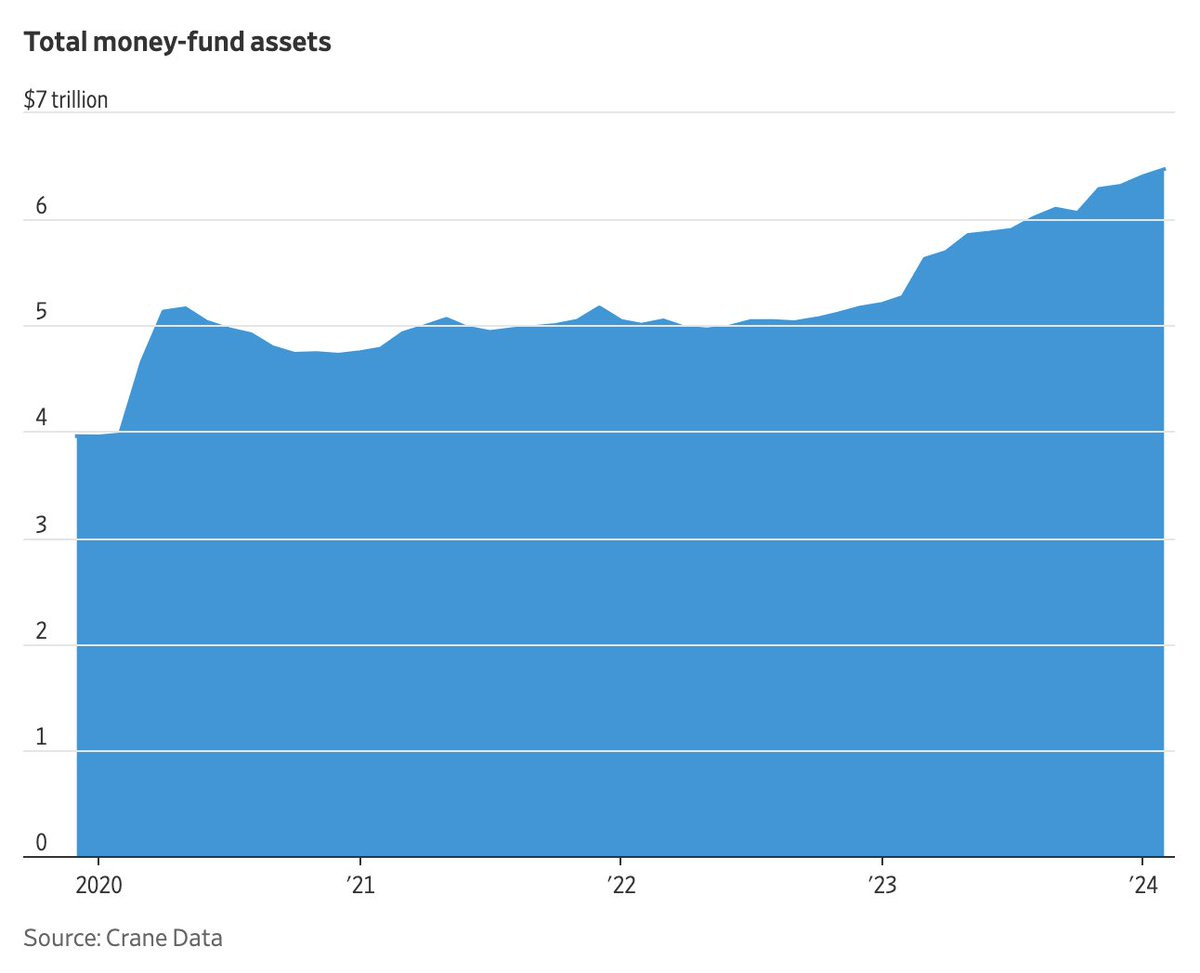

I haven’t even mentioned the 6 TRILLION DOLLARS OF CASH SITTING ON THE SIDELINES WAITING TO BE DEPLOYED.

That’s right. 6 TRILLION DOLLARS held in money market funds just collecting interest from the federal government at a clip of ~5% per year. This is cash people have chosen to move out of the market when the Fed started to raise interest rates a few years ago and they finally had a reason to sit in cash rather than be fully invested in stocks.

When interest rates eventually come down as the Fed starts to cut and get down to the 2-3% range (or lower) from 5% where they are now, where do you think that money is going to go? If inflation averages 2-3% (a joke, I know, but just go with it) as CPI claims, are you really ok earning 2-3% interest sitting cash (savings accounts won’t stay at 5% as Fed rates decline)? I suppose you’re not “losing” money and you’re keeping even, but you’re definitely not beating inflation and growing your purchasing power. That’s when a sizeable (not all) of that 6 trillion dollars will rotate back into stocks, bitcoin and crypto. People will want to BEAT inflation and will seek higher yielding investments. Bitcoin, being the most scarce and now easily accessible asset by EVERYONE ON THE PLANET, will be the ultimate winner, in my opinion. The lower interest rates go, the higher bitcoin will go. 6 Trillion dollars is a freaking tsunami of money. Unfathomable amounts. All dips in the market will and can be bought. A stock market “crash” is out of the question in my mind for this very reason. There’s too much money waiting for the dip. The US government also desperately needs the capital gains tax receipts they get from people making money in the stock market. Can you imagine the deficit if there was a stock market crash and most people only had stock market losses and not gains? The US deficit would balloon to unimaginable levels. All this to say, I’m incredibly bullish on all things Bitcoin, crypto, and stocks for at least the next few years until new data emerges.

Debt death spiral

You can’t make this up. The US is adding nearly a trillion dollars of debt to its deficit every 100 days.

This isn’t the only reason bitcoin is flying higher, but it helps. And no, regardless of who gets elected this November, it’ll be the same thing. Print baby print.

Bitcoin is scaling

There have been HUGE developments over the past few years that will allow faster, easier, and cheaper bitcoin payments. I think a few of them will hit primetime in the next 1-2 years, allowing things like Defi(decentralized finance) on bitcoin (what people view Ethereum as good for) and payments on Lightning. Stay tuned, but it’s just more utility for bitcoin, which will lead to demand.

Nation-state adoption

I guarantee another nation-state will proclaim they’re acquiring or mining Bitcoin in the next 1-2 years. El Salvador is doing it publically, but others will see how insanely beneficial it has been for their country and will try to replicate their model. Then, game theory kicks in. Who wants to be the last country not to acquire the world’s best neutral money with a fixed supply? The longer you wait, the less you get. Wouldn’t be me!!! If you own Bitcoin, you can trade with anyone, and no one can stop you. Sounds pretty nice, doesn’t it? You also aren’t dependent on the other country’s monetary policy debasing the currency to which you trade. Bitcoin is a global, neutral, censorship-resistant digital money that cannot be debased. Get some!

GBTC selling

Despite the nice rise in bitcoin’s price from 40ks to 70ks since the ETF launch, the sizable amount of selling from GBTC has dampened it. People are selling the GBTC ETF (and thus bitcoin) for many reasons, but none of which are due to a lack of belief in the underlying asset. Most of it is the high ETF fee, as discussed above; some of it is profiting from a trade, and some of it is selling to pay debts (Genesis and FTX debacle from 2022). Trust me, over the next few months, this selling will wind down, if not stop entirely.

If you add up all the new global bitcoin demand while factoring in the halving supply shock, GBTC selling winding down, interest rate cuts, and QT tapering down while the US government continues to add 1 trillion of debt every 100 days during a Presidential election year, I literally could not think of better ingredients for bitcoin in the next 12-24 months.

We’re talking banana land. I don’t know how crazy it’s going to get, but I’m mentally prepared for insanity so I can keep my head on straight. If it doesn’t materialize, oh well. If it does, I’m ready for it.

That’s not even to mention during the last bitcoin cycle, the criminal SBF and his company FTX, were selling people’s bitcoin to buy their FTT shitcoin token. Thanks for sponsoring that Tom Brady! Yet another reason I don’t like him as a Bills fan. These criminals and their companies shouldn’t be as prevalent this cycle and people are on guard from 2022. Now they’re mostly in prison. That’s good for everyone and bitcoin.

I also don’t expect another massive selloff this cycle, like when China “banned bitcoin mining” last April 2021 and forced tons of Chinese bitcoin miners to sell bitcoin so they could relocate to a friendlier jurisdiction or just stop mining altogether. Nearly 50% of the mining hashrate turned off nearly overnight back then. Crazy! Bitcoin didn’t care though (the network). The price took a hit as miners sold, but the network kept producing blocks like nothing happened. Exactly what you want to see.

MSTR buying (Disclosure – I own MSTR shares)

Microstrategy, the publically traded defacto bitcoin ETF proxy company, just continues to buy bitcoin in huge size using leverage, and they won’t be stopping anytime soon. They are playing an entirely different ballgame and may have found a flaw in the Matrix traditional finance system. Time will tell. They are essentially carrying out a speculative attack on fiat currency (the USD) using the stock market. They’re getting insanely cheap loans in fiat and going out and buying the best money ever to exist – bitcoin. They are also issuing/printing MSTR shares like all public companies do and using that money to go out and buy bitcoin, which benefits its shareholders as bitcoin’s value increases. It’s pretty complicated to explain, but regardless, the strategy will either end up being genius-level stuff that history books will write about forever, or a complete disaster that history books will also write about forever. You have to give him credit…he’s going for it. No Fs given. I think the guy is a genius, but just be careful if you’re buying MSTR. There’s a ton of leverage used, and the CEO himself has told you to buy bitcoin instead of his stock. I’d listen to the man personally. I think MSTR is a nice “trading” stock, but it’s not a long-term investment like Bitcoin for me, at least.

Bitcoin within OTHER ETFs

Oh you thought people buying the bitcoin ETFs would be the only demand? Nope! As predicted, other ETFs are now buying shares of the bitcoin ETFs as part of their index fund! Let that sink in. Soon, most of you will own bitcoin and you probably won’t even know it. It will be a small percentage of some mutual fund/ETF that you own, and the fund manager you pay a fee to will be buying bitcoin ETF shares to juice the returns on the index fund to meet their benchmarks and keep pace with others. It’s all game theory, and no one wants to be the worst performer. They get fired. This, again, is trillions and trillions of demand. Don’t fade it.

My predictions for the next 12-24 months are essentially unchanged. I still think bitcoin will hit between 150-350K during 2024-2025. I wouldn’t be surprised if it goes over this projection, as the superhighways are now built, and trillions of global fiat money have easy access to purchase bitcoin now compared to any other bitcoin bull market in history. Add to that the continued global debasement of fiat currencies at a record pace, and you get the kindling for a massive explosion.

What’s the spark?

When it breaks 100k, the news outlets will start reporting on it, and I’ll start getting emails and texts from people.

Around that time there will likely be some “major news event” that someone or some company like Apple is putting bitcoin on their balance sheet. Kaboom!

That’s when FOMO will begin, and from there, it’s anyone’s guess how high it goes.

Maybe it won’t happen like that, and it’ll be a steady grind higher. Who knows, but that’s not how bull markets typically go. There will be 10-30% or more dips along the ascent. Don’t get scared. Buy the dip if you want. HODL.

I personally, for full disclosure, maybe stopping my DCA strategy very soon. I’ve nearly hit my target accumulation goal and around 75-100K bitcoin can be considered “fairly valued” based on its commodity cost to mine it. Anything over that isn’t really a bargain to me.

It WILL be overvalued at 200-500k per bitcoin based on its commodity value. Its monetary premium is entirely different, but I don’t think we’ve reached that stage yet of hyperbitcoinizaition. That’s still 5-25 years away I think.

I believe bitcoin will dip back down to the 70-100k range in 2026-2028, but I don’t have a crystal ball. The buyers of the bitcoin ETF are a new breed. They are boomers and institutions with “old money” that buy and hold. They hold for decades or sometimes forever. They don’t sell desirable scarce assets. They use them as collateral, take out loans against them, and get super filthy rich.

Thus, maybe this was the last bitcoin bear market with a 70-80% drawdown. Who knows? I kind of doubt it, though, as the ETFs only currently make up about 5% of the Bitcoin supply. Maybe when that number gets much higher, we will see the volatility fade a bit. Time will tell.

Regardless, don’t use leverage, only spend what you can afford to lose, have a 5-10 year time horizon when saving in bitcoin, DCA (dollar cost average), HODL, and enjoy the ride.

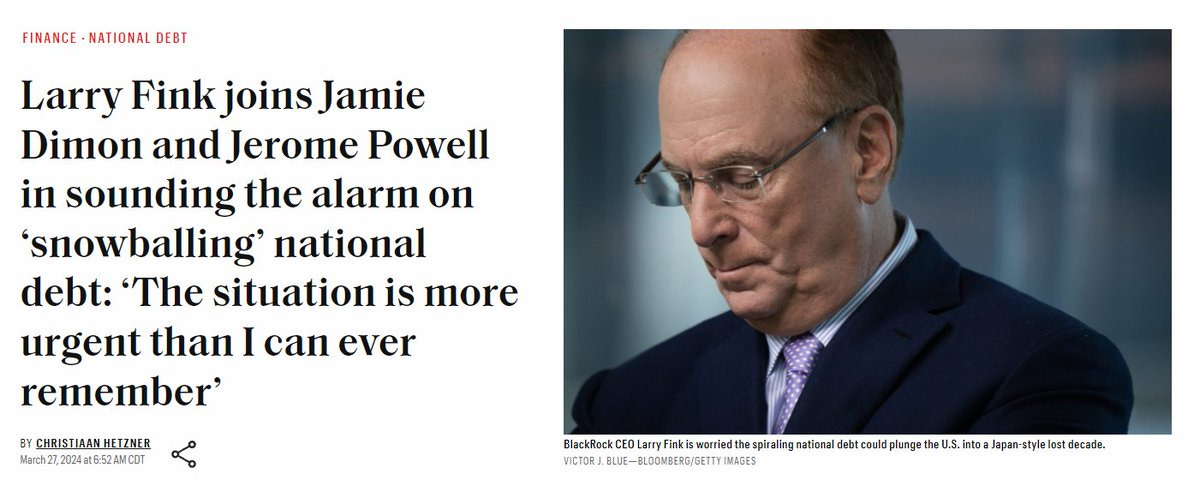

Wrapping up, Larry Fink of Blackrock issued their newsletter to their shareholders, and what he wrote was enlightening. A few notes:

- There is no guarantee that other countries will continue to buy our debt

- 4/10 young people find it hard to have hope for the world (because they can’t afford the American dream)

When one of the most powerful people in the world speaks, the US government should listen. It’s getting dire folks. Your money is losing value faster than you think. The stock market will continue to zoom higher BECAUSE OF THIS. The stock market in Zimbabwe, Turkey, and many other countries that experience profound currency debasement all have phenomenal stock market returns. The key question you must ask yourself is, “What are my REAL returns”? Your stock returns go up nominally, but in real terms, adjusting for inflation, you’re staying even or losing unless you manage to beat the market, which is tough.

At the end of the day, you should care about PURCHASING POWER, not the nominal amount of dollars you have.

You care how much the dollars you have will buy you, not how many dollars you have. If everyone is a millionaire but that just buys you a used car and you can afford to rent an apartment, is that so great or any different from today?

Bitcoin increases your purchasing power over time, fiat decreases it. It’s that simple. The choice is easy for me.

The next newsletter will be post-halving, which should take place on or near 4/20/24. How cool is it that I know the monetary policy of bitcoin and the day it changes already? Can’t say that about the Federal Reserve, that’s for sure.

And just in case you weren’t bullish enough, dwell on this…

After the halving, bitcoin will be THE SCARCEST ASSET ON THE PLANET. More scarce than gold or real estate. Right now, it’s not quite as scarce as these two highly desirable assets based on their “stock to flow” ratio. That all changes at the halving and then bitcoin will just keep continuing to get more scarce from there until 2140 while those other assets just continue to increase in supply.

What do you think ultimately will be a better store of value??

A gold, more or less useless rock?

Seriously? Seriously?? It’s quite honestly laughable when you think about it. A freaking rock!! People thousands of years will laugh so hard at us for this. What “primitive” humans we were.

This “amazing,” “desirable,” “rare,” “prime location” house going for 2 million in San Francisco?

No thanks!

Absolutely scarce digital money requiring minimal effort that transacts on a global open monetary network no single entity controls?

I know it’s hard to grasp this concept, but it’ll be SO OBVIOUS in hindsight. Zoom out on the superhighway to hyperbitcoinization. It’ll be here sooner than you think.

Until next time!

Share if you like it! Orange pill some friends and family!

THIS is Crypto Pulse

Long time no see.

I was looking for your X handle to investigate what was going with you.

As a fellow physician (not as exciting, as emergency medicine, just urology) I made a non-double blinded “study” with my colleagues in the hospital and 90% weren’t aware of BTC nor crypto assets.

Besides that, here in Mexico, the few that know about Bitcoin existence, are not willing to invest on it because they trust more traditional banks. Go figure.

Not so easy to educate on others.

Keep sharing your knowledge.

Best regards,

Jon

Chris -- have you read about the Bitcoin Power Law? Any thoughts on it?https://giovannisantostasi.medium.com/the-bitcoin-power-law-theory-962dfaf99ee9